Has SEBI’s Integrity Been Sold for ₹22.16 Crore? Congress Exposes Conflict of Interest! People Demand SEBI Chairman Madhabi Puri Buch To Resign.

The Congress party has accused SEBI Chairperson Madhabi Puri Buch of corruption, alleging she let out her property to Carol Info Services belonging to the Wockhardt group, a case under probe by SEBI. Quoting the records, Congress said Buch earned ₹22.16 crore as rental income between 2018-19 and 2023-24 when she was a whole-time member of SEBI, thus raising a conflict of interest in cases under investigation.

Serious accusations have recently been levied against Madhabi Puri Buch, the chair of SEBI (the Securities and Exchange Board of India), the key regulatory body overseeing India’s financial markets. Recently, serious accusations have been thrown at Madhabi Puri Buch, who chairs the key regulatory body, SEBI (Securities and Exchange Board of India), responsible for the regulation of financial markets in India.

Her accusation of corruption by the opposition party, Congress, includes unethical behaviour. They say that she let out properties to entities related to a known pharmaceutical company, Wockhardt, for which SEBI is probing possible misconduct.

Before we go into the allegations, a little understanding of what SEBI is and why it matters is important. SEBI, or the Securities and Exchange Board of India came into being in 1988. The objective of SEBI will be to keep the stock markets fair in India and to protect the investments of people.

Since SEBI controls the financial market, they need to be trustworthy. If people cannot have confidence in SEBI, then it will affect the whole market. That is why this case against the chairperson of SEBI is such a big issue. It has the potential to cause people to lose their confidence in the system, thereby hurting the country’s economy.

What Are the Allegations Against Madhabi Puri Buch?

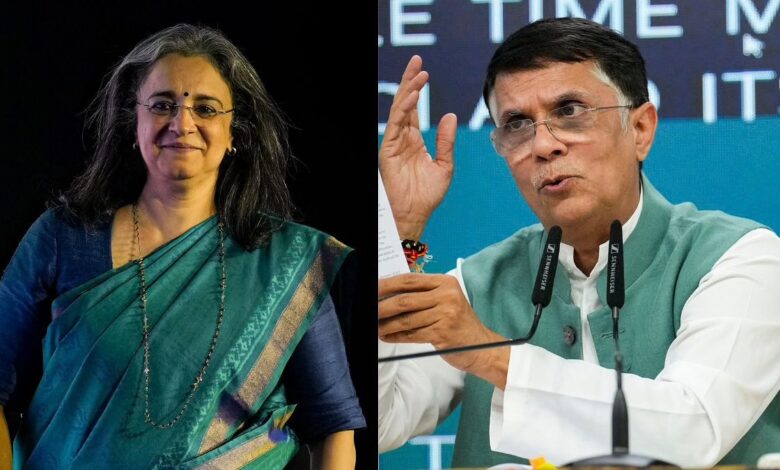

On September 6, 2024, Congress spokesperson Pawan Khera made several accusations against Madhabi Puri Buch. He said Buch, with a number of properties in her name, had those properties on rent to Carol Info Services, a company associated with Wockhardt, the pharmaceutical company which SEBI is investigating. Facing investigation for insider trading among others, Wockhardt thus becomes an interested party in the eyes of Congress in Buch’s acts of omission/commission.

1. Anomalous Rise in Rent Income

The Congress says Madhabi Puri Buch has been renting out the properties to Carol Info Services, a Wockhardt Group Company. Khera then furnished details on how rentals from those properties started rising phenomenally within a short period. She received ₹7 lakh as rent in 2018-19 but ₹36 lakh in 2019-20 and ₹46 lakh by 2023-24. This sudden increase invites serious questions as to whether this series of payments relates to an improper relationship between Buch and Wockhardt.

2. Conflict of Interest

The Congress party claims that because Wockhardt is under investigation by SEBI, Buch should not have any personal financial relationship with the company and its subsidiaries. The fear is that Buch’s financial interest in an organisation being scrutinised by SEBI would compromise the fairness of an investigation. This sets up the perception that he will not act impartially or even influence the investigation’s outcome.

3. Impact on Public Trust

The Congress further states that Buch’s actions, if true, could badly dent public trust in SEBI. As millions of people look to SEBI in India for fair dealing in the stock market, any question concerning the integrity of its leadership would shake investor confidence. Khera said that if people start to lose faith in SEBI, their investments may go awry.

4. Questions to the PM

The Congress also sought to know whether the Narendra Modi government was an accomplice in Buch’s appointment despite her financial dealings, as alleged. Congress believes this is one of those cases in which the Prime Minister must come forward with answers as to why Buch was appointed and whether she is being overlooked or excused. Understanding the Details of the Allegations

Let’s take a more detailed look at what Congress is accusing Buch of and why this is an issue.

