Haifa Port is the largest Adani Revenue Generator Outside Of India.

The largest port operator in India is focusing initially on the Haifa port's city-side development, which will include the construction of hotels and conference facilities in addition to the innovation centre.

The most important source of revenue for Adani Ports & SEZ (APSEZ) outside of India will be the vital Haifa port in Israel. The important Israeli port was purchased by the Adani Group, headed by billionaire Gautam Adani, for $1.2 billion last month after bidding up Chinese and Turkish firms.

According to certain sources, APSEZ is also constructing the largest startup accelerator for the group’s incubation center near the port. To increase visitor arrivals at the port, APSEZ is in discussions with several partners, including cruise companies, the sources noted. To create the strategy for city-side growth, it is also closely collaborating with regional municipal organizations. At the Haifa port, the corporation employs 800 people, including top management and port personnel.

According to the sources, the largest port operator in India is first concentrating on the city-side development of the Haifa port, which will involve the construction of hotels and conference centers in addition to the incubation center.

The combination of APSEZ and the Israeli chemical business Gadot Group, valued at $1.18 billion, had won the contract to privatize the port. In January, it acquired control of the port.

One of Israel’s three main ports and the second biggest port overall is Haifa.

It serves as the major center for tourist cruises in the area in addition to handling container goods. For Israel’s healing political connections with Gulf states, which have led to it harboring aspirational trading links with the area, Haifa has come under growing scrutiny over time.

It is perfectly positioned in terms of strategy. It is the Mediterranean harbor that is the furthest east. Everyone wants to engage in business there. Plans include a train link that would connect Saudi Arabia and Jordan to the Mediterranean and run from the United Arab Emirates to Haifa, according to the APSEZ executive.

The Haifa port is strategically positioned to facilitate cargo transshipment from ports in Europe to the Mediterranean Sea via the United Arab Emirates. It offers a substitute for the present, a more costly approach that uses the Suez Canal. Now, the Suez Canal is required for all ships traveling across the Mediterranean. Prices continue to rise. Because of this, when the port is modernized and the railway link is improved, transit times will be shorter and a new gateway to Europe as well as to Jordan, Saudi Arabia, and the United Arab Emirates will be created, mentioned APSEZ executive.

According to Pramit Pal Chaudhury, head of India practice at Eurasia Group, the alternate route and operations will boost transportation efficiency by 60%. The UAE and Israel would be connected by cargo railway lines, and Haifa would be a part of the wider network through Jordan and maybe Saudi Arabia. Shanghai International Port Company, a Chinese competitor, unveiled a cargo facility just next door last year.

