Gautam Adani explains why he bought ACC, Ambuja Cements, and group’s future plans 2022

Gautam Adani explains why he bought ACC, Ambuja Cements, and the group’s future plans 2022

In a gathering on Saturday, Chairman Gautam Adani discussed how the Adani Group had grown to become the second-largest cement producer in India. He stated that the group had plans to increase its cement production capability and become the most lucrative creator in the nation.

After completing the acquisition of the Indian resources of Holcim Ltd., Adani Group has an intention to increase the yearly capacity of cement production by 2027. The purchase of Holcim’s shares in Ambuja (63.19%) and ACC (4.48%; Ambuja’s amazing investment, almost 50% of ACC) by Adani Group were announced in May of this year. The open bid by the Adani Group for a 26% share in each of Ambuja and ACC expired on September 9, 2022.

When explaining the rationale for entering the cement market, he noted that China has a per capita consumption of 1,600 kg compared to India’s 250 kg, which leaves nearly a 7x headroom for expansion. India is the second-largest manufacturer of cement in the world.

At a Saturday event that was later posted on YouTube on Monday, Gautam Adani stated, “We expect going from the existing 70 million tonnes capacity to 140 million tonnes in the next five years.” He added that the Dani Group’s proficiency in motivating operational efficiency will lead to a major margin expansion, making it the most lucrative cement manufacturer in the country.

He predicted that the government’s push to build infrastructure and India’s record-breaking economic development would lead to a proper margin expansion and a multifold increase in cement demand.

He described the acquisition to be historic and said that it was completed in a record-breaking four months, making it the largest inbound M&A transaction to ever take place in India in the construction and materials sector. In the address, which was made public on Monday, he stated that “our entry into this market is happening at a moment when India is on the verge of one of the largest economic booms seen in the contemporary world.” Adani expects that attempts by the Indian government to promote infrastructure growth will majorly increase the demand for cement.

