Half Of Russia’s Oil And Petroleum Exports Went To China In 2023; How China Reduced Its Energy Bill Thanks To Russian Oil Discounts

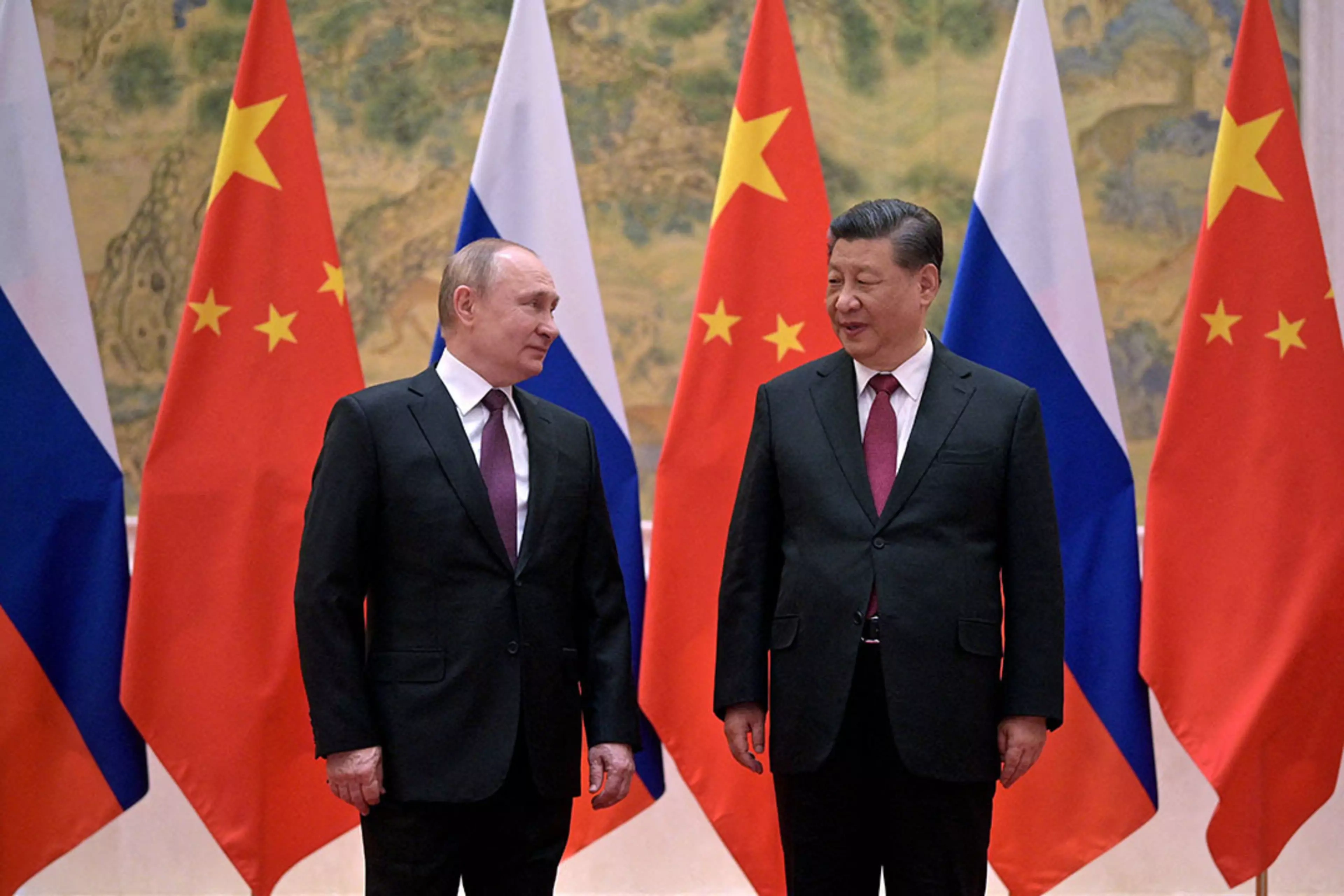

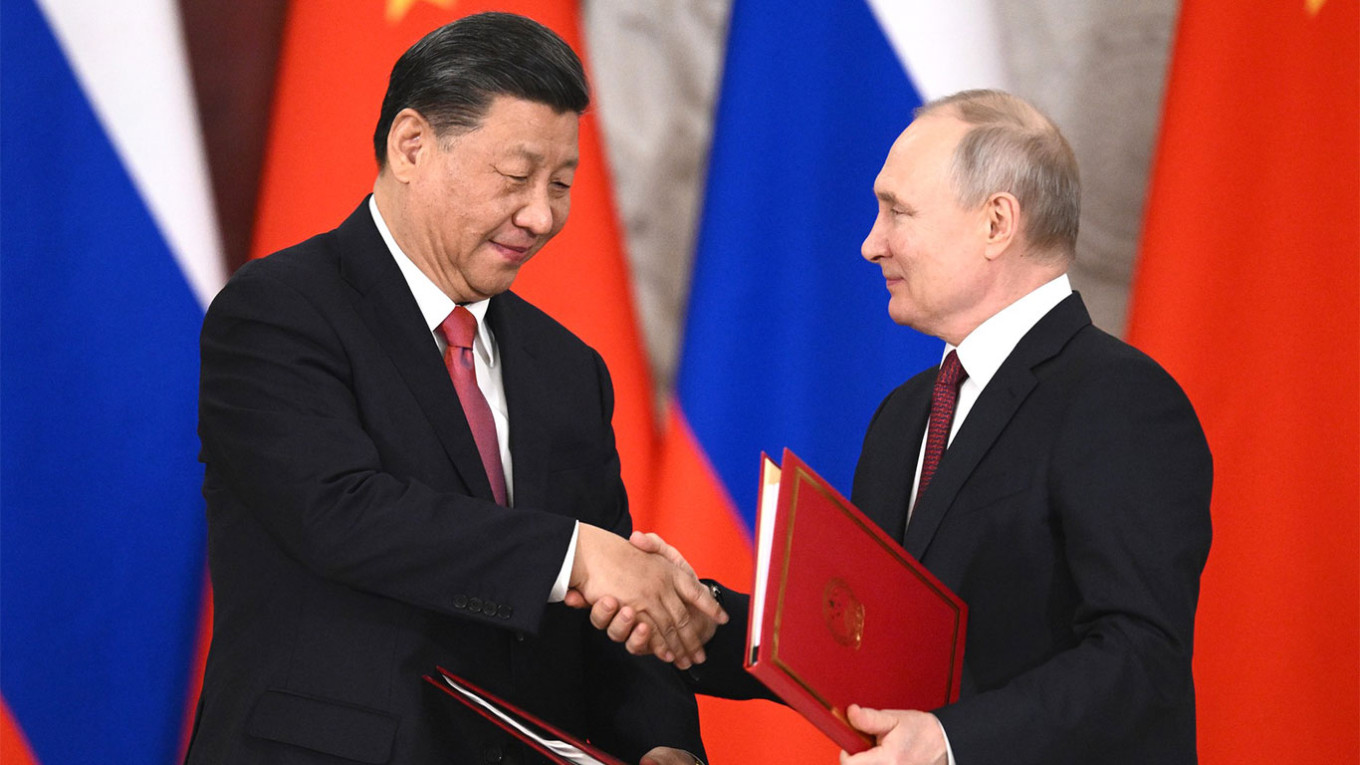

Deputy Prime Minister Alexander Novak disclosed a remarkable shift in Russia's export destinations, notably highlighting China as the recipient of half of its oil and petroleum exports, coupled with a notable surge in India's participation. As Europe's stake diminishes amidst shifting geopolitical dynamics, the redirection of Russian crude exports to China, prompted by European sanctions, has introduced new dimensions to the energy trade equation.

Deputy Prime Minister Alexander Novak revealed that half of Russia’s oil and petroleum exports were directed to China, marking a significant increase from previous years.

Additionally, India’s share in these exports experienced a notable rise, reaching 40% within a two-year period, according to statements published on Wednesday by Russia’s state news agencies.

Deputy Prime Minister Novak, overseeing Russia’s energy sector, emphasized their partnerships’ evolving dynamics, highlighting China‘s escalated share, now ranging between 45-50%, and acknowledged India’s substantial growth in the past two years, where the total share of supplies reached 40%.

