Incorporate A Company In Venezuela In 2025

Venezuela, officially known as the Bolivarian Republic of Venezuela, is a country located on the northern coast of South America. Venezuela is also home to vast reserves of oil, making it one of the world’s leading oil producers. Despite its rich natural resources and potential for prosperity, Venezuela has faced significant socio-economic challenges over the past few decades, primarily due to political instability, hyperinflation, and mismanagement of resources.

Standard of Living in Venezuela

The standard of living in Venezuela has undergone a drastic decline in recent years. Once considered one of the wealthiest countries in Latin America, Venezuela now grapples with widespread poverty, food shortages, and inadequate access to healthcare and education. Hyperinflation has rendered the local currency, the Bolívar, nearly worthless, making basic goods unaffordable for a large portion of the population. Many Venezuelans have resorted to bartering or using foreign currencies like the U.S. dollar for transactions. However, the situation varies across socio-economic groups, with wealthier individuals and expatriates enjoying a relatively better quality of life through access to private services and foreign currencies.

Personal Taxes in Venezuela

Venezuela’s personal tax system is progressive, meaning that tax rates increase with higher levels of income. The tax authority, Servicio Nacional Integrado de Administración Aduanera y Tributaria (SENIAT), oversees tax collection.

Residents of Venezuela are taxed on their worldwide income, while non-residents are only taxed on income earned within the country. The personal income tax rates range from 6% to 34%, depending on the taxpayer’s income bracket. Various deductions and exemptions are available, including those for dependents, education expenses, and healthcare costs.

Corporate Taxes in Venezuela

Corporate taxes in Venezuela are levied on the profits earned by companies operating within the country. The general corporate tax rate stands at 34%, which is relatively high compared to other countries in the region. Oil companies, given their significant role in Venezuela’s economy, face even higher tax rates, often exceeding 50%.

In addition to income tax, businesses are also subject to a value-added tax (VAT) on the sale of goods and services, which is currently set at 16%. Companies must comply with a myriad of additional tax obligations, including payroll taxes, municipal taxes, and special contributions for specific industries.

Major Industries in Venezuela

Venezuela’s economy historically revolves around its oil and gas sector, which accounts for nearly 90% of the country’s exports and a significant portion of government revenue. The country possesses some of the largest proven oil reserves in the world, concentrated primarily in the Orinoco Belt.

However, the oil sector’s dominance has overshadowed other industries, leading to a lack of diversification. Other notable industries include:

- Agriculture: Venezuela produces coffee, cocoa, rice, corn, and sugarcane. The fertile plains and favorable climate make it suitable for agriculture, though challenges like outdated infrastructure hinder growth.

- Mining: In addition to oil, Venezuela is rich in minerals like gold, diamonds, and bauxite. The mining sector, while underdeveloped, holds substantial potential for investment.

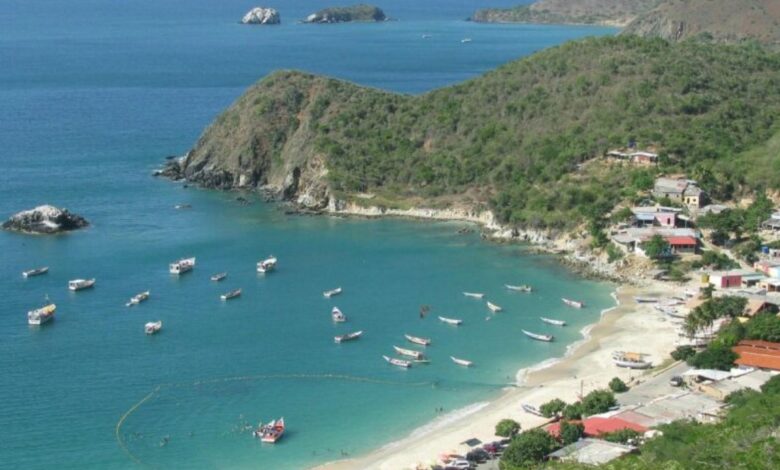

- Tourism: Venezuela’s natural beauty, including Angel Falls and the Caribbean coastline, offers tourism potential. However, political instability has limited this sector’s development.

- Manufacturing: Food processing, textiles, and cement production are notable components of the manufacturing sector. These industries cater primarily to domestic consumption.

