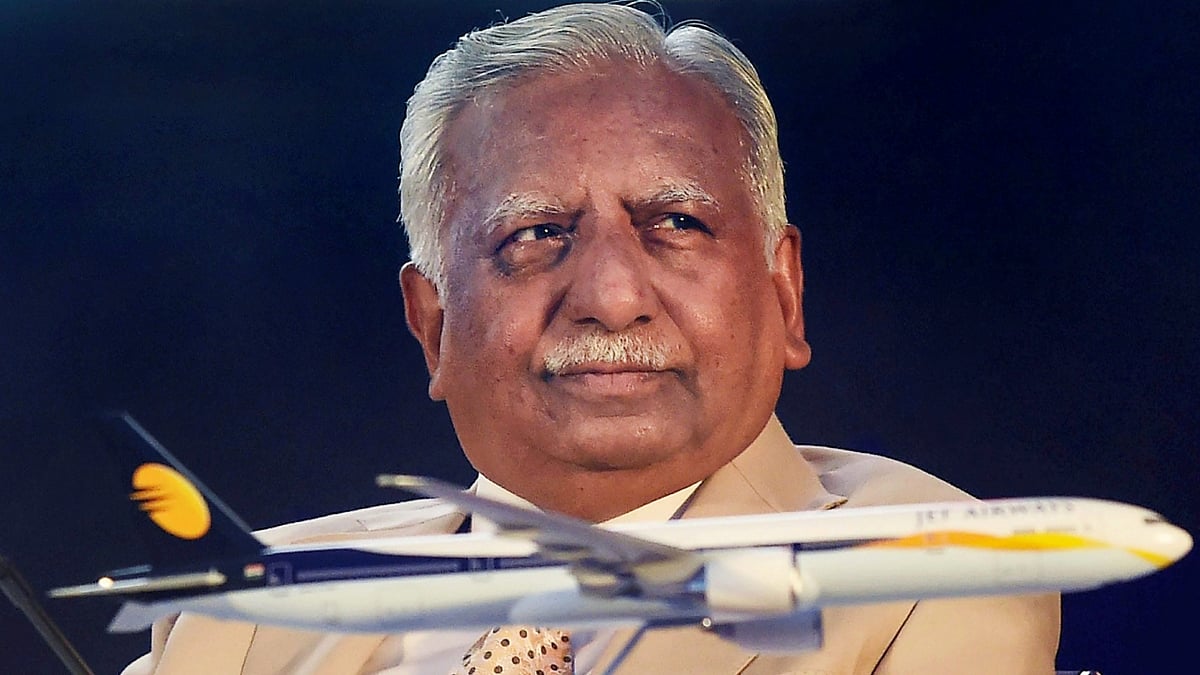

Jet Airways Founder Naresh Goyal Arrested in Bank Fraud Case by ED 2023

Jet Airways Founder Naresh Goyal Arrested in Bank Fraud Case by ED 2023

According to official sources, Jet Airways founder Naresh Goyal was detained by the Enforcement Directorate late on Friday night in connection with a money laundering case involving an alleged bank fraud of Rs 538 crore at the Canara Bank.

After a protracted period of interrogation at this location of the central agency, he was put into custody in accordance with the Prevention of Money Laundering Act (PMLA).

According to the sources, Goyal, 74, is anticipated to appear before a special PMLA court in Mumbai on Saturday when the ED would ask for his prison detention.

Due to financial difficulties, full-service airline Jet Airways had to cease operations in April 2019. Later, Goyal resigned from his position as airline chairman.

The Central Bureau of Investigation (CBI) filed a FIR against Jet Airways, Goyal, his wife Anita, and several former business officials in connection with the alleged Rs 538-crore fraud case at the Canara Bank, giving rise to the money laundering case.

In July, searches were conducted by the Enforcement Directorate (ED) on Goyal and others connected to the case.

According to the bank’s allegation, which formed the basis for the CBI FIR, it had approved credit limits and loans totaling Rs 848.86 crore for Jet Airways (India) Ltd (JIL), of which Rs 538.62 crore was still owed. The account was allegedly designated “fraud” on July 29, 2021, according to the CBI.

/newsdrum-in/media/media_files/FtEvv4BRdW6QbvMHyv5w.jpg)

The bank said that JIL’s forensic investigation revealed that it had syphoned off money from JIL by paying “related companies” Rs 1,410.41 crore out of the total commission charges.

According to a sample agreement from Jet Airways (India) Ltd. (JIL), it was mentioned that General Selling Agents’ (GSA’s) fees were to be covered by GSA and not by JIL. The allegation, which is now a part of the CBI FIR, said that JIL had paid different costs totaling Rs 403.27 crore in a manner that was contrary to the GSA.