Meanwhile, Europe’s portion of Russia’s crude exports dwindled significantly, dropping from about 40-45% to a mere 4-5%.

Amid European sanctions, Russia redirected some of its crude oil exports to alternative markets, notably China. As a result, China enjoyed discounted prices on its Russian oil imports, underscoring the broader implications of sanctions beyond the Russia-Europe relationship.

How China Played To Its Advantage

In the wake of the Russian invasion of Ukraine, China strategically adjusted its crude oil imports; despite a marginal decline in overall volume (-1%) due to economic challenges in 2022, Chinese customs data revealed an 8.2% increase in crude oil imports from Russia and nearly doubled imports from Malaysia (90.6%).

The shift, analyzed in various publications, explores how China leveraged the situation arising from the war in Ukraine to its advantage.

This trend persisted into the first half of 2023, with the volume share of Russian oil in Chinese imports rising from 15.5% in 2018 to 18.6%.

The increase of 1.7 percentage points within 18 months solidified Russia’s position as China’s primary oil supplier, surpassing Saudi Arabia (16.5%) and Iraq (10.5%).

Malaysia also experienced a remarkable rise in its share of Chinese imports, with a 5.5 percentage point increase over 18 months, becoming China’s fourth-largest oil supplier in the first half of 2023, up from ninth place in 2021.

This suggests that Malaysia may have re-exported oil, potentially sourced from other countries, including Russia.

China has reaped the benefits of discounted oil prices from Russia and Malaysia.

The onset of the war in Ukraine led to a general surge in global energy prices from February 2022 onwards. However, the price of Russian oil exhibited an immediate decline, especially in comparison to international benchmarks like Brent.

Market hesitancy towards Russian oil, coupled with sanctions imposed by the EU and G7 nations, resulted in a significant drop in Russian crude prices.

This pricing discrepancy has notably favoured China in its oil imports from both Russia and, to some extent, Malaysia; the sanctions, including a price cap policy and an embargo on most EU imports of Russian oil, contributed to this advantageous differential.

Discounts on Chinese imports of Russian oil commenced in April 2022, reaching their peak in July with a remarkable 19% reduction compared to other suppliers.

Although prices briefly aligned with Brent prices in December 2022, following the imposition of the embargo and price cap, they diverged again in 2023.

Despite remaining above the price cap (USD 60 per barrel) but below Brent prices, the gap with other suppliers widened in 2023, averaging a 12.7% reduction in the first half compared to 10.4% in 2022.

For Malaysian oil imports, discounts, which were already present before the war in Ukraine, increased from 7% in 2021 to an average of 18.9% in 2022 and 17.6% in 2023.

These observed discounts, in comparison to the average import price from other suppliers, are estimated to have resulted in a reduction of China’s energy expenditure by USD 6.6 billion in 2022 and USD 4 billion in the first half of 2023 for oil imported from Russia.

Similarly, for oil imported from Malaysia, the savings amounted to USD 4.9 billion in 2022 and USD 2.7 billion in 2023.

In total, China is estimated to have saved EUR 18 billion over 18 months, equivalent to approximately 3.5% of the total value of its crude oil imports.

However, despite this substantial saving in the oil sector, the reorganization of liquefied natural gas (LNG) imports, influenced by increased European demand to replace Russian gas, did not offer similar cost-cutting opportunities for China.

Although China increased its LNG imports from Russia, the lack of sanctions against Russian LNG exports meant that China could not benefit from comparable discounts seen in Russian crude oil exports.

While Australia’s LNG share decreased, Russia’s share in China’s LNG imports rose significantly, further diversifying the sources of China’s energy imports.

Russian Oil Slashes India’s Import Expenditure by Approximately $2.7 Billion

Meanwhile, India has realized substantial savings of approximately $2.7 billion in the first nine months of this year, courtesy of discounted Russian oil imports, as per calculations derived from government data.

The financial reprieve has played a crucial role in supporting India’s economic growth trajectory and alleviating the strain on its trade deficit.