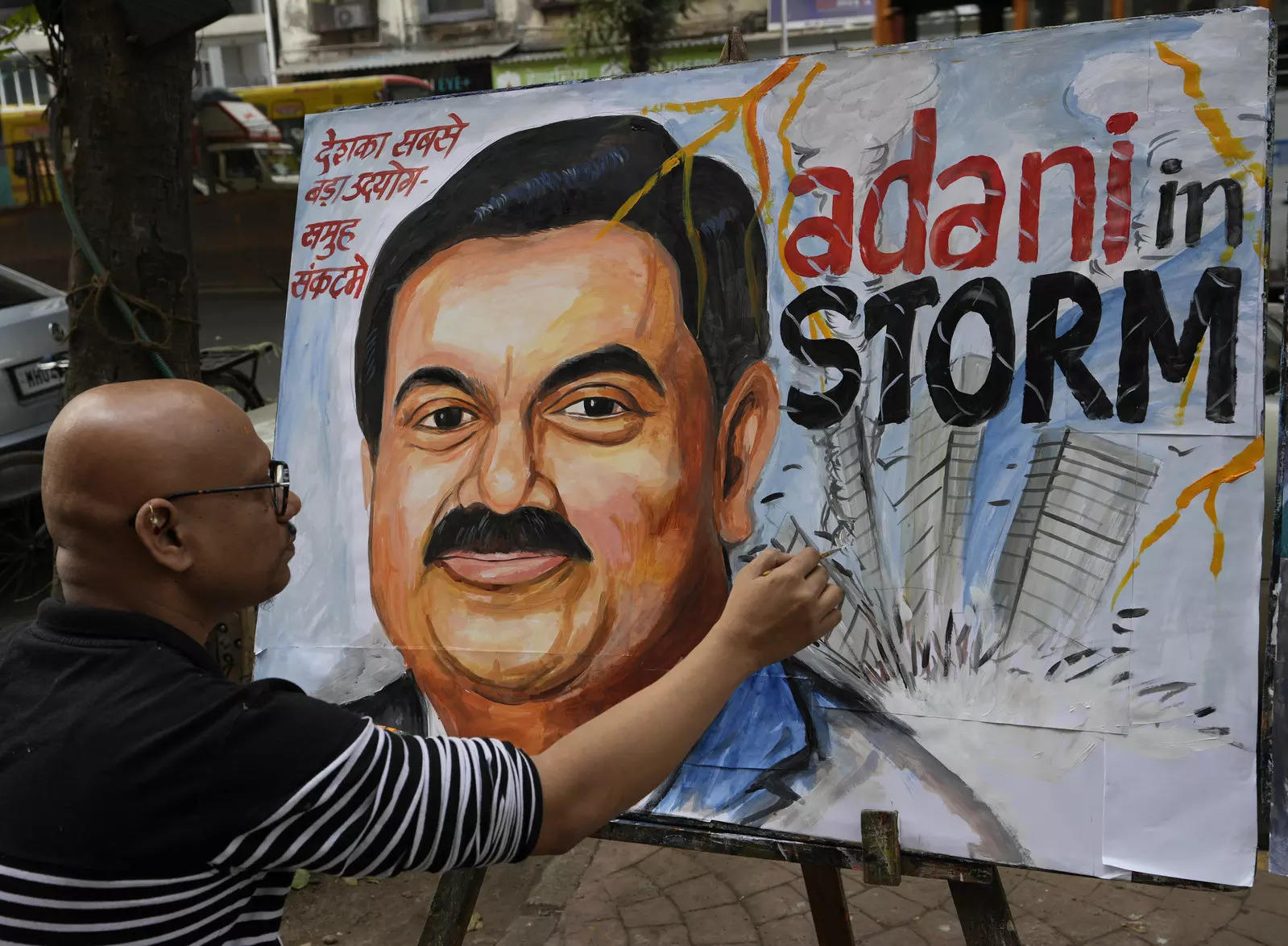

India has a long history with Haifa. Indian soldiers were instrumental in the Battle of Haifa in 1918, which put an end to the 400-year Ottoman occupation of the region. Since late last month, when American short-seller Hindenburg Research published a study accusing the Adani Group of corporate misconduct, its market value has decreased by more than $110 billion. Recently, the shares of APSEZ ended at $583 after losing 25% of their value. 24% of the cargo in India is handled by 13 ports run by APSEZ. It took control of a port in Sri Lanka earlier this year, becoming the first Indian port operator to do so.

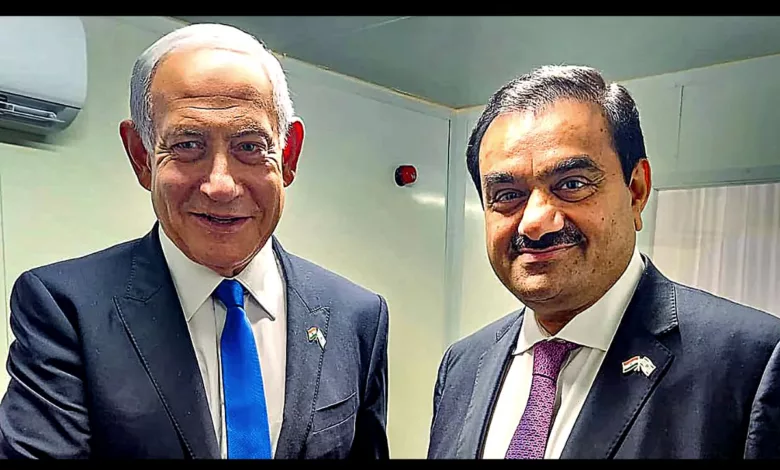

The perception of the Israeli opponent is one of great confidence.

When asked if the current controversy surrounding the Adani Group would have an impact on the company’s acquisition of Israel’s Haifa Port, Israel’s ambassador to India, Naor Gilon, responded that he is confident the project would be successful and that the Indian company was looking for additional projects in the nation. The Israel envoy said that handing over a strategic resource like the Haifa Port to an Indian enterprise was “a sign of great trust.”

The last call.

After a report by American short-seller company Hindenburg Research accusing the Group of financial irregularities and stock manipulation, the conglomerate Adani has been dealing with a crisis. The audit looked into the Indian company’s offshore subsidiaries and highlighted various concerns about how they were run.

The scandal caused the Adani Group to lose about $100 billion in value, although its stock has recently rebounded from its lows by nearly 75%. Let’s wait and watch what unfolds in the Adani saga over the next several times.

edited and proofread by nikita sharma