The Goyal family’s personal costs, including employee wages, phone bills, and automobile expenses, were claimed to be covered by JIL.

In addition to other claims, it came to light during the forensic audit that money was also embezzled through Jet Lite (India) Ltd (JLL) through advance payments, investments, and provision writing.

JIL diverted money for JLL’s subsidiary in the form of loans, advances, and prolonged investments.

After the Maharashtra Police filed a closure report stating it found no substance in the complaint and the dispute appeared to be of a civil nature, the Bombay High Court in February quashed another money laundering case against Goyal related to alleged cheating and forgery filed by Mumbai-based Akbar Travels.

This ED case was held invalid by the high court since it was founded on a police FIR and served as the basis for filing a money laundering case.

The ECIR (Enforcement Case Information Report, or the ED counterpart of a FIR) filed on February 20, 2020, as well as all related actions against the Goyals, were overturned by a division bench of justices Revati Mohite Dere and Prithviraj Chavan for “being illegal and contrary” to the law.

In a significant development, the Enforcement Directorate (ED) has arrested Naresh Goyal, the founder and former chairman of Jet Airways, in connection with a bank fraud case. The arrest marks a major milestone in the ongoing investigation into financial irregularities and alleged fraudulent activities within the now-defunct airline. This article delves into the details surrounding Naresh Goyal’s arrest and the broader implications of this case.

Jet Airways, once one of India’s leading airlines, ceased operations in April 2019 due to financial troubles and mounting debts. Its downfall sent shockwaves through the Indian aviation industry, leaving thousands of employees jobless and creditors with substantial unpaid dues. The airline’s financial woes were attributed to various factors, including mismanagement, high operating costs, and a competitive market.

As Jet Airways unraveled, allegations of financial irregularities and fraud began to emerge. Various government agencies, including the ED, initiated investigations into the matter to uncover any wrongdoing that might have contributed to the airline’s downfall.

Naresh Goyal, who co-founded Jet Airways in 1992, had been at the helm of the airline for nearly three decades until he stepped down as chairman in March 2019, just before the airline suspended operations. It is during his tenure that the airline amassed a significant amount of debt and faced allegations of financial mismanagement.

The ED’s investigation into Naresh Goyal focused on suspected money laundering and siphoning off funds from Jet Airways. The agency alleged that Goyal and other top executives had diverted funds to various shell companies, both in India and abroad, under the guise of legitimate business transactions. These allegations included the creation of fraudulent invoices, the purchase of overseas assets, and the routing of money through tax havens.

the Enforcement Directorate took Naresh Goyal into custody for questioning in connection with the bank fraud case. His arrest came after hours of interrogation at the ED’s office in Mumbai. The agency reportedly uncovered substantial evidence pointing to financial irregularities and money laundering during the investigation, leading to Goyal’s arrest.

The arrest of a high-profile business tycoon like Naresh Goyal sent shockwaves through the business and aviation sectors in India. It highlighted the seriousness of the allegations and underscored the government’s commitment to cracking down on financial wrongdoing, especially in cases involving public funds and the aviation industry.

Naresh Goyal’s arrest has several significant implications:

- Legal Proceedings: With his arrest, Naresh Goyal will likely face legal proceedings, including charges related to money laundering, fraud, and diversion of funds. The outcome of these legal proceedings will have far-reaching consequences for him and the reputation of Jet Airways.

- Investor Confidence: This arrest sends a message to the business community about the government’s resolve to tackle financial fraud. It may boost investor confidence in the Indian market by demonstrating that fraudulent activities will not go unpunished.

- Aviation Industry Impact: The Jet Airways case has already had a profound impact on the Indian aviation industry. The arrest of its founder and former chairman may further influence the industry’s dynamics, including the restructuring of airlines and financial institutions involved with the troubled carrier.

- Recovery for Creditors: The arrest may also have implications for the recovery of dues owed to creditors, including banks, employees, and other stakeholders. The ED’s investigation and legal proceedings could potentially lead to the confiscation of assets to repay these dues.

The arrest of Naresh Goyal, the founder of Jet Airways, by the Enforcement Directorate in connection with a bank fraud case is a significant development in the ongoing investigation into the airline’s financial irregularities.

This high-profile case serves as a reminder of the need for transparency and accountability in the business world, particularly in industries that involve public funds. As legal proceedings unfold, the outcome will not only impact Naresh Goyal’s future but also set a precedent for addressing financial wrongdoing in India’s corporate landscape.