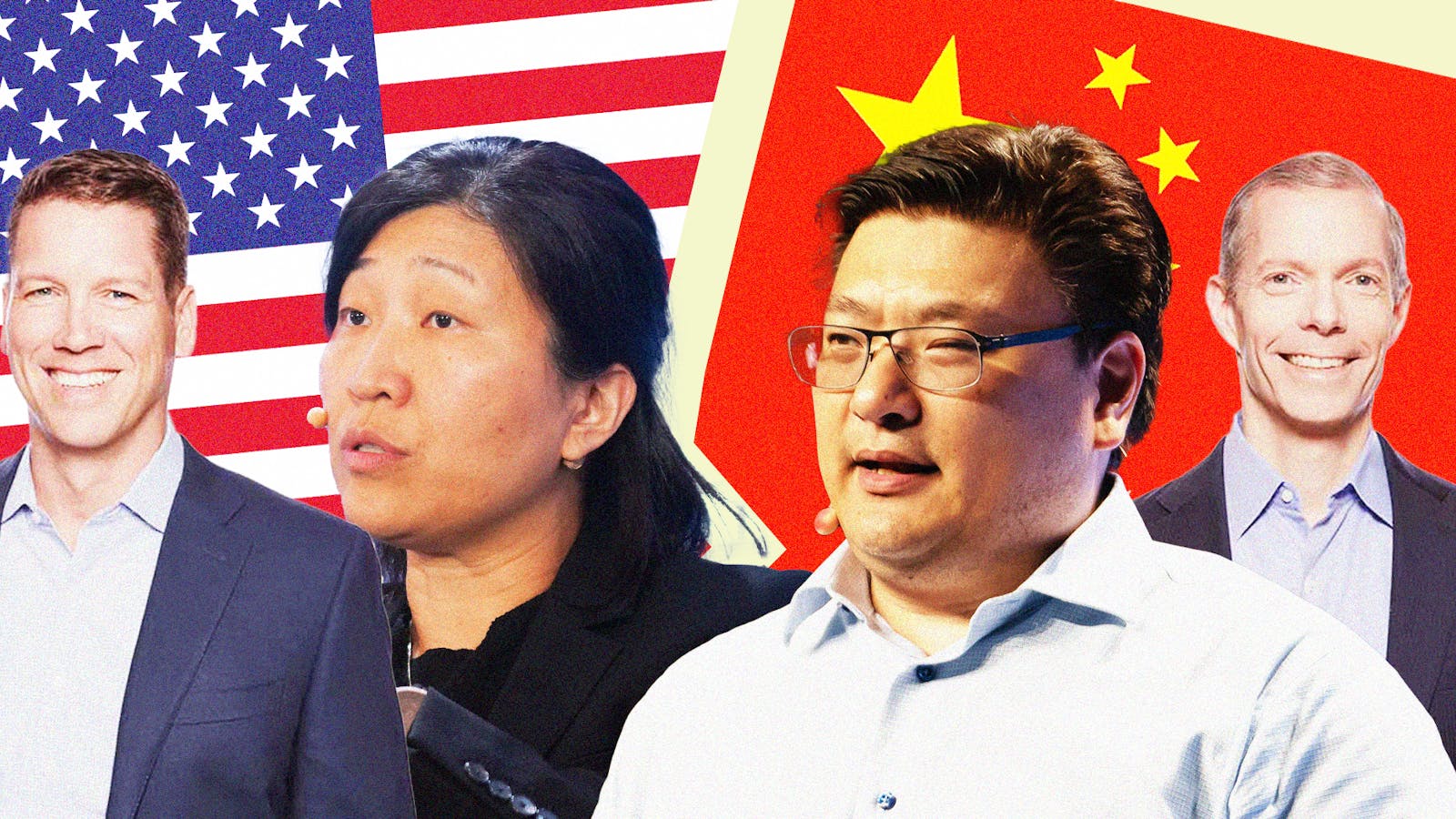

FY23, The Year Of The Split, Top Silicon Valley Investors (Global Firms) Are Separating US And China Operations Into Distinct Entities Amid Escalating Tensions Between The Two Countries

A significant shift has been observed in the strategies of global firms operating in China. Multinational corporations are reassessing their positions in one of the world's largest markets due to mounting regulatory complexities and geopolitical tensions. Earlier, Dentons, the world's largest law firm, then global venture capital giant Sequoia and now GGV Capital, has announced separating US And China operations into distinct entities. The shift involves a careful reconfiguration of their China-related operations, leading to greater autonomy and separation from their parent companies.

Global firms with extensive operations in China are reevaluating their business models to adapt to a rapidly changing environment; regulatory changes, data privacy concerns, and increased scrutiny by authorities have prompted many of these companies to restructure their operations.

To counter the challenges, one of the common approaches that several of the companies have initiated involves establishing independent entities within China, enabling them to navigate the local landscape more effectively while adhering to stringent regulations.

Furthermore, firms are taking steps to separate their China divisions from the rest of their global operations; these moves signify a shift towards greater autonomy and self-sufficiency in managing the unique challenges posed by China’s evolving regulatory framework.

Global Firms Splitting Businesses

GGV Capital, a well-known venture capital firm from Silicon Valley, has joined the growing trend of separating its US and China operations into distinct entities amid escalating tensions between the two countries in the realms of technology and geopolitics.

