Incorporate A Company In Andorra In 2025

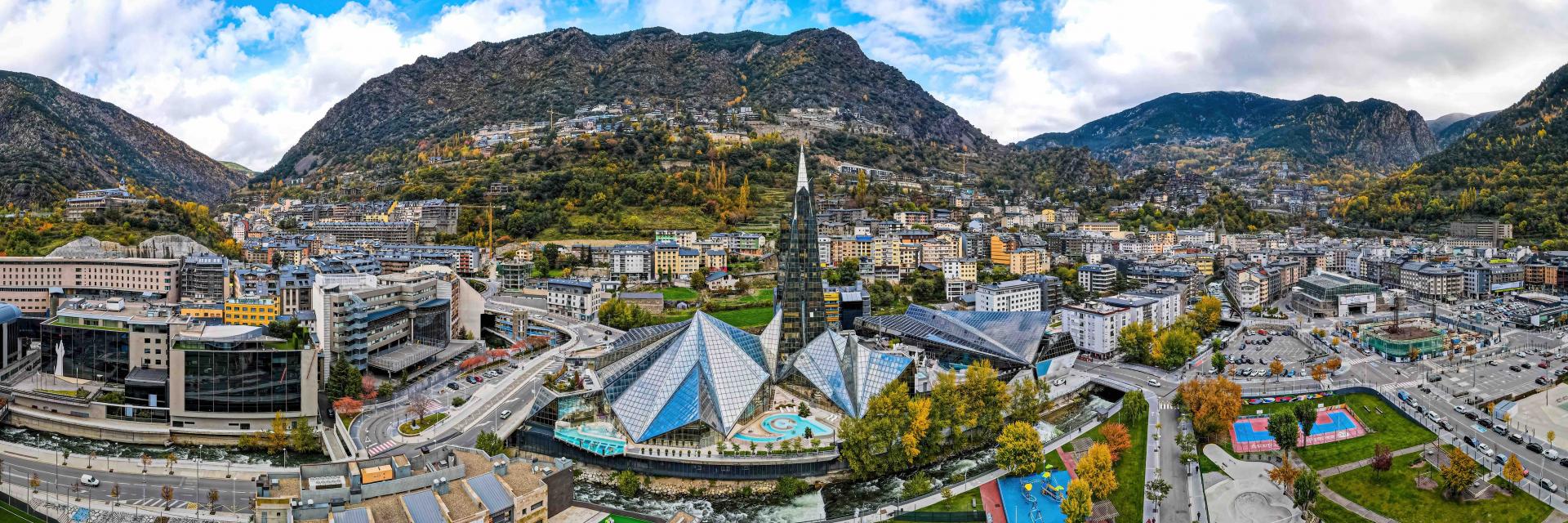

Nestled in the Pyrenees mountains between France and Spain, Andorra is one of Europe’s smallest countries, renowned for its breathtaking landscapes, tax-friendly policies, and high standard of living. With a population of approximately 80,000 people, the country spans just 468 square kilometres, making it a micro state with a big appeal.

Known for its picturesque ski resorts, duty-free shopping, and outdoor adventures, Andorra attracts millions of tourists each year. While its official language is Catalan, Spanish, French, and English are widely spoken. Despite not being a member of the European Union, the country enjoys a close economic and political relationship with the EU through trade and customs agreements.

Standard of Living in Andorra

Andorra offers an exceptional standard of living, thanks to its stable economy, low crime rates, and pristine environment. The country consistently ranks high on global quality-of-life indices.

- Healthcare

Andorra’s healthcare system is one of the best in Europe, providing universal coverage to residents. Both public and private healthcare facilities are equipped with modern technologies and highly trained professionals. - Education

Education in Andorra is multilingual, with schools offering instruction in Catalan, Spanish, and French. The country places a strong emphasis on academic excellence and cultural integration. - Lifestyle

The country’s serene environment, clean air, and outdoor recreational opportunities contribute to a healthy lifestyle. Activities like skiing, hiking, and cycling are integral to daily life. - Safety

The country has one of the lowest crime rates in the world, making it a secure place for families and individuals. Its political stability further enhances its appeal as a safe haven. - Cost of Living

While the cost of living is slightly higher than neighbouring countries, the absence of VAT on many goods and services balances expenses. Utilities, healthcare, and public services are reasonably priced.

