InGovern advises shareholders to defer Finolex Cables’ resolutions 2023

InGovern advises shareholders to defer Finolex Cables’ resolutions 2023

InGovern, one of India’s leading proxy advisory firms, recently made headlines by recommending that shareholders of Finolex Cables Limited should ‘defer’ two critical resolutions proposed at the company’s Annual General Meeting (AGM).

The move has garnered significant attention in corporate governance circles and the investment community. According to InGovern, Chhabria’s overall salary is unrestricted, and neither the perquisites nor any other retirement compensation have been valued.

.png)

Although the commission component would make up the majority of the pay, the performance standards used to determine the commission have not been made explicit.

Additionally, it claimed that no effort was made to compare Chhabria’s salary to that of peers in the business. The advisory company has asked shareholders for permission to postpone the plan and have it properly represented with a 21-day notice period.

The board of Finolex Cables has that Deepak Chhabria be reappointed as executive chairman for a five-year term beginning July 1, 2023, and ending June 30, 2028. Chhabria was appointed as a full-time director in 1986, and on July 1, 2013, he succeeded as executive chairman.

Additionally, InGovern advised shareholders to postpone paying non-executive directors’ commissions.

“Given the scale of operations of the company, 1% of net profits or Rs 2 crore being the maximum threshold specified for payment of such commission, is not significant,” stated InGovern, which also cited the shareholders’ lack of adequate notice and the resolutions’ changes through a corrigendum as factors.

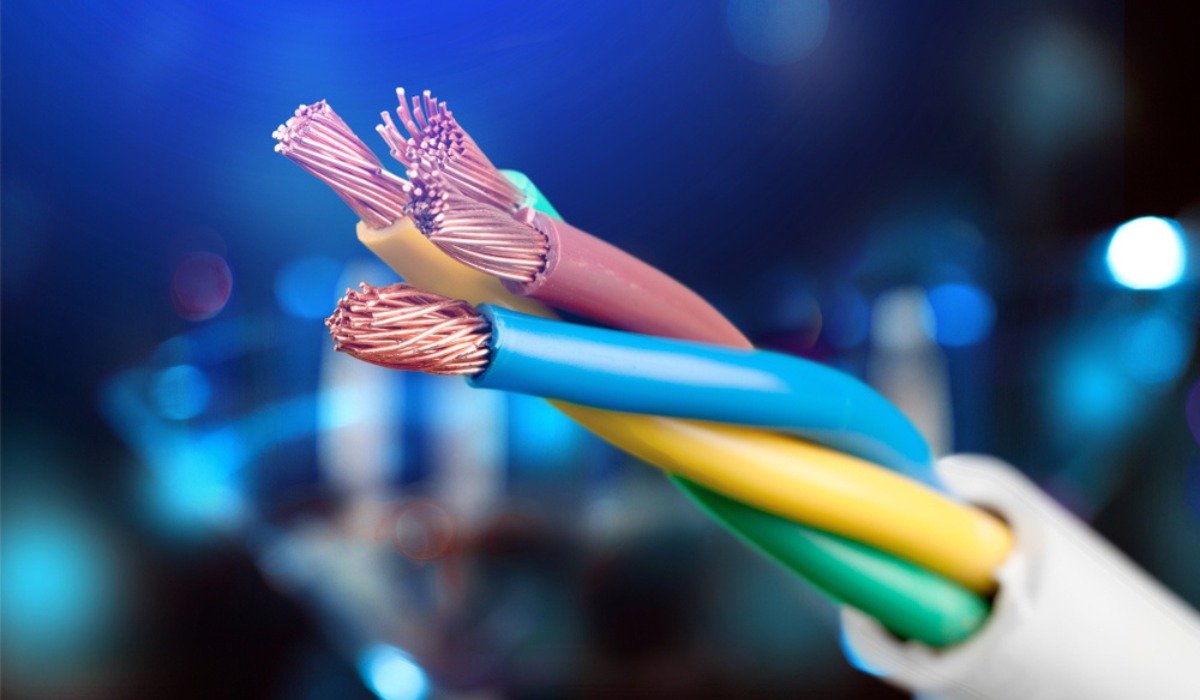

Finolex Cables Limited, a prominent player in the Indian electrical and communication cable industry. During the meeting, several resolutions were put forward for approval by shareholders. Among these, two resolutions have become subjects of debate and controversy.

InGovern, a respected authority in matters of corporate governance and shareholder activism, has advised shareholders of Finolex Cables to ‘defer’ voting on these two resolutions.

This recommendation is not binding, but it serves as a crucial guideline for shareholders, especially institutional investors, in making informed decisions.

InGovern’s primary concern appears to be the perceived lack of transparency surrounding the proposed resolutions. Transparency is a cornerstone of good corporate governance, as it allows shareholders to make well-informed decisions. If the necessary information and justifications for these resolutions are not adequately presented, it can raise doubts about the motives behind them.

InGovern is also likely to scrutinize any potential conflicts of interest that may arise from these resolutions. Corporate governance principles emphasize the importance of avoiding conflicts between the interests of management and shareholders. If the resolutions could benefit certain stakeholders disproportionately or harm minority shareholders, it warrants a closer look.

Protecting the rights of minority shareholders is crucial in corporate governance. InGovern may be concerned that these resolutions could infringe upon the rights of minority shareholders or dilute their influence within the company.

InGovern is likely to assess the long-term impact of these resolutions on the company’s financial health, strategic direction, and overall governance.

A short-term gain for a select group of stakeholders should not come at the expense of the company’s long-term sustainability.

InGovern’s recommendation reflects the increasing emphasis on corporate governance in India.

In recent years, regulatory bodies like the Securities and Exchange Board of India (SEBI) have introduced various reforms and guidelines to enhance transparency and protect shareholder interests.

Proxy advisory firms like InGovern play a pivotal role in holding companies accountable and ensuring compliance with these regulations.

Shareholder activism has also gained momentum in India, with institutional investors and minority shareholders becoming more vocal in demanding better corporate governance practices.

The deferment of resolutions at AGMs, as advised by proxy advisory firms, is becoming a more common occurrence when shareholder concerns about transparency and conflicts of interest arise.

InGovern’s recommendation to ‘defer’ two resolutions proposed at Finolex Cables Limited’s AGM highlights the growing importance of corporate governance in India.

Shareholders, particularly institutional investors, are increasingly taking an active role in holding companies accountable for their actions. The recommendation underscores the need for greater transparency, avoidance of conflicts of interest, and protection of minority shareholder rights in corporate decision-making.

In the end, it is a reminder that corporate governance is not merely a legal obligation but a fundamental aspect of responsible and sustainable business practices.