France Gets $16 Billion Of Foreign Investments As Part Of ‘Choose France’ Event; Amazon, Microsoft, AstraZeneca, Pfizer Bet Big On France; EU Countries Vying For Investments Amid Growing Competition From China.

The French presidency announced on Monday that this year’s “Choose France” event, an annual summit dedicated to attracting foreign investment to France, is expected to yield 15 billion euros ($16.2 billion) in foreign investments, showing an increase from last year’s figures.

The summit’s objective is to enhance Paris’ standing as a premier European business hub, particularly crucial as France, the euro zone’s second-largest economy, struggles with challenges like its budget deficit and sluggish first-quarter economic performance.

Historically, Paris has trailed behind New York and London in global financial prominence, as highlighted in the Z/Yen survey, with New York topping the list and London coming in second.

The French presidency noted that these 15 billion euros of foreign investments stem from 56 different business ventures, with prominent sectors for investment including technology, artificial intelligence (AI), and finance.

France’s success in securing major contracts during the “Choose France” summit includes Microsoft’s commitment to invest 4 billion euros in the country.

Brad Smith, the vice-chair and president of the technology giant, disclosed to Le Figaro that a significant portion of this investment will be directed towards the artificial intelligence (AI) sector, with plans to establish a data center in Mulhouse, France.

Additional investments and job opportunities were secured with notable companies like Amazon, Pfizer, and Morgan Stanley.

Amazon announced an extra 1.2 billion euros investment in France, potentially creating 3,000 new jobs, while Pfizer and AstraZeneca unveiled new investments totaling nearly $1 billion.

Moreover, Morgan Stanley aims to expand its workforce in Paris to 500 employees by 2025, with an immediate addition of 100 staff members in the French capital, as announced by French Finance Minister Bruno Le Maire.

Countering Competition

Countering Competition

Le Maire emphasized that France and the European Union must intensify efforts to counter the competition posed by China and the United States.

This concern was highlighted by French oil giant TotalEnergies’ recent consideration of a primary stock market listing in New York.

At an EU meeting in Brussels, Le Maire reiterated the importance of establishing a capital markets union to facilitate investments in emerging sectors such as renewable energy and artificial intelligence. He stressed, “Europe needs money; otherwise, it will continue to lag behind the United States and China in terms of productivity.”

As part of the ‘Choose France’ event, Le Maire announced plans to host meetings with CEOs from prominent financial institutions like JPMorgan, Goldman Sachs, Morgan Stanley, and Bank of America.

These discussions aim to reinforce Paris as an attractive destination for financial investors, supporting major industrial and economic projects in collaboration with the President.

Growing Chinese Concern

Growing Chinese Concern

China’s economic growth has created various challenges for European nations, including:

- Impact on manufacturing jobs: In 2020, approximately 450,000 German manufacturing jobs relied on Chinese demand, facing increasing pressure.

- Concerns about overcapacity: China’s manufacturing focus has raised concerns about overcapacity, potentially leading to price wars.

- Growth in high-tech sectors: Chinese exports to the EU have surged in high-tech areas, challenging Europe’s traditional dominance in these sectors.

- Aggressive competition policy: China’s expansive economic ties and aggressive competition policy, disregarding international norms, present challenges.

While Europe has historically maintained productive relations with China, recent years have seen a reevaluation of this relationship, similar to the reassessment undertaken by the United States and other countries worldwide.

China’s economic success has transformed it into a formidable competitor across various industries, including railways, automobiles, chemicals, and machinery.

In sectors like 5G technology, China has surpassed European rivals, posing new challenges due to the dominance of its state-owned enterprises and banks, coupled with the opacity of its operational systems.

The Numbers

The Numbers

China maintains significant trade relationships across the globe, but its primary partnerships are with the United States and Europe.

In 2018, Chinese exports to the EU amounted to Euro 394.7 billion, while exports to the US totaled Euro 406.317 billion.

Conversely, EU exports to the US reached Euro 406.372 billion, and to China, Euro 210 billion.

This robust trade, coupled with foreign direct investment (FDI) from European firms, has contributed to Beijing’s development of domestic industries that now compete with European counterparts.

