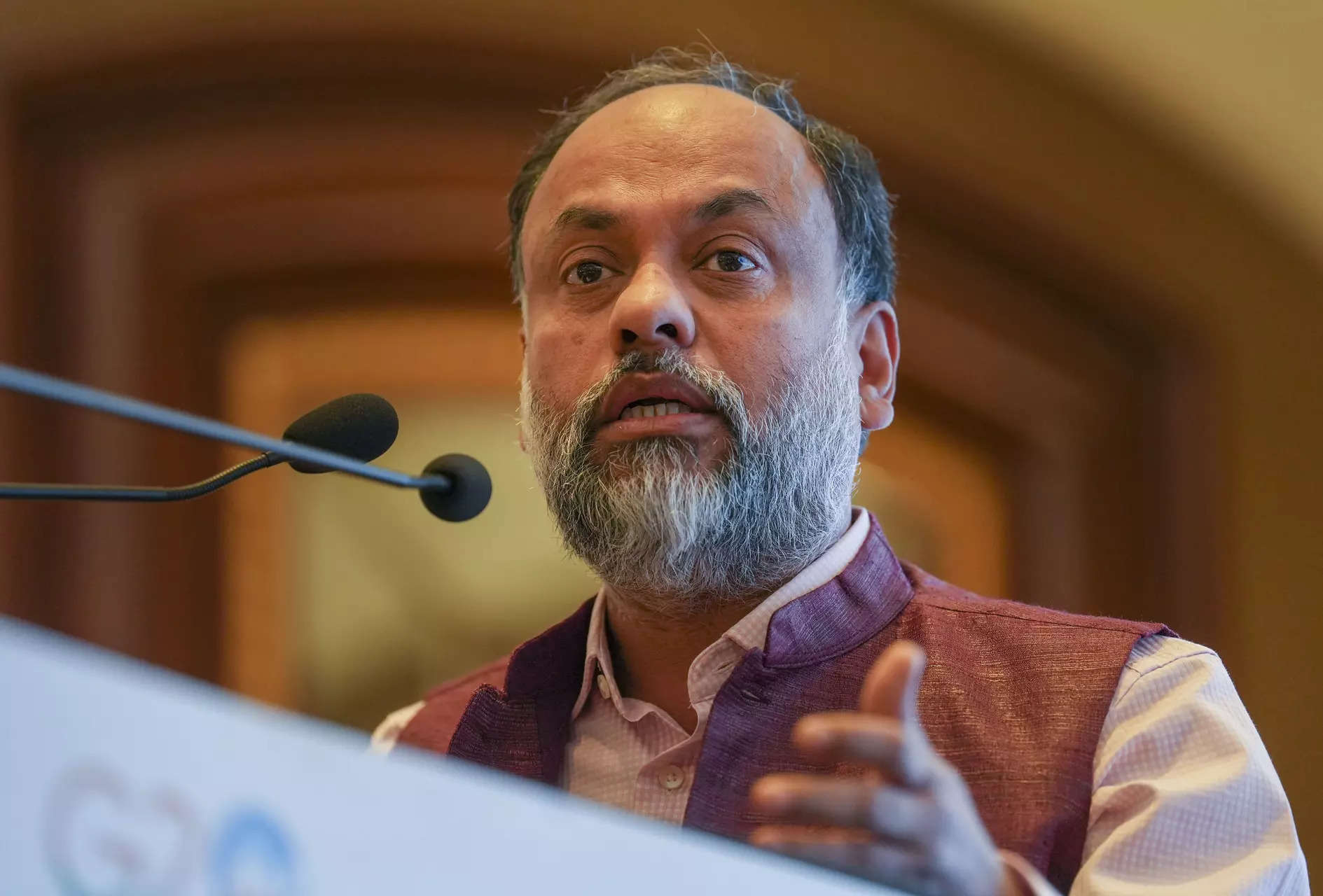

IRDAI Chairperson Debasish Panda on Flexible Insurance at Global Fintech Fest 2023

IRDAI Chairperson Debasish Panda on Flexible Insurance at Global Fintech Fest 2023

Insurance Regulatory and Development Authority of India (IRDAI) Chairperson Debasish Panda stated during his speech at the Global Fintech Fest 2023 that the organisation is working to change the insurance industry in order to investigate and provide flexible, do-it-yourself insurance solutions.

“To improve the insurance sector’s adaptability and reactivity, IRDAI is aggressively pursuing changes. We are at a turning point when personalised products and changing customer preferences are prevalent.

We are investigating adaptable, DIY insurance products to address these shifts, utilising advising technology and digital assistants. According to Debasish Panda, “We see a world in which insurers can effectively manage massive and varied data sources, leveraging quantum computing to revolutionise risk assessment and decision-making, considerably enhancing the insurance lifecycle.

