Japan to invest up to $500 million to manufacture advanced chips

Semiconductors will be critical for developing technologies and innovations such as the digital industry, artificial intelligence, and healthcare, according to Yasutoshi Nishimura, Minister of Economy, Trade, and Industry. He said that the new chip company’s name would be Rapidus. It plans to begin chip production in the second half of this decade.

TOKYO, April 16 (Reuters) –

Japan announced on Friday that it would invest up to 70 billion yen ($500 million) in a new semiconductor company led by tech companies such as Sony Group Corp and NEC Corp to re-establish itself as a leading manufacturer of cutting-edge chips.

Yasutoshi Nishimura, Minister of Economy, Trade, and Industry, stated at a press conference that semiconductors would be critical in developing new cutting-edge technologies in artificial intelligence, digital industries, and healthcare.

He also stated that Rapidus, a brand-new chip company, plans to start manufacturing chips in the second half of this decade.

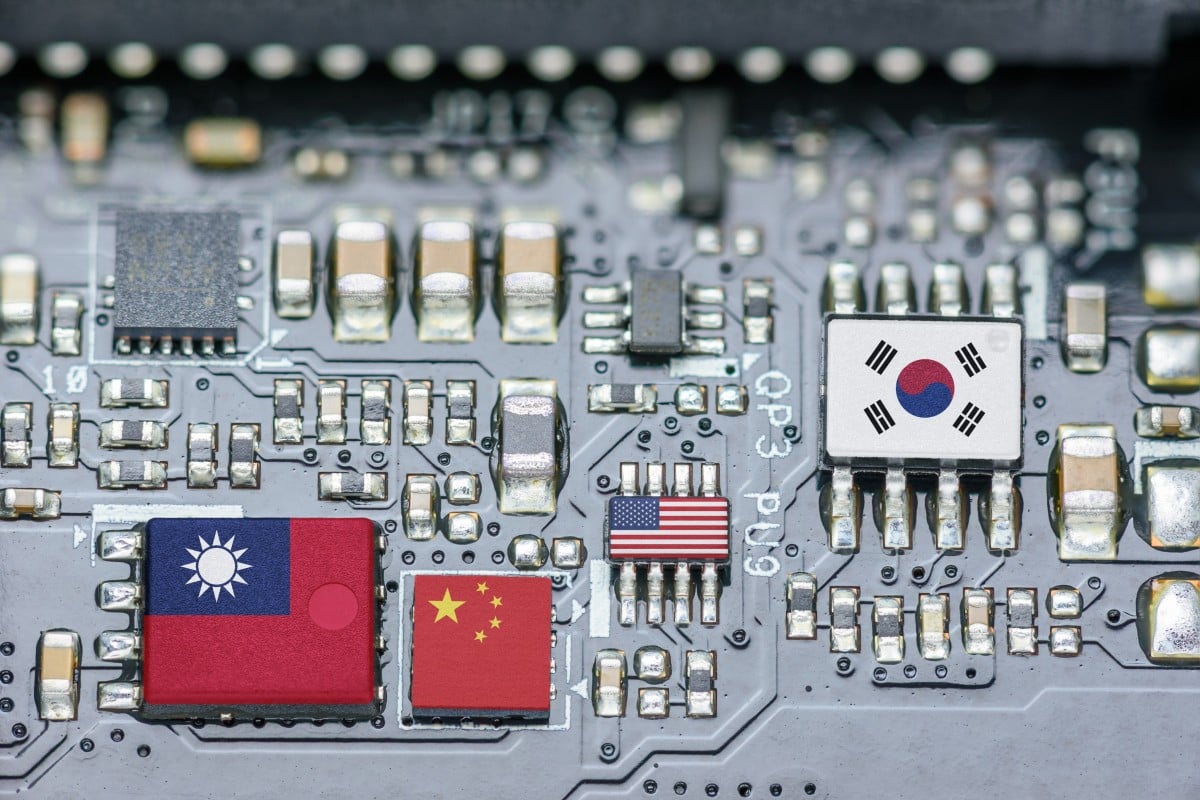

Japan is rushing to resurrect its chip manufacturing base as trade tensions between the United States and China worsen. The United States restricts Beijing’s access to cutting-edge semiconductor technology to ensure that its automakers and information technology firms do not run out of the critical component.

Japan is also worried that China will try to take over Taiwan, the world’s primary chip manufacturing centre.

As part of this, the Japanese government is providing financial incentives to foreign chip makers to establish themselves in Japan, including 400 billion yen to support the construction of a plant in Kumamoto Prefecture by Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s largest producer of logic chips, which will supply semiconductors to Sony and auto parts manufacturer Denso Corp.