Notably, major European companies such as Volkswagen and Daimler rely on the Chinese market for growth, with some, like Volvo, being acquired by Chinese entities.

China’s rapid economic growth has significantly expanded its domestic market, over the past decade, China has fostered globally competitive companies and financial institutions, positioning itself as a leading industrial force in the 21st century.

China’s focus on technological advancement suggests ambitions for the next industrial revolution. However, its pursuit of progress sometimes involves sidestepping established norms.

For instance, China has acquired technology through purchases, licensing agreements, or foreign company acquisitions, often coercing technology transfer from foreign partners or resorting to cyber theft.

Implicitly or explicitly, China aims not only for self-sufficiency but also to surpass existing technology leaders and achieve global dominance, sparking concerns worldwide.

Despite apprehensions, China recognizes the benefits of the EU’s common market and its role in a multipolar world order. Conversely, European countries harbor reservations about their relationship with China.

This sentiment is evident in their reluctance to fully engage with initiatives like the Belt and Road Initiative (BRI) or the Asian Infrastructure Investment Bank (AIIB).

While the UK joined the AIIB in 2015 and several other European nations followed suit despite US pressure, Italy’s formal participation in the BRI attracted significant attention as the first major European country to do so.

Additionally, the 16+1 cooperation between Central and Eastern European countries and China has raised concerns among European stakeholders.

Despite the many concerns, European countries are carefully managing their response.

On one front, the EU is signaling its intention to regulate the aggressive acquisition of technology by Chinese firms.

At the same time, it aims to maintain an environment where legitimate Chinese investments, including merger and acquisition activities, can continue within established rules.

China’s actions have contributed significantly to this atmosphere of distrust. By fostering separate internet spheres to support its domestic champions like Baidu, Tencent, and Alibaba, China has fractured the global digital sector.

Moreover, rampant cyber-espionage activities have heightened suspicions surrounding Chinese telecommunications firms like ZTE and Huawei.

Compounding these concerns is China’s National Intelligence Law, mandating cooperation between Chinese entities and the state.

While countries and companies have benefited from their connections with China, the lack of trust and cooperation has hindered China’s objectives.

The US-China Problem

The complex dynamics between the US and EU, marked by trade disputes and defense spending disagreements, influence European policy towards China.

However, despite these nuances, the EU remains the primary trading partner of the US and a military ally within NATO.

Additionally, Europe’s recent vocalization of grievances regarding China’s business practices and industrial policies has received unexpected support from the shifting American stance towards China.

This sentiment was succinctly summarized in a European Commission document from March 2019, which described China as a multifaceted entity:

- A cooperation partner

- A negotiating counterpart

- An economic competitor vying for technological leadership

- A systemic rival advocating alternative governance models

The bulk of Chinese investment in Europe, more than half of which is concentrated in the continent’s largest economies—namely the UK, Germany, France, Italy, and Spain—reflects strategic acquisitions aimed at positioning China as a global leader in key industries.

These sectors span robotics, biopharmaceuticals, renewable energy, environmental technologies, microelectronics, electric vehicles, as well as infrastructure domains like real estate, ports, railways, high-voltage electricity grids, and 5G technology, which serves as a key enabler for innovations such as driverless cars and the Internet of Things (IoT).

The strategic intent behind Chinese acquisitions is evident, particularly concerning grid infrastructure.

China has prioritized investments in ultra-high voltage grids, anticipating their significance in future technologies.

Notably, in 2017, China’s State Grid Corp acquired a 24% stake in Greece’s national power operator ADMIE, becoming its second-largest shareholder.

State Grid also holds a 25% stake in Portugal’s Redes Energeticas Nacionais (REN) and a 10% stake in Italy’s national grid.

In 2018, it pursued a 20% stake in a German grid company, albeit unsuccessfully.

Moreover, Three Gorges Corp’s attempt to acquire a majority stake in Energias de Portugal (EDP) faced shareholder opposition, resulting in the bid’s collapse in April.

The turning point came in May 2016 with the acquisition of Kuka, a German company specializing in automotive robotics, by China’s Midea Group, the largest home appliance manufacturer in China.

