“Google Under Fire for Considering Controversial MeitY Ban On 200 Betting And Loan Apps”

The Indian government has taken action to block certain mobile applications in the country due to concerns about potential money-laundering and data privacy violations. According to sources from the Ministry of Electronics and Information Technology, the decision was made in accordance with Section 69A of the Information Technology Act and the Information Technology (Procedure and Safeguards for Blocking of Access of Information by Public) Rules.

The Indian government has considered Google to take action to block certain mobile applications in the country due to concerns about potential money laundering and data privacy violations. According to sources from the Ministry of Electronics and Information Technology, the decision was made in accordance with Section 69A of the Information Technology Act and the Information Technology (Procedure and Safeguards for Blocking of Access of Information by Public) Rules.

There have been allegations that some smaller Fintech companies took advantage of thousands of people by providing high-interest payday loans and tormenting them afterwards using the personal information they collected through their apps. Blocking these programmes is viewed as a move by the government to protect the financial and personal data of its residents. There have been allegations that some smaller fintech firms exploited thousands of people by providing high-interest payday loans and afterwards harassing them using the personal information they collected through their apps. Blocking these programmes is considered as a move by the government to safeguard the financial and personal data of its residents.

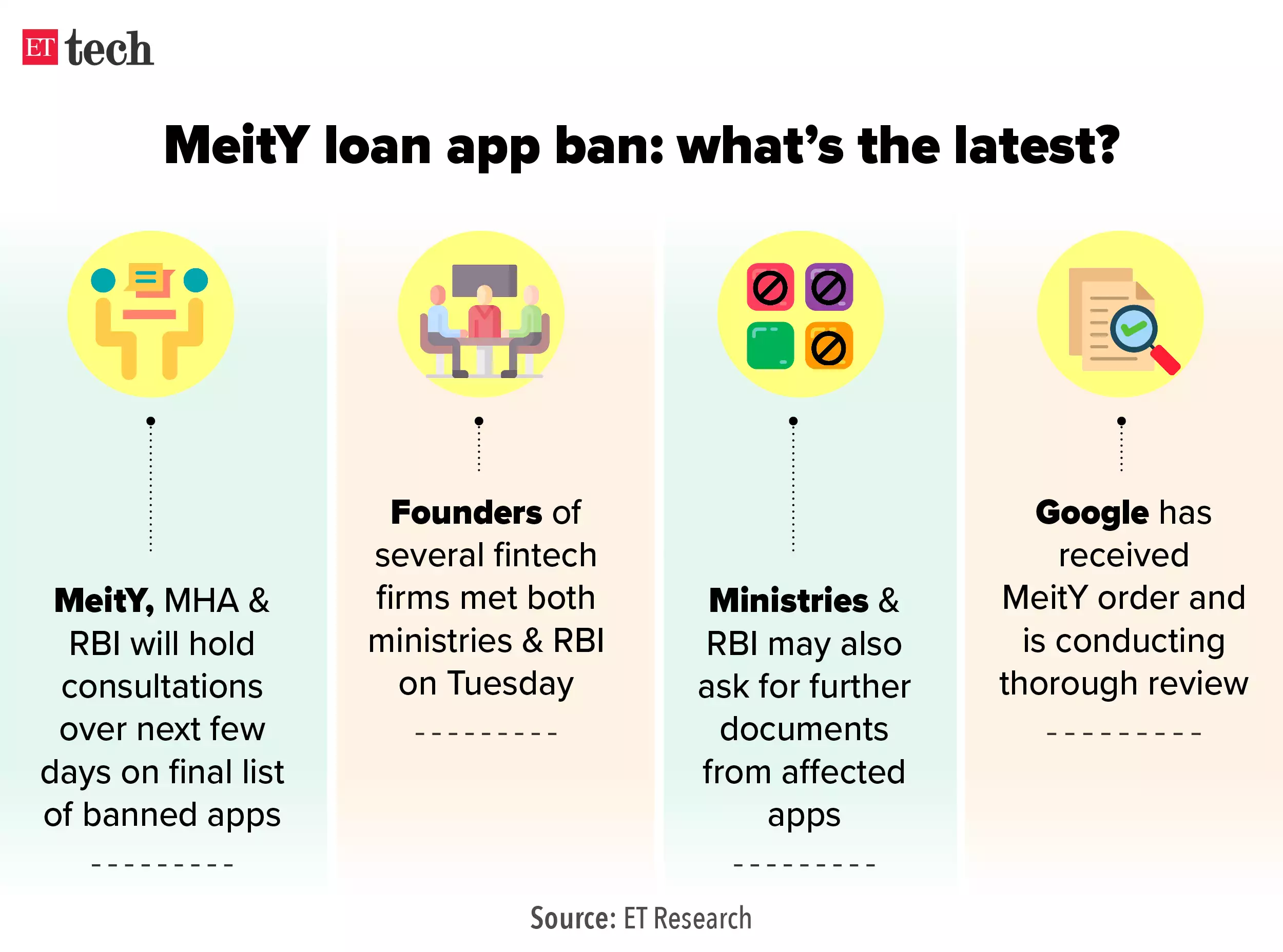

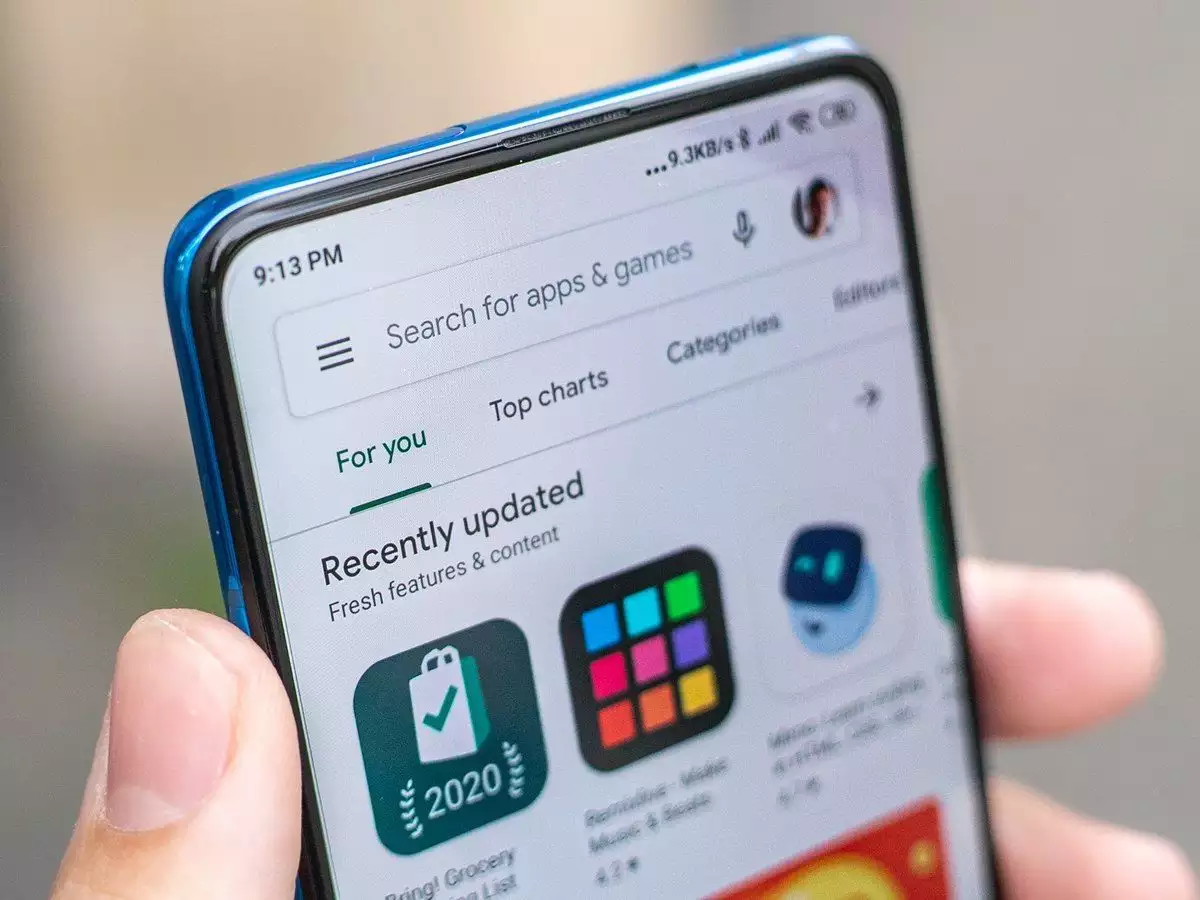

The Indian Ministry of Electronics and Information Technology (MeitY) has reportedly asked Google to block access to more than 200 gambling and loan apps that are available on the Google Play Store. Google is reportedly looking into this request. The apps being tested include well-known loan websites like Kissht, LazyPay (supported by PayU), KreditBee, and Ola Avail Finance.

According to an unnamed source, Google has been informed of the government order and is currently evaluating it. The tech giant will prohibit the apps after carefully reviewing them, the insider said.

On February 5th, the MeitY mandate was forwarded to app stores and internet service providers with the labels urgent and emergency. The decision was reportedly taken following consultation with the Ministry of Home Affairs.

Although Google has declined to comment on the situation, some of the apps referred to in the order are housed on a third-party app store called Aptoide. Lending app Kreditbee has claimed that the ban of their Aptoide link is actually a positive outcome for the company.

