Inflation, Growth At Risk Says Govt Due To Oil Price Hike From Red Sea Crises; Analysts Outlook For Consumers And India’s Economy In FY25 Due To The Red Sea Crisis

The Indian government has warned of potential risks to the country's economic growth and inflation due to escalating oil prices caused by disruptions in the Red Sea. Due to attacks from Yemen-based Houthis, these disruptions have stressed the importance of diversifying trade routes for India and could substantially impact India's growth In FY25 and potentially drive prices upward for all essential items.

The government cautioned on Friday that India’s inflation and economic growth face jeopardy due to the escalation in oil prices triggered by disruptions in the Red Sea, thus requiring diversification of trade routes.

India has so far largely shielded itself from the ongoing conflicts in Europe and the Middle East.

However, recent disturbances in the Red Sea, stemming from attacks by Yemen’s Houthis, have begun to impact India’s shipping activities, raising concerns within the government.

The persistent attacks initiated on November 19, when the Houthis seized control of a commercial vessel in the Red Sea, are causing apprehension due to the looming prospects of increased freight costs, potentially detrimental to Indian exports.

Additionally, there’s concern about a probable surge in crude oil prices and the safety of Indian ships and sailors.

External Affairs Minister S. Jaishankar raised this matter with Iran, a supporter of the Houthis, during a visit to the country in mid-January. Simultaneously, the commerce ministry collaborated with exporters to address their challenges, while the Indian Navy has been mobilized to safeguard Indian vessels.

Approximately 80% of India’s trade with Europe, involving vital commodities such as crude oil, auto parts, chemicals, and textiles, traverses the Red Sea route.

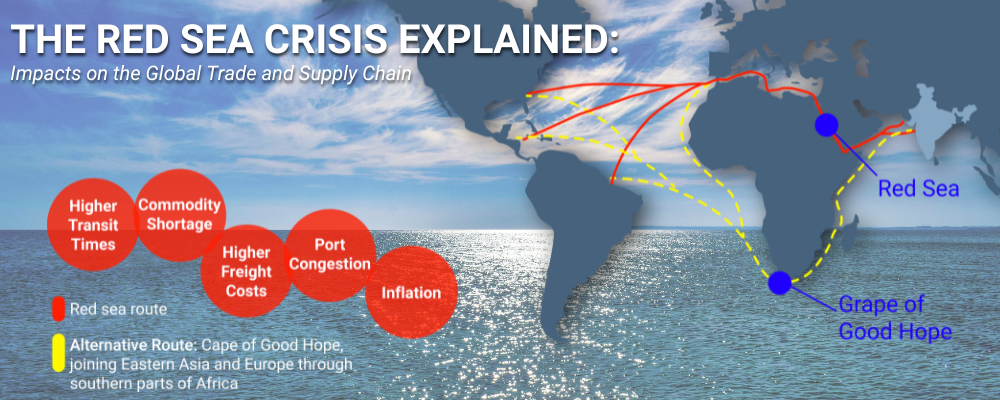

However, missile and drone strikes by Yemen’s Houthi militants have compelled many shipping companies to reroute their vessels away from the Suez Canal to circumvent the southern tip of Africa.

The finance ministry of India noted in its monthly economic review that a combination of exorbitant freight costs, insurance premiums, and prolonged transit times could significantly inflate the prices of imported goods.

The disruptions could affect India’s exports of agricultural commodities, textiles, chemicals, capital goods, marine, and petroleum products, potentially undermining the competitiveness of export prices.

Thus, the finance ministry suggested diversifying trade routes and transportation options to tackle these challenges effectively.

Gauging The Impact

The impact of the crisis on export values in the next financial year remains uncertain, according to the government, as India’s financial year spans from April to March.

Despite the challenges to India’s strong growth and stable inflation environment, the ministry expressed confidence in the economy’s ability to conclude the current financial year on a positive trajectory.

According to the government, the outlook for inflation in the upcoming months is favourable, with increased summer crop sowing expected to help alleviate food prices. While India’s retail inflation marginally eased to 5.09% in February, the central bank remains focused on achieving the 4% inflation target.

The government has revised the official gross domestic product growth estimate for the current fiscal year to 7.6% from 7.3%, signalling confidence in the enduring resilience of the Indian economy.

The All-Important Sea Route

The Red Sea, which connects to the Mediterranean via the Suez Canal, is a vital conduit for Asia-Europe container shipments, which represent up to 15% of global trade.

However, because of the Houthi attacks, believed to be retaliation for the war between Israel and Hamas, vessels have had to be rerouted all the way around Africa via the Cape of Good Hope, doubling shipping costs and lengthening delivery times by as much as 25%.

For Indian exporters, this is becoming a significant challenge.

