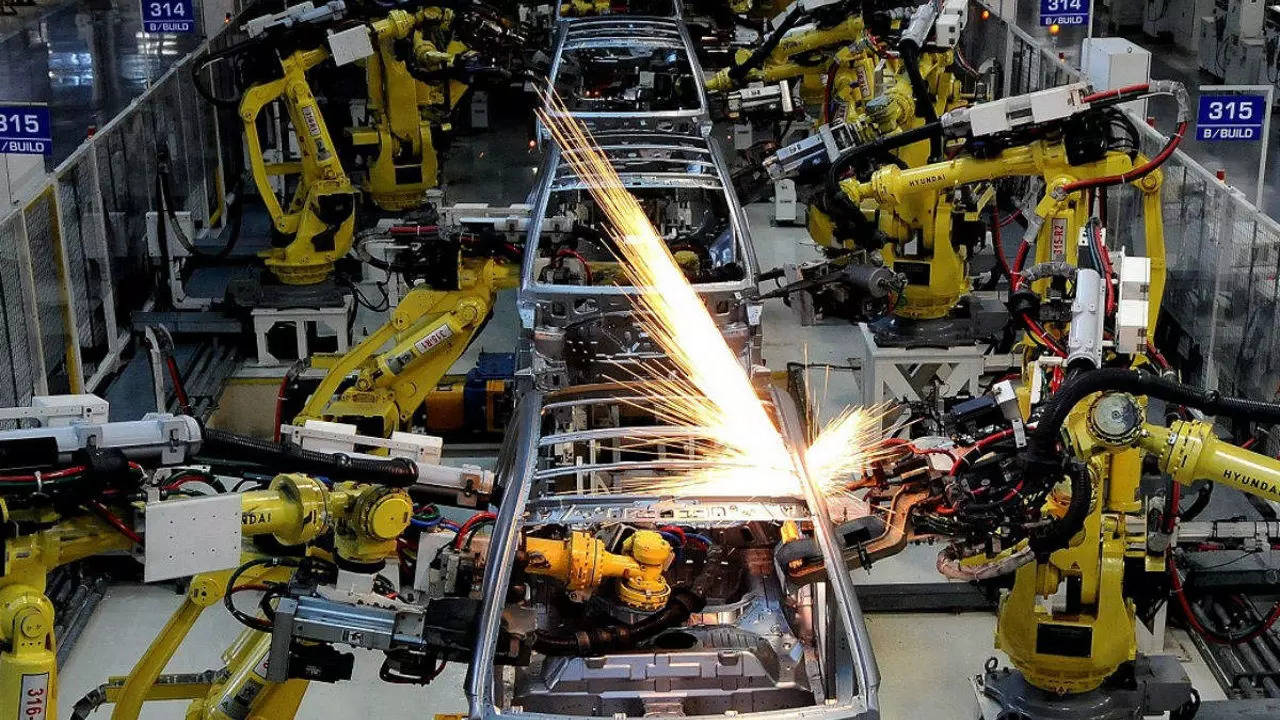

India Marks The Beginning Of Great “Acche Din” In Manufacturing Sector In 2023.

In a June study, India's National Statistical Office (NSO) claimed that there was a significant rise in industrial output, following the Index of Industrial Output climbed 4.2% year on year in April.

India may have reason to rejoice. The country’s industrial production and demand for locally created goods have increased. According to industry watchers, this is an indicator that a manufacturing ecosystem is gradually establishing itself in the home economy.

In a June study, India’s National Statistical Office (NSO) claimed that there was a significant rise in industrial output, following the Index of Industrial Output climbed 4.2% year on year in April.

For the past five months, goods imports have been declining. It dropped 3.63% to $50.66 billion in January, from $52.57 billion in January 2022; 8.21% to $51.31 billion in February, from $55.9 billion the previous year; 7.9% to $58.11 billion in March, from $63.1 billion the previous year; and nearly 14% to $49.9 billion in April, from $58.06 billion the last year. Merchandise imports in May 2023 were $57.10 billion, a 6.8% decrease from $61.13 billion in May 2022.

When these two data sets are compared, industry watchers note that a boost in manufacturing is fulfilling domestic demand in India, reducing the need to import goods in India. They claim that the tendency isn’t widespread and is limited to specific commodities. Also contributing to the reduction in imports has been the decline in the import value of gasoline, vegetable oil, coal, and other commodity prices. Nonetheless, it is evidence that the government’s efforts to stimulate manufacturing in India are bearing fruit.

Imports of electronics, solar photovoltaic (PV) modules, and medical products have consistently declined in India. Imports of electronic products fell 18.55% in January, from $7.6 billion to $6.2 billion. This figure declined 11% in February, from $6.3 billion to $5.6 billion, followed by a 10.25% reduction in March.

According to Rajoo Goel, Secretary-General of the Electronics Industry Association of India (ELCINA), the percentage of electronics imports from China has decreased from 12% to 10% in 2022-23 compared to 2021-22. This might be attributable to the rapid rise of higher EMS (electronics manufacturing services) in India during the previous year.