GGV Capital unveiled its decision to create two entirely independent companies, each with new yet undisclosed brand identities, while one entity will center its focus on North America, Latin America, Europe, Israel, and cross-border US-India ventures, led by managing partners Glenn Solomon, Hans Tung, Jeff Richards, and Oren Yunger, primarily operating from California and New York.

The second entity will direct its attention to China, Southeast Asia, and South Asia, operating from its headquarters in Singapore under the leadership of managing partners Jenny Lee and Jixun Foo; at the same time, GGV’s existing Chinese yuan-denominated funds will continue to operate autonomously under the Chinese brand, Jiyuan Capital.

Why The Change

In an official statement, GGV Capital cited the changing investment landscape and the increasingly intricate operating environment over the past decade as the driving forces behind this decision.

The firm expressed its affirmation of evolving in response to these new realities, although it did not provide specific details; the transition is slated for completion by the end of the first quarter of the following year.

GGV Capital manages assets totalling approximately $9.2 billion and is renowned for its investments in global tech giants such as Alibaba, Airbnb, Slack, ByteDance (owner of TikTok), and Didi (Chinese ride-hailing provider).

GGV Capital’s decision follows a trend set by other firms earlier in the year, Dentons, the world’s largest law firm in terms of employee count, is also reorienting its China operations in response to escalating regulatory pressures within the country.

The firm communicated this decision to its clients through an internal memo, outlining that, commencing this month, its China unit would operate as an autonomous legal entity. However, The Hong Kong practice would remain unaffected and part of Dentons.

The Chinese entity will continue using its current local name, “Dacheng,” and maintain a partnership with Dentons under the status of a “preferred firm.”

Dentons explained that this restructuring was prompted by the emergence of “new mandates and requirements related to data privacy, cybersecurity, capital control, and governance.”

In a statement, the firm emphasized that despite the alteration in its legal structure, it would continue collaborating to serve its clients’ needs effectively.

Dentons boasts itself as the world’s largest law firm, asserting that it has a presence “in more locations across more countries than any of our competitors” in its memo, and the company employs 21,000 individuals in over 80 countries, with 12,000 of them being lawyers.

While Dentons did not elaborate on the specific regulatory changes that prompted this decision, it coincides with China’s broadening of its counter-espionage law in April, expanding the definition to encompass the handling of any materials or data linked to national security and interests, a move that has raised concerns among foreign businesses operating in the country.

Dentons’ move, however, aligns with a broader crackdown on international consulting firms. In May, state security authorities raided several offices of Capvision, an advisory network with headquarters in Shanghai and New York, followed by the closure of the Beijing office of Mintz Group, a US corporate due diligence firm, and inquiries into the local branch of consultancy Bain by Chinese officials.

China’s Crackdown

These actions are part of Beijing’s wider efforts to enhance oversight over what it perceives as sensitive information related to national security.

According to Michael Hart, president of the American Chamber of Commerce in China, this campaign has had a chilling effect on US businesses in China, raising concerns about who might be targeted next.

Similarly, the British Chamber of Commerce in China has also reported its members feeling unsettled and has called on the Chinese government to clarify regulatory guidelines.

While Dentons’ formal split may seem drastic, global businesses have been under mounting pressure in recent years to reconsider their organizational structures due to heightened geopolitical tensions and increasing regulatory demands across different jurisdictions.

In June, the European Union Chamber of Commerce in China reported that more businesses were “decoupling” their headquarters from their China operations, primarily as a risk management measure.

According to the organization’s annual survey, 64% of respondents experienced greater difficulties in conducting business in China over the past year, marking the highest figure on record.

China-US Tension At The Heart Of It All

This move by many companies reflects the ongoing repercussions of US-China tensions on global business operations.

In the previous month, the Biden administration had announced restrictions on investments by US venture capital, private equity firms, and joint ventures in Chinese artificial intelligence, quantum computing, and semiconductor industries.

As analysts and investors have noted, this executive order is expected to further diminish deal activities between the US and China and impact Chinese startups negatively.

However, when questioned about whether the US order or broader geopolitical tensions influenced GGV Capital’s decision, the firm declined to comment, although the firm has recently been under increased scrutiny from US lawmakers.

In July, a US House committee expressed serious concerns and requested information from four investment firms, including GGV, regarding their investments in Chinese artificial intelligence, semiconductor, and quantum computing companies.

One of the investments in question was GGV’s involvement with Megvii, an AI developer known for its facial recognition software.

Megvii has faced allegations of human rights violations against Uyghurs and other Muslim minority groups in China’s Xinjiang region and hence had been blacklisted by the US in 2019 due to these allegations, although it had denied any grounds for such actions.

Additionally, in June, the top global venture capital firm Sequoia also announced its division into three separate entities to cover Europe and the United States, China, and India and Southeast Asia.

Its China business operates independently under the name Hongshan, with the leaders of the firm citing the growing complexity of managing a decentralized global investment business.

The Last Bit, The transformation of global firms’ strategies in China reflects a new reality shaped by intricate regulatory changes and heightened geopolitical tensions, and multinational corporations are forging a path forward by reconfiguring their China-related operations.

While some may view these changes as drastic, they are, in fact, adaptive responses to the complex landscape in which these firms operate.

However, the question is how these shifts will ultimately shape the future of international business in China as companies seek to strike a delicate balance between opportunity and risk in this dynamic environment.