LIC IPO is one of Asia’s top wealth losers, with a $17 billion loss.

LIC IPO is one of Asia’s top wealth losers, with a $17 billion loss.

Life Insurance Corporation of India is one of the largest wealth destroyers among Asia’s initial public offerings this year, with a market value wipeout of $17 billion. According to data provided by Bloomberg, India’s largest-ever IPO has dropped 29 per cent since its May 17 debut, ranking second in terms of market capitalization loss since listing. Currently, it is second only to LG Energy Solutions Ltd. of South Korea, which suffered a more than 30% peak-to-trough collapse in its share price after an early jump on debut.

The long-awaited LIC IPO was nicknamed India’s ‘Aramco moment’ about the world’s largest IPO, Saudi Arabian Oil Co., which raised $29.4 billion in 2019. Prime Minister Narendra Modi’s aspirations to strengthen the country’s capital markets included this move. The share offer, which was nearly three times oversubscribed, was intended to help the government reduce its budget deficit, which had broadened as a result of increased spending during the pandemic.

However, LIC’s $2.7 billion initial public offerings (IPO) have turned out to be one of Asia’s greatest new stock disasters this year, as increasing interest rates and inflation levels globally led to a decrease in demand for share sales, and India’s stock market has been impacted by unprecedented foreign selling pressure. This year, the S&P BSE Sensex has lost more than 9% of its value. After a mandated lock-up period for anchor, investors expired Friday, on Monday, June 13, the stock of Life Insurance Corporation of India (LIC) hit a new low.

The first day of trading for one of the government’s largest stock market launches had been a tragedy. LIC began trading on the stock exchanges for Rs 865 per share, a 9% decrease from the issue price of Rs 949 per share. Despite local money helping the establishment remain afloat, selling pressure was intense from the start, with the price just momentarily touching the Rs 900 level. LIC was finally closed at Rs 873. To make matters worse, the stock market had a good trading day, with the Nifty rallying and concluding nearly 400 points higher. Today’s big global markets aren’t even to blame.

The government of Prime Minister Narendra Modi has raised $2.7 billion by selling LIC shares to new shareholders and millions of LIC policyholders across the country. Subscription performed satisfactorily. The offer was over three times oversubscribed. In reality, policyholders put bids for more than six times the number of shares allotted for them, while employees got orders for four times the number of shares reserved for them. The Government of Singapore, Government Pension Fund Global, Monetary Authority of Singapore, BNP Investments LLC, and Saint Capital Fund were some of the IPOs’ carefully followed anchors.

However, it is important to keep in mind that domestic mutual funds bought more than 71 per cent of the IPO at the top end of the pricing range (Rs 949 a share). SBI Mutual Fund, ICICI Prudential, SBI Life Insurance, Aditya Birla Sun Life, HDFC Trustee, Nippon Life, Bajaj Allianz General, Kotak Mahindra Life Insurance, L&T Mutual Fund, Axis Mutual Fund, Tata Investment Corporation, UTI Mutual Fund, Sundaram Mutual Fund, IDFC MF, UTI Mutual Fund, Sundaram Mutual Fund, IDFC MF, Bajaj Allianz General are the major names here. As a result, the extensive majority of those with a direct or indirect interest in LIC are middle-class retail investors.

LIC, being the country’s largest institutional investor and insurer, is the market leader in the life insurance sector, both in terms of premiums collected and policies sold. However, what precisely is LIC’s story? LIC had a perfect monopoly till the year 2000. Buyers who were interested would contact it directly. The LIC was run by an extensive army of agents. According to industry estimates, LIC has close to 10 lakh active agents.

Currently, over 80% of the top-end market that has been made attainable by bank outreach tactics is now held by private insurance providers. In a situation where banks contribute 50% of the insurance industry’s contribution, LIC neither participates nor tries to capture that market. The agent sector accounts for 97% of its revenue, while banks account for only 3%. Agents themselves are a broken system with little conversion and revenue potential.

The LIC IPO Timeline

This is the timeline of the Indian government’s efforts to list the Life Insurance Corporation of India (LIC), which controls more than 60% of the Indian insurance market.