Efforts to diversify the economy have been ongoing, though tangible progress remains limited due to governance and economic hurdles.

Inflation & Cost of Living in Venezuela

Venezuela has been plagued by hyperinflation for years, with rates reaching unprecedented levels. The country’s currency, the Bolívar, has suffered significant devaluation, leading to an increased reliance on the U.S. dollar for everyday transactions.

The cost of living in Venezuela varies widely depending on access to foreign currency. For locals relying on the Bolívar, basic goods like food and medicine can be prohibitively expensive due to limited availability and high prices. For those with access to dollars, the cost of living is relatively lower but still marked by challenges like unreliable utilities and limited services.

Property Tax, Services Tax, and Sales Tax in Venezuela

Venezuela’s taxation system includes several components that businesses and individuals must navigate.

Property Tax:

Property taxes are levied at the municipal level and vary depending on the location, type, and value of the property. Rates are generally low, but valuation procedures and enforcement can be inconsistent.

Sales Tax:

Venezuela imposes a value-added tax (VAT) on the sale of goods and services, currently set at 16%. Certain essential goods like food and medicine are exempt, while luxury items may incur higher rates.

Service Taxes:

Specific services, such as telecommunications, financial transactions, and entertainment, may be subject to additional taxes. Businesses are responsible for ensuring compliance with these levies.

Types of Business Entities in Venezuela

Foreign investors and local entrepreneurs can establish several types of business entities in Venezuela. The most common structures include:

- Corporation (Sociedad Anónima or S.A.):

- The most widely used structure for large businesses.

- Requires at least two shareholders.

- Shareholder liability is limited to their capital contribution.

- Limited Liability Company (Sociedad de Responsabilidad Limitada or S.R.L.):

- Suitable for small and medium-sized enterprises.

- Limited to a maximum of 20 shareholders.

- Shareholder liability is restricted to their capital investment.

- Branch of a Foreign Company:

- Allows foreign businesses to operate directly in Venezuela.

- Requires registration with the local commercial registry.

- Partnerships:

- Includes general partnerships and limited partnerships.

- Partners in general partnerships share unlimited liability, while limited partners’ liability is restricted to their investment.

Licenses to Start a Business in Venezuela

Starting a business in Venezuela requires compliance with a range of licensing and regulatory requirements. Key steps include:

- Commercial Registry:

- Businesses must register with the local commercial registry to obtain legal recognition.

- Tax Registration:

- All businesses must obtain a Taxpayer Identification Number (RIF) from the National Integrated Service for the Administration of Customs Duties and Taxes (SENIAT).

- Sector-Specific Licenses:

- Depending on the industry, additional licenses may be required. For example, food businesses need health permits, while mining companies require government approval.

- Municipal Licenses:

- Businesses must secure operating permits from local municipal authorities.

Opportunities for Expats for Business Growth in Venezuela

Despite the challenges, Venezuela offers unique opportunities for expats with the right strategy:

- Oil and Energy: Expats with expertise in oil extraction, refining, or renewable energy can find lucrative opportunities in partnerships with the government or private entities.

- Agribusiness: Investments in modernizing agricultural practices can yield substantial returns, given Venezuela’s fertile land and unmet demand for food.

- Healthcare and Pharmaceuticals: The scarcity of medicines and healthcare services presents opportunities for companies specializing in medical supplies or healthcare solutions.

- Tourism and Hospitality: Developing eco-tourism or high-end hospitality services in underutilized regions can attract international tourists.

- Digital Services: Expats with technology skills can leverage the growing demand for digital solutions, including e-commerce, fintech, and IT services.

- Infrastructure Development: Opportunities abound for expats involved in rebuilding infrastructure, including transportation, housing, and utilities.

Successful ventures require a deep understanding of local markets, reliable local partnerships, and risk mitigation strategies.

Citizenship for Expats in Venezuela

Venezuela offers pathways for expats to obtain citizenship, though the process is often lengthy and requires adherence to specific legal requirements.

- Residency Requirements:

- Expats must reside in Venezuela for five consecutive years to qualify for citizenship. This period is reduced to two years for individuals from Latin American or Caribbean countries.

- Marriage to a Venezuelan Citizen:

- Expats married to a Venezuelan citizen can apply for citizenship after residing in the country for two years.

