‘Sovereign’ cryptocurrencies serve governments, not people

Blockchain-based cryptocurrencies promise to enable economic, political and social freedom, if implemented properly. But the emergence of “sovereign” cryptocurrencies — backed by governments — contradicts everything that blockchain stands for and hoped to fix.

Iran has now decided to develop its own national digital currency in response to reimposed US sanctions, according to Press TV, the country’s state sponsored media. An official from Iran’s Directorate for Scientific and Technological Affairs said a domestic digital currency would “help” the country bypass U.S. sanctions, including a universal ban on the purchase of US dollars. The digital currency will be developed in conjunction with the Central Bank of Iran, whose own deputy for foreign exchange affairs was arrested three days ago as part of a judicial investigation into financial corruption.

In case anyone has forgotten: The end goal of cryptocurrencies was to decentralize power, not to bolster existing centers of authority. And yet we are seeing a real surge of interest in fiat-backed cryptocurrencies, with numerous startups jumping in to compete in this space. Tether, Vault (backed by JPMorgan, Morgan Stanley, and Goldman Sachs, among others), Basis, DAI, and Carbon are a few of the players.

The original cryptocurrency, Bitcoin, was made in response to the 2008 financial crisis, a manifestation of the negligent and destructive behaviour of banks. Satoshi Nakamoto created this currency to withstand any kind of centralized control, with power distributed solely among and by the people through its blockchain architecture – a permissionless and censorship-resistant public ledger that allows anyone in the world to pseudo-anonymously send and receive cryptographically signed digital “cash” without the need for an intermediary.

Bitcoin addressed the weaknesses of our very flawed financial system. Among them, the unchecked power of corrupt central banks and governments (Latvia and Vietnam are good examples there). Cryptocurrencies like Bitcoin and Ether are immune to political influence or warfare. Decentralized blockchain systems move the trust and risk model from people to software, making their networks more resilient and less susceptible to human greed.

Power is contained in centralised blockchains

With centralized blockchains, power is heavily concentrated as their proprietors maintain majority control over the entire network. Government-controlled and manipulated cryptocurrencies, which run on these blockchains, impose dangerous limitations on our civil freedoms, including pervasive anti-privacy measures.

Consider Venezuala’s oil-pegged cryptocurrency, the Petro, which launched earlier this year and is now being used to back yet another new national currency that will start circulating on August 20. The Bolívar Soberano will replace the Bolivar Fuerte and be anchored to the Petro.

Venezuela’s President Maduro, a dictator with a track record of corruption and reports of a starving population, has driven his own country’s economy into the ground and has now turned to cryptocurrency in a desperate attempt to bail himself out while navigating around US-imposed economic sanctions.

This is exploitation of blockchain technology and of its core philosophy. As one reporter perfectly summarized it, “the point was to take corrupt institutions out of the picture, not to bail them out.”

According to the Brookings Institute, there is a very real danger that the Petro will not only “fail to cure Venezuela’s economic woes but will also weaken the integrity of cryptocurrencies writ-large.”

In this case, the very essence of what cryptocurrencies are, of the opportunity they represent to revolutionize the world economy, is crumbling in the hands of their government.

In other instances, Senegal and Tunisia in Africa have attempted to serve their unbanked citizens using digitized fiat but have failed to keep these currencies free from destructive external influences.

In 2015 Tunisia became the first nation in the world to roll out its national currency, the Dinar, on a blockchain. Yet reports from last month reveal a bleak economic future; the population is frustrated and pessimistic as the country’s debt to the Inernational Monetry Fund has been pushed into the billions while the Dinar’s value recorded a new low.

The Senegalese government launched its eCFA currency in 2016 to help its struggling population access adequate financial platforms and networks, especially to settle common cross-border transactions. The currency has been met with criticism by the cryptocurrency community as it does not run on blockchain-based technology but is created instead by a private company that enables central banks to issue digital fiat. The currency is still vulnerable to corruption and manipulation, so little has changed in helping its population.

