Kirloskar Electric Company’s Stock Emerges as a Multibagger, Offering Remarkable 450% Returns to Investors

LIC-backed small-cap stock achieves significant growth, delivering impressive returns in 2023

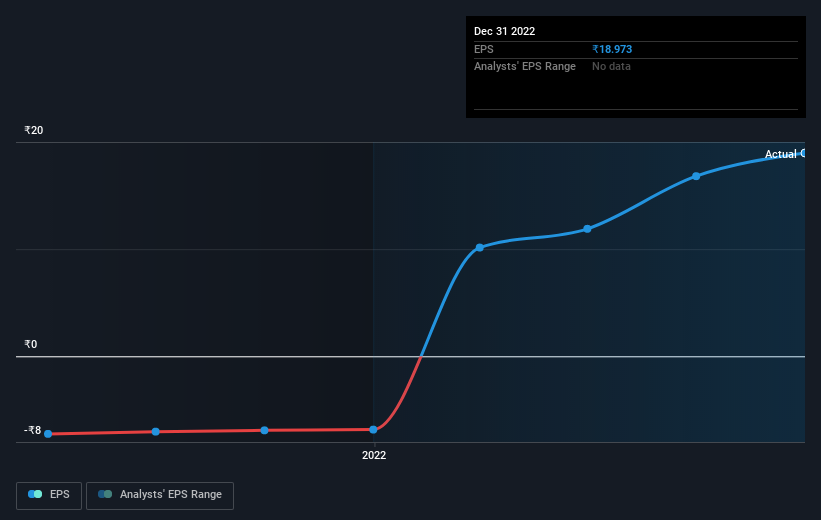

Kirloskar Electric share price

Kirloskar Electric Company, a small-cap stock, has captured the attention of the Indian stock market with its remarkable performance, establishing itself as a multibagger stock. Over the past month, the stock has surged, providing investors with an impressive 45% return. Furthermore, in the year-to-date (YTD) period, shareholders have nearly doubled their investments, enjoying returns exceeding 85% in 2023.

The exceptional performance of Kirloskar Electric shares extends to the past year, where it has emerged as one of the top multibagger stocks in the Indian market, delivering an astounding 450% return. Such impressive growth has garnered significant interest from investors, seeking to capitalize on the stock’s upward trajectory.

It is worth noting that Kirloskar Electric Company benefits from the backing of the esteemed Life Insurance Corporations (LIC) of India, as LIC owns a 1.26% stake in this small-cap multibagger stock. This endorsement by LIC adds to the stock’s credibility and reinforces the confidence placed in the company’s potential for sustained growth.

The stock price of Kirloskar Electric Company has consistently reached all-time highs, with the exception of May 11. In four out of the last five trading sessions, the stock has achieved record highs, further fueling investor optimism. Recent trends indicate that the stock has delivered a 5% return in the past week alone, rising from around ₹83 to ₹121.50 apiece levels in the last month, representing a significant 45% increase. Over the past six months, the stock has exhibited a substantial rise from approximately ₹67.65 to ₹121.50, translating to an impressive 80% surge.

Analyzing the share price history of Kirloskar Electric Company unveils its exceptional growth trajectory. Within a single year, the stock has soared from ₹22.30 to ₹121.50 apiece, offering extraordinary returns of 450% to long-term investors.

₹1 lakh turns ₹5.5 lakh in one year

For instance, considering an investment of ₹1 lakh made in this LIC-backed multibagger stock one month ago, it would have grown to ₹1.45 lakh today. Similarly, an investment of ₹1 lakh at the beginning of 2023 would now be valued at ₹1.85 lakh, while an investment made six months ago would have reached ₹1.80 lakh. Remarkably, an investment of ₹1 lakh made in this multibagger stock one year ago would have grown to an impressive ₹5.50 lakh today.

In terms of shareholding, the latest data for the January to March 2023 quarter reveals that the insurance giant LIC holds 8,34,457 shares of Kirloskar Electric Company, representing 1.26% of the company’s total paid-up capital. This investment by LIC further emphasizes the potential of Kirloskar Electric Company and bolsters investor confidence.

The outstanding performance of Kirloskar Electric Company can be attributed to a combination of robust business fundamentals, strategic initiatives, and a favorable market environment. As a player in the electric engineering sector, the company has benefited from significant growth and increasing demand. Kirloskar Electric has capitalized on these favorable conditions by delivering innovative products, expanding its customer base, and improving operational efficiencies.

However, it is important for investors to exercise caution and conduct thorough research before making any investment decisions. While the stock has exhibited exceptional growth, it is crucial to remember that stock market investments carry inherent risks, and past performance is not indicative of future results. Investors are advised to consult with financial advisors, carefully analyze the

company’s fundamentals, and consider their own risk tolerance and investment objectives before venturing into the market.

Given the remarkable performance of Kirloskar Electric Company and the attention it has garnered from investors, its future performance will undoubtedly be closely monitored.

The soaring performance of Kirloskar Electric Company continues to impress investors, as the stock reaches new milestones and sets record highs. With only one exception on May 11th, this small-cap stock has consistently achieved all-time highs in four out of the last five trading sessions, highlighting its strong upward momentum.

In the past week alone, Kirloskar Electric has delivered an impressive return of over 5%. Looking at the one-month performance, the stock has surged from around ₹83 to ₹121.50 apiece levels, reflecting a substantial 45% increase. This remarkable growth has been a source of excitement for investors.

Examining the year-to-date (YTD) performance, Kirloskar Electric has experienced significant growth, with the stock rising from approximately ₹64.50 to ₹121.50. This translates to an impressive return of around 85% for investors who have maintained their positions in the company. Similarly, over the past six months, the stock has seen a substantial rise from around ₹67.65 to ₹121.50 levels, representing a remarkable 80% increase in value.

These consistent upward movements in the stock price reflect the market’s confidence in Kirloskar Electric’s business performance and growth potential. The company’s ability to consistently achieve new highs and deliver impressive returns demonstrates its strong market position and investor appeal.

Investors who have remained invested in Kirloskar Electric Company have reaped the rewards of its multibagger status. The stock’s substantial growth over the past year, soaring from ₹22.30 to ₹121.50 apiece levels, has resulted in returns of an impressive 450%. This exceptional performance has attracted the attention of long-term investors seeking significant capital appreciation.

It is important to note that investing in the stock market carries inherent risks, and past performance is not a guarantee of future results. While Kirloskar Electric Company has demonstrated remarkable growth, investors should exercise caution and conduct thorough research before making investment decisions.

As the stock continues to hit new highs and deliver impressive returns, investors and market participants will closely monitor Kirloskar Electric’s performance to assess its future potential and sustainability in the dynamic stock market landscape.