How Jio-BlackRock JV May Have Disrupted Tata’s Bid For UTI AMC

The Tata Group is currently deliberating on the possibility of submitting a bid for UTI Asset Management Company in light of Jio Financial Services' recent entry into the mutual fund sector. Reportedly, Tata Group is closely monitoring the future plans of Jio Financial Services and their potential impact on the financial industry. UTI AMC is currently primarily owned by four state-owned entities, collectively holding slightly over 45% of its stake, and these entities are exploring avenues to divest their interests. Previous discussions between the Tata Group and these public sector entities had stalled due to disagreements regarding the divestment process. Notably, Jio Financial Services has attracted attention due to its appointment of KV Kamath to lead its financial services division.

The Tata Group, India’s largest conglomerate in terms of market capitalization, is presently evaluating its options with great care, contemplating whether to engage in the bidding process for UTI Asset Management Company, according to industry insiders.

This decision comes in the wake of Jio Financial Services, owned by Mukesh Ambani, entering the market at a time when the financialization of savings is on the rise in India, where real estate and bullion have traditionally been favoured as stores of value.

Sources close to the matter have revealed that the conglomerate, with diverse interests ranging from salt to software, is closely observing the market to assess the future plans of Jio Financial Services and their potential impact on the competitive landscape of the mutual fund industry.

Major players in the financial sector perceive Jio Financial Services as a possible disruptor, particularly as the Indian mutual fund industry is expected to see the entry of several new players.

UTI Asset Management Company is currently predominantly owned by four state-owned financial entities, namely Punjab National Bank, Life Insurance Corporation of India, State Bank of India, and Bank of Baroda, who collectively hold slightly over 45% of its stake.

These entities, both individually and collectively, are exploring options to formally solicit bids from interested parties for the sale of their stakes, having appointed SBI Capital Markets as their banker for this endeavour.

Previously, the Tata Group had been in advanced negotiations to acquire a majority stake in UTI AMC from these four public sector entities.

However, the discussions reached an impasse when a significant investor in UTI AMC insisted that a formal bidding process be followed by all stakeholders for the sale of their stakes, instead of utilizing the nomination route.

An informed source commented, “There is undoubtedly a significant interest in UTI AMC, and the group would have preferred to conclude the bidding process much earlier; regrettably, that was not the case.

The entry of Reliance has altered the dynamics, as Reliance had previously shown no interest in bidding for UTI AMC and may opt for a different strategy.

Nevertheless, the Tata Group is vigilantly monitoring the situation and will make a well-timed decision accordingly.”

Tata Sons, the holding company of the Tata Group, has refrained from providing any official comments on the matter.

Jio Financial Services has enlisted the expertise of KV Kamath, Chairman of the National Bank for Financing Infrastructure and Development (NaBFID), to lead its financial services division.

Industry players are taking note of Kamath’s substantial skills and extensive experience in institution-building, anticipating that he may steer Jio Financial Services on a distinct growth trajectory.

As of June 2023, over 40 asset management companies collectively managed assets worth nearly ₹43.77 lakh crore. In descending order, the three largest asset managers in the country are SBI Mutual Fund, ICICI Prudential Mutual Fund, and HDFC Mutual Fund.

Indian Mutual Fund Sector’s Swift Growth

The Indian mutual fund industry is currently in the midst of a significant transformation, driven by a combination of factors such as the increasing trend of financialization, growing investor appetite for risk, and the widespread adoption of digital platforms.

Rapid Growth in Assets Under Management (AUM)

One of the standout features of the Indian mutual fund industry is its remarkable growth in assets under management (AUM) over the past few years.

According to McKinsey, the industry’s AUM surged from 23 trillion rupees (approximately $287 billion) in 2016 to an impressive 52 trillion rupees (around $650 billion) as of December 2020.

A Crisil report extended this growth trajectory, estimating the industry’s AUM to have reached a staggering 135 trillion rupees (about $1,687.5 billion) as of March 2022.