Personal Taxes in Andorra

Andorra is widely known for its favourable personal tax policies, making it an attractive destination for high-net-worth individuals and expatriates:

- Income Tax

Andorra has a progressive income tax system, with rates ranging from 0% to 10%.- Income up to €24,000 is tax-exempt.

- Income between €24,001 and €40,000 is taxed at 5%.

- Income exceeding €40,000 is taxed at the maximum rate of 10%.

- No Wealth or Inheritance Taxes

Andorra does not levy taxes on wealth, inheritance, or gifts, further enhancing its appeal for affluent individuals. - Social Security Contributions

Employees and employers contribute to the country’s social security system, which funds healthcare, pensions, and unemployment benefits.

Corporate Taxes in Andorra

Andorra has a business-friendly corporate tax regime designed to attract foreign investment and entrepreneurship:

- Corporate Tax Rates

The standard corporate tax rate is 10%. However, companies that meet specific criteria, such as engaging in international trade or research and development, may benefit from reduced rates as low as 2%. - Value-Added Tax (VAT)

The country imposes a General Indirect Tax (IGI), which functions like VAT, at a flat rate of 4.5%. This is one of the lowest indirect tax rates in Europe. - Tax Incentives

The government offers tax incentives for businesses in tourism, technology, and financial services. These benefits include reduced tax rates and exemptions for qualifying startups.

Major Industries in Andorra

Despite its small size, Andorra boasts a diverse economy with several key industries:

- Tourism

Tourism is the backbone of the country’s economy, contributing nearly 80% of its GDP. The country attracts millions of visitors annually, drawn by its world-class ski resorts, duty-free shopping, and outdoor activities. Winter sports dominate the tourism sector, but summer activities like hiking, mountain biking, and cultural festivals are also significant. - Retail and Duty-Free Trade

Andorra’s duty-free status makes it a shopping paradise for tourists and locals. The retail sector thrives on the sale of electronics, luxury goods, alcohol, and tobacco at competitive prices, driving significant revenue for the economy. - Finance and Banking

The country’s financial sector has transitioned from a historically secretive banking system to a transparent, modern framework aligned with international regulations. The country now focuses on wealth management and private banking, attracting clients from around the globe. - Agriculture and Livestock

Though limited by geography, agriculture in Andorra supports the production of high-quality dairy products, vegetables, and local wines. Livestock farming, especially cattle and sheep, contributes to the domestic market. - Telecommunications and Technology

With a growing emphasis on digitalization, the country has invested in technology infrastructure. Initiatives like smart city projects and digital platforms aim to position the country as a hub for innovation.

Inflation and Cost of Living in Andorra

- Inflation Trends

Andorra’s inflation rate has remained moderate in recent years, reflecting its stable economy and effective monetary policies. Its close ties with the European Union, despite not being a member, help maintain price stability. - Cost of Living

The cost of living in the country is generally higher than in neighbouring Spain but lower than in France. Key factors include:- Housing: Rental prices vary, with a one-bedroom apartment in Andorra la Vella costing €800–€1,200 per month, while rural areas are more affordable.

- Utilities: Utilities, including electricity, water, and internet, are reasonably priced, costing about €100–€150 per month.

- Groceries and Dining: Locally sourced goods are affordable, but imported items can be expensive due to transportation costs. Dining out is popular and relatively inexpensive compared to Western Europe.

- Transportation: Public transport is efficient and affordable, with local bus services and well-maintained roads for private vehicles.