February 2020

The Indian government aimed to sell a part of its share in LIC through an initial public offering (IPO) to assist reach a $29.6 billion state asset divestment objective for the fiscal year ending March 2021.

April 2020

As a result of market uncertainty caused by the COVID-19 epidemic, some businesses’ financing efforts have been thwarted.

December 2020

The sale was further delayed when the government began to establish the insurance giant’s embedded value for the first time, a process that would take more than a year. The preliminary financial statistic for insurers is embedded value, which is a measure of future cash flows in life insurance companies.

February 2021

According to the government, it plans to sell approximately 10% of its shares in LIC by the end of March 2022.

January 2022

The government sets a mid-March deadline for raising $12 billion through an IPO and demands that a draft prospectus is reviewed quickly by regulators.

1st February 2022

The government had declared significant reductions to its intentions to sell interests in state-owned businesses. The proposal to lessen the overall divestment aims to lower the LIC IPO’s expected stake sale to 5%, down from 10% before.

3rd February 2022

According to Reuters, the LIC’s embedded value had been finalized at more than 5 trillion rupees ($66.82 billion). The market value of LIC is estimated to be two to three times its embedded value.

13th February 2022

In its draft IPO papers, LIC outlines an embedded value of 5.39 trillion rupees. After that, the company’s management begins holding virtual roadshows for possible investors.

24th February 2022

Russia launched a ‘special military operation’ in Ukraine, causing global markets to crash and many foreign investors in emerging nations to sell their holdings.

26th February 2022

The Indian cabinet authorizes a policy modification permitting up to 20% foreign direct investment in LIC. Officials from the government are optimistic that an IPO will take place by the end of March 2022.

1st March 2022

According to Reuters, bankers advising LIC have urged the government to postpone the IPO debut due to the market jolt caused by Russia’s invasion of Ukraine. In the following months, sources revealed that the proposal to list LIC will be delayed until the next financial year, which begins in April.

22nd April 2022

According to a government source, New Delhi may make half its LIC IPO fundraising objective to approximately $3.9 billion after reducing valuation projections in response to investor comments.

26th April 2022

After investors questioned LIC’s development potential, India filed the IPO prospectus, cutting the amount it intends to raise from the sale of a 3.5 per cent share to roughly $2.7 billion, less than a third of its previous estimates.

2nd May 2022

The LIC IPO starts with an anchor investor subscription, which results in strong demand and prices towards the top of the range.

4th May 2022

The government fixed the price band for the LIC IPO at Rs 902-949 per share for retail and other investors, with a discount of Rs 45 for retail investors and Rs 60 for policyholders. The minimum bid lot size is 15 shares, while the maximum bid lot size is 100 shares. The LIC IPO was completely subscribed on day two and was three times oversubscribed by May 9. It attracted even the tiniest investors, with almost 7 million taking part.

16th May 2022

Grey market activity and limited institutional investor demand a day before the listing suggested that LIC shares could list at a discount, anywhere between Rs 900 and Rs 940.

17th May 2022

LIC made its stock market debut at a roughly 8% discount, with a share price of Rs 867.20. The LIC market capitalization fell sharply to Rs 557,675 crore, a loss of Rs 42,500 crore, as a result of the disappointing market debut. LIC’s market capitalization previously stood at Rs 600,242 crore at the issue price of Rs 949.

In line with the market disaster, LIC falls over 6% to a new low of Rs 668.

After the lock-in period for anchor investors in the company’s IPO ended on June 13, the stock of Life Insurance Corporation of India (LIC) hit a new low. On the BSE, the stock closed at a new low of Rs 668.20, down 5.85 per cent from its prior closing. It began trading at Rs 691. This was the stock’s eighth consecutive session of decline. Only four sessions have passed since the stock was listed, or in the last twenty sessions. LIC’s shares are probable to tumble for the 10th straight session, after dropping further on Monday.

The stock has now dropped to sixth place in terms of market capitalization as a result of this decline. With a market capitalization of Rs 6 trillion at the time of IPO, it was India’s sixth most valuable company. Since its IPO, the stock has exhausted roughly Rs 1.7 trillion from investors’ funds. The rout has alarmed India’s government, with officials stating that the company’s management will ‘look at all of these areas and will increase shareholder value.

