In inversion of US treasury yields, a recession is foretold.

A recession is predicted by the inversion of US Treasury yields. A recession is typically characterised by job losses, a decline in overall demand, and a contraction of an economy’s overall output for at least two consecutive quarters.

Many of the top economies in the world, including the biggest and most significant of all, the United States, are experiencing recessionary fears as the new year draws near. The inversion of US treasury yields is a key indicator that the US is indeed headed for a recession.

What is a recession in the first place?

A recession is typically characterised by job losses, a decline in overall demand, and a contraction of an economy’s overall output for at least two consecutive quarters. Based on its evaluation of the intensity, breadth, and duration of the impact on the economy, the US National Bureau of Economic Research (NBER) determines whether the economy is in a recession.

Even though the duration isn’t always long, a pandemic like COVID-19 can cause a very severe decline, as was the case in the aftermath. Or, the recession may have less depth and spread but last longer, as is anticipated in the UK after the financial crisis brought on by the Liz Truss-Kwasi Kwarteng mini-Budget of September 2022.

US treasuries: What are they?

Government loans are the most secure in any economy because they are made to permanent organisations that rarely go into default. Governments must borrow money because, in most cases, their tax revenues are insufficient to cover all of their expenditures.

Government bonds are the means by which the government borrows money from the market. In India, they are referred to as G-secs, in the UK, as gilts, and in the US, as treasuries.

And what is a treasury’s yield?

A government bond has a fixed “coupon” payment, unlike a bank loan, whose interest rate changes over time. Therefore, the US government may “float” a $100,00 face value, $5.00 per year coupon bond. This means that if you lend $100 to the US government by purchasing this bond, you would receive $5 annually for the following ten years as well as the full $100 at the conclusion of those ten years. This would suggest a 5% yield.

However, if this bond were to be sold for some reason to a different investor, the yield would change according to the price paid for the bond. The yield will decrease if the price rises—say let’s the bond is sold for $110—because the annual return ($5) stays the same. And the yield will increase if the price drops.

The yield curve: what is it?

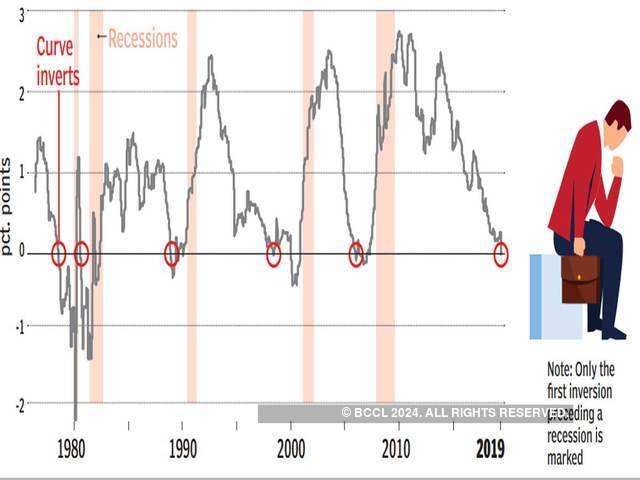

Governments can borrow money for periods of one month to thirty years. Because one is lending money for a longer period of time, yields are typically higher for longer tenures. When the yields for various bond tenures are mapped, an upward-sloping curve (designated “Normal” in the chart above) results.

Depending on the amount of money on the market and the anticipated level of overall economic activity, the curves can be flat or steep. When the economy is doing well, investors move money out of long-term bonds and into shorter-term, riskier investments like the stock market. Long-term bond yields increase as their prices decline, steepening the yield curve.

Yield inversion: What is it?

When the yields on bonds with shorter terms are higher than those on bonds with longer terms, this is known as a yield inversion. Investors will withdraw money from risky short-term assets (like the stock market) and invest it in long-term bonds if they believe the economy is in trouble. Long-term bonds’ prices increase as a result, while their yields decrease.

The yield curve first flattens as a result of this process before eventually inverting. US treasuries have been experiencing yield inversion for a while, which has made it a reliable indicator of an impending recession in the country. The difference in yields between 3-month and 10-year Treasury bonds has turned negative.

Is anything here shocking?

Not completely. The US Federal Reserve has been increasing short-term interest rates to reduce overall demand and economic activity in an effort to contain historically high inflation levels. The US has experienced a recession every time the Fed has attempted to reduce inflation by more than two percentage points in the past.

The Fed seems committed to getting inflation down to 2%, but despite rapid rate increases of 425 basis points, inflation has only slowed down from around 9% in July to 7% in November.

In addition, the economy added hundreds of thousands of jobs during the July–September quarter, pushing up wages and maintaining historically low unemployment rates. As a result, even though the Fed has now started raising rates more slowly, it is anticipated that it will continue to do so and maintain those higher rates for a longer period of time.

The probability that the US economy will enter a recession increases as the Fed tightens its monetary policy. The yield inversion demonstrates this.

Why does India care about this?

It has a variety of implications. The US dollar will likely become even stronger against the Indian rupee as interest rates rise. As a result, Indian imports will cost more and may increase domestic inflation.

