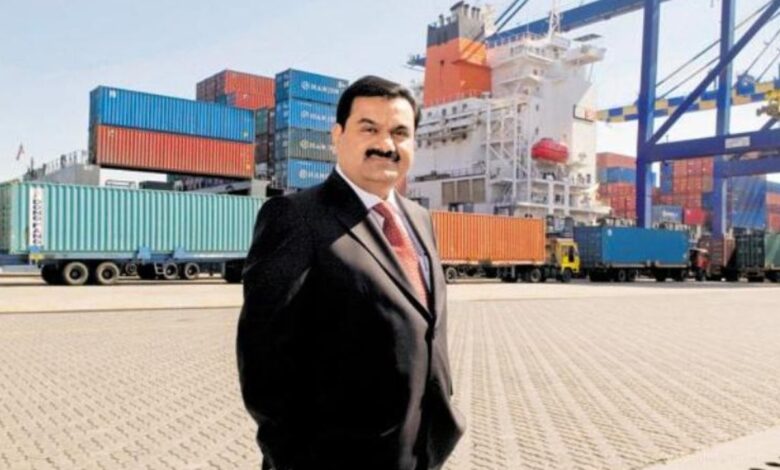

Gautam Adani will build a super app and invest $4 billion in a petrochemical Industry

Gautam Adani will build a super app and invest $4 billion in a petrochemical facility.

Indian billionaire Gautam Adani stated in an interview on Friday that he intended to invest more than $4 billion in a petrochemical plant in the state of Gujarat. According to the source, Adani, the richest man in Asia, intends to introduce a “super app” to link Adani airport visitors with other Adani Group services over the next three to six months.

Adani disputed that entering the petrochemical industry would put him in direct conflict with fellow billionaire Mukesh Ambani. He declared, “There is no rivalry.” “Everyone is welcome in India, a vast growth market.”

Today’s board meeting of the flagship business, Adani Enterprises Ltd., will explore potential fund-raising strategies. The possible manoeuvre by Adani is similar to one made by fellow Indian tycoon Mukesh Ambani, who in 2020 garnered almost $27 billion from foreign investors by selling shares in subsidiaries of his conglomerate Reliance Industries Ltd.

According to Gautam Adani, India’s GDP is expected to grow to $30 trillion by 2050, or almost ten times its current size, as a result of social and economic reforms, increased consumerism, and other factors.

The country’s GDP may start growing by $1 trillion per 12 to 18 months within the next ten years, increasing its appeal as a location for investments, the billionaire predicted at a recent conference in Mumbai. By 2050, he predicted, India’s GDP share in the world will certainly surpass 20%.

The tycoon behind coal-to-ports confirmed his group’s intention to invest $70 billion in a value chain for sustainable energy. According to him, India’s energy consumption would probably increase by 400% by 2050 as a result of its economic expansion, and to meet this need, the nation will go through “an unmatched” energy revolution.

The government of Prime Minister Narendra Modi has outlined goals for increasing the country’s capacity for solar and wind energy as well as making it a centre for green hydrogen on a global scale.

Business tycoons like Adani and his adversary Mukesh Ambani are leading that effort and investing billions of dollars in green energy. The third-largest greenhouse gas generator in the world has set a goal to become a net zero emitter by 2070.

Adani predicted that India would continue to produce unicorn start-ups—companies with a market value of over $1 billion—at a high rate. India would add a unicorn every nine days in 2021, he claimed.

Through a follow-on public offering, Adani will raise 20,000 crores.

Adani Enterprises Ltd., the flagship business of billionaire Gautam Adani, received board approval on Friday to raise to 20,000 crores through a secondary public offering (FPO).

According to a stock exchange filing, the company would ask shareholders for approval through a postal ballot for the share sale.

The share offering will become the largest FPO in the nation to date if Adani Enterprises can raise the whole 20,000 crores. Currently, Yes Bank holds the record by raising $15,000 crore in an FPO in July 2020.

On 24 November, the money to be raised through the FPO will aid in funding the group’s entry into green and digital companies and provide the majority of the equity needed for its expansion ambitions for the following three to five years.

The second-richest person in the world, Adani, announced in September that his organization would invest $100 billion over the following ten years, mostly in the digital and energy transitions as well as businesses in the petrochemical, metal, aerospace, and defence sectors.

Seventy per cent of this will be used for the energy transition. Adani outlined his organization’s goals while pledging to invest $70 billion in a fully integrated hydrogen-based value chain.

“Adani Enterprises, the coalition incubator, has a 3-5 year fundraising plan on paper. 80–90% of its equity investment needs for the specified period will be met by the present fundraising plan, an Adani executive. He didn’t want his name mentioned.

The CEO claims that the Adani Group’s operations produce a combined Ebitda of roughly 30,000 crores, of which 13,000 crore is utilized to pay down the group’s debt. According to him, growth is financed with the remaining 17,000 crores.

In its capacity as an incubator, Adani Enterprises will eventually create spin-off businesses for projects like roads, data centres, airports, and green hydrogen. Each of these businesses produces free cash flow, according to the Adani executive.

To introduce its operations to investors, the organization recently held roadshows in important metropolises. Currently, the healthcare sector is a not-for-profit company.

The group’s airport business achieved positive cash flow this quarter. Adani Airports got a contract from the Airports Authority of India to run and modernize six airports: Ahmedabad, Lucknow, Mangaluru, Jaipur, Guwahati, and Thiruvananthapuram. The Mumbai airport is also owned and operated by it.

Adani Enterprises can attract a larger range of investors by raising money through an FPO, which will increase the stock’s float and liquidity and may improve price discovery in the market.

The FPO proposal fits in with the group’s previous initiatives to diversify its funding sources. According to a 7 November article in Mint, Adani Enterprises hopes to raise to 2,000 crores through its first retail bond offering by the end of the year.

Work on the FPO offer document has already begun at investment banks ICICI Securities and Jefferies, and more banks will join as we get closer to filing day. Shares of Adani Enterprises closed Friday’s trading at 3,903.35 on the BSE, down 0.48%.

Edited by Prakriti Arora