The stock fell 4% to an all-time low of Rs 681.70 on the BSE, with its market capitalization (m-cap) falling to Rs 4,34,052 crore. Anchor investors’ 30-day lock-in period expires, and the stock is presently down almost 28% from its issue price of Rs 949. After a month of the equity allocation, the anchor lock-in period for a newly listed stock expires. ‘In light of the recent decline in LIC share prices, we are extremely alarmed. It will take time for people to learn the fundamentals of LIC. All of these factors would be reviewed by LIC management, to increase shareholder value’ Tuhin Kanta Pandey, DIPAM secretary, stated.

On May 17, the stock was floated, with the inaugural share sale bringing in roughly Rs 21,000 crore. At an issue price of Rs 949 per share, anchor investors bought 59.3 million shares in the state-run life insurance firm. The anchor investors, the bulk of whom were domestic mutual funds, have seen their holdings plummet by more than 25%.

The Government of Singapore, HDFC Mutual Fund, SBI Mutual Fund, and Axis Mutual Fund were among the biggest investors in the IPO. Domestic mutual funds were big buyers in the public offering, which is off to a bad start in the secondary market. LIC shares valued at Rs 4,000 crore were bought by 99 plans participating in the anchor issue.

The stock could suffer more pain due to its poor quarterly performance, says Avinash Gorakshakar, head of research at bargain brokerage Profitmart Securities Pvt. ‘Management’s communication with investors is confusing.’ He stated further that they hadn’t held an analyst call following the results. Therefore, there is no clarity on the company’s strategy or how it plans to grow.

Analysts believe demand for the largest Indian IPO plunged as a result of the RBI’s unexpected interest rate hike.

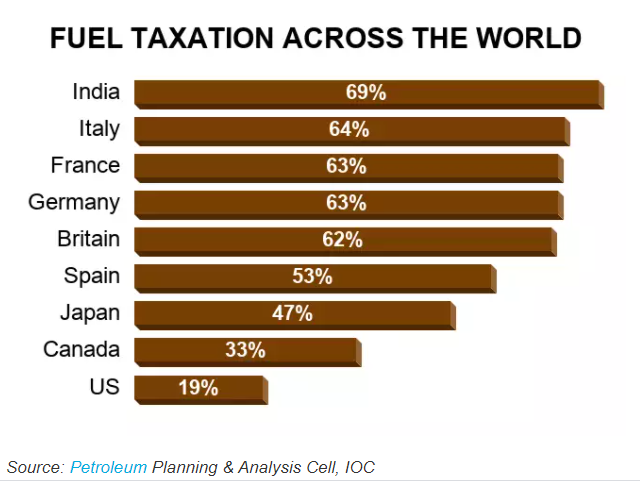

The rapid drop in demand might be attributed to several factors. The surprise move by the Reserve Bank of India (RBI) to raise interest rates by 40 basis points at 2 p.m. on May 4 is one example. The move was improbable because the RBI has been behind the curve up to this moment, waiting for inflation to subside while central banks across the world were raising rates. The variables affecting such decisions include rising global gasoline and commodity prices. Following the statement, Sensex fell more than 2%, dampening investor confidence in the market.

Low subscriptions can be attributed to a variety of factors;

1) The 40 basis point rate hike by the RBI must have sparked fears of unpredictable markets in the following days, thereby lowering investors’ expectations for listing profits.

2) The RBI’s decision may have had an influence on financing for persons who demand finance, like high-net-worth individuals (HNIs), hence limiting oversubscription.

3) Due to current market conditions, the grey market premium (GMP) for LIC had decreased, perhaps lowering investor beliefs, as stated by Manoj Dalmia, founder and director of Proficient Equities.

Another element contributing to the LIC IPO’s lower-than-expected response could be its size at INR 21,000 crore, it is India’s largest IPO to date. The offer has presently received bids for INR 16,380 crore, with a 78 per cent subscription rate, smaller-ticket IPOs would have been subscribed multiple times more at this rate. To add to the concerns, the IPO was poorly accepted even by overseas investors, with only a few showing up for anchor stakes.

The real issue for LIC right now is the larger downturn in the market dynamic, which has unsettled the buying attitude not just in the United States but around the world with inflationary pressures and monetary policy tightening, the buying mood has been unnerved. The insurance sector has also hopped on the volatility bandwagon.

