How are Ukraine’s sparse wheat plantings complicating global food security?

Ukraine is one of the world’s leading wheat exporters, with key buyers including Egypt, Tunisia and also Morocco, Indonesia, Pakistan, and Bangladesh, and a further drop in output will force many to seek alternative supplies. This could cause global prices to rise, affecting importers who do not buy directly from Ukraine.

War, rain, and economic hardship have reduced wheat plantings in Ukraine, depriving the country of vital export earnings in 2023 and also heralding another year of more tight global supplies and potentially high food prices.

Ukraine is one of the world’s leading wheat exporters, with key buyers including the main cities of Egypt, Tunisia, Morocco and also Indonesia, Pakistan, and Bangladesh, and a further drop in output will force many to seek alternative supplies. The rush to secure grain is likely to raise global prices, affecting importers who do not buy subsequently from Ukraine.

Ukraine harvested around more than 19 million tonnes of wheat this year and down more than 40% from the previous season’s record of around 33 million tonnes, and analysts predict a further sharp drop in production in 2023.

In a further blow to the production prospects, cash-strapped Ukrainian farmers are reducing their use of critical crop inputs such as fertilizers. Farmers who do plant will have lower yields as a result of using less fertilizer.

“Farmers do prefer to see what happens next year, so they planted very little in the fall.” People also just want to wait and also see what happens, sit on the money and maybe they don’t have money for various reasons,” says Kees Huizinga, a Dutch national who also runs a 15,000-hectare dairy and also crop farm in central Ukraine.

The drop in output will have an impact on some of the world’s poorest countries. Ukraine exports some wheat to Turkey, where it is processed into flour and shipped to Africa and particularly Sub-Saharan Africa, as well as soft wheat-based pasta, which is popular among developing-country consumers due to lower prices compared to durum pasta.

The Agricultural Market Information System (AMIS), which was also established by G20 members to strengthen global food security, has warned that another poor crop in Ukraine will mean that global stocks will not recover for at least another year, ensuring that prices remain high and markets are volatile.

The food crisis also coincides with the main ongoing economic consequences of the COVID-19 pandemic, climate change, and high energy prices.

“I fear that higher food prices are here to stay, and not just because of Ukraine’s problems.” “All other producers are facing high fertilizer, fuel, labor, and transportation costs,” said Marex Solutions analyst Georgi Slavov.

In contrast, farmers in Ukraine continue to receive very low prices due to the difficulty and high cost of transporting crops across the war-torn country to main export hubs.

“Everyone is saving more money and planting at the lowest possible cost (including less fertilizer use), which results in a very significant drop in yield next year,” said Dmitry Skornyakov, CEO of Ukraine farm company HarvEast.

Lower fertilizer application, according to Alexander Karavaytsev, a senior economist at the International Grains Council, could also have a negative impact on crop quality.

“It is understood that also soils in Ukraine have some buffer due to previous farmer investment, and Chernozems (black soils) are the world’s best fertile soils,” he said. “However, low fertilizer application rates can have an impact on quality.”

Reduced export earnings in Ukraine

According to Reuters calculations, a sharp drop in production will also result in Ukraine’s wheat export revenues falling far short of the roughly $4 billion in the 2021/22 season.

According to government data, farmers had planted 3.6 million hectares of winter wheat as of month Nov. 7, down 41% from 6.09 million during the same time last year.

Ukraine sowed approximately 6.1 million hectares of winter wheat for the 2022 harvest, but also, a large area has been occupied by Russian forces since their February invasion, and only 4.6 million hectares have been harvested.

“The drop in planted area is a triple effect of weather, economic, and also technical factors (such as inability to access fields),” said Sebastien Poncelet, who is an analyst at Agritel, a French crop consultancy with a Ukrainian office.

Rapeseed plantings, in contrast to wheat, have fared well. “Rapeseed was planted. It’s a little lower, but still reasonable. “We believe about 1 million hectares were sown, compared to the usual 1.15-1.3 million,” Poncelet said.

Transporting crops to Europe is expensive, but it accounts for a much smaller portion of the value of rapeseed, which can be sold very roughly twice the price of wheat which was also once delivered to the European Union.

“Rapeseed also generates more revenue. There is more money than cereals if you can get one of the lorry dispatched from the farm. “Rapeseed has good margins,” Poncelet added.

Spring oilseeds are preferred.

Similar shifts are expected in Ukraine’s upcoming spring planting season, with corn being the main grain crop sown and sunflowers being the main oilseed.

“Spring may look the same as fall,” Huizinga said, noting that there may be fewer grain plantings and a similar area for oilseeds.

However, prospects are also dependent on whether it is possible to export from Ukrainian ports under a United Nations-led pact that was signed on July 22 but is set to expire on November 19.

The agreement allows agricultural products to be mainly exported from three Ukrainian ports, and also it is hoped that it will be mainly extended despite Russia’s reservations about how the pact is working. Without it, prices within Ukraine are more likely to fall further, particularly in eastern and central Ukraine, because exports will be limited to land routes running from western Ukraine into the European Union.

“A lot depends on being able to export by sea.” Indeed, one of the reasons for the fall in sown areas this autumn was a lack of funds for farmers as a result of their inability to sell the grain at (global) market prices,” said Denys Marchuk, who is a deputy chair of the Ukrainian Agrarian Council.

“If the sea export from Ukraine does not work, the number of crops will decrease.” “First and foremost, I believe corn will fall,” he added, adding that he believed the grains initiative would continue.