While the use of progressive financial technology is a positive step forward for Africa’s many underserved and unbanked, this initiative and drive could be better spent on facilitating the mass adoption of existing cryptocurrencies like Bitcoin, which already have communities, value, and strong technological infrastructure backing them.

Bitcoin presents an exciting opportunity and has already become a refuge for many in Africa who face economic and political hardship at the hands of their governments. Demand for Bitcoin rose dramatically in Zimbabwe last year, as citizens are able to transfer money without bank accounts, are not victim to crippling hyperinflation, and ensure their savings are not jeopardized when conflict breaks out.

Gateway to economic control

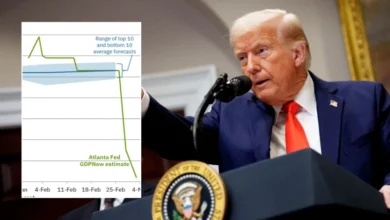

Sovereign cryptocurrencies are a way for governments to fight back against the threat of cryptocurrencies, which have disrupted traditional banking for good. Governments are currently scrambling to assert control over their financial systems, with new laws and regulations forming in jurisdictions worldwide. The European Parliament Committee on Economic and Monetary Affairs (ECON), published a report on July 20, stating that “permissioned cryptocurrencies” issued by central banks could “reshape” the cryptocurrency market by introducing viable competition.

No longer able to ignore Bitcoin, countries like Russia, Iran, England, China, Japan, Sweden, Australia, the Netherlands, Singapore, and India are all said to be road-testing new digital and blockchain-based currencies.

The Public Bank Of China is developing its own digital currency, while generally discouraging the use of Bitcoin and banning trading platforms. Expectedly, Bitcoin’s decentralized architecture does not sit well with the Chinese government, whose political and economic strategies have generally been based on closed, centralized, heavy-handed policies.

Economic powerhouse Bank of England has already begun testing its RSCoin, a centralized cryptocurrency based on Bitcoin. The irony is not lost on the blockchain community, with respected figures like Andreas Antonopoulos commenting that “RSCoin may be more palatable to banks … it is business as usual, dressed up as innovation.”

The key features of RSCoin weaken the integrity of blockchain technology. Blockchain offers a trustless, immutable, and neutral system. RSCoin offers a currency that can be fully traced from the moment it comes into your possession to the moment it is spent. Your accounts can be frozen and money seized. Banks will fully control the digital currency, from its supply and distribution to its inflation rate and pegged value. The financial ‘freedom’ offered to its users is confined to a system built on the interests of a central bank. RSCoin empowers banks, not people.

In Switzerland, despite calls from certain groups, the Swiss National Bank (SNB) has dismissed any requests to create an e-Franc. In June board director Thomas Moser of SNB compared blockchain to a “useless innovation” like the CD. Yet the Swiss Financial Market Supervisory Authority commented on the nature of cryptocurrencies and token payments, stating that “cryptocurrencies give rise to no claims on their issuer.” This definition would contradict any attempt to build a cryptocurrency, even based on fiat, on a closed blockchain. Switzerland’s strong position is helping to lead the way; instead of dismissing a quick call to action, it’s trying to ensure there is first an in-depth comprehension of the mechanisms of cryptocurrencies.

Valuing Bitcoin

An economy inspired by Satoshi’s blockchain is meant to ultimately serve people for the better. Central banks need to rethink their position as financial institutions and accept that Bitcoin’s transformative power will help people interact with the world economy.

Central banks need to stop resisting the power of Bitcoin and instead facilitate its potential to transform the world economy.

National currencies are now in competition with decentralized currencies like Bitcoin, and with time, more and more people will come to see and appreciate their differences. Bitcoin, Ethereum, and others are paving the way for future currencies, monetary policies, automation, and exploration. Central banks will have no choice in the future but to use these open networks to ensure their own currencies survive a little longer.

Alexandre Poltorak is the Key Account Manager for Bity, a Switzerland-based cryptocurrency services provider. He is also cofounder and CEO of Alsenet SA, a company specializing in free software and open hardware technologies.

Source: VentureBeat