Approximately 34% of India’s exports are destined for Europe and the eastern coast of the US. With the rerouting of these shipments, ships now have to cover an additional 4,000 to 6,000 nautical miles, resulting in delays of at least two weeks.

The ongoing turmoil in the Red Sea shipping route is also exerting upward pressure on global food prices.

Longer distances for cargo transportation and increased freight rates could potentially escalate costs.

According to the finance ministry’s monthly economic review for February 2024, the heightened crude oil prices stemming from the Red Sea crisis may pose risks to India’s inflation, economic growth, and the value of merchandise exports.

The economic review, quoting a report from the United Nations Conference on Trade and Development (UNCTAD), showed that the Suez Canal witnessed a significant decline in transits—42% and 49%, respectively—in January 2024 compared to peak levels.

Impact of the Red Sea Crisis on the global economy

Alteration in trade routes – Container ships that typically traverse the Suez Canal are now opting to reroute around the Cape of Good Hope.

By the first half of February 2024, container tonnage crossing the Canal plunged by 82%, while vessel tonnage passing through the Cape of Good Hope surged by 60%.

Increase in distance and operational shift due to ship rerouting – The additional miles covered and days lost due to trade diversion have resulted in supplementary expenses, such as fuel costs and diminished value of time-sensitive cargo.

Moreover, heightened security concerns, including piracy risks, are leading to a surge in insurance and legal claims.

Indications of mounting inflationary pressures – Current container freight rates are approximately half of the peaks observed during the COVID-19 pandemic.

However, continued rises in shipping costs due to disruptions can fuel inflation. Additionally, the crisis could lead to a surge in global food prices, with disruptions in grain shipments from the Russian Federation, Ukraine, and Europe posing risks to global food security.

Nigel Green, the CEO of deVere Group, expressed concerns about the escalating tensions in the Middle East, particularly along the crucial Red Sea global shipping route, suggesting that they could potentially instigate a second wave of inflation in 2024.

He noted that disruptions in the supply chain could typically lead to increased expenses for transportation, production, and distribution, which could ultimately be passed on to consumers.

Green further emphasized that as demand surpasses supply, prices may escalate, thereby contributing to inflation, noting that industries heavily reliant on just-in-time inventory systems might be particularly susceptible to such disruptions.

Indian Economy In FY25

The impact of the Red Sea crisis on the Indian economy is also significant

Approximately 80% of India’s merchandise trade with Europe traverses through the Red Sea, affecting key sectors such as crude oil, automotive and auto ancillaries, chemicals, textiles, iron, and steel.

The collective impact of escalated freight costs, insurance premiums, and prolonged transit times could substantially inflate the prices of imported goods.

A continuous disruption in trade routes has the potential to affect the capital goods sector, with possible ripple effects leading to undesirable inventory accumulation, as per insights from a CRISIL report cited in the economic review.

The conflict has disrupted the Middle East’s fertilizer exports to India, particularly impacting the import of Muriate of Potash from Jordan and Israel.

According to BMI, a Fitch Solutions company, the crisis is expected to influence economic growth and inflation across Asia.

Asian economies like China, Japan, India, and South Korea are among the largest net oil importers globally. Therefore, sustained disruptions in shipping could have adverse effects on Asia.

Additionally, a surge in crude oil prices may pose upward risks to inflation and subsequently impact gross domestic product (GDP) growth.

In the report, the finance ministry noted that the resurgence of demand in advanced economies is anticipated to benefit India positively.

However, India may encounter sector-specific impacts on agricultural commodities, marine products, textiles, chemicals, capital goods, and petroleum products.

To effectively tackle these challenges, there might be a necessity to diversify trade routes and transportation options.

Analysts Analysis

According to S&P Global Commodity Insights, the Red Sea crisis has prompted Asian refiners to reassess their oil strategies and develop alternative plans to ensure consistent feedstock flows.

Zhuwei Wang, the firm’s Asian oil analytics manager, outlined three ways in which the Red Sea crisis affects Asian oil flows.

He mentioned potential obstacles for Russian crude flowing to Asia, cautiousness among exporters of products moving northbound from Asia to Europe, and the likelihood of longer routes leading to increased bunker demand in Asia.

Wang explained that any escalation in the crisis would create hurdles for Russian crude flowing to Asia, compelling buyers to seek substitutes from other sources.

Additionally, exporters of products moving from Asia to Europe are cautiously monitoring developments. Moreover, longer routes may generate incremental bunker demand in Asia.

While immediate impacts on near-term oil supplies seem restricted, refiners are contemplating alternative routes to ensure uninterrupted feedstock supply, potentially resulting in elevated insurance costs and squeezed refining margins.

Turning to the domestic economy, the capital goods sector has undergone significant changes since the onset of the Red Sea crisis, and rising costs and delays in deliveries are among the prominent challenges that are being faced.