This move startled the German public, as Kuka symbolized the pinnacle of the country’s industrial prowess.

By 2018, mounting concerns prompted several European nations to progressively tighten their domestic regulations, particularly regarding foreign direct investment (FDI) in sectors deemed critical to national security.

The EU initiated discussions on implementing a unified law to scrutinize sales or takeovers of companies deemed sensitive. These actions were significantly influenced by American criticism of China’s industrial policies, coinciding with the United States’ reinforcement of the Committee on Foreign Investment in the US (CFIUS).

As US pressure on China intensified in 2017, Chinese investment swiftly shifted towards Europe.

According to a study by Baker McKenzie, Chinese FDI in Europe reached US$ 12 billion in the first half of 2018, marking a four percent increase from the previous year, excluding the Syngenta acquisition. Conversely, Chinese FDI destined for the US experienced a drastic 92 percent decline, plummeting to just US$ 2 billion.

Germany, France, Sweden, and the UK emerged as prominent recipients of Chinese investments.

However, Foreign Policy’s analysis highlights a shift due to Chinese capital export controls and heightened resistance from European and American regulators.

Consequently, Chinese investment in both the US and Europe sharply declined in 2018. Completed Chinese transactions in Europe dropped from approximately US$ 80 billion in 2017 to US$ 22.5 billion in 2018. Nevertheless, investments continued to flow into France, Germany, Spain, and Sweden.

Flagging Concerns

Flagging Concerns

China’s expanding presence in Europe is raising concerns due to its propensity for employing dubious tactics.

Another notable factor is the state’s involvement in promoting business, a practice subject to stringent regulations in Europe.

In early 2018, Bloomberg conducted an audit of Chinese acquisitions, analyzing data from 678 completed or pending deals across 30 countries since 2008.

The audit revealed that Chinese state-backed and private companies had engaged in deals worth at least US$ 255 billion throughout the continent, involving the takeover of approximately 360 companies.

Notably, 100 of the Chinese corporations involved in these transactions were state-backed entities or investment funds, accounting for US$ 162 billion or 63 percent of the reported deals.

Among the top acquirers identified by Bloomberg, eight out of ten were state-owned or state-backed entities, including China Investment Corp, a sovereign wealth fund; Aluminum Corp of China Ltd; and the Silk Road Fund Co, another sovereign wealth fund.

The EU, characterized by consensus-based policymaking, faces challenges in swiftly implementing new procedures.

