Inflows to Flexi-cap funds totalled Rs 35,877 crore in FY22, the highest among equity categories

Flexi-cap funds saw a net inflow of Rs 2,478 crore in the three months ended June 2021, and Rs 18,258 crore in the quarter ended September 2021, out of a total of Rs 35,877 crore.

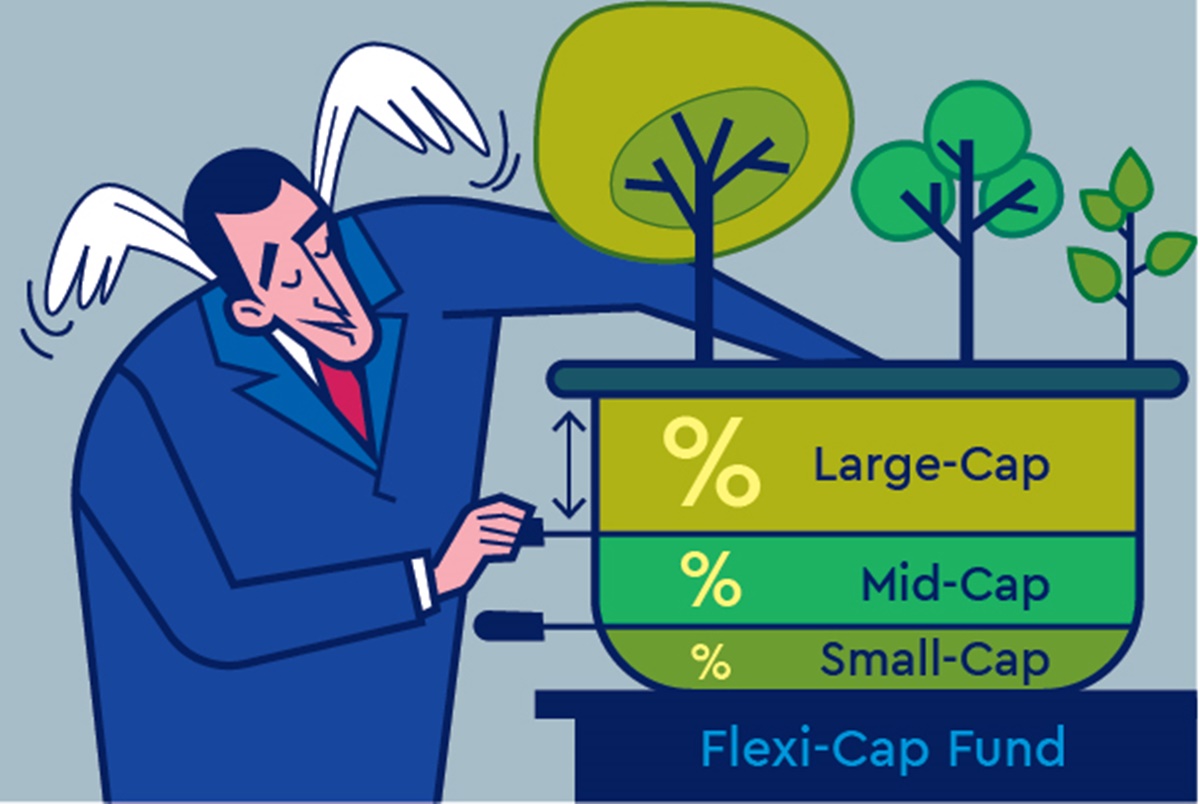

In 2021-22, a net inflow of Rs 35,877 crore was recorded in the newly created Flexi-cap category, which requires mutual funds to invest at least 65 per cent of their corpus in equities without any constraints on investing in large, mid, or small-cap stocks. According to data collected from the Association of Mutual Funds in India (Amfi), this was the most significant net inflow among the equity categories.

According to Morningstar India, since capital markets regulator Sebi created the Flexi-cap category in November 2020, many asset management companies (AMCs) that had been realigned their existing funds into the category of Flexi-cap have launched multi-cap funds, while those AMCs that had kept their funds in the multi-cap category have launched Flexi-cap funds.

What are Flexi-cap funds?

Flexi-cap funds are the funds invested in companies with a range of market capitalizations, including various equities like such as large-cap, mid-cap, and small-cap equities. All large-cap, mid-cap, and small-cap companies are represented in these funds.

A flex-cap fund is a fund that allows investors to diversify their portfolio by investing in firms with other varying market capitalizations, reducing the risk and volatility. Diversified equities funds or multi-cap funds are other names for them.

Unlike mid-cap and small-cap funds, which invest in equities depending on their market capitalization. The Flexi-cap funds can invest in any firm regardless of its market capitalization. The fund manager evaluates the total growth potential of numerous businesses, regardless of their size, and allocates funds to various market segments and businesses.

Factors to be considered in Flexi-cap funds.

Flexi-cap funds have a diverse portfolio, allowing the fund to balance risk and return. These funds also deliver consistent returns, especially during weak market periods.

In addition, the fund manager has the option to periodically review the fund allocation and swap between sectors based on performance.

For example, suppose a fund manager discovers that a market segment in which he or she had invested has become unattractive over time. In that case, the fund manager can shift the allocation to a section that has recently performed better. This provides investors with the option of not just investing in the best-performing equities but also exiting the ones that aren’t performing well.

Market capitalisation is a key factor when it comes to selecting firms to invest in through mutual fund houses. This is because market capitalisation represents the size of a firm, but it also shows other factors that investors consider, such as the company’s track record, growth potential, and risk.

Flexi-cap funds received a net inflow of Rs 2,478 crore in the three months ending June 2021, Rs 18,258 crore in the quarter ending September 2021, Rs 6,191 crore in the quarter ending December 2021, and Rs 8,950 crore in the three months ending March 2022, out of a total of Rs 35,877 crore.

Large-cap funds saw a net inflow of Rs 13,569 crore for the entire fiscal year 2021-22, while mid-cap funds received Rs 16,308 crore and small-cap funds received Rs 10,145 crore.

Apart from this, the multi-cap fund category saw a net influx of Rs 28,095 crore during the period under review, while the sectoral segment saw a net inflow of Rs 27,182 crore.

Through fresh realignment of funds and new fund launches, the Flexi-cap category amassed assets of a total of Rs 2,25,430 crore by the end of March 2022.

A news panel reported that “the Flexi-cap category now accounts for 17% of the aggregate assets of open-end equity funds.”

It had successfully managed to surpass the assets in the large-cap category and gain the top spot in terms of largest assets under management (AUM), but it went back to second in the quarter ended March 2022.