GST Council Meeting 2023: Deciphering Key Changes in GST Rates and Compliance Measures

GST Council Meeting 2023: Deciphering Key Changes in GST Rates and Compliance Measures

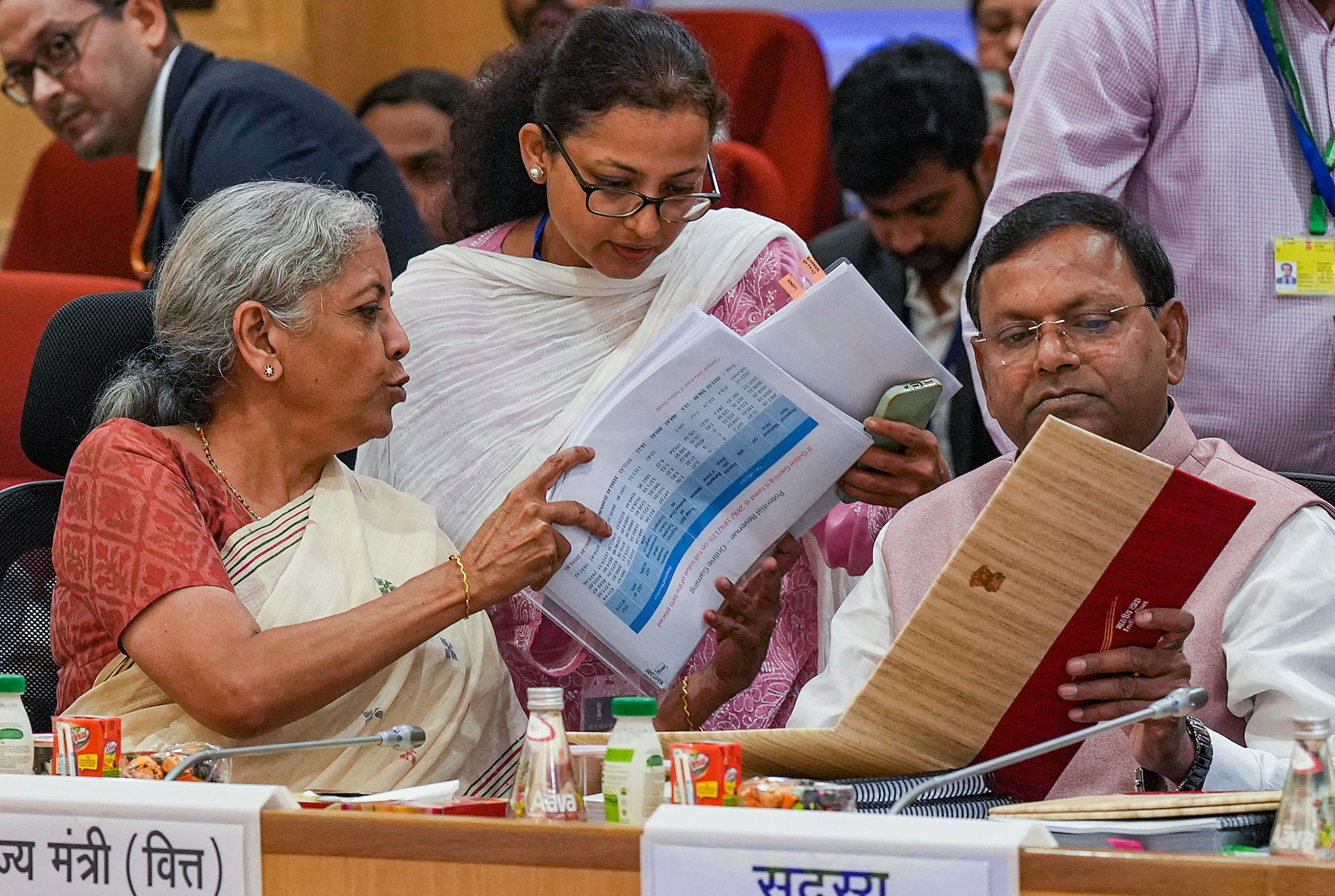

After its 50th meeting, which was presided over by Finance Minister Nirmala Sitharaman, the GST Council released several essential recommendations on adjustments to the GST tax rates, steps to facilitate commerce, and streamlining compliance procedures.

In the latest meeting of the GST Council, several critical changes were introduced to the existing Goods and Services Tax (GST) rates and compliance measures.

The GST Council issued several vital recommendations on July 11 during its 50th meeting, which was presided over by Finance Minister Nirmala Sitharaman. These suggestions related to adjustments to the GST tax rates, steps to facilitate commerce and simplification of compliance procedures.

It has been determined to lower the charge on uncooked/unfried snack pellets from 18% to 5% regarding suggestions on GST rates on commodities. The National Policy for uncommon illnesses, 2021, also determined to exclude IGST on imported medications and food for particular medical purposes (FSMP) used to treat peculiar diseases. Additionally, it was agreed to make it clear that agriculturalists must pay taxes when they supply cooperatives with raw cotton, especially kala cotton. The GST rate for counterfeit zari thread or yarn has been lowered from 12 to 5 per cent.

To promote better usage of this product and environmental preservation, the Council has resolved to lower the GST rate on LD slag from 18% to 5%. The GST rate for fish-soluble paste was also reduced from 18% to 5%.