What Russia’s suspension of the grain deal may imply?

Wheat futures prices jumped more than 5% in Chicago on Monday after Russia announced its withdrawal from the agreement, while key oil futures prices also rose in Asian markets.

Courtney Bonnell and Cara Anna

Russia has suspended its part of the agreement that allowed Ukraine to ship grain from its main Black Sea ports safely in the midst of a months-long conflict, and it appears that the current remaining partners are now on their own. Despite initially reporting that above 200 vessels, many of which were loaded and ready to sail, were stuck after Russia’s weekend announcement, Ukraine said on Monday that a dozen had sailed.

These kinds of exports are critical: Ukraine and Russia are major global suppliers of wheat, barley and sunflower oil, and other foods to Africa, the Middle East, and also parts of Asia, where many people are already starving. It’s unclear who would risk sailing from Ukraine without Russia’s protection after Moscow claimed a Ukrainian drone attack on its Black Sea fleet.

Ship tracking maps, according to William Osnato, a senior research analyst with his agriculture data and analytics firm Gro Intelligence, do not show any vessels heading toward Odesa. A spokesperson for the Joint Coordination Center, which oversees ship logistics and inspection, did not immediately respond to questions about which ships might sail. When asked if Turkey intends to continue implementing the agreement without Russia’s participation, a Kremlin spokesman said only that “contacts with the main Turkish side, as well as the UN,”

What will happen now?

Russia has requested a meeting of the United Nations Security Council currently on Monday to discuss the issue, and has offered to supply up mainly to 500,000 tons of grain “free of charge to the current poorest countries in the next four months.” While Russia’s grain exports are unaffected by sanctions, and a parallel wartime agreement was intended to clear the way for Moscow’s food and also fertilizer shipments, some businesses have been wary. Ukraine, the United States, and also its allies have once again accused Russia of engaging in “hunger games.”

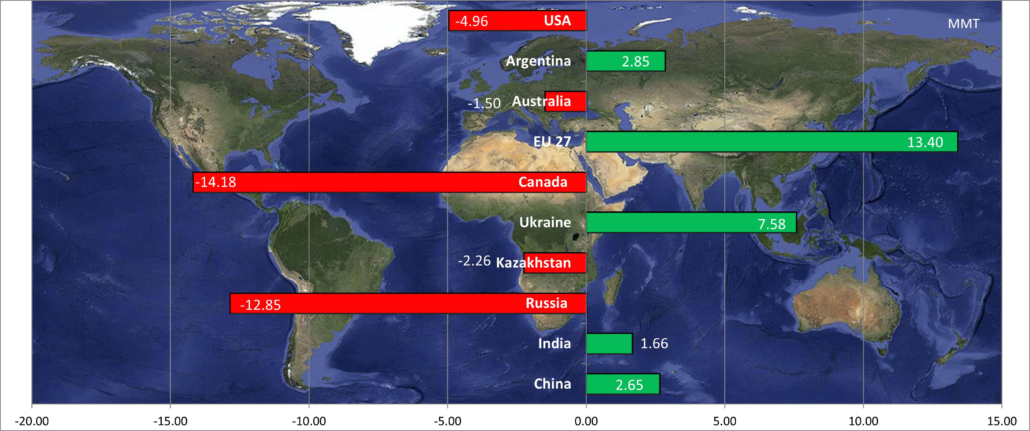

According to Glauber, developing countries will have to find new suppliers and also pay more from countries such as the United States, Argentina, and Australia, where dry conditions or rain are causing problems. However, high prices encourage producers to plant more, and non-traditional wheat exporters, such as Brazil and India, have shipped more. “What the current world needs are mainly some really big crops,” he said, adding that with Ukraine accounting for 10% of global wheat exports, “that’s a big hole to fill.”

What else has an impact on the food supply?

S&P Global Platts’ head of grain and oilseed analytics, Peter Meyer, believes Russia’s decision will have little long-term impact on corn and grain prices and supply. Commodity traders were skeptical that the agreement would last, he said, which is why corn prices have risen rather than fallen since the agreement was reached in July.

Grain markets are also more focused on other issues, according to Meyer, such as low water levels in the Mississippi River, which slows the export of American farm products, a disappointing corn crop in the current American West, and the threat of a rail strike in the United States.

However, in parts of Africa where prices have remained high, concerns are resurfacing. “This will send another mini type shockwave through the markets, and also I think it will also lift prices for a while,” said by Shaun Ferris, a Kenya-based agriculture and markets adviser for Catholic Relief Services, a World Food Program distribution partner. “This means that prices in East Africa, which are already at record highs, are unlikely to fall anytime soon.”

Millions and millions of people in the Horn of Africa are hungry as a result of four failed rainy seasons, and millions of livestock, a critical source of food and also wealth, are dying. Pastureland has vanished. Ferris stated that he has spoken with companies that are sending more than hundreds of tons of processed feeds to northern Kenya in order to keep sick animals alive.

According to him, the latest setback in Ukrainian exports adds another layer of stress to food security systems. According to Glauber, in poorer North African and also Middle Eastern countries where bread is an important part of people’s diets, there may not be alternatives like rice in Asia or sorghum elsewhere in Africa. This raises the prospect of unrest in areas where bread prices fueled Arab Spring uprisings. “The wheat is out there,” he said, “but it will come at a high price.”

Edited by Prakriti Arora