Google Venture- Funded Startups| GV Investments

Google Ventures-Funded Startups | GV Investments

Almost no major business or organisation today began from scratch. Most of them, including Tesla, Apple, and Pixar, got their start with a good concept, a tonne of work, and a modern garage. Entrepreneurs develop great business ideas and newer ways to put them into practice every day.

However, this is easier said than done because companies need a lot of work, capital, and support to succeed. Google has aided some of the greatest startups with its funding programme, and some of those companies have grown into well-known corporations.

Equity and venture capital companies can help with this. Investors provide the important initial investment in a business if they believe the concept is at least moderate sound.

While Google Ventures is a venture investment business, some equity investment firms include Blackstone and Apollo Global Management. But first, let’s learn how funding functions before discovering which firms Google supports.

In this article, we will answer these two questions:

1. What is the Process for Startup Funding?

2. Startups Funded by Google Ventures

- Slack

- Uber

- Medium

- StockX

- Stripe

- GitLab

- DocuSign

- Magenta Therapeutics

- One Medical

- Zipline

- Farmer Business Network

- Sense

- Scribble Data

- Jio Platforms

- Wysa

- Dailyhunt

- Glance

What is the Process for Startup Funding?

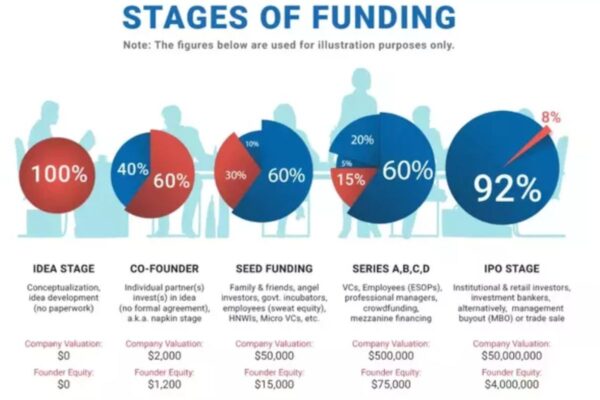

There are various types of funding depending on things like startup valuation, clientele, strategy, revenue model, and other technological aspects. These funds fall under the following categories:

Pre-seed Funding: This is the first stage of a startup, and the founders themselves invest the majority of the money at this point in the idea. Even though it isn’t formally mentioned in the investment rounds, this stage is where a startup starts.

Seed Funding: The initial formal investment in a firm or endeavour is made here. Startups with seed funding can begin the process of creating their goods. Startups that fail never advance past this point, but those who succeed move on to the Series A round.

A startup or business may choose to receive Series A funding once it has completed its Seed round, has built a customer base, and is actively marketing its services or goods.

Startups can raise anywhere from $2 million and $15 million in this way and use the funds for product improvement.

Following Series A, the Series B round of funding aids in a company’s growth. If the business has established a solid client base and a high valuation to back up the initial investment, Series B capital aids in expanding the operation.

This round’s investment may total somewhere between $30 million and $60 million.

The businesses that are currently profitable and seeking to develop new goods to enter untapped markets get invested in the Series C round.

The investors and entrepreneurs in this round seek exponential growth, and the companies in this round may also acquire startups. Companies in this round can be valued at hundreds of millions of dollars.

These are the funding rounds that most businesses achieve, even if there may be more that match the letters of the alphabet.

Away from the open markets, private corporations can privately finance startups through private equity investing.

Google Ventures

The CEO of Google Ventures, an Alphabet subsidiary and the parent company of Google, is David Krane. Since its inception, Google Ventures, now known as GV, has focused on supporting founders who have a vision for the future of entrepreneurship. GV has financed over 500 portfolio businesses and is always looking for fresh, disruptive firms and ideas.

The entrepreneurs, doctors, and other professionals on the GV team have a wealth of experience in the startup environment and a deeper understanding of it than others. This group of experts, engineers, consultants, and fund managers assists GV in overcoming obstacles and providing input to improve services.

GV makes investments in businesses, medical sciences, consumer products, and cutting-edge technology across all stages and industries. GV has so far made 988 investments. Recently, on July 29, 2022, GV invested $3.3 Million in a consumer software studio in New York.

Startups Funded by Google

Slack

The Slack Industry is Enterprise Software, in which GV Investment is $110.8 Million. The proprietary commercial communication platform Slack was built by American software startup Slack Technologies. Slack has several IRC-like capabilities, such as private groups, direct messaging, and topic-organized persistent chat rooms. In October 2014, Google Ventures made a $110.8M investment.