This astounding expansion can be attributed to several key trends:

- The increased adoption of digital platforms has made it easier for investors to access mutual fund products, thereby broadening the investor base.

- There has been a noticeable uptick in investors’ risk appetite, leading to a greater allocation of funds to equity-based mutual funds.

- The availability of advisory services has played a pivotal role in guiding investors towards mutual fund investments.

These trends have also coincided with a significant increase in the number of adults holding bank accounts, rising from 53% in 2016 to an impressive 78% in 2021.

The same has, therefore, translated into higher household savings and a consequent surge in investments in capital market products, with mutual funds witnessing their AUM grow from 7% in 2018 to 10% in 2022.

Mutual Fund Investors and Their Demographics

As of April 2022, the AUM in the mutual fund segment stood at 38.4 trillion rupees (approximately $480 billion), and this figure climbed further to 41.53 trillion rupees (about $519.13 billion) by March 2023. As of June 2023, over 40 asset management companies collectively managed assets worth nearly ₹43.77 lakh crore

Despite the industry’s impressive growth, there is room for further expansion. An Edelweiss report reveals that the actual number of investors in mutual funds is only around 3.5 crore (35 million), a relatively small fraction compared to India’s working-age population, which exceeds 94 crores, thus highlighting the substantial untapped potential within the industry.

Penetration Challenges and Opportunities

While the Indian mutual fund industry has achieved remarkable growth, it still faces challenges related to market penetration.

According to a Crisil report, penetration rates in India remain relatively low, particularly in T30 (Top 30) and B30 (Beyond 30) cities when compared to developed markets like the United States.

Limited awareness, a scarcity of distributors in smaller towns, and the need for a robust intermediary system contribute to this phenomenon.

However, Nithin Kamath, the CEO of the largest broking firm, Zerodha, offers a different perspective. He argues that penetration is actually quite decent when considering the population segment with sufficient funds to invest.

Kamath’s analysis suggests that the industry’s target customer base is approximately 10 crores (100 million people), with around 3 crores (30 million) unique mutual fund investors; therefore, the industry’s penetration rate stands at about 30%, a noteworthy achievement, especially for a developing economy.

The Mutual Fund Show: Will Jio-BlackRock JV Disrupt AMCs?

Reliance Industries Ltd.’s financial services arm, Jio Financial Services, and global investment manager BlackRock joined forces to venture into the asset management industry in a significant move that stirred the financial industry.

The 50:50 joint venture, aptly named Jio BlackRock, is well poised to make waves in the mutual fund space, as already seen with Tata Group reconsidering its bid on UTI, thus presenting an intriguing blend of disruption and financial expertise.

The Birth of Jio BlackRock

On July 26, 2023, Reliance Industries and BlackRock inked a historic agreement marking their entry into the asset management industry through a joint venture.

Both Reliance Industries and BlackRock are committing an initial investment of $150 million each to fuel the growth of Jio BlackRock.

The Last Bit, The entry of Jio Financial Services, now part of Jio BlackRock, presents a significant disruption in the mutual fund industry.

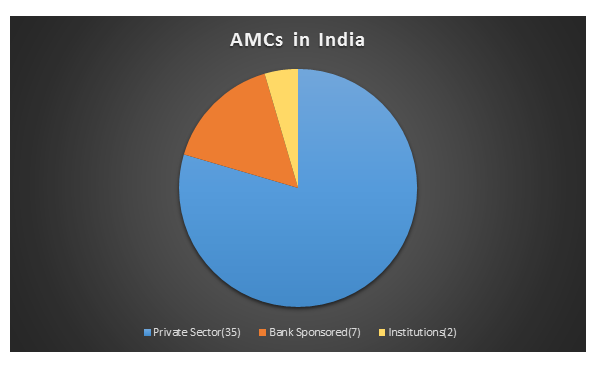

The joint venture enters the scene with a substantial Asset Under Management (AUM) portfolio, surpassing a staggering ₹44 lakh crore; the development makes Jio BlackRock the 44th firm to enter the mutual fund industry, highlighting the competitive intensity in this space.