- Naturalization Process:

- Applicants must demonstrate fluency in Spanish, knowledge of Venezuelan history, and a commitment to the country’s values.

- The naturalization process involves submitting documents to the Ministry of Interior and Justice and attending an interview.

- Dual Citizenship:

- Venezuela allows dual citizenship, enabling expats to retain their original nationality while becoming a Venezuelan citizen.

While obtaining citizenship can be a lengthy process, it offers benefits such as property ownership rights and ease of doing business in the country.

Why Register a Company in Venezuela?

Registering a company in Venezuela can be advantageous for several reasons, particularly for those seeking to tap into its underutilized market. Key benefits include:

- Access to Natural Resources: Venezuela is home to some of the world’s largest reserves of oil, natural gas, and minerals like gold and bauxite. Entrepreneurs in energy, mining, or related industries can benefit significantly.

- Emerging Market Potential: With a large population and unmet demand for basic goods and services, businesses in sectors like healthcare, agriculture, and consumer goods can thrive.

- Strategic Location: Located at the northern tip of South America, Venezuela offers proximity to major global markets, including the United States, Latin America, and the Caribbean.

- Government Incentives: The Venezuelan government offers incentives, particularly for foreign investors in priority sectors like agriculture, tourism, and renewable energy.

- Dollarized Economy: While the local currency, the Bolívar, has faced hyperinflation, the growing use of U.S. dollars in transactions provides relative stability for foreign investors.

How to Register a Company in Venezuela

The process of registering a company in Venezuela involves several steps and requires compliance with local laws and regulations. Here’s a step-by-step guide:

- Choose the Business Structure: Decide on the type of entity you want to establish. Options include corporations (Sociedad Anónima – S.A.), limited liability companies (Sociedad de Responsabilidad Limitada – S.R.L.), or branches of foreign companies.

- Reserve a Business Name: Register the desired company name with the Commercial Registry to ensure it is unique and complies with naming regulations.

- Draft the Articles of Incorporation: Prepare the company’s articles of incorporation, which outline the business’s purpose, capital structure, and governance.

- Register with the Commercial Registry: Submit the articles of incorporation and other required documents, such as identification of shareholders and proof of address, to the local Commercial Registry.

- Obtain a Taxpayer Identification Number (RIF): Register with the National Integrated Service for the Administration of Customs Duties and Taxes (SENIAT) to obtain your RIF, essential for all tax and financial activities.

- Open a Bank Account: Open a corporate bank account in the country to deposit the company’s initial capital.

- Secure Additional Licenses: Depending on the industry, obtain necessary permits and licenses from municipal or sector-specific authorities.

- Municipal Registration: Register with the local municipality where your business will operate to obtain the required operating license.

While the process is bureaucratic, hiring a local consultant or legal expert can ensure smooth navigation through the requirements.

Cost to Register a Business in Venezuela

The cost of registering a business in Venezuela can vary based on the type of business, location, and industry. Key expenses include:

- Commercial Registry Fees: Typically range from $200 to $1,000, depending on the company’s capital and legal structure.

- Legal Fees: Hiring a lawyer to draft articles of incorporation and assist with registration can cost $500 to $2,000.

- Municipal Fees: These vary by locality and range from $100 to $500.

- Sector-Specific Licenses: Costs depend on the industry and can range from $100 to $5,000.

Overall, registering a small to medium-sized business in Venezuela can cost between $1,000 and $10,000.

Relation with Other Countries of Venezuela

Venezuela’s international relations play a significant role in shaping its business environment. Key aspects of its foreign relations include:

- Oil Diplomacy: Venezuela’s vast oil reserves have historically been a cornerstone of its foreign policy. The country has strong ties with nations reliant on its oil exports, such as China, India, and Cuba.

- Strategic Alliances: Venezuela maintains close relationships with countries like Russia, China, and Iran, which have provided economic and political support during its economic crisis.

- Regional Integration: As a member of organizations like MERCOSUR (currently suspended), ALBA, and UNASUR, Venezuela aims to promote economic cooperation within Latin America.

- Sanctions and Isolation: Relations with Western countries, particularly the United States and the European Union, have been strained due to political disagreements and sanctions. These sanctions affect financial transactions and access to international markets.

Understanding Venezuela’s global relationships is crucial for businesses relying on imports, exports, or international partnerships.