Property Tax, Services, and Sales Tax in Andorra

- Property Tax

Andorra’s property tax rates are among the lowest in Europe. Property owners pay an annual fee based on the location and size of the property, making real estate investment highly attractive. - General Indirect Tax (IGI)

The IGI functions similarly to VAT and is levied at a flat rate of 4.5%, one of the lowest in Europe. Reduced rates apply to essential goods and services. - Other Taxes

- No Wealth or Inheritance Tax: Andorra does not impose taxes on wealth, inheritance, or gifts, making it a haven for high-net-worth individuals.

- Tourism Tax: A minimal tax is levied on accommodations, contributing to the maintenance of tourism infrastructure.

Types of Business Entities in Andorra

The country provides several options for setting up a business, each catering to different needs:

- Sole Proprietorship

A simple structure for small-scale businesses where the owner has full control but is personally liable for debts. - Limited Liability Company (SL)

The most popular choice for entrepreneurs, an SL requires a minimum share capital of €3,000. Shareholders’ liability is limited to their contributions. - Public Limited Company (SA)

Designed for larger businesses, an SA requires a minimum share capital of €60,000 and allows for the issuance of shares. - Branch or Subsidiary

Foreign companies can establish branches or subsidiaries to operate in Andorra, with the parent company bearing liability for branch activities. - Non-Profit Organizations

Charities and non-profit entities can be registered for specific social, cultural, or environmental causes.

Licenses to Start a Business in Andorra

Starting a business in Andorra involves obtaining the necessary licenses and permits:

- Company Registration

Businesses must register with the Andorran Chamber of Commerce, submitting documents like the business plan, Articles of Association, and shareholder details. - Foreign Investment Authorization

Foreign investors require government approval to hold more than 10% of an Andorran business. - Sector-Specific Licenses

Depending on the industry, additional permits may be required. For example, restaurants need health and safety certifications, while tourism businesses must obtain special tourism licenses. - Tax Registration

Businesses must register with the tax authorities for IGI, corporate tax, and social security contributions.

Opportunities for Expats for Business Growth in Andorra

Andorra offers numerous opportunities for expatriates to establish and grow businesses:

- Tourism Ventures

With millions of visitors annually, opportunities exist in hotels, restaurants, guided tours, and adventure sports businesses. - Real Estate and Property Development

The growing demand for housing and commercial spaces provides lucrative prospects for expatriates in real estate investment and development. - Digital Economy and Startups

Andorra’s emphasis on technology and innovation creates a favorable environment for expats in IT, fintech, and e-commerce. - Education and Language Training

With a multilingual population, language schools and vocational training centers are in high demand. - Sustainability and Renewable Energy

The country’s focus on environmental sustainability offers opportunities for businesses in renewable energy and eco-friendly services.

Citizenship for Expats in Andorra

- Residency Permits

Expats can apply for passive or active residency permits, depending on their circumstances:- Passive Residency: Ideal for retirees and investors, requiring proof of financial independence and investment in Andorra.

- Active Residency: Granted to individuals who work or run businesses in the country.

- Path to Citizenship

Citizenship in the country is attainable through naturalisation, but the process is stringent:- Applicants must reside in the country for at least 20 years or 10 years if educated in Andorra.

- Dual citizenship is not allowed; applicants must renounce their previous nationality.

- Benefits of Citizenship

Andorran citizenship provides access to the country’s high standard of living, robust healthcare system, and visa-free travel to over 150 countries.

Why Register a Company in Andorra?

Andorra is an attractive destination for business registration due to its numerous benefits:

- Low Taxes

Andorra’s tax-friendly regime is one of its main attractions. The country offers a corporate tax rate of 10%, which can be reduced to 2% for specific activities. Additionally, the absence of wealth, inheritance, and capital gains taxes makes the country particularly appealing for high-net-worth individuals. - Strategic Location

Positioned between France and Spain, the country provides easy access to European markets while maintaining its status as a non-EU member. This unique position allows businesses to operate within the European economic sphere without adhering to all EU regulations. - Political and Economic Stability

Andorra is politically stable, with a robust economy driven by tourism, retail, and financial services. Its safe and secure environment ensures business continuity. - High Standard of Living

Andorra offers excellent healthcare, education, and infrastructure, making it an attractive place to live and work. The low crime rate and serene environment enhance its appeal. - Business-Friendly Policies

The country actively encourages foreign investment, offering incentives and streamlined processes for business setup. Reforms in recent years have further opened the economy to international entrepreneurs.

