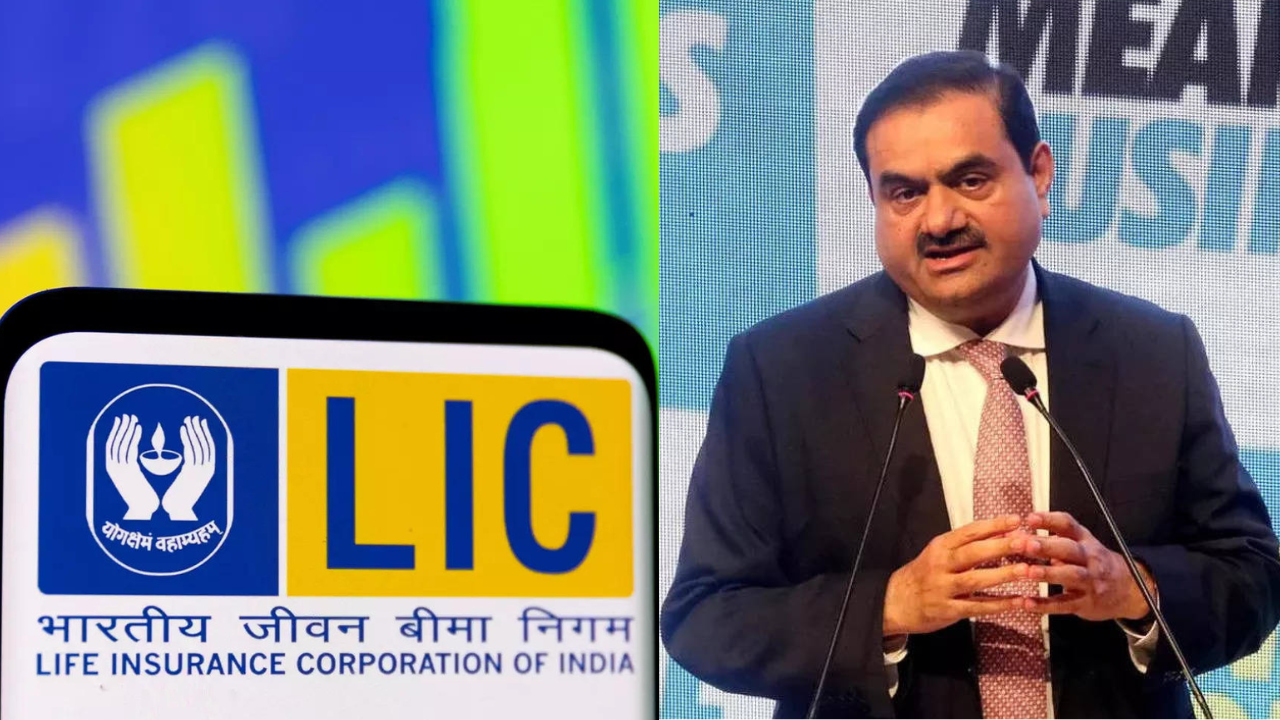

LIC Recovering Its Losses As Adani Group Shares Rise Significantly For Straight 3 Days.

According to statistics accessible on the stock markets, the value of LIC's shareholding in the Adani Group stocks has increased by roughly Rs 9,000 crore since, and it stands at Rs 39,068.34 crore.

LIC Recovering Its Losses As Adani Group Shares Rise Significantly For Straight 3 Days.

The shares of the conglomerate, Adani Group, surged for a third straight day, allowing India’s largest institutional investor and insurance titan, Life Insurance Corporation (LIC), to recover losses on its investment.

LIC owns stock in seven of the ten publicly traded Adani Group entities. Information found on stock markets indicates that the stake spans from 1.28 percent in Adani Green Energy Ltd. to 9.14 percent in Adani Ports & SEZ Ltd.

LIC’s Investments became negative as a result of the collapse in Adani Group stock that occurred after US short-seller Hindenburg Research published a damaging report on January 24.

The value of the shares held by LIC in the Adani Group fell to Rs 29,893.13 crore on February 24 from an original acquisition price of Rs 30,127 crore.

But the scenario has changed because of the surge in investor interest in the Adani Group equities.

The Adani Group’s stock increased for the third session in a row, effectively giving investors a profit of crores in just two days. A little over a month ago, a critical analysis by US short-seller Hindenburg Research led to a big decline in the price of Adani Group shares.