Furthermore, Japan provided a 93 billion yen subsidy in July to support the local production expansion of memory chip manufacturers Kioxia Corp. and Western Digital Corp. In September, it promised to give $46.5 billion yen to American chipmaker Micron Technology to expand production at its Hiroshima plant.

The new chip company represents the next phase in Japan’s semiconductor strategy and a further indication of the country’s deepening cooperation in technology development with the US, following the establishment of a new joint research centre in July to develop faster and more power-efficient next-generation 2-nanometer semiconductors.

According to a Thursday TV Tokyo report, the new company would also receive investments from Kioxia Holdings, Nippon Telegraph, and Telephone Corp.

According to the report, the Japanese government intends to construct a new research facility by the end of 2022 to create semiconductors smaller than 2 nanometers.

($1 = 141.6500 yen)

The Semiconductor Industry’s Importance in Japan

Semiconductors are becoming increasingly important in global economies. Japan has long been a significant producer and exporter of semiconductor devices. Still, the global chip shortage has highlighted the country’s need to step up efforts to secure supply chains and improve manufacturing processes. Semiconductors are used in many high-tech products, including smartphones, computers, and automobiles. As a result, the industry is regarded as critical to Japan’s economic success, raising concerns about national security.

Despite accounting for more than half of global chip production in the late 1980s, Japan was unable to maintain its dominance due to several factors such as equipment shifting to foreign manufacturing facilities, the rise of rivals such as South Korea and Taiwan, a focus on vertically integrated production models, and a lack of public funding.

The Semiconductor Industry’s Current Situation

In the spring of 2021, there was an increase in demand for new vehicles. While customers worldwide rushed to charters, flush with pandemic savings, Japanese automakers remained in production as they awaited the import of a critical component, semiconductors.

Chip factories have closed due to the coronavirus outbreak, and supplies have been constrained by an unexpected surge in demand from people staying at home due to the pandemic. The chip shortage, which harmed Japan’s budget and economy, made the country aware of the fragility of supply chains. This has prompted a thorough reevaluation of how Japan can protect its world’s third largest economy from unexpected economic shocks like the pandemic and looming risks like rising US-China tensions. Despite the fact that the review affects many industries, including the energy sector, semiconductors are one of the most pressing concerns.

As China takes a more hostile stance toward Taiwan and expands its chip market share, both countries see the new initiatives as critical to national security and finances.

Because of globalization, which has forced businesses in developed countries to outsource chip production, Japan’s market share has dropped to around 10% from its historical high of more than 50% production of semiconductors that powered Nintendo consoles and Toshiba calculators.

Companies like Taiwan Semiconductor Manufacturing Company, or TSMC, that produced custom chips and were heavily subsidized by the government, had enough clients to realize economies of scale. It made little sense for Japanese and other companies to continue producing the majority of the chips in-house.

Japan maintains its market dominance in some semiconductor-related products, such as specialty chemicals and silicon wafers. Furthermore, the country has a monopoly on a few highly specialized tools used in the manufacturing process.

High-end chips, which are only made in South Korea and Taiwan, cannot be produced due to a lack of technical know-how. Despite changes in the geopolitical calculus surrounding supply chains, many of the economic factors that contributed to Japan’s declining chip market share have remained constant.

Analysts predict that reviving the sector in Japan will be difficult and potentially costly. According to a semiconductor study group led by Japanese lawmaker Mr. Seki, a $78 billion investment is required to succeed in this industry.

The Japanese semiconductor industry’s revenue, which had already reached around USD 36.5 billion in 2020, was expected to rise further in the coming years. Manufacturing is the primary industry that the country uses to add value to the global semiconductor market. Japan’s manufacturing equipment industry is expected to benefit from the accompanying demand for machinery as global investment in manufacturing capacity increases.

Semiconductor Industry Recovery

Both the private sector and the government have worked to restore and improve domestic manufacturing capacity as a result of increased market competition and recent supply chain disruptions. In June 2021, METI issued a strategic report emphasizing the importance of semiconductors to the economy and economic security.

In November of that year, the Japanese government decided to support the semiconductor industry with a 774 billion yen package, roughly half of which will be used to assist TSMC in the construction of a new foundry in Kumamoto Prefecture.

Despite the country’s lack of high-end domestic manufacturing capacity, Tokyo Electron, Kioxia, Sony Semiconductor Solutions, Renesas Electronics, Toshiba, and Rohm are just a few of the major Japanese technology companies active in the semiconductor industry. Japan is a significant and leading spender on semiconductor R&D. (R&D).

EDITED AND PROOFREAD BY NIKITA SHARMA