Other factors, he claims, have also contributed to the drop. In India, government initiatives such as the production-linked incentive (PLI) scheme for large-scale electronics manufacturing, PLI for IT hardware, SPECS, and the Modified Electronics Manufacturing Clusters Scheme (EMC 2.0) have all resulted in the establishment or expansion of manufacturing operations. Several enterprises, especially MSMEs, have been inspired to engage in such areas as a result of this.

According to Goel, these initiatives give financial advantages to enterprises in the electronics sector, supporting local manufacturers in India, despite the fact that they still import a large number of components and raw materials, particularly semiconductors. They require significantly more significant expansion and investment to boost India’s local sector.

The increase in net penetration and disposable money also aided gadget sales, such as cell phones. According to Goel, this has helped India become one of the major marketplaces for electrical items, adding to the manufacturing increase.

The argument that local production is increasing is also seen in medical equipment. According to Rajiv Nath, Forum Coordinator, Association of Indian Medical Device Industry (AIMED), medical device imports in India fell from Rs 63,276 crore in 2021-22 to Rs 61,179 crore in 2022-2023. Manufacturing of non-Covid care, made-in-India medical equipment has increased significantly. According to him, there has also been a restriction on public procurement of imports and a preference for Make in India devices with more than 50% domestic content.

According to data from the Association of Indian Medical Device Industry of India, imports of critical Covid medical devices such as oxygen therapy equipment fell from Rs 1,975 crore to Rs 248 crore, diagnostic test kits fell from Rs 3,850 crore to Rs 2,250 crore, thermometers fell from Rs 1,480 crore to Rs 130 crore, examination gloves fell from Rs 2,275 crore to Rs 488 crore, and oximeters fell from Rs 1,200 crore to Rs 800 crore.

In India, the PLI plan, which was started in 2020, was expanded to the medical devices sector in 2021. According to Anish Bafna, CEO of Bangalore-based medical device maker Healthium Medtech, local manufacturers have focused more on improving product capabilities and expanding into domestic and foreign markets since then. When a company’s geographic reach expands, it helps to enhance economies of scale. This will promote capital expenditures and research and development. This is what they’ve observed over the last few years. He claims that the government’s campaign for indigenisation is at an all-time high right now.

The economies of scale are improving as Indian firms benefit from the government e-marketplace and public procurement order. This also gives these businesses the confidence to compete on a global scale. According to industry watchers, the trend is evident in the growth in exports by 27% in disposables, 24% in electronics and equipment, and 40% in implants. Overall, exports increased by a healthy 16% from Rs 24,000 crore in 2021-22 to Rs 27,800 crore in 2022-2023 in India.

The desire of international corporations to diversify away from China resulted in India being regarded as a destination. According to Bafna, it has also resulted in an increase in production. Because of the dangers and the lengthy regulatory process, not all players are prepared to relocate 100% of their operations outside of China. As a result, they plan to relocate 20-25% of the business over the next few years. Bafna believes India has a disproportionate edge in this area since even a small percentage of movement from China to India would result in a big market.

Both Bafna and Nath predict significant progress in their respective professions during the next four to five years.