How to Register a Company in Andorra

Registering a company in Andorra involves several steps. The process is straightforward but requires compliance with local regulations:

- Choose a Business Structure

Select a legal structure for your business. Common options include:- Sole Proprietorship: Ideal for small businesses owned by a single individual.

- Limited Liability Company (SL): A popular choice requiring a minimum share capital of €3,000.

- Public Limited Company (SA): Suitable for larger enterprises, with a minimum share capital of €60,000.

- Branch Office: For foreign companies looking to establish a local presence.

- Obtain Foreign Investment Approval

Foreign investors must receive authorization from the Andorran government. This involves submitting a business plan, proof of financial stability, and personal identification documents. - Reserve a Company Name

Choose a unique name and register it with the Andorran Company Registry. - Draft Articles of Association

Prepare the company’s Articles of Association outlining its objectives, structure, and operational guidelines. - Register with the Chamber of Commerce

Submit the required documents to the Chamber of Commerce and Industry of Andorra for company registration. - Tax Registration

Register the company with the Andorran tax authorities to obtain a tax identification number (NRT) and comply with the General Indirect Tax (IGI) regulations. - Open a Bank Account

Open a corporate bank account in an Andorran bank to deposit the initial share capital and manage business transactions. - Obtain Licenses and Permits

Depending on the nature of your business, you may need additional licenses or sector-specific permits.

Cost to Register a Business in Andorra

The cost of registering a business in the country varies depending on the type and scale of the company. Key expenses include:

- Company Registration Fee

The standard registration fee ranges from €400 to €1,000, depending on the complexity of the business. - Legal and Administrative Fees

Hiring legal experts to draft documents and navigate the registration process costs between €1,000 and €3,000. - Minimum Share Capital

- Limited Liability Company (SL): €3,000

- Public Limited Company (SA): €60,000

These amounts must be deposited into a company bank account.

- Licenses and Permits

Sector-specific licenses can cost €500–€5,000 annually, depending on the industry. - Ongoing Costs

Businesses must also budget for annual renewal fees, accounting services, and compliance reporting, which typically cost €1,000–€3,000 per year.

Relation with Other Countries of Andorra

Andorra maintains strong diplomatic and economic relationships with its neighbors and international partners:

- France and Spain

The country shares close ties with France and Spain, its immediate neighbors. These relationships facilitate trade, tourism, and infrastructure development. Both countries also play a role in Andorra’s co-principality governance system. - European Union

While not an EU member, Andorra has agreements with the EU for trade, customs, and taxation. These agreements allow the country to access European markets while maintaining its fiscal independence. - International Organizations

Andorra is a member of the United Nations, the International Monetary Fund (IMF), and the World Health Organization (WHO), reflecting its commitment to global cooperation. - Global Trade

The country’s strategic position and duty-free status make it a hub for trade and retail. The country has worked to align its financial regulations with international standards to attract global investors.

Any Other Taxes in Andorra

In addition to corporate and personal taxes, businesses in the country should be aware of other taxes:

- General Indirect Tax (IGI)

Andorra imposes an IGI, similar to VAT, at a flat rate of 4.5%. Reduced rates apply to essential goods and services, making it one of the lowest consumption taxes in Europe. - Property Tax

Property owners pay an annual tax based on the assessed value of their property. Rates vary depending on the location and type of property. - Social Security Contributions

Employers contribute approximately 15.5% of employees’ salaries to social security, which covers healthcare, pensions, and unemployment benefits. - Tourism Tax

Accommodations like hotels and rental properties are subject to a tourism tax, contributing to the maintenance of Andorra’s infrastructure. - Environmental and Sectoral Taxes

Specific industries, such as energy and telecommunications, may be subject to additional levies to support environmental sustainability and infrastructure projects.

