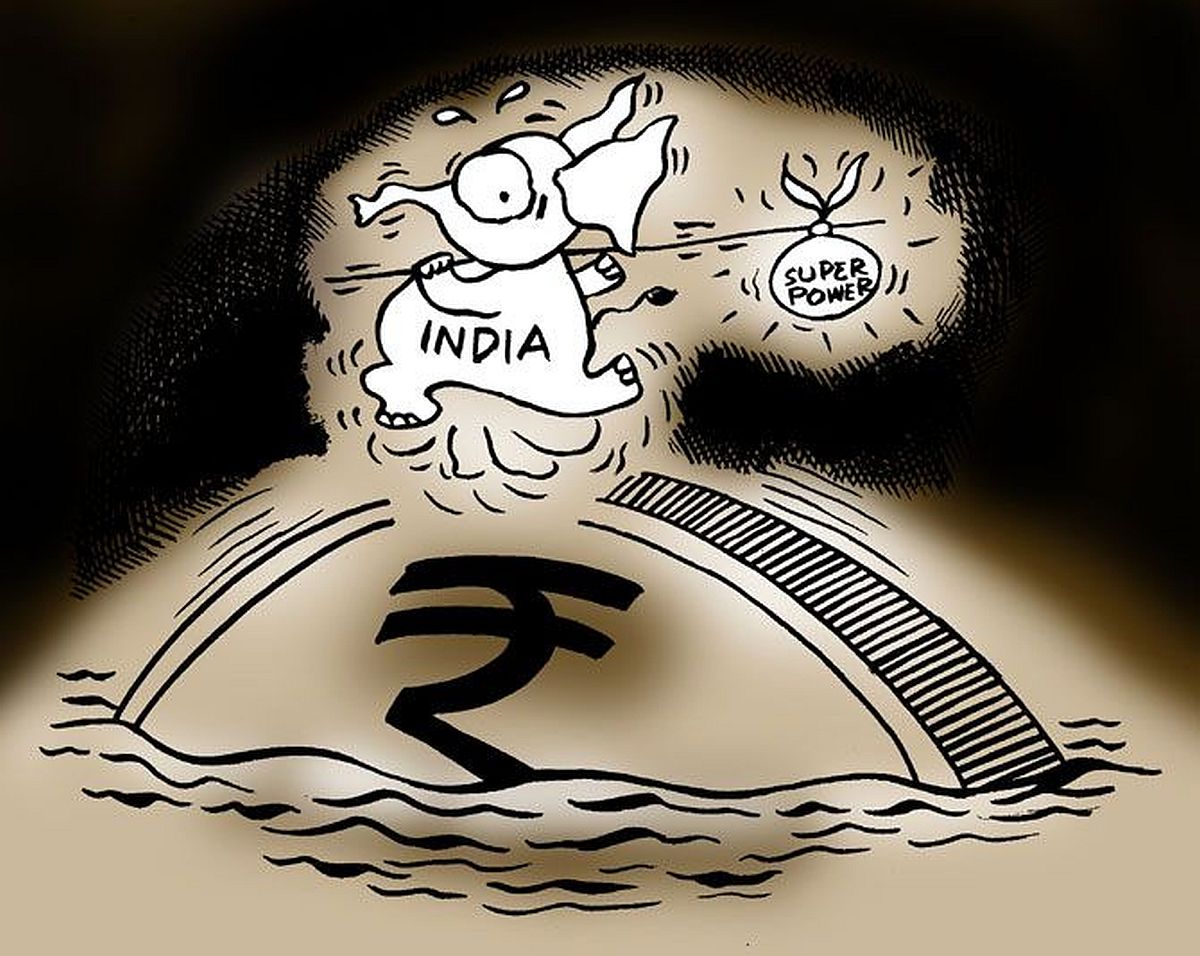

India External Debt $711.8 Billion Crisis Demands Action

Exploring Trends, Implications, and Solutions for India's Rising External Borrowings

India external debt increased by 4.3% to $711.8 billion by the end of September 2024 from June 2024. According to the Finance Ministry, it released some figures that show its debt has increased by $29.6 billion, as the newly released Quarterly External Debt report for the last quarter stated. This article will discuss India’s rising external debt trends, implications, and components. The article shines a light on how it affects the country’s economy.