Adani Green Energy Ltd. (AGEL), Adani Transmission Ltd. (ATL), Adani Enterprises Ltd. (AEL), and Adani Ports and Special Economic Zone Ltd. (APSEZ) shares were sold through Secondary Market block deals, according to an official announcement from the Adani Group.

Shares of Adani Ports have increased by 25.36% over the last month.

Adani Ports stock increased 9.81% to close at Rs. 684.35, Ambuja Cements stock increased 5.70%, and ACC stock increased 5.11%. Adani Green Energy, Adani Transmission, and Adani Total Gas all had gains of 5%.

According to statistics accessible on the stock markets, the value of LIC’s shareholding in the Adani Group stocks has increased by roughly Rs 9,000 crore since, and it stands at Rs 39,068.34 crore.

Some people had doubts about LIC’s investment choice as a result of the decline in Adani Group equities. In a statement on January 30, LIC stated that as of December 31, 2022, the total holding under equity and debt under the Adani Group of enterprises was Rs 35,917.31 crore.

By the close of business on January 27, 2023, the market value of the investment was Rs 56,142 crore, which was more than the value of the Initial Investment and thus profitable.

The Gautam Adani-led firm has come under fire after US-based short seller Hindenburg Research charged them with stock manipulation, using offshore shell companies for round-trip transactions, and abusing corporate Governance Procedures.

After the report was made public, LIC’s holdings in the stock of Adani group companies have drawn attention. By the end of December 2022, LIC owned 9.14% of Adani Ports, 5.96% of Adani Total Gas, 4.23% of Adani Enterprises, 3.65 % of Adani Transmission, and 1.28% of Adani Green Energy.

The Opposition parties’ allegations that LIC and SBI’s “Overexposure in Adani Group stocks” is a notable swindle have roiled the parliament. In contrast to the purchase price of Rs 30,127 crore, the value of the shares held by LIC in the Adani Group fell to Rs 29,893.13 crore on February 24.

After the publication of the report, the group stated that the overall stock purchase value across all Adani Group entities over the past many years was over Rs 36,000 crore, and the market value as of January 27 was Rs 56,142 crore.

But, the big selloff in Adani shares that followed caused the insurance industry giant to suffer a big loss.

The government-run insurance firm suffered a loss of around Rs 50,000 crore in mid-February as a result of its holdings in Adani Group stocks.

Adani Enterprises, Adani Green Energy, Adani Ports, and Special Economic Zone, Adani Total Gas, Adani Transmission, Ambuja Cements, and ACC are the seven Adani stocks in which it has invested, and their combined market value fell to Rs 33,242 crores as of February 23 from Rs 82,970 crores as of December 31, 2022.

Against a previous close of Rs 584.65, shares of Life Insurance Corporation of India hit its 52-week low level of Rs 566 on February 27. The LIC counter experienced losses in the Adani stocks and a sharp decline in market capitalization (m-cap).

After the conglomerate’s shares increased for the third straight day last week, the state-run insurance company was able to recoup its losses on its investment in the Adani Group stocks.

LIC’s notional losses have been made up thanks to a surge in Adani stock following an investment from a major international investment group.

Notwithstanding the increase, the Aggregate Market capitalization of the Adani group has decreased by more than 55%, or 12.2 lakh crore, since the Hindenburg report was first made public on January 24.

The head of insurance giant LIC, MR Kumar, has stated that his team met with the Top Executives of the Adani Group throughout the entire Adani-Hindenburg controversy.

According to Kumar, LIC is more optimistic about its commercial prospects with the port-to-power company as a result of the encounter, he told a source in an interview.

Earlier this month, in an exclusive interview Kumar, stated that LIC had set up a meeting with the Adani Group management to better grasp the situation as a whole.

When asked specifically if LIC was more optimistic about the group’s economic prospects, Kumar responded that they were fairly happy with the meeting.

The chairman of LIC stated that the company’s investment division had contacted Adanis at the post-earnings presentation. Moreover, LIC had earlier declared that it intended to speak with the group’s management and ask questions about the Hindenburg report.

According to Kumar, the insurance industry will be driven by three factors in the future: technology, composite licenses, and universal insurance in 2047.

He continued that LIC does not currently have any concurrent intentions of broadening its financial products; instead, they are merely debating and waiting for the regulation to take effect.

Several changes to the insurance laws have been proposed by the Finance Ministry, including giving insurers a composite license and allowing them to market other financial products.

To improve coverage, Kumar said the company would concentrate on the North-East, Andaman & Nicobar Island, and Lakshadweep. Also, there are plans to establish facilitation councils so that customers may learn more about the goods.

Edited by Prakriti Arora