LIC Is Happy And Optimistic With Adani Group’s Meeting About Their Stakes In Adani Equities.

LIC met with Adani executives and is now more optimistic about its commercial prospects, according to the LIC Chairman.

LIC Chairman MR Kumar recently stated that the life insurance behemoth had met with top officials from the Adani Group. Following the meeting, LIC is more optimistic about its commercial possibilities with the Adani group. Kumar stated in February that LIC officials planned to meet with Adani Group’s top management to get an explanation of the situation the company was facing following the Hindenburg Research study.

The situation of Adani equities after Hindenburg’s Research Report.

After the Hindenburg claims, LIC’s investment in the conglomerate’s shares was criticized by investors and government leaders. After the revelations about the Hindenburg, LIC CEO Siddhartha Mohanty told that the life insurance company was bullish on Adani stocks. He stated that all investments are done under the company’s standard operating procedures (SOPs) and that they are within LIC’s cautious criteria. LIC is a major player, and he believes this will have no impact on LIC’s overall investments. They are optimistic about all of our investments, not just one.

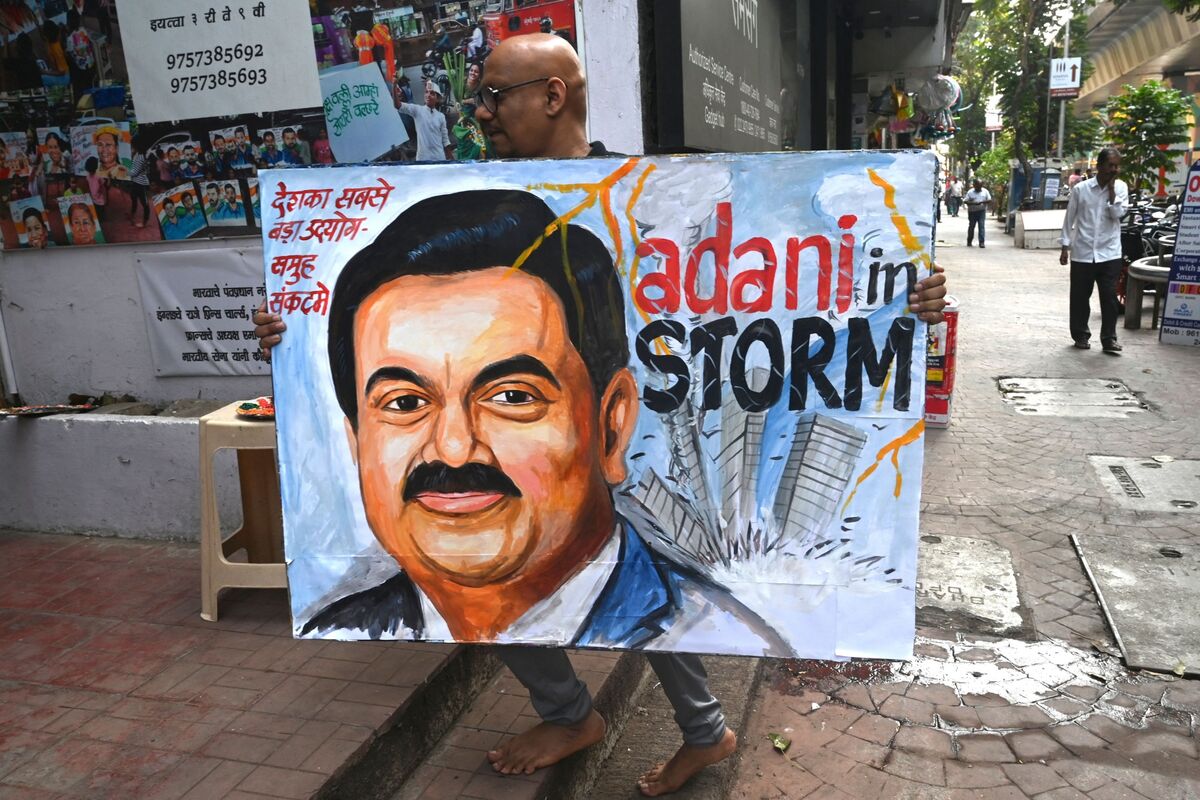

Mohanty further stated that LIC contacts the firms in which it invests regularly. He stated that previous plans with an amount insured greater than ten times the premium had been discontinued. A month after the claims, the Adani group’s market value had more than halved from its high and it was no longer the $100 billion corporation it once was. Since US-based short seller Hindenburg Research alleged the Gautam Adani-led company of stock manipulation, using offshore shell firms for round-tripping, and abusing corporate governance procedures, the port-to-power behemoth has been under siege.

With the report’s release, LIC’s holdings of Adani group enterprises’ stock have come under investigation. The insurance giant has invested in seven of the Adani Group’s ten publicly traded entities. Following are LIC’s assets in the Adani group as of December 2022.

- 9.14 percent of Adani Ports.

- 5.96 percent of Adani Total Gas.

- 4.23 percent of Adani Enterprises.

- 3.65 percent of Adani Transmission.

- 1.28 percent of Adani Green Energy.

The matter has also roiled parliament, with opposition parties claiming that LIC and SBI’s “overexposure in Adani group equities” is a massive swindle. On February 24, the value of LIC’s shares in the Adani Group fell to Rs 29,893.13 crore, compared to a purchase price of Rs 30,127 crore. After the publication of the report, the company stated that the entire purchase value of stock bought over the previous several years by all Adani Group firms was more than Rs 36,000 crore, with a market value of Rs 56,142 crore as of January 27.

Losses incurred by LIC over Adani equities.

The state-run insurance firm lost about Rs 50,000 crore on its bets in Adani group equities in mid-February. The aggregate market value of its holdings in seven Adani equities fell to Rs 33,242 crore on February 23 from Rs 82,970 crore on December 31, 2022. The firms are-

- Adani Enterprises.

- Adani Green Energy.

- Adani Ports and Special Economic Zone.

- Adani Total Gas.

- Adani Transmission.

- Ambuja Cements, and ACC.

Shares of Life Insurance Company of India reached a 52-week low of Rs 566 on February 27 as compared to a previous closing of Rs 584.65. The LIC counter mirrored the downturn in Adani equities and the significant reduction in market capitalization (m-cap).

Relief after the apex body entered the scene.

Nevertheless, the Supreme Court has directed an expert panel and the markets regulator SEBI to look into the recent decrease in Adani Group shares caused by Hindenburg Research’s fraud claims. According to experts, the Supreme Court’s ruling is a boon to investors. Following the Supreme Court’s decision, the majority of the group’s equities were trading in a 5% upper circuit.

The relieving role of the foreign investor.

Also, the notional losses of LIC have been recovered thanks to a surge in Adani equities following a huge investment from a foreign investment group. The aggregate market value of the 10 listed Adani Group enterprises increased by Rs 1.73 lakh crore in the four trading days ending last week. This activity is crucial since it comes on the heels of GQG Partners, a US-based global equity investment group, investing ₹15,446 crores in four Adani Group firms through secondary market transactions last week, fueling a rise in Adani Group equities.

The last line.

Once a business behemoth, the Adani group suddenly tasted the dark phase of their career at the onset of the new year. Following the Hindenburg report, there were many downs witnessed by the Adani group. However, the group was confident about its business practices. And it seems that the national investors are also optimistic about Adani equities. Let’s see what happens next in the Adani saga.

edited and proofread by nikita sharma