Social Security in Andorra

Andorra’s social security system, managed by the Caixa Andorrana de Seguretat Social (CASS), provides comprehensive benefits to residents, ensuring a high quality of life. The system is funded through contributions from employees, employers, and self-employed individuals.

- Healthcare

Residents enjoy access to universal healthcare, with the government subsidising up to 75% of medical expenses through CASS. For hospitalisation and specialised care, the coverage increases to 90%. The healthcare system is modern, with well-equipped hospitals and clinics. - Pensions and Retirement

The social security system includes a pension scheme that ensures financial security during retirement. Contributions made during one’s working years determine the pension benefits. - Unemployment and Disability Benefits

Unemployed individuals and those with disabilities receive financial assistance through the social security system, promoting inclusivity and stability. - Family Support

The government offers benefits for families, including maternity and paternity leave, childcare allowances, and educational subsidies.

Weather, Climate, and Regional Safety

- Weather and Climate

Andorra has a mountainous climate with four distinct seasons:- Winter: Cold and snowy, ideal for skiing and other winter sports. Temperatures average -2°C to 6°C.

- Summer: Warm and sunny, perfect for hiking and outdoor activities, with temperatures ranging from 14°C to 26°C.

- Spring and Autumn: Mild with occasional rainfall, providing picturesque views of the changing landscape.

The clean air and low pollution levels contribute to a healthy environment, attracting outdoor enthusiasts year-round.

- Regional Safety and Security

The country is one of the safest countries in the world, with an exceptionally low crime rate. Its political stability, strong law enforcement, and close-knit community enhance safety for residents and visitors alike. Natural disasters are rare, further solidifying Andorra as a secure and peaceful place to live.

Passport Power of Andorra

The Andorran passport is highly valuable, offering significant global mobility:

- Visa-Free Travel

Andorran citizens enjoy visa-free or visa-on-arrival access to over 150 countries, including Schengen Area nations, the United Kingdom, and Canada. This global reach is particularly advantageous for business and leisure travel. - EU Relations

Although the country is not an EU member, its passport grants many of the same benefits, thanks to agreements with the European Union. Residents and citizens benefit from close economic and political ties with Europe. - Dual Citizenship Restrictions

Andorra does not permit dual citizenship, so individuals must renounce their previous nationality to acquire Andorran citizenship.

Scope of Education, Growth, and Opportunities in Andorra

Andorra provides a range of opportunities for personal and professional development, supported by excellent educational institutions and a thriving economy.

- Education

- Multilingual Education System: The country offers a unique trilingual education system, with schools teaching in Catalan, Spanish, and French. This multilingual approach prepares students for global opportunities.

- Higher Education: The University of Andorra, though small, offers specialized programs in fields like computer science, nursing, and business administration. Students can also access universities in neighboring countries.

- Affordability: Education is free at the primary and secondary levels, with scholarships available for higher education.

- Career Growth

- Thriving Industries: Tourism, retail, finance, and real estate dominate Andorra’s economy, offering numerous job opportunities for residents and expatriates.

- Entrepreneurial Environment: Andorra’s low taxes and business-friendly policies encourage entrepreneurship, particularly in sectors like technology, e-commerce, and sustainability.

- Lifestyle and Recreation

- Outdoor Activities: Residents enjoy a variety of outdoor activities, including skiing, hiking, and mountain biking.

- Cultural Enrichment: The country hosts numerous festivals, concerts, and art exhibitions, enriching the cultural experience.

- Family-Friendly Environment

With excellent healthcare, education, and safety, Andorra is an ideal place for families. The government’s focus on environmental conservation and public welfare adds to the quality of life.