Any Other Taxes in Venezuela

In addition to corporate and personal income taxes, businesses operating in the country must comply with other tax obligations:

- Value-Added Tax (VAT): A 16% VAT applies to most goods and services. Certain essentials, such as food and medicines, are exempt.

- Municipal Taxes: Businesses must pay municipal taxes, calculated as a percentage of gross revenue. Rates vary by locality.

- Payroll Taxes: Employers must contribute to social security, unemployment insurance, and other labor-related funds. The total contribution is typically around 9% of an employee’s salary.

- Special Tax for the Oil Industry: Companies involved in the oil sector face additional levies, including royalties and special income taxes.

- Import Duties: Tariffs apply to imported goods, with rates depending on the product type and origin.

Compliance with these taxes is essential to avoid penalties and ensure smooth business operations.

Social Security in Venezuela

Social security in Venezuela is managed by the Instituto Venezolano de los Seguros Sociales (IVSS). The system provides a range of benefits, including pensions, healthcare services, maternity benefits, and unemployment assistance. Contributions are mandatory for both employers and employees, with employers contributing around 11% and employees 4% of their monthly salaries.

Despite its structure, the social security system faces challenges due to economic instability. Benefits are often insufficient to cover basic living costs, and healthcare services are underfunded, leading many to rely on private services. However, reforms and international assistance programs aim to improve the situation, especially for the most vulnerable populations.

Weather and Climate in Venezuela

Venezuela’s climate is diverse, thanks to its varied geography, which includes the Andes Mountains, the Amazon rainforest, and the Caribbean coastline. The country primarily experiences a tropical climate with two distinct seasons:

- Rainy Season (May to November): Characterised by frequent rain and high humidity.

- Dry Season (December to April): Known for sunny skies and pleasant weather.

Temperatures range from 21°C to 27°C (70°F to 81°F) in most regions, but higher altitudes, like Mérida, experience cooler climates, while the plains and coastlines remain warmer.

This favourable weather supports agricultural activities and attracts tourists to its beaches and natural wonders. However, climate change has brought occasional extreme weather, affecting agriculture and infrastructure.

Regional Safety and Security of Citizens

Safety and security in the country are significant concerns, with high crime rates and political unrest posing challenges. Major cities like Caracas, Maracaibo, and Valencia face issues such as theft, armed robberies, and kidnappings. Rural areas, while less populated, may also lack adequate law enforcement.

To mitigate these risks, citizens and visitors are advised to:

- Avoid displaying wealth in public.

- Stay informed about local developments and political protests.

- Rely on trusted transportation options and avoid traveling at night.

Despite these challenges, many regions, particularly small towns and coastal areas, remain relatively safe and offer a welcoming atmosphere for residents and tourists. Efforts by the government and international organizations continue to aim for enhanced security.

Passport Power of Venezuela

The Venezuelan passport ranks moderately on the global mobility scale. As of 2024, Venezuelan citizens can travel visa-free or with visa-on-arrival to over 130 countries, including prominent destinations like Russia, Turkey, and most South American countries.

However, gaining access to the United States, Canada, or European Union countries often requires a visa, which can be a cumbersome process due to diplomatic challenges. Despite these limitations, the passport provides significant regional mobility within Latin America, fostering economic and cultural exchange.

Scope of Education, Growth, and Opportunities

Education in the country is free and compulsory for children aged 6 to 15. The country boasts a literacy rate of over 95%, reflecting a historically strong emphasis on education. Public universities, such as the Central University of Venezuela, offer affordable higher education in fields like medicine, engineering, and social sciences.

Despite these positives, the education sector faces challenges:

- Underfunding has led to deteriorating infrastructure and limited resources.

- Brain drain, with many skilled professionals leaving the country for better opportunities abroad.

- Limited access to modern technology in rural schools.

However, private institutions and international partnerships are filling some gaps, ensuring quality education for those who can afford it.

Opportunities for Growth

- Entrepreneurship: With a growing reliance on dollarised transactions, small businesses in sectors like food, healthcare, and retail are thriving.

- Agriculture: Fertile land and government incentives offer potential for growth in farming and agri-business.

- Digital Economy: Venezuela’s young, tech-savvy population is fostering opportunities in remote work, IT services, and e-commerce.