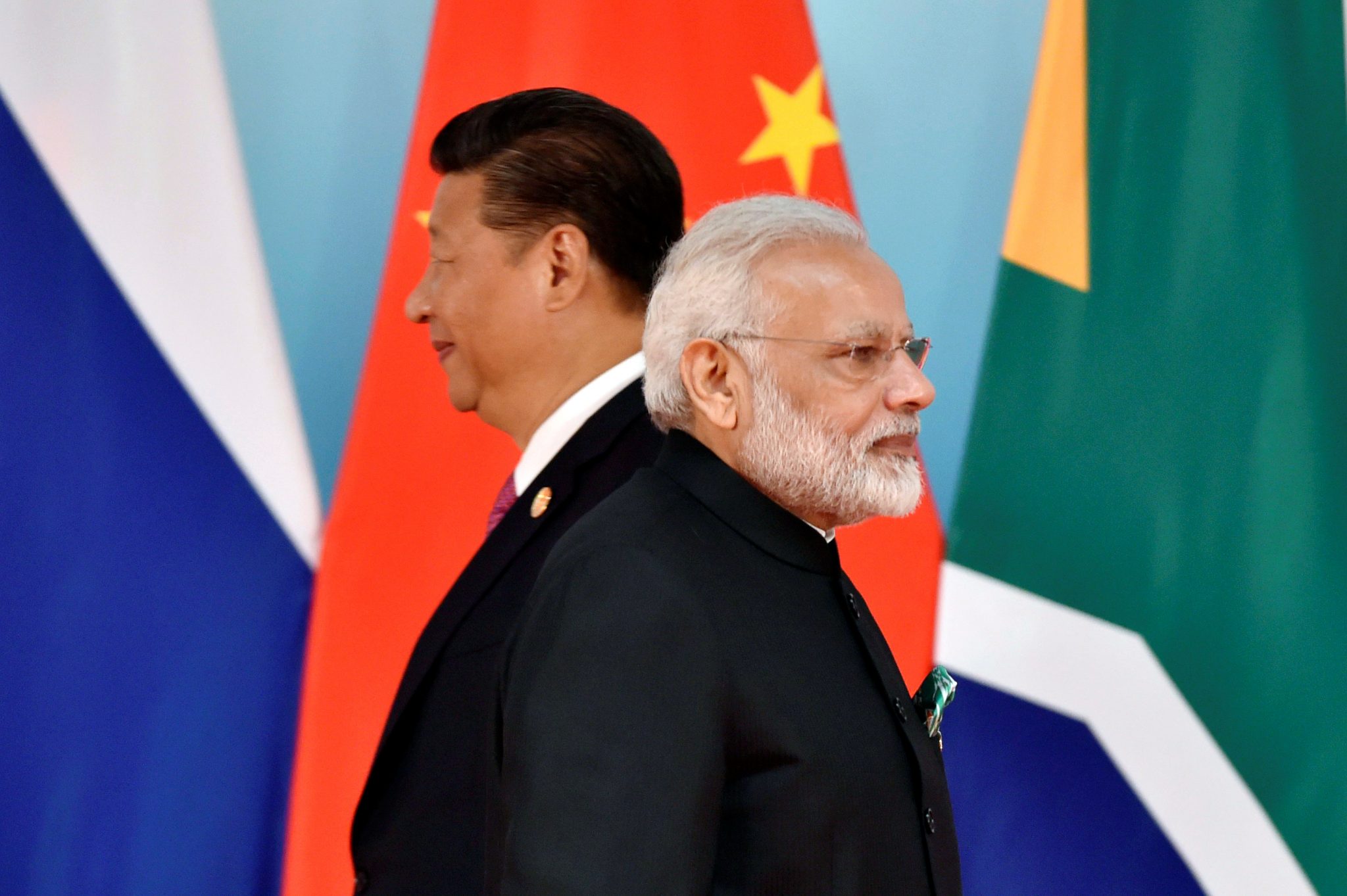

India Stands to Gain More from China Plus One: UBS 2023

India Stands to Gain More from China Plus One: UBS 2023

A sizable local market, political stability, and macroeconomic stability are other factors that help the nation become a centre for alternative manufacturing.

According to Tanvee Gupta Jain, chief economist at UBS India, the China Plus One policy, which several foreign nations have enacted to lessen their reliance on Chinese imports, may make India a manufacturing powerhouse in several industries.

While China is still the world’s top manufacturer, according to Jain, India is better positioned due to its size to replace China as a major manufacturing centre. She stated that several metrics, such as competitive tax rates, decreased manufacturing costs, ease of doing business, and government efforts like the $36 billion production-linked incentive plan, had considerably improved in India since 2019.

Additional factors encouraging the nation’s development as an alternative industrial hub include a sizable local market and political and economic stability. However, high logistical costs, low workforce productivity, and regulatory barriers present difficulties for multinational corporations looking to open offices in India.