Additionally, the GST Council lowered the GST rate on meals provided at movie theatres from 18% to 5%. “The GST Council’s decision to impose a 5% GST on food and drink sold at movie theatres is a comfort to consumers and businesses. This will increase consumer spending and stimulate investment in the entertainment industry, which is good news for the Indian economy. Additionally, it demonstrates the GST Council’s commitment to streamlining the tax code and making it more accommodating to businesses, according to Saurabh Agarwal, Tax Partner, EY.

For a smooth establishment and operation of the proposed GST Appellate Tribunal, the GST Council has also suggested rules regulating the appointment and conditions of the President and Members. It further indicated that the FORM GSTR-9 and FORM GSTR-9C table relaxations offered in FY 2021–22 be maintained for FY 2022–23. In addition, the exemption from submitting an annual return for taxpayers with an aggregate annual revenue of up to Rs 2 crore would be maintained for FY 2022–23 to lessen the compliance burden on smaller taxpayers. The Council said a circular would be released to clarify TCS’s responsibility when numerous e-commerce operators (ECOs) participate in a single supply transaction of products or services.

The GST Council also issued provisions that clarified that a holding company could not be taxed under the GST for just holding securities of a subsidiary firm since the stocks cannot be viewed as a delivery of services. The dispute concerning the specific entry in the Services Accounting Code 997171, which covers Services of holding stock of subsidiary firms, will also be resolved, a significant relief for the taxpayers. Even though this is the first instance, there still needs to be more disagreement and certainty on how the laws for presumed supplies apply to cross-border transactions. Mahesh Jaising, Partner, Deloitte India, stated that businesses should contact policymakers on these issues.

He said the idea of an input service distributor was taken from the Service Tax regime. It mandates the distribution of input tax on standard services to many registrants under the same PAN under the established norms. Even though the provision has been in place since July 2017, he explained, “ambiguities have been raised due to the language of the law and clarifications in the early days of law about the concept being optional. This will greatly relieve the industry and put disputes around this to rest.”

The GST Council suggested that the Centre notify the GST Appellate Tribunal effective August 1, 2023. “The government will present the comprehensive road map for how the GST Tribunal would operate over time. According to Saurabh Agarwal, this significant move would lessen the workload on the High Courts and guarantee that firms may seek a remedy through a tribunal rather than going to the High Courts. Additionally, he applauds the Council’s suggestion to make the Input Service Distributor (ISD) mechanism optional to allocate input tax credits for typical input services obtained from third parties.

This will end tax issues resulting from cross charges against ISD and clarify how these services will be taxed. To allow companies time to implement the transition, the Council has also suggested that ISD become obligatory.

Before this, the department’s statistics indicated that India’s GST collection soared in June, with a 12 per cent year-over-year growth of Rs 1.61 lakh crore.

The GST Council’s meeting saw a revision in the tax rates for numerous goods and services. Here are some significant modifications:

- Reduction in GST for Essential Commodities: In light of the ongoing economic strain, the Council reduced the GST rates for numerous essential commodities. Products such as cereals, pulses, and edible oils, previously taxed at 5%, will now attract GST at a lower rate of 3%. This measure aims to lessen the financial burden on households across the country.

- Increased GST for Luxury Goods: Luxury goods such as high-end cars and branded clothing saw an increase in GST rates from 28% to 31%. This decision was taken to ensure more tax is collected from non-essential goods, helping generate government spending revenue.

- GST Exemption for COVID-19 Related Goods: Acknowledging the ongoing pandemic, the Council extended the GST exemption for COVID-19-related goods and services until the end of 2023. This covers items like masks, sanitisers, ventilators, and COVID-19 vaccines.

The meeting also introduced several new compliance measures to simplify the GST filing process and curb tax evasion:

- Introduction of Quarterly Return Monthly Payment (QRMP) Scheme: Small businesses with a turnover of up to Rs 5 crore can now opt for a QRMP scheme, allowing them to file GSTR-3B returns every quarter while making monthly tax payments.

- E-Invoicing Made Mandatory: The Council expanded the scope of e-invoicing. It is now compulsory for businesses with a turnover exceeding Rs 50 crore. The e-invoicing system is aimed at curbing tax evasion and enabling easier tracking of business transactions.

- Late Fee Rationalisation: The Council introduced a maximum cap on the late fee payable for delayed filing of GSTR-3B. The late fee has been limited to Rs 500 for each return, providing significant relief for businesses struggling with timely GST filings.

These decisions hold substantial implications for the Indian economy. The reduction of GST on essential commodities could decrease their retail prices, potentially increasing their consumption and contributing to poverty alleviation.

On the other hand, the increase in GST on luxury goods could lead to higher prices for these items, potentially affecting their demand. However, it could also contribute to increased government revenues, which could be utilised for welfare measures. The compliance measures, particularly the QRMP scheme and e-invoicing, are expected to make GST filings more straightforward for businesses and reduce tax evasion. They also signify a step towards digital transformation and ease of doing business.

In conclusion, the GST Council’s meeting was noteworthy for its extensive changes to GST rates and compliance measures. These decisions reflect the government’s ongoing efforts to stimulate the economy, manage the fiscal deficit, and ease the burden on businesses and consumers in the wake of the COVID-19 pandemic. As these changes come into effect, monitoring their impact on the economy and making further adjustments as necessary will be crucial.