Is The Banking Crisis Still A Matter Of Concern: Some Shreds Of Evidence On The Collapse Of US Banks, The Upcoming Inflation Predictions And India’s Stand On All Of These!

Ten years ago, Mr. Raghuram Rajan, who was also the governor of the RBI, said that when policymakers tighten regulations, loose money and a flood of liquidity from central banking institutions lead to "addiction" and instability within the financial system.

Former IMF chief economist Raghuram Rajan, who forecasted the global financial crisis more than a decade ago, has warned that the banking industry is destined for additional instability following the rescues of Silicon Valley Bank and Credit Suisse. Mr Raghuram Rajan, who was also the governor of the RBI, stated 10 years ago that loose money and a torrent of liquidity from central banking institutions have resulted in “addiction” and instability within the financial system when policymakers tighten policy.

Ex-RBI governor stated in Glasgow that he aspires for the good but anticipates more to happen, in part because some of what folks saw was unexpected. The entire issue is that very easy money (and) great liquidity over a long period develops perverse incentives and perverse institutions that become weak when everything is reversed. His remarks add to the concerns that the crises at SVB and Credit Suisse point to deeper fundamental issues in the banking system.

Earlier warns on the banking industry by the IMF ex-chief economist.

In 2005, as IMF chief economist, Rajan issued a forewarning on the banking industry before the global financial crisis in a Jackson Hole address, prompting former US Treasury Secretary Larry Summers to label him a “Luddite.” Rajan, who is currently a professor at the University of Chicago Booth School of Management, received praise for his handling of the Indian economy while serving as the country’s central bank governor from 2013 to 2016.

One’s put an addiction into the system by flooding it with low-return liquid assets, and banks are saying, that they have got to keep this, but what do they do with it? The approach of let’s figure out how to make money off of it is putting the banks sensitive to liquidity withdrawal.

The turmoil in the banking sector.

With the failure of Silicon Valley Bank, there has been an unsettling calm in the US banking sector, with many waiting for prominent corporations to report profits. Bank shares fell following the crises at SVB and Credit Suisse, but central banks have continued to tighten policy to control inflation.

Meanwhile, in Switzerland, the parliament is conducting a special three-day session beginning Tuesday to discuss government backing and guarantees granted to enable UBS’ purchase of Credit Suisse Group. There is no anticipation that the deal would fail, but possible conditions might start to take form. State funds and guarantees of almost 260 billion Swiss francs ($280 billion) had to be paid out by the government.

For the Alpine nation, which takes great pride in its financial industry and where banking assets account for more than 500% of the yearly gross domestic product, the argument is predicted to be contentious and emotive. Switzerland has given Credit Suisse the go-ahead to decrease or cancel all pending incentive payments for the top three management levels and investigate the possibility of recovering any previously made payments.

Rajan, who foresaw the global financial disaster more than a decade ago, also said that central bankers have had a “free ride” as policymakers swiftly reversed the ultra-accommodative approach adopted in the decade after the financial crisis. This awareness that the spillover consequences of monetary policy are enormous and are not dealt with by regular monitoring has just missed the attention over the previous several years, according to Rajan.

Impact of fuel prices on inflation in the US.

On April 2, OPEC+ producers announced output reductions of almost 1.16 million barrels per day through the end of 2023, sending oil prices skyrocketing. This came after crude prices fell in March as turbulence in the banking sector fueled worries of a recession. Whether oil prices will continue to rise and fuel increased inflation or stabilise to balance production cutbacks with the weak global economy is a major unknown.

Although China’s economy has grown since its openness, factory demand is still low. The most recent ISM assessment of US manufacturing revealed a terrible situation.

The market’s first response to OPEC’s move was subdued, except for gains for resource stocks. Investors were waiting for U.S. inflation data on April 12 to see if price increases had moderated enough to curb central banks’ desire for additional aggressive rate increases.

The stand of Indian territory.

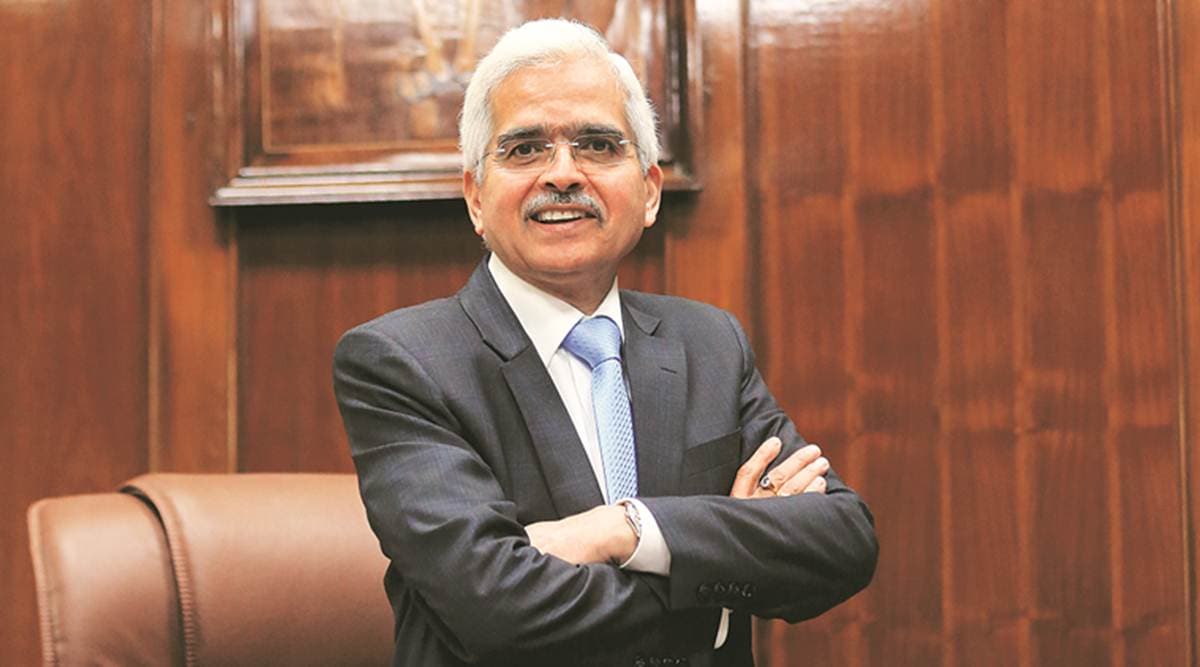

The policy rate would remain at 6.5%, the RBI Monetary Policy Committee, under Governor Shaktikanta Das, stated recently. This unexpected decision to maintain the repo rate shouldn’t be considered a sign that similar actions would be taken in the future. Also, he added that the central bank will “not hesitate” to take more rate action if necessary. The RBI governor told reporters, If he were, to sum up, today’s monetary policy in one word, it would be a pause, not a pivot. The RBI also stated that it is closely monitoring the unrest in the banking industry in various industrialised nations.

The banking and non-banking financial service industries in India are still strong despite this volatility, and the financial markets have developed in a controlled way, Das continued.

Conclusion.

It seems that the onset of the new year has many plus and minuses for the banking industry. The pandemic, the Russia-Ukraine crisis triggered food scarcity in many parts of the region, followed by the need for conscious efforts to work in the direction of climatic change, oil prices, and many more. Let’s see what unfolds in the upcoming chapters of the third year of this new decade.