Crude oil constitutes roughly one-third of India’s total imports by value, making it a pivotal component of the nation’s economic expenditure. As the world’s third-largest oil importer and consumer, India has emerged as the principal purchaser of seaborne Russian crude in 2023, surpassing Europe.

The accessibility of cost-effective Russian oil has empowered India to decrease its reliance on Middle Eastern imports. The strategic move was prompted by strengthened prices in the Middle East, notably due to voluntary additional supply cuts implemented by Saudi Arabia since July.

According to commerce ministry data, India imported a significant volume of Russian oil—69.06 million metric tons, equivalent to 1.85 million barrels per day—between January and September.

This figure includes Russian oil imported via transshipments from South Korea, Greece, and Spain.

Government data reveals that the average price of Russian oil delivered to Indian refiners during this period was $525.60 per ton, encompassing shipping and insurance costs.

In comparison, the average landed cost of Iraqi oil, comparable in quality to Russia’s Urals crude that constitutes the majority of India’s purchases, was $564.46 per ton over the same duration.

Consequently, India’s calculated savings from opting for Russian oil rather than Iraqi oil amount to $2.7 billion.

This noteworthy development signifies Russia’s ascendancy over Iraq as India’s primary oil supplier, relegating Saudi Arabia to the third position.

In addition to the predominant medium-sour Russian Urals crude, India also procures other Russian grades such as the light sweet ESPO and Sokol varieties.

While China, the world’s leading oil importer, has achieved savings nearing $10 billion this year through substantial oil purchases from countries under Western sanctions, including Russia, India distinguishes itself by refraining from acquiring Venezuelan and Iranian oil.

By embracing Russian oil, Indian refiners capitalized on reduced feedstock costs, bolstering gross refining margins and mitigating revenue losses associated with subsidized retail fuel sales.

The sustained stability in pump prices for over a year has aligned with government efforts to control inflation, coinciding with a notable 14% growth in refined products demand this year.

Payment Challenges Hinder Russian Oil Shipments to India

In the latest development, delays in Russian Sokol crude oil shipments to India have surfaced due to payment-related issues, compelling Indian Oil Corp (IOC) to augment its oil purchases from the Middle East.

Indian Oil Corp, the largest refinery in India and the sole state-owned refinery with an annual contract for various Russian grades, including Sokol, from Rosneft, has encountered setbacks in receiving six anticipated Sokol shipments from late November to December.

Notably, one of the tankers, the NS Century, faced U.S. sanctions on November 16, with the remaining shipments currently floating off the coasts of India and Sri Lanka.

Delays in IOC’s payments are attributed to Sakhalin-1 LLC, the Rosneft entity responsible for supplying Sokol oil to IOC, encountering difficulties in opening a UAE bank account capable of accepting dirham payments.

India, emerging as a crucial market for Russian oil amid heightened Western sanctions, has become the primary buyer of Russian seaborne crude. However, the complexities of sanctions present logistical challenges in coordinating these shipments.

India’s oil ministry informed a parliamentary panel in December that state oil companies encountered difficulties in paying for Russian oil supplies due to certain banks being unable to process payments for Russian oil in U.S. dollars. The ministry also emphasized India’s adherence to the G7’s price cap of $60 per barrel for seaborne Russian oil.

Despite these challenges, customs data do not indicate a discount for liquefied natural gas (LNG) from Russia or Qatar. In fact, the price of Russian LNG, while initially significantly higher (42% above the Australian price) than LNG from Qatar, appears to have gradually aligned in the first half of 2023.

From Russia’s perspective, the strategic redirection of exports towards non-aligned countries like China and India has served as a partial offset to losses incurred due to reduced imports from Western nations.

The Last Bit, the reconfiguration of Russia’s oil and petroleum export, with a predominant focus on China, reflects the intricate interplay of geopolitical forces and economic strategies.

Deputy Prime Minister Novak’s insights shed light on the altered dynamics, emphasizing China’s ascent as a primary recipient of Russian energy resources.

The ramifications of European sanctions have not only reshaped trade patterns but have also granted China and, to some extent, India the advantage of discounted prices on Russian oil imports.

As we peek into international energy relations, the first half of 2023 signals a continued strengthening of the Russia-China energy partnership, positioning Russia as a pivotal supplier for China.