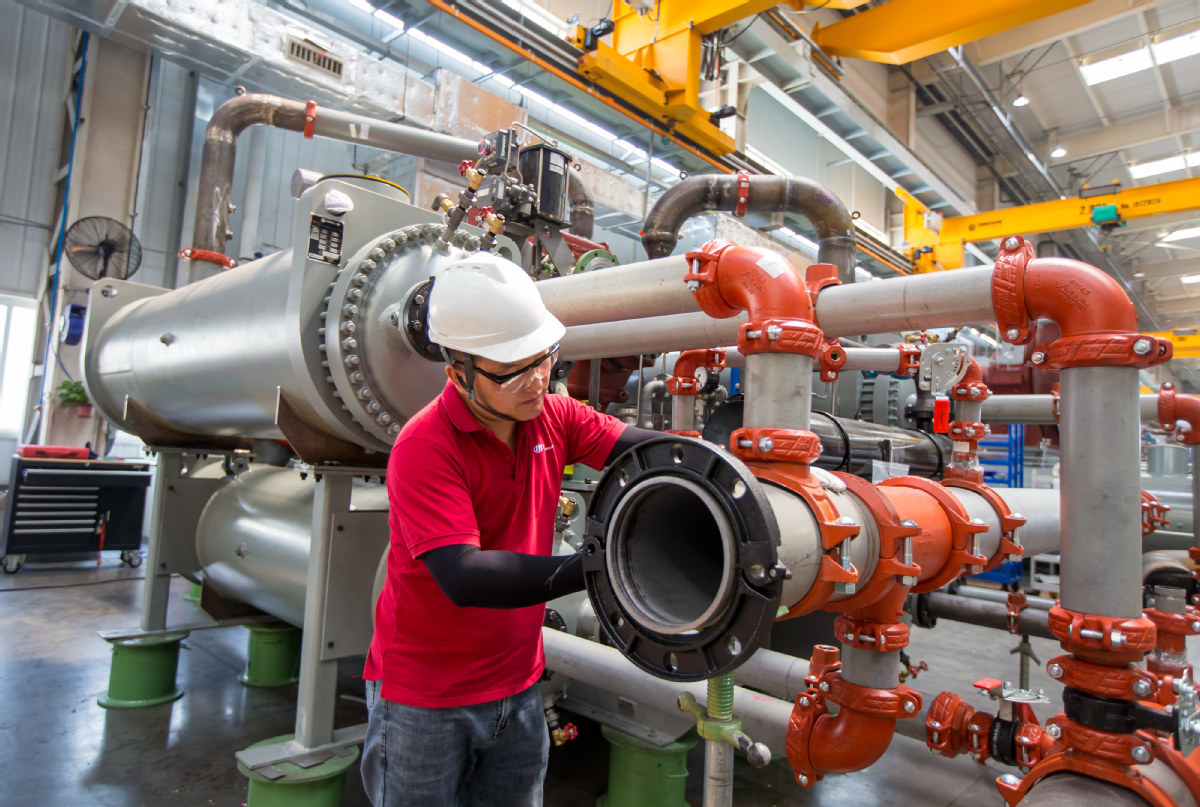

Solar cells, which are built in modules or manufactured into panels, are another sector that has shown promise in terms of lowering imports. According to figures from India’s Ministry of Commerce, imports fell by 0.64%, 5%, and 4.88% in January, February, and March, respectively, compared to the previous year.

The government has been opposed to the importation of solar cells and PV modules. It imposed a baseline customs tariff of 40% on solar modules and 25% on cells in April 2022. According to Gautam Mohanka, MD of Gautam Solar, as demand for these items surged dramatically, local producers were encouraged to enhance their production and capacity. They produced 250 megawatts of solar capacity through 2022. They achieved 500 megawatts in January. They intend to double it shortly. Similarly, several enterprises in the industrial sector have increased their power in response to rising demand in India’s home market.

Mohanka applauds the government’s decision to extend PLI to the solar industry but notes that this is not the only cause for dropping imports. The ongoing backing of the Ministry of New and Renewable Energy, which made the Approved List of Models and Manufacturers (ALMM) mandatory, as well as imposing a baseline customs tariff, aided the Indian business. This aided engineering, procurement, and construction (EPC) firms eager to do business in India, he says.

The ALMM is a list of solar photovoltaic (PV) module types and manufacturers published by the ministry. Government or government-backed projects are required by law to employ only certain models and manufacturers of solar PV modules. This was implemented to lessen reliance on solar module imports. The list now includes around 66 manufacturers.

Since 90-95% of India’s solar parts were previously supplied from China, the decline in imports from China has been considerable.

According to a survey released by the Global Trade Research Initiative in New Delhi, imports of solar cells, components, and diodes from China have decreased by 70.9% to $1.9 billion in 2022-23. China’s proportion of India’s product imports has fallen to 13.79% in 2022-23 from 15.43% in 2021-22, according to the report.

According to AIMED’s Nath, the greatest reduction in medical equipment imports is from China, which has dropped from Rs 13,000 crore to Rs 10,400 crore, a 20% drop.

While these may suggest an improvement in the country’s manufacturing environment, industry watchers believe the country’s necessity to import raw materials for many goods renders it uncompetitive.

Bafna, the CEO of Healthy Medtech, which manufactures surgical needles, sutures, support bandages, and implants, says he would want to expand his product line. However, he would require 200 component suppliers to do this. And because the ecosystem in India is underdeveloped, such component providers do not exist. If he imports these components, he will be unable to price them competitively in the market.

According to Nath, the most difficult obstacle for medical equipment manufacturers is the low custom duty of 0-7.5% in most situations. This results in the importation of various items that are already manufactured and exported from here. Contact lenses, syringes, personal weighing scales, heart catheters, and endoscopes are examples.

There is no need for these items to be imported when they already have a large export market.

According to ELCINA’s Goel, the hurdles for the electronics sector are high logistical costs, complex regulatory procedures, limited local supply chain capabilities, and a scarcity of experienced workforce. According to him, component manufacturers have a 10-12% cost disadvantage, whereas EMS businesses experience a 5-8% cost disadvantage when compared to their worldwide counterparts.

There is no dispute about India’s aim to become a global manufacturing powerhouse. However, in order for this to become a reality soon, the country must pool its resources and begin to develop its domestic market. What they require is captive consumption of locally manufactured goods. Because if you have a high production capacity and capacity utilisation is really low, the unit economics will not work out, explains Bafna.

Conclusion.

In recent months, the country has experienced a decrease in imports of medical gadgets, technological items, and solar modules. Is this the beginning of “acche din” in manufacturing?

Proofread & Published By Naveenika Chauhan