April through September, India’s fiscal deficit increased by Rs. 6.2 lakh crore.

April through September, India’s fiscal deficit increased by Rs. 6.2 lakh crore.

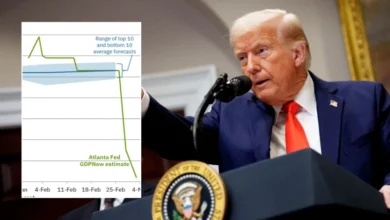

According to figures issued by the Chief Controller of Accounts on Monday, India’s budget deficit increased to 6.20 lakh crore between April and September, or 37.3% of annual estimates. The fiscal deficit increased from 35% reported in the corresponding year-earlier period.

Between April and September, there was 18.24 lakh crore in expenses and 12.04 lakh crore in receipts. While non-tax revenue totaled 1.58 lakh crore, net tax revenue increased to 10.12 crore. According to the figures, the revenue shortfall for the fiscal year was 3.11 lakh crore rupees or 31.4% of the budgeted amount. To 3.42 lakh crore, the Center has boosted its capital expenditures.

The government’s budget deficit for 2022–23 is predicted to be 16.61 lakh crore or 6.4% of GDP. The government plans to spend close to 40 trillion rupees during the current fiscal year, up roughly 4% from the previous one but lower in real terms because of this year’s inflation rate of close to 7%.

Finance Minister Nirmala Sitharaman established the fiscal deficit target for 2022–23 in April at 6.4% of GDP, down from 6.7% in the prior fiscal year, when she unveiled the annual budget in February.

In September, the Centre reported a budget shortfall of Rs 78,248 crore, an increase of 33% from the same month last year. While non-tax revenue increased 248 % to Rs 40,796 crore, net tax revenue increased 13% yearly to Rs 3.12 crore. The total amount received increased by 22% to Rs 3.55 crores.

While capital spending increased 57 percent from the previous year to Rs 90,561 crore, total expenditure increased 24 percent in 2009 to Rs 4.34 lakh crore. Overall, for April through September, the Center’s receipts increased by 9.5 percent to Rs 12.04 crores, while its total expenditure increased by 12 percent to Rs 18.24 lakh crore.

According to its borrowing schedule for the second half of the fiscal year, the government reduced its market borrowing for the fiscal year after Rs 10,000 to Rs 14.21 lakh crore. Data from the monthly accounts of the union government until September show that capital expenditure was 45.7% of the full-year budget objective in the current fiscal, up to 41.4% in the same period the previous year.

Out of the total revenue spending, interest payments accounted for 4.36 lakh crore and substantial subsidies for 1.98 lakh crore, respectively.

“Even as the Government of India’s income shortfall reduced slightly, a solid 50% YoY rise in its capital spending caused a worsening of the budget deficit to Rs 6.2 crores in April-September FY2023 from Rs 5.3 lakh crore in the initial half of FY2022,” said Aditi Nayar, chief economist at ICRA.

Within the first half of 2022–2023, the government’s net tax revenues increased by 10%, balancing a decline in non-tax income of 2% and an increase in revenue expenditures of 6% to moderately reduce its revenue shortfall year over year.

Corp tax and CGST, which contributed to over three-fourths of the increase in the additional gross tax collections in that month compared to September 2021, were the main drivers of the solid 15% YoY growth in the net tax collections in September 2022, according to Nayar.

Additionally, she stated that even though spending would significantly exceed the budgeted level due to fertilizer and food subsidies, and even though the cess reduction on gasoline and diesel will have a negative impact on excise revenues, ICRA expects the fiscal deficit to overshoot by only a modest amount of Rs 1 lakh crore due to the significant increase in non-excise tax revenues in addition to the anticipated savings under other expenditure headings.

Data showed that the total spending for the first half of the current fiscal year was 18.24 lakh crore, up from 16.26 lakh crore the previous year. Minister of Finance Nirmala Sitharaman established the deficit goal for 2022–23 at 6.4% of the gross domestic product, down from 6.7% in the prior fiscal year when she unveiled the annual budget in February.

The government intends to spend close to 40 lakh crore inside the current fiscal year, which is down, in actual fact, due to the near 7% inflationary this year but up roughly 4% from the prior year.

The fiscal deficit, which demonstrates the entire amount of borrowing required by the government, is defined simply as the difference between the total revenue and expenditure of the government. It’s important to note that from April to September of 2022–23, the disparity between expenditures and revenues was Rs 6,19,849 crore.

The most recent statistics show that the Center’s total receipts—including taxes—were Rs. 12.03 lakh crore or 52.7% of the BE for 2022–23. Despite mounting concerns about a fall in revenue from the sale of holdings in state-run enterprises this year, net tax revenues from April through September increased to Rs 10.12 lakh crore, about a 10% increase from the same period last year. This helped the Centre.

According to data, overall spending for the first half of the current financial year has been Rs 18.24 lakh crore, up from Rs 16.26 lakh crore the previous year.

According to monthly accounting of the union government through to September, capital expenditure was 45.7% of the full-year budget objective in the current fiscal, compared to 41.4% in a similar time the previous year.

Edited by Prakriti Arora