A rebalancing of the investments going to India may result from higher returns in the US. A weaker rupee may help Indian exports, but a recession will reduce global demand for Indian goods.

Lower crude oil prices for India could be the silver lining of a slowdown or recession, though.

Recent events marked the deepest inversion of a portion of the US yield curve since 1981, which is a louder indicator of an impending recession.

The gap between the 10-year US Treasury yield and the two-year yield last week was the largest in 41 years, according to the Wall Street Journal.

The US experienced a severe recession that raised the unemployment rate to 10.8% the last time the curve was this inverted. At the time, Paul Volcker, the then-Chairman of the Federal Reserve, was waging war on inflation. In contrast, unemployment reached its highest point during the Great Financial Crisis at 10%.

The 10-year yield on Tuesday was 0.74 percentage points lower than the two-year yield. The inversion indicates that investors anticipate the Federal Reserve will eventually cut interest rates to help an ailing economy that is being burdened by a harsh tightening cycle.

Despite the fact that policymakers have stated it will continue, the Fed’s hawkish campaign appears to be having some success. Better-than-expected CPI data from the Labor Department earlier this month supported the idea that inflation is starting to decline.

Stocks, meanwhile, have recently increased. The S&P 500 index increased by 6% since the day before the inflation reading on November 10 despite a 17% year-over-year decline.

Prior to the Fed’s upcoming policy meeting on December 13–14, when rates are widely anticipated to increase by 50 basis points, Fed Chair Jerome Powell will deliver a speech at a gathering sponsored by the Brookings Institution on Wednesday.

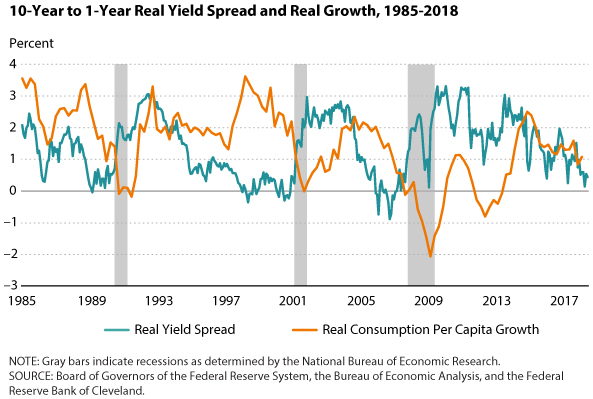

Inversions of the real economy are more difficult. They represent the consensus of the market that a recession is imminent. Consumers and businesses try to reduce debt rather than acquire more of it during recessions.

However, some consumers and some businesses are compelled to borrow in order to pay their bills and finance inventory that cannot be sold. Investors charge high-interest rates for these risky short-term loans because they prefer to lend to organisations that don’t need the money.

However, there aren’t many profitable investments during recessions. Typically, investors withdraw their funds from risky investments like stocks and opt for safe, long-term fixed-income investments instead, where they are willing to accept lower returns.

However, because businesses are not growing and people are not actively buying homes, there is little demand for long-term funds. Long-term rates decrease when there are many willing lenders and few long-term borrowers.

Of course, the real economy is messier than these straightforward stories, and inversions and the economy have many nuances and elaborations. Today’s key insight is that both of these self-limiting mechanisms explain why inversions are typically mild.

In a monetary inversion, long-term rates don’t fall much below short-term rates because people anticipate the Fed will eventually cut rates if a recession occurs. Investors anticipate that the recession will eliminate economic deadwood, reduce leverage through a combination of repayment and default, and lead to the emergence of new, alluring, risky long-term investments. A typical, upward-sloping yield curve should then resume after that.

There are two main reasons why the current inversion might increase: monetary and real economic factors. The market understood Volcker’s willingness to maintain high rates throughout the 1978–1982 period, and it also understood that it would take some time to squeeze inflation out of the economy.

If the current inversion is primarily monetary in nature, it means that the market believes that current Fed chair Jerome Powell is willing to maintain high-interest rates even in a recession and that it may take four to five years to correct the massive expansion of the federal debt and money supply, as well as the bubbles inflated during the longest bull market in history.

However, if real economic calculations are to blame for the current inversion, then its growing size may indicate that investors do not anticipate a productive recession that will allow for the restoration of the economy to a state that will support the subsequent bull market. Not through repayment or default, but rather through government forgiveness and subsidies, debt will be reduced. Instead of prices falling, markets will stabilise through price controls or government borrowing.

The monetary scenario indicates that current issues are more serious than most people believe them to be and that the Fed has the capacity and motivation to address them. According to the real economy scenario, political leaders have the capacity and desire to bring about problems in the future.

So, is the main focus of the current inversion monetary or real? The Fed’s rate hike history can provide some information. In the 1978–1980 inversion, the average federal funds rate was 194 basis points higher than the average for the two years prior to the inversion. However, the average rate over the course of the following four inversions was significantly lower than the average rate from the previous two years. This suggests that the inversion between 1978 and 1980 was monetary, and the subsequent four were economic.

Edited by Prakriti Arora