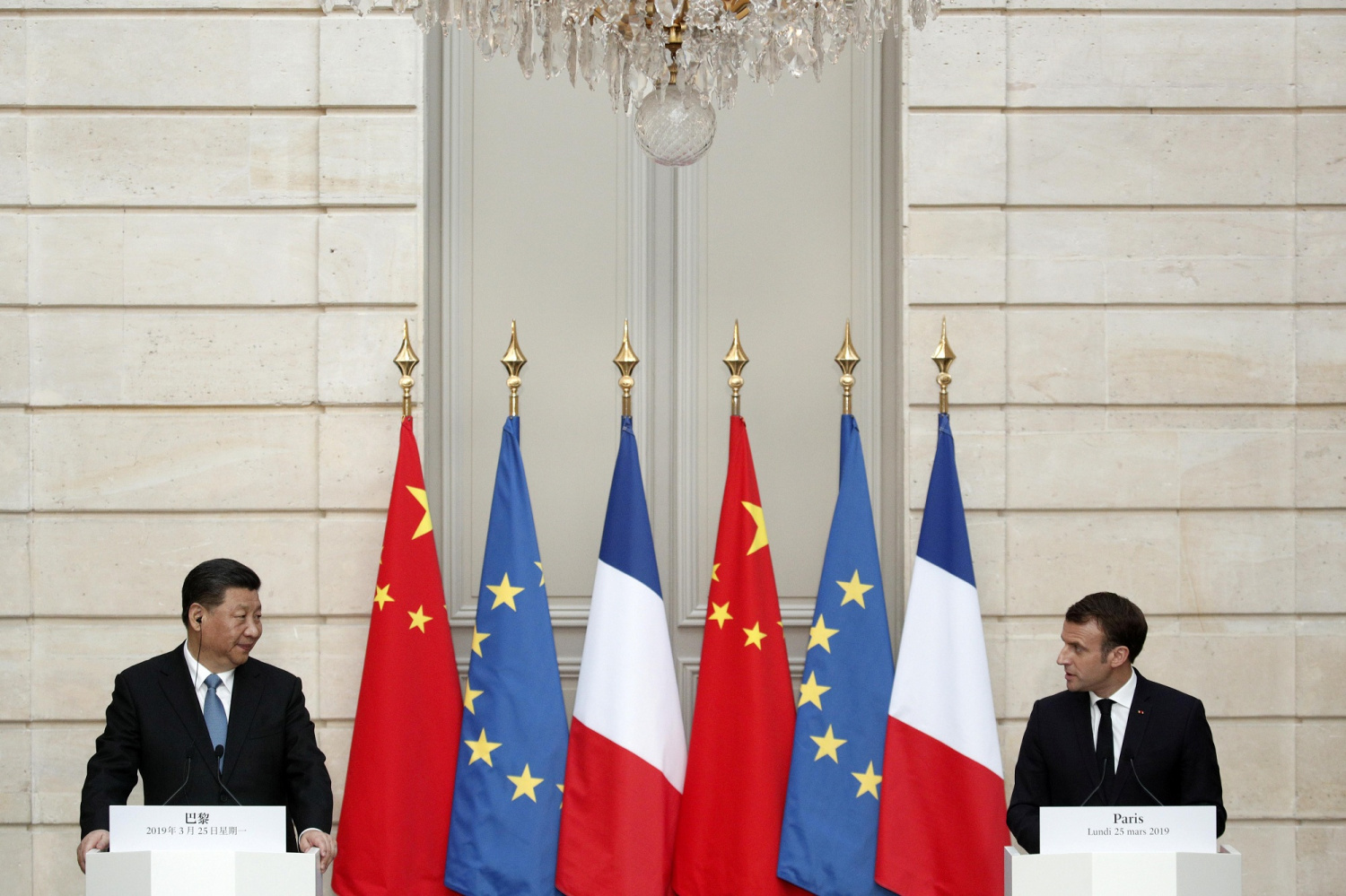

Despite this, Chinese policies have garnered increased scholarly attention, particularly amid the Brexit era. Recent efforts by European leaders, such as French President Macron inviting German Chancellor Merkel and European Commission President Juncker to meet with Xi Jinping in Paris, stress the emphasis on European unity and negotiation in contrast to the US approach.

Currently, only 14 of the 28 EU countries have formal systems for screening foreign direct investment (FDI), with varying scopes and designs.

The EU balances FDI screening issues with individual states’ sovereignty over investment decisions within their borders.

To address disparities with China, the EU aims for reciprocity in public procurement and plans to introduce EU norms on labor, environmental standards, and pricing in procurement.

Additionally, the European Commission aims to fill gaps in EU law to counter distortive effects of foreign state ownership and financing in the internal market.

Europe is also debating how to compete with China’s state-backed firms, with discussions on allowing the emergence of European champions to rival Chinese giants.

China’s rapid economic and political changes pose significant challenges for Europe, driven by its rapid advancement and political-economic system misalignment with Europe’s interests.

European companies rely on Chinese markets and investments, including in telecommunications and electric vehicles. While NATO allies share national security concerns with the US, some issues seem more about US technology dominance. Trade disputes like subsidies for Boeing and Airbus highlight US-EU differences.

Addressing United States

Addressing United States

US-China tensions have reverberated in Europe, with reports of technology transfer pressure on companies operating in China.

Both the US and Europe now view China as a competitor, challenging fair trade practices and aspiring to technological dominance.

The US is urging European countries to adopt a tougher stance against China, shifting supply chains away from China. However, China’s dominance in critical technology areas presents challenges to such shifts.

Europe’s prosperity hinges on its relationship with China, necessitating a balanced approach promoting trade and investment while safeguarding sensitive technology.