Debasish Panda talked about upcoming technical advancements in the insurtech industry. According to him, underwriting will become a crucial step in the insurance sector thanks to AI algorithms, machine learning models, and predictive analysis.

Process automation will aid in accelerating manual intervention-based, conventional processes. Additionally, conversational AI will be used throughout the insurance industry’s value chain to benefit clients by supporting them at various phases of the insurance purchase to claim process.

Debasish Panda emphasised his outlook for the industry’s future by stating that “smart contracts, parametric triggers, and distributed insurance will be the future. We want to achieve simplicity, speed, automation, and efficiency.

The future lies on technology-driven accessibility, availability, awareness, choice, and healthy competition. He praised India for its development in the fintech industry as well. Sarbvir Singh, Joint Group CEO of PB Fintech, moderated the discussion.

GFF 2023 is sponsored by the Department of Economic Affairs (DEA), Ministry of Finance, Reserve Bank of India (RBI), International Financial Services Centres Authority (IFSCA), and Ministry of Electronics and Information Technology (MietY). It is also organised by the National Payments Corporation of India (NPCI), Fintech Convergence Council, and Payments Council of India (PCI).

Insurance Regulatory and Development Authority of India (IRDAI) Chairperson Debasish Panda stated during his speech at the Global Fintech Fest 2023 that the organisation is working to change the insurance industry in order to investigate and provide flexible, do-it-yourself insurance solutions. “To improve the insurance sector’s adaptability and reactivity, IRDAI is aggressively pursuing changes. We are at a turning point when personalised products and changing customer preferences are prevalent.

The Global Fintech Fest 2023 marked a significant milestone in the world of insurance as Debasish Panda, the Chairperson of the Insurance Regulatory and Development Authority of India (IRDAI), unveiled ambitious plans to revolutionize the insurance sector.

In his keynote address, Chairperson Panda announced that the IRDAI is actively exploring the development of flexible, do-it-yourself insurance products. This groundbreaking initiative has the potential to transform the way people perceive and purchase insurance, making it more accessible and tailored to individual needs.

The insurance industry has been ripe for innovation for quite some time. Traditional insurance policies often come with fixed terms, limited customization options, and complex procedures.

This has led to a gap between what consumers need and what insurance providers offer. Recognizing these challenges, the IRDAI has been actively seeking ways to enhance the insurance experience for consumers and promote innovation within the industry.

Chairperson Panda emphasized the need for insurance products that are flexible and adaptable to the evolving needs of customers. Traditional insurance policies tend to be rigid, offering little room for customization. The IRDAI’s vision is to create insurance products that allow consumers to tailor coverage to their specific requirements, whether it’s for health, life, property, or other insurance types.

Perhaps the most groundbreaking aspect of this initiative is the DIY approach to insurance. The IRDAI is exploring the concept of enabling consumers to design their insurance coverage themselves. This would involve choosing the level of coverage, policy duration, and additional riders or features based on individual preferences.

Chairperson Panda stressed the importance of leveraging technology to make these flexible, DIY insurance products accessible and convenient. The use of digital platforms and advanced data analytics will play a pivotal role in streamlining the entire insurance process, from purchase to claims settlement.

To ensure that consumers can make informed decisions, Chairperson Panda highlighted the importance of transparency in insurance products. Clear communication of terms, conditions, and pricing will be a priority. Furthermore, the IRDAI plans to invest in consumer education to help people better understand insurance and make informed choices.

Chairperson Panda made it clear that while innovation is essential, the regulatory framework must ensure consumer protection and industry stability. The IRDAI will work closely with industry stakeholders to develop a robust regulatory framework that fosters innovation while safeguarding the interests of policyholders.

Consumers will have the freedom to create insurance policies that align with their unique needs, providing them with a sense of ownership and control over their coverage.

Flexible insurance products can potentially lead to cost savings as policyholders only pay for the coverage they need, avoiding unnecessary expenses.

The digitalization of the insurance process will make it easier for people to access and purchase insurance, particularly those in remote or underserved areas.

Simplified processes, transparency, and consumer education will enhance the overall customer experience, making insurance more user-friendly.

The introduction of innovative insurance products can stimulate market growth, attract new customers, and encourage competition among insurers, ultimately benefiting consumers.

Chairperson Debasish Panda’s announcement at the Global Fintech Fest 2023 heralds a new era for the insurance industry. The IRDAI’s ambitious plans to explore flexible, do-it-yourself insurance products represent a paradigm shift that prioritizes consumer empowerment, innovation, and digitalization.

While challenges lie ahead in terms of regulatory framework development and implementation, the potential benefits for both insurers and policyholders are immense.

As the insurance sector embarks on this transformative journey, it promises to deliver insurance solutions that are more relevant, accessible, and tailored to the evolving needs of the modern consumer.