Key Highlights of the Report

- Debt-to-GDP Ratio:

- The debt-to-GDP from external debt increased from June 2024 to 18.8%, then peaked at 19.4% by September 2024.

- The dependency level of the country to foreign borrowing had risen compared to its economic output.

- Currency Composition:

- The largest share of the debt remains US dollar-denominated, representing 53.4% of total external debt.

- The Indian Rupee stands second at 31.2%, followed by the Japanese Yen (6.6%), Special Drawing Rights (SDR) at 5%, and the Euro at 3%.

- Debt Components:

- Loans constitute the largest share, at 33.7% of total external debt.

- Currency and deposits form 23.1%, trade credit and advances account for 18.3%, and debt securities stand at 17.2%.

- Debt Service Burden:

- Debt service (principal repayments plus interest payments) rose to 6.7% of current receipts by September 2024, slightly higher than the 6.6% recorded in June 2024.

- Sectoral Distribution:

- The general government and the non-government sectors have seen an increase in outstanding external debt during this period.

Analyzing the Rising External Debt

What is External Debt?

External debt comprises public and private debt due to foreign creditors, including foreign-currency-denominated loans, trade credits, and deposits. There has been increasing evidence that the state is increasingly dependent on external borrowings, which means the nation increasingly relies on it to maintain economic stability.

Historical Perspective

It is noticeable that the $711.8 billion now exceeds that in September 2023, at $637.1 billion; there has thus been a net addition of $74.7 billion to external debt since last year. The increase in the figure also reflects the acceleration of borrowings from year-end into this quarter, which could be owing to government and private sector requirements.

Currency Distribution Trends

Dollar-denominated debt amounts to 53.4% of total debt. This again clearly reflects that India depends heavily on dollar-based borrowings. It allows extensive trade and investment facilities across the world, but the nation would be prone to dollar fluctuations and monetary policies of other countries.

Sectoral Contributions

Different types of borrowing are required to raise debt in the government and non-government sectors. Government borrowing finances infrastructure development and fiscal management. The private sector usually borrows to finance trade, manufacturing, and service expansion.

Implications for the Indian Economy

Positive Impacts

- Economic Growth:

- When appropriately utilized, borrowing can lead to infrastructure projects, increase exports, and provide jobs.

- Increased Investments:

- External loans help bring in foreign investments, promoting technological upgrading and economic diversification.

Challenges and Risks

- Exchange Rate Vulnerability: The vulnerability to currency fluctuations, especially during dollar appreciations, can arise from a high share of dollar-denominated debt.

- Debt Servicing Pressure: Increasing debt service ratios (6.7% of current receipts) point to rising repayment burdens, which could pressure foreign reserves.

- Sovereign Credit Risk: An increasing debt-to-GDP ratio could raise concerns among global credit rating agencies, thus affecting India’s borrowing costs.

Strategies for Sustainable Debt Management

Diversifying Borrowing Sources

It will reduce the debt in US dollar terms by diversifying borrowings into other currencies, like the Euro or Japanese Yen. Also, regional agreements for concessional financing could minimize risks.

Boosting Export Revenues

Higher export earnings will help the government manage external debt servicing costs as it would add to the foreign exchange reserves. Policies towards the promotion of manufacturing and reduction in import dependence are also important.

Strengthening Domestic Borrowing

This can minimize exposure to global market volatility with domestic borrowing instead of external debt. The mobilization of resources through domestic bonds and securities could, thus, be safer.

Enhancing Debt Transparency

The regular release of comprehensive debt reports and efficient management of the government’s fiscal aspect helps to retain debt levels in manageable bounds. This helps bring investor confidence also.

A Global Perspective

Foreign debt in India reflects trends in other developing countries of the stabilization process following a pandemic. Such an economy is in high demand from any state which borrows in financing anti-inflationary pressures to fully realize economic stability and expansion. It is this balance that becomes key in the computation for payback coverages.

Conclusion: India External Debt Crisis

India’s increasing trend of external debt at $711.8 billion presents both a challenge and an opportunity. Since it is both an indicator of growing financial activities and growth potentials, it certainly needs prudent handling for long-run economic stability. India can manoeuvre through the issues arising from such an external debt scenario if policies with targeted diversifications of borrowing, enhancement of export prospects, and strong domestic fiscal discipline are incorporated.