Chief Investment Strategist Dr VK Vijayakumar of Geojit Financial Services stated, ‘Part of the reason for the poor post-listing performance is the current market conditions.’ The insurance industry has also underperformed in recent years. He recommended that the investors should wait patiently and treat it as a long-term investment.

Irresponsible or a Hasty Decision of the Indian Government to Launch LIC IPO?

In an unexpected decision, the finance minister declared in the February 2020 Budget that LIC would be listed on stock exchanges, despite her government’s disinvestment aim. The anticipation was that selling a piece of this insurance behemoth would raise enough money to fulfil the Modi government’s likewise lofty divestment objective of Rs 2.1 lakh crore in FY21. Year after year, the divestment targets have been lowered. The initial estimation was that selling a part of LIC’s stock would raise between Rs 50 and Rs 70,000 crore.

For Rs 21,000 crore, a 3.5 per cent equity dilution was carried out. The fiscal deficit goal for the current fiscal year was set at 6.4 per cent of gross domestic product (GDP) in this year’s budget. According to the IMF, India’s general government fiscal deficit (states and central government combined) will reach 9.9% of GDP in FY23, as rising oil and food prices put increased pressure on the budget gap. Is a figure of Rs 21,000 crore going to be a solution?

The Indian primary market had a remarkably good year in 2021. Sixty-three companies raised Rs 1.2 lakh crore through initial public offerings, establishing a new record for the most money raised in a single calendar year. According to reports, foreign anchor investors were interested in the LIC IPO when it was proposed in 2021/early 2022. Why didn’t the government take advantage of the resulting interest? Was it a different challenge, or did the finance ministry not perceive the possibility at the time? Was it because presentations abroad and meetings for pre-IPO arrangement didn’t go as planned?

Funds are required, however, taxes cannot be increased, but they can be reduced. Why isn’t the government stepping in with budgetary support in the face of a raging inflationary situation? Reduce central charges on gasoline and diesel, along with import duty rates, to keep inflation in check. But divesting a public-sector corporation that has been a non-starter for years is not the best choice.

The most important thing to consider is how the LIC stock performs over time. If prior state-owned IPOs are any sign, there may be more dismay ahead. The poorest performers have been Coal India Ltd, General Insurance Corp. (GIC), and New India Assurance, which were all floated in 2017 and are presently trading at around 75% below their IPO pricing. These public-sector corporations have a track record, and it isn’t good.

It confirms that initial public offerings (IPOs) are the most manipulative and complex tools available, with promoters urged on by investment bankers playing a betting game to see how much money they can extract from customers while selling them a lemon. This is a disaster. The LIC scandal will affect the prevalence of domestic investors. Whether it was a conscious decision or a result of the mutual fund schemes they invest in, it is undoubtedly an irreversible reality.

A Bigger Issue- The Scam of Privatisation

In terms of implementing the government’s policies, the public sector is legally considered an arm of the government. All of the tools to jump-start the economy are stifled by privatization, which is particularly concerning given that we are still recovering from the ravages of the pandemic.

It’s essential to remember that the eventual privatization of a publicly-owned firm is just one step in a long process, or the culmination of a process in which public-sector companies are decommissioned, creating a favourable environment for privatization. For example, before its privatization, Air India was sabotaged, purposefully weakened, and derailed.

By connotation, any privatization scheme is doomed to fail. Because the valuation is built on the assumption that it must be ‘attractive’ to a private buyer, privatization is certain to be a scandal. As a result, every case of privatization is based on a shaky estimate of a publicly-owned corporation’s genuine worth. This might have been the matter for the Life Insurance Corporation of India (LIC) as well.

Uncertainty of the Indian Market

India is presently experiencing a spike in inflation and food prices, along with a massive withdrawal of foreign institutional investment, a falling rupee, and a conflict in Europe that shows no signs of stopping. Stock markets are incredibly jittery as a result of this. All of this spoiled the LIC stock’s performance. However, we definitely cannot ignore the fact that this was a poorly performed attempt with a less-than-satisfactory result. Many small investors will pay the price for this. That is the harsh reality.

Article proofread & published by Gauri Malhotra.