The Slack Industry is Enterprise Software, in which GV Investment is $110.8 Million. The proprietary commercial communication platform Slack was built by American software startup Slack Technologies. Slack has several IRC-like capabilities, such as private groups, direct messaging, and topic-organized persistent chat rooms. In October 2014, Google Ventures made a $110.8M investment.

Uber

The Industry is Transportation where GV Investment is $1.8 Billion. Who else in the digital age hasn’t heard of Uber, the most well-known taxi service? It has emerged as one of the most well-liked cab booking services worldwide, and both cab drivers and those who use them frequently use it. It offers consumer services and has a presence in the food delivery industry. Uber has provided dependable door-to-door service and will keep doing so by including safety features in its Community Guidelines regularly. The largest investment made by Google Ventures to date is Uber. Uber has received an estimated $1.8 billion in investment from Google Ventures.

Medium

The Industry is Digital Media where GV Investment will be $19 Million. A blogging platform called Medium recommends that users blog through clever algorithms. The most recent research papers, articles, and blogs are published by renowned publications and specialists in a variety of niches, and readers can select their chosen topics to read about. Google became interested in Medium as a result of its success and made an investment. With 170 million users and growing, Medium boasts a writer community that includes journalists, authors, specialists, and everyday people.

StockX

The Industry is Stock Market where GV Investment is $22 Million. The first “Stock Market for Things” in the world is StockX, according to Google Ventures. In this online market, both buyers and sellers submit their bids and asking prices, and the transaction only happens when the two parties are present. All you have to do to sell anything that may be sold, from sneakers to watches, is sign up for StockX’s marketplace. Battery Ventures and Google Ventures contributed $44 million to the series B funding.

Stripe

The Industry is Digital Payment where GV Investment is $600 million (along with other investors). One of the most widely used payment gateways for mobile applications and online purchases is Stripe. Today, Stripe is the preferred payment processor for millions of startups and established physical and online businesses. You may use Stripe in all of these situations, whether it be through the software or its API, whether it be Software as a Service, an online platform, or your marketplace.

GitLab

The Industry is Software where GV Investment: $20 Million. GitLab is a DevOps platform that streamlines communication and automates development. GitLab delivers strong automation with real-time security and vulnerability monitoring thanks to the numerous enterprises that depend on its source code, CI/CD, and security. Additionally, well-known, market-leading businesses like Nvidia, Siemens, and Drupal rely on GitLab. Both the Series C and Series D rounds of investment for GitLab came from Google Ventures.

DocuSign

The Industry is Software where GV Investment: $8.1 Million. DocuSign, a pioneer in eSignature transaction management, has established itself as a market and international standard for eSignatures. Google was instrumental in the growth of DocuSign. Over 500k users and hundreds of millions of signers have signed up for DocuSign. Because most modern organisations will need to go online, DocuSign was created with the understanding that online document management would need to be taken into account. In June 2012, Google Ventures made a Series D round investment.

Magenta Therapeutics

The Industry is Healthcare & Life Science where GV Investment is $8 Million. The foremost authority in utilising stem cell biology for risk-free transplants is Magenta Therapeutics. It aims to treat disorders like blood cancer by resetting a patient’s immune system through stem cell transplantation. Additionally, it is creating novel medicines with dedication and expertise. By accurately eradicating disease-causing cells and improving stem cell mobilisation, Magenta is also transforming medicine.

One Medical

The Industry is Healthcare where GV Investment will be $13 Million. With the use of innovation and technology, One Medical is currently working to redefine healthcare. One Medical currently provides and organises in-person or virtual appointments, 24/7 on-demand video chats with a virtual medical team, over 90 drop-in lab procedures, as well as COVID-19 testing and care. Additionally, OneMedical partners with over 7000 businesses to provide employee benefits. In December 2015, Google Venture contributed to a round of private equity funding.

Zipline

The Industry is Robotics where GV Investment will be $12 Million. A startup called Zipline uses electric planes and drones to transport essential medications to hard-to-reach regions of the globe. It reliably and safely performs important, on-demand, and exact deliveries wherever and whenever required. Thanks to Zipline, on-demand delivery is now available everywhere. Zipline aims to replace the conventional delivery system with customer-focused, cutting-edge technology. Google project invested in the May 2019 Series C fundraising round. Zipline raised $250M in its most recent round of fundraising in June 2021, valuing the company at $2.5 billion.