Renting Properties to Carol Info Services

Apparently, the party has accused Madhabi Puri Buch of renting her properties to Carol Info Services, connected with Wockhardt. Here is a timeline showing how her rental income changed:

- 2018-2019: Buch earned ₹7 lakh in rental income from Carol Info Services.

- 2019-2020: This increased manifold to ₹36 lakh, more than five-and-half times.

- 2023-2024: The rent rose further to ₹46 lakh.

The massive increase in rent has raised several eyebrows. It is over this that the Congress party is questioning if the rental payments are linked with the ongoing SEBI investigation of Wockhardt and thus establish a case of conflict of interest.

SEBI Investigation into Wockhardt

Wockhardt has come under the scanner of SEBI for allegedly committing various serious offenses in terms of violation on insider trading and market manipulation. The company’s operations have raised several red flags in the regulatory domain, which have compelled SEBI to take action against the operations of the company.

Serious charges against Wockhardt

- Insider Trading: There have been allegations that some people in the organisation took advantage of unpublished information for profitable trading.

- Market Manipulation: There have also been allegations of manipulating stock exchange rates by Wockhardt through fictitious transactions, which deeply affects investor confidence and the integrity of the market.

Since Buch has been entrusted with the investigations of these alleged irregularities and is simultaneously getting a monthly rent from a company known to be Wockhardt Group’s front, there is a high possibility of a conflict of interest in these cases. Allegations by the Congress party also show that Buch’s financial dealings pose a serious threat to fair investigations by SEBI.

Response of Wockhardt

Wockhardt has completely rejected the allegations of the Congress party. In its response, the company claimed that the allegations regarding rental payments to Madhabi Puri Buch were “completely baseless and misleading.” Wockhardt insisted it was following all the rules and regulations and had no role in any unethical deal with Buch.

All this has hardly served to clear the air, as allegations raise a host of ethical questions about the nexus between Buch, SEBI, and Wockhardt. This aside, under-investigation Wockhardt adds to the tension, making the allegations on Buch graver.

How Does This Affect SEBI?

It is now alleged that such complaints against Madhabi Puri Buch could have serious consequences on the functioning of SEBI and therefore its reputation. Here are some ways it may affect the regulatory body:

Loss of Public Confidence

Basically, SEBI works on the course of instilling confidence among people in the financial markets. If people perceive corrupt practices in SEBI itself, then clearly the faith will break. It may lead to lesser investing in the stock market, which will have a cascading effect on the entire economy.

The allegations, based on their merits, may guarantee that more attention is given to the way SEBI conducts its affairs. Questions might begin to arise as to how investigations are conducted by SEBI and some transparency may be sought from them. SEBI may be forced to change its policies so that in the future, even the perception of a conflict of interest would not arise.

Political Fallout

All these allegations are put into political use by the Congress party, thus there can be political fallout. Congress is on to its aatma of demanding accountability, and if the charges against Buch hold good, it could add to the ruling party’s discomfiture in the ensuing elections.

Regulatory Oversight in India

The Madhabi Puri Buch controversy thus epitomises the bigger problem that India has grappled with all these years: the need to keep such regulators as SEBI fair, transparent, and efficient.

India’s regulatory bodies are always tarred with accusations of corruption, inefficiency, and lack of transparency. All such reasons combine to make it very hard for these institutions to gain the public’s complete trust. The allegations against Buch are just the latest in a long history of such controversies.

The Role of the Inventiva

Investigative journalism by Inventiva has played an important role in the case of SEBI chief Madhabi Puri Buch. For months now, Inventiva has reported on the alleged involvement of Buch in corruption, with a particular emphasis on the investigation of her financial linkages and conflict of interest.

From the increasing rental income she received from companies under investigation by SEBI to the ethical implications of her position, their reports outlined some very vital details.

The incessant investigation that followed by Inventiva has kept the issue alive in public memory and asked for greater transparency and accountability in the regulatory apparatus at SEBI.

For more, you can go through their in-depth coverage here .

Opinion

Corruption allegations against the SEBI Chairperson, Madhabi Puri Buch, have put this regulatory body in the spotlight. As the story unfolds, SEBI needs to be transparent about the investigations and what is being done to try and regain the public’s trust. The bottom line of these allegations goes to bigger issues relating to how regulatory bodies function in India, with possible consequences pointing toward financial and political landscapes in the country.

Some of the things SEBI has to do to regain public confidence are:

1.SEBI has to institute an investigation against Buch to determine if there is any cover-up and to ascertain the seriousness of the allegations against him.

2. More openness in operations and the decision-making process will convince the public of how investigations are carried out and nullify suspicions of a cover-up.

3. SEBI should revisit and revise its policy framework to avoid conflicts of interest in the future. This ensures that persons in positions of authority do not have financial linkages that could influence their decisions.

Ultimately, this is something that SEBI cannot afford to lose its character as a fair and credible regulator. The continuing controversy is a grim reminder of the need for restraint in the exercise of authority and accountability of regulatory bodies.