Leading financial services provider Kreditbee has disclosed that it is looking at a potential proxy software on the unofficial Aptoide App Store. The business claimed in a formal statement that it has no formal or informal collaboration with Aptoide and that it is speculating that the aforementioned app might be a proxy. Blocking the Aptoide link is seen as having benefited Kreditbee.

It is in normal functioning across India, the Kissht app claims in a separate release. The business accepted the change but said they had not been formally notified of the app’s status. While requesting clarity from the relevant authorities, they remain optimistic. Current clients’ services won’t be impacted, and the problem will be quickly fixed.

The Ministry of Electronics and Information Technology has released a list of popular lending platforms with venture capital support (MeitY). This follows a previous directive intended to get rid of unreliable operators in the sector.

The MeitY’s list includes well-known businesses including Faircent, IndiabullsHomeLoans, Quick Finance, Lifecash, Moneywoods BuddyLoan, Cashtm, RupeeRedee, and others.

This list of lending platforms reflects MeitY’s commitment to promoting transparency and reliability in the industry, and supports the growth of trustworthy lending options for consumers.

The Indian Ministry of Electronics and Information Technology (MeitY) has stirred up controversy in the fintech industry after ordering the suspension and banning of 138 betting apps and 94 loan lending applications with what appear to be connections to China. Fintech executives that were approached expressed their shock and disappointment with the unilateral order, hoping it was a mistake that would soon be corrected.

According to a tweet by Prasar Bharti, MeitY acted on the suggestion of the Ministry of Home Affairs, which flagged the apps in question. As the industry continues to navigate this unexpected development, it remains to be seen what the next steps will be.

Many in the fintech sector are perplexed by the Ministry of Electronics and Information Technology’s (Meity) sudden prohibition. The ban affected several popular lending apps, and has raised concerns about the compliance of these platforms.

According to a fintech founder, whose startup was included in the banned list, the company was fully compliant in all aspects and received no prior notification of the ban. This has led the founder to believe that this could be a short-term glitch.

However, investors and experts in the industry have a different perspective. They believe the ban could be the result of a breach in digital lending guidelines or a lack of transparency by some apps. Prabhu Rangarajan, co-founder of M2P Fintech, commented on the issue saying, “The Reserve Bank of India and all regulators are moving towards greater transparency for consumers. Any app or website that does not follow these guidelines could face trouble.”

Concern among those involved in the industry has been raised by the recent ban on a number of fintech companies. Many people think that an increase in customer complaints is what led to the ban. A fintech founder stated that the complaints have all resulted in loan shark activities, including harassing calls to relatives, morphed images, and possibly even reports from the cyber cell.

Fintech investors are especially worried about the impact of the ban on the growing industry. Despite reassurances that the ban will not have an immediate impact, it is considered a setback for the industry. A fintech investor who has invested in over 10 late-stage fintech firms stated that while the ban may not have an immediate effect, it is still a cause for concern.

An unnamed investor has shared their thoughts on the recent ban on mobile wallet companies, stating that while established startups that have raised significant funds are in a better position, the ban is a significant setback for newer companies trying to secure funding. The investor also mentioned that companies like Kissht, PayU, and LazyPay have not received any official explanation for the block from the government.

The Enforcement Directorate (ED), the Income Tax Department, and the Directorate of Revenue Intelligence (DRI), among other central agencies, are looking into the companies and apps on allegations of income tax evasion, customs violations, fraud, and money-laundering. As a result, a ban on micro-financing apps has been put in place. Additionally, police forces in different states are also investigating these firms.

The micro-financing apps have faced accusations of harassing borrowers through recovery agents, leading to cases of suicide among borrowers. These disturbing incidents have sparked widespread concern, leading to the ban of these apps.

The Indian government has sparked confusion by banning several apps without official confirmation of which apps have been affected. LazyPay, IndiabullsHomeLoans.com, QuikFinance.co.in, and Kissht have been reportedly listed as prohibited apps, however they are still accessible through Google’s app store. However, new user sign-ups appear to have been stopped.

These corporations, which were established in India as distinct legal entities from their parent enterprises, were allegedly following direct orders from China and sending a significant amount of money back to the neighbouring country. According to the same sources, profits were shifted to shell companies by changing sales records to reflect losses in some cases and lower income taxes, while in other cases, money was “laundered” as royalties or licence payments.

The removal of several applications from the Play Store has been authorised, according to Google. A Google representative said the company is evaluating the decision and will move further as appropriate. Apple has not yet provided a response regarding the iOS platform ban.

This move by the Indian government follows a pattern of action against companies with Chinese links. The Ministry of Corporate Affairs filed more than 700 charges against these businesses in 2022.

Edited by Prakriti Arora