Farmer Business Network

The Industry is of AgriTech where GV Investment: $15 Million. The Farmer Business Network is a technology that provides farmers with cutting-edge insights and real-time data analysis to help them better understand and improve their crops and yields. It is a multinational Agritech firm that aims to assist farmers in lowering production costs, increasing agricultural yield and output, and making decisions about their crops with knowledge and assurance. With top-notch crop marketing and financial services, Farmer Business Network can assist farmers in managing contracts, choosing seeds, inspecting fields, and planning operations. Google Ventures provided $15 million in funding to FBN in 2015. In November 2021, they recently raised $870 million in a series G funding round.

Sense

The Industry is Artificial Intelligence where GV Investment will be $16 Million. Dharni and Pankaj Jindal founded Sense in 2015, an artificial intelligence-driven platform for talent engagement and communication. The business, which has its headquarters in San Francisco, is renowned for offering enterprise-ready technologies that give talent acquisition teams a system of interaction.

Sense has so far assisted numerous businesses in finding, hiring, deploying, and automating manual duties for recruiters. As part of its Series C investment, the company received $16 million from investors including Avataar, Google Ventures, Accel, and Khosla Ventures. According to reports, the company plans to use this money to expand its staff, enter more geographies, add new goods, and establish a presence in the Indian market.

Scribble Data

The Industry is Machine Learning. For mid-market enterprise data teams, Scribble Data, an ML engineering product firm, offers ML Feature Store. The company is well-known for Enrich, its main product, a highly adaptable machine learning feature. Data scientists can create and manage production-ready datasets that are used to train ML models more quickly and confidently using Scribble Enrich, a store product.

In May 2020, data-driven businesses like Google and Amazon invested an undisclosed sum of money into the organisation. The platform has been able to scale and deliver Enrich in foreign markets for enterprise-grade Machine Learning products thanks to Google financing for businesses like Scribble.

Jio Platforms

The Industry is Telecommunication where GV Investment is $4.5 billion. An affiliate of Reliance Industries and an Indian technology business, Jio Platforms. The corporate headquarters of the company are in Mumbai, Maharashtra. The firm serves as a holding company for Jio, which is Reliance’s largest digital business and the third-largest mobile network in the world. By market value, Jio Platforms rose to the fourth-largest Indian firm as of 2020.

The Jio platform received $4.5 billion from Google in November 2020, making it the largest investment ever made in an Indian business. According to reports, Google currently owns more than 7.73 per cent of the business. By selling an over 33 per cent share to over 13 financial and strategic investors in under 11 weeks, the company has now raised a total of Rs 1.52 lakh crore. This will assist the business in achieving Reliance’s full fiscal year net debt target reduction.

Wysa

The Industry is Artificial Intelligence. Wysa is a life coach with AI that was created with mental and emotional health in mind. The business offers its users the option to activate coach and communicate anonymously and was first introduced in 2017. The business offers three ways to get early intervention: an AI chatbot, a collection of self-help resources, and messaging-based support from real psychologists.

In May 2021, Google Ventures India invested an undisclosed sum in the AI Platform. Wysa was a member of the initial group of 10 startups selected for Google Launchpad Accelerator India in 2018. However, the Google Play Store named the Sleep by Wysa app as its best app in 2021. Crunchbase reports that the business has received $3.9 million from three funding sources to date.

Dailyhunt

The Industry is Social Media where GV Investment: $33 Million. One of the top content and news aggregator apps in India is Dailyhunt. The corporate headquarters of the company are in Bengaluru, Karnataka. Over 300 million users of the site can get news in 14 Indian languages from a variety of content providers. With 70,000 titles available in ten languages as of 2015, Dailyhunt is now the leading distributor of e-books in the Indian language.

By the end of 2020, Dailyhunt had raised more than $100 million from backers including AlphaWave, Microsoft, and Google. As the company’s valuation rose to above $1 billion as a result of Google fundraising rounds, it became a Unicorn. The company intends to utilise the money to expand its Josh app, which is an addition to its selection of local language content. firms in India that are backed by Google and have an estimated $10 billion in funding.

Glance

Founded in 2018, Glance is a startup that has received funding from Google. On the lock screens of more than 100 million cellphones, the firm offers games, audiovisual content, and news. The business, a division of the InMobi Group, is renowned for employing AI to give customers a tailored experience.

In a fresh fundraising round, Google and pre-existing investors like Mithril Partners contributed roughly $145 million to the company. Google claims that Glance is an excellent example of innovation that addresses mobile-first & mobile-only consumption while also offering content in a variety of Indian languages. Startups like Glance have benefited from Google financing by evolving and expanding their audience.

edited and proofread by nikita sharma