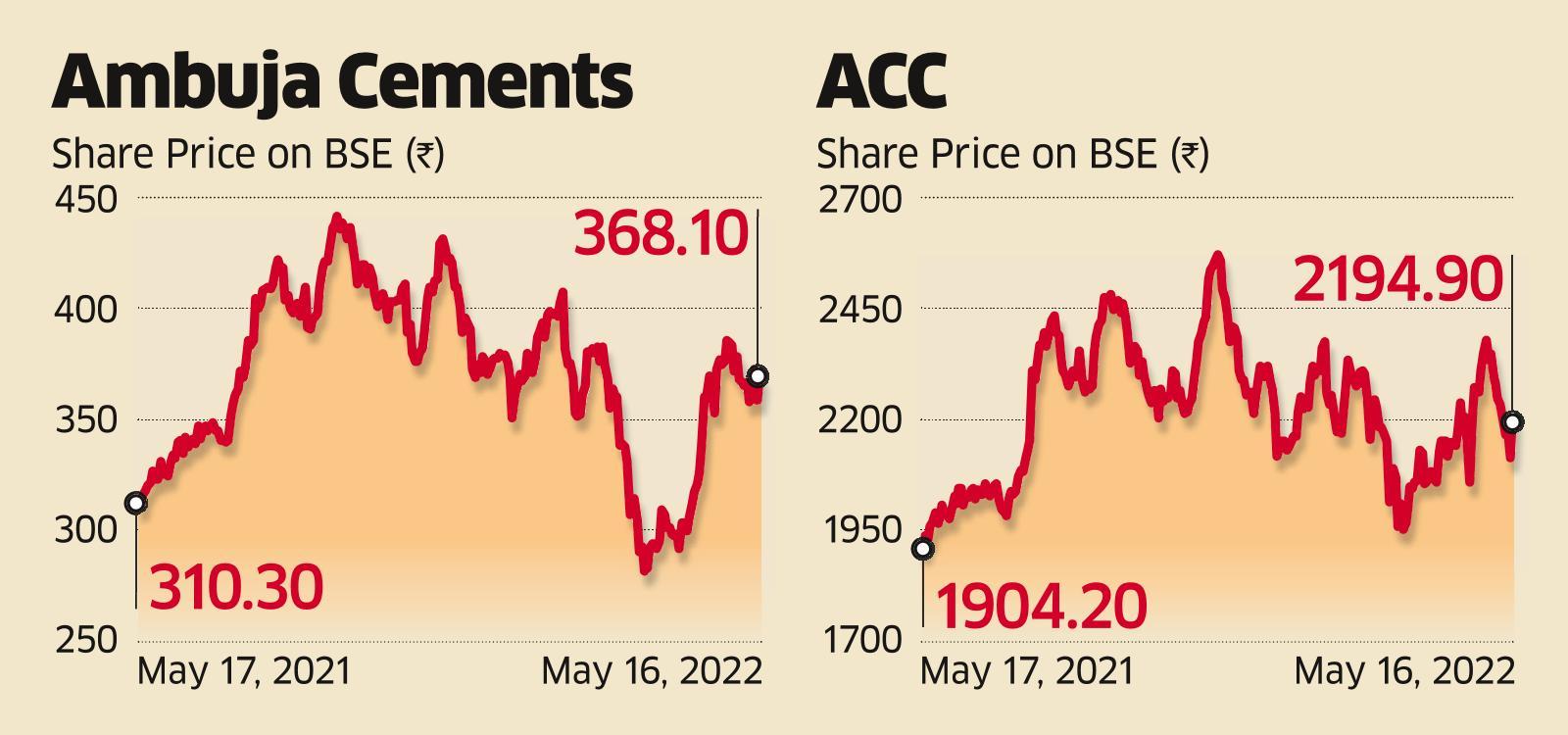

Following the appointment of Indian business magnate Gautam Adani who is the company’s new chairman on Monday, stocks of Ambuja Cements increased by about 10% to a record high. Over the weekend, the company authorized a preferential deal of warrants to the Adani Group in the sum of 20,000 crores.

Adani group Chairman Gautam Adani stated a day after the Ambuja transaction was completed that the ability of Ambuja Cements and ACC will motivate from the existing 70 million tonnes to 140 million metric tonnes in the next five years, and both businesses will become the country’s most profitable cement businesses from margins will go up due to increasing demand.

Needless to say, the combined quality of the guidance we receive from ACC and Ambuja accounts for a major part of my trust. According to Adani, every decision we make must be guided by this conviction and in line with national interests.

Speaking to both companies’ employees on Saturday, Adani referred to the merger to be a historic program because it elevated the Adani group to the second-largest cement producer in the country. With a 120 mtpa capacity, UltraTech is India’s largest cement manufacturer.

“We now control two of the most recognizable companies in the country. He added that the $6.4 billion purchase was India’s largest ever incoming M&A transaction in the facilities and equipment space and shuttered in a record time of four months. “One that defines the ‘grit’ of which was before India and a third that defines the spirit of a confident India,” he said.

He stated, “Our foray into this market is taking place when India is poised to see one of the biggest economic booms in contemporary times. Regarding the justification for entering the market, Adani stated that the company thought India’s economy would be worth $25–30 trillion by 2050.

This growth potential is roughly seven times more. In addition, the long-term auto-scaling in cement demand is expected to be 1.2-1.5 times that of the GDP which is several government initiatives gain traction. We expect to increase at a price which is twice as fast,” he said.

Adani stated that cement is an appealing adjacency to their facilitating economy, because the group’s ports and logistic business, green power business, and e-commerce connection are being created. India’s growth story develops with trillion-dollar infrastructure-related investments and housing.

“This linkage gives us a suitable competitive kind of edge and allows us to achieve unprecedented size. The Adani Group, in my opinion, is unmatched in its ability to increase operational efficiency, and we will gain from the lessons we’ve learned from the many acquisitions we’ve done in recent years. We expect a major margin expansion. As a result, we are becoming the most lucrative cement company in the country, according to Adani.

The largest solar company in the world, according to Adani, the corporation is driving India’s greening. “We are at the forefront of the green hydrogen industry globally, having put in $70 billion in this industry.

With 25% passenger traffic and 40% air cargo share, we are the leading airport operator in India. India’s largest port and logistics company has a 30% national market share.

He stated that we have some of the major road agreements in the country, and we’re headed in the right direction to dominate this market. Adani Wilmar had a “grand IPO,” making it the highest-valued FMCG firm in the country. “We have announced our course ahead in many new industries, including data centers, super applications, aerospace and defense, commercial clouds, metals, and petrochemicals,” Adani added.

Regarding group finances, Adani stated that the company was now more important than ever and was still raising millions of dollars from foreign markets and business partnerships to accelerate economic growth further. He stated that our market valuation is present $260 billion, growing more quickly than any of the other Indian companies in history.

edited and proofread by nikita sharma