India’s GDP growth might reach 6.25–6.75% year-on-year (y-o-y) by 2030 under an “optimistic” scenario and 6.75–7.25% y-o-y under a “blue-sky” system, according to Jain, assuming supply chain changes and reforms continue to benefit the country. According to her, a change in the supply chain would be highly beneficial to industries including medicines, textiles, cars, electronics, chemicals, and industrial gear.

While a favourable base effect could enable India’s real GDP to increase at a pace of 7.5–8% y-o-y in the June quarter, according to Jain, the growth trend is expected to slow over the following quarters to 5-6% y-o-y. UBS predicts that real GDP growth will slow to 6.2% y-o-y for the entire year from 7.2% y-o-y in the previous fiscal. This contrasts with the 6.5% y-o-y prediction from the RBI and the consensus expectation of 6.1% y-o-y.

“According to our strategy team’s study, most historically significant capex spenders indicate decreased expenditure in the short term/FY24. Finally, she noted that the services trade surplus was declining, and the goods trade deficit was starting to grow.

According to a study by UBS, prices for all veggies are likely to reach their high in July and August and begin to decline significantly in September, according to Jain.

The increase in India’s headline CPI inflation, driven mainly by rising vegetable prices, particularly tomatoes, reached a 15-month high of 7.4% y-o-y in July from 4.9% y-o-y in the previous month.

While the price pressures on most vegetables have cooled off since August, Jain predicted that the price of onions will rise in the following months, following that of tomatoes. Accordingly, UBS predicts that CPI inflation will average 5.4% y-o-y in FY24. It anticipates that headline CPI inflation will stay excessive in August at approximately 7% y-o-y before notably declining from September forward.

“We anticipate that the MPC would maintain its vigilance and hold the repo rate low for the remainder of FY24. Policymakers’ active food control and an expected decrease in fuel prices in 2H both assist in reducing pricing pressure, according to Jain.

The China Plus One strategy is a business model companies worldwide are adopting to diversify their supply chain by adding a production base in a country other than China.

This strategy emerged as businesses sought to reduce their dependence on China due to rising labour costs, trade tensions, and other risks. According to a recent report by UBS, India stands to gain significantly from this trend. This article explores how India is poised to benefit from the China Plus One strategy.

The China Plus One strategy could drive a manufacturing boom in India. As companies look for alternatives to China, India’s large labour force, improving infrastructure, and recent reforms, like the Production Linked Incentive (PLI) schemes, make it an attractive destination for manufacturers.

As more companies set up manufacturing units in India, employment opportunities will significantly rise. This is expected to help India leverage its demographic dividend with its young and working-age population.

Due to the China Plus One strategy, UBS predicts a surge in FDI into India. This FDI could come from new factories, technology transfers, and strategic partnerships between Indian and foreign firms.

India has introduced several policy reforms to encourage foreign investment, such as the PLI schemes, which incentivize companies to produce certain goods domestically. The government is also working to improve the ease of business in India by simplifying labour laws and reducing red tape.

To facilitate increased manufacturing activity, India has been aggressively developing its infrastructure. The government has launched ambitious projects, such as the Sagarmala and Bharatmala, which aim to enhance port and road connectivity.

Recognizing the need for a skilled workforce, India has been investing in training programs to prepare its workers for the demands of modern manufacturing jobs.

India is one of many countries looking to benefit from the China Plus One strategy. Southeast Asian nations like Vietnam and Thailand are also attractive options. For India to fully capitalize on this opportunity, it must continue improving its ease of doing business and infrastructure at a faster pace than these competitors.

While India has significantly improved its regulatory environment, further work is required, especially concerning land acquisition laws, labour market rigidities, and the speed of bureaucratic procedures.

As companies move their production bases to India, exports will likely show a significant uptick. This will help to improve India’s trade balance, which has traditionally been in deficit.

Companies relocating to India may bring with them advanced technologies and production techniques. This could significantly upgrade India’s manufacturing capabilities, allowing it to move up the global value chain.

The UBS report suggests that India stands to gain significantly from the China Plus One strategy, offering a unique opportunity to accelerate its economic development and play a more central role in global supply chains. However, to realize these gains, India must continue its policy reform, infrastructure development, and workforce training efforts.

With its unique combination of a large labour force, improving infrastructure, and increasingly business-friendly policies, India is well-positioned to become a primary beneficiary of the China Plus One strategy. As per UBS, the next decade could see India solidify its position as a global manufacturing hub, helping it to achieve its ambitious economic goals.

The potential is vast, but the challenges are real. The road ahead is paved with opportunities, but it will require concerted efforts from the government, industry stakeholders, and the workforce to fully harness the potential of the China Plus One strategy for India.