Former US Treasury Secretary Lawrence Summers says recession still looms, Fed getting closer to done

Former US Treasury Secretary Lawrence Summers claims that although the Fed is almost done, a recession still looms. Despite positive news in recent weeks, according to former Treasury Secretary Lawrence Summers, the US economy is still in a recession this year.

Summers advised viewers of Bloomberg Television’s “Wall Street Week” with David Westin to be wary of false dawns. “I’d continue to hold the opinion that a recession this year is more probable than not.”

The most recent US consumer price index report revealed a further slowdown in inflation to a 6.5% annual rate, the lowest since October 2021, the day before Summers gave his speech. He stated that recent “good news” included evidence of “wage restraint” following a slowdown in earnings growth in December.

A recession would be required, according to the Harvard University professor who is a paid contributor to Bloomberg Television, in order to bring US inflation down to the Federal Reserve’s 2% target.

According to Summers, the Fed’s efforts to reduce inflation by raising interest rates are about to come to an end.

US Fed Predictions

He said, “We’re getting much closer to that day, but it’s a little early to be thinking about pausing.” However, he added, “I don’t think we have to make a firm decision beyond February” at this time.

On February 1, Fed policymakers are anticipated to increase their key rate by 25 basis points, according to futures trading. After a 50 basis-point increase in December and four increases of 75 before that, that would represent a further slowdown in the rate of increases. Futures point to a springtime increase of one last quarter-point.

According to Summers, “the more optimistic possibilities” of avoiding a recession “look more plausible today than they did several months ago.” However, he added that consumer price increases over 6% are “still inconceivably high” when compared to the time before the pandemic.

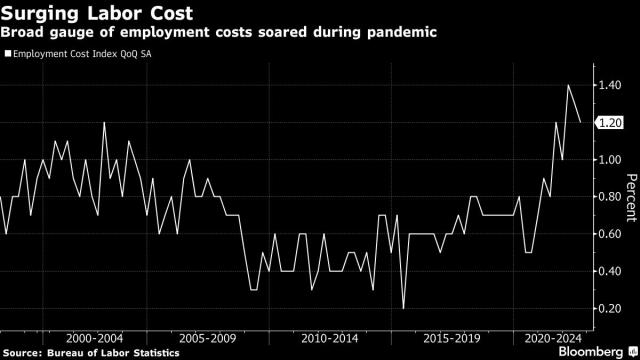

According to Summers, the employment cost index for the last quarter of 2022 will be a crucial indicator to watch. The “gold standard” of these indicators, according to him, is the ECI, a more comprehensive indicator of labour costs than the monthly hourly earnings indicator.

On January 31, the day before the Fed announces its upcoming rate decision, that report is due. The ECI increased by the most since records have been kept, which date back to 1997, in the first quarter of last year.

The former head of the Treasury Department criticised such fights as the “dumbest” debates in Washington as lawmakers prepare for what is expected to be a contentious political battle to raise the federal debt ceiling. Republicans in the House, which they now control, have threatened to demand spending cuts in exchange for raising the debt ceiling and preventing a default on US debt.

Summers emphasised that a default would be disastrous because it would result in permanently higher borrowing costs.

Despite this, he urged a discussion on the fundamentals of US fiscal policy, citing the need to “very substantially” increase national security spending in the years to come as well as other issues like escalating healthcare costs.

We’ll need to examine the federal government’s revenue sources, he said. There will be some very important discussions involved in that.

After year-over-year inflation dropped to 6.5% in December, former Treasury Secretary Larry Summers is concerned that investors and economists are becoming overly optimistic.

False dawns must be avoided at all costs. If you stop to think about it, the good news was inflation running in the sixes, which is still unimaginably high by the standards of two or three years ago, he said in an interview with Bloomberg on Friday. He continued by saying that his prediction for this year’s recession is still that it will happen more likely than not.

Seven interest rate increases have been made by the Federal Reserve since March in an effort to curb inflation without main triggering a recession, but economists and Wall Street analysts have questioned whether these actions will be successful. Summers has found himself in the bears’ camp on numerous occasions. He told the Financial Times in October that “a recession” and also “unemployment towards the 6% range” would be necessary to ensure that US inflation is actually over.

The latest inflation report was “good news,” the economist acknowledged on Friday, even though the unemployment rate was only 3.5% in December. This, he claimed, shows that wage growth isn’t accelerating too quickly, suggesting that the Fed may soon be able to switch up its strategy.

Certainly, one has to believe that the Fed’s job is much, also much closer to being done, he said, looking at some of these trends. And while they are still not my bet, I believe that the more optimistic economic scenarios are more likely to be realised today than they were a few months ago.

Summers argued that the Fed should continue raising interest rates in February despite acknowledging that recent inflation data was “good news” because wage pressures haven’t completely subsided. Inflation-adjusted real average hourly earnings increased by 0.4% last month, up slightly from 0.3% in November and a 0.1% decline in October.

The Fed’s ability to keep inflation under control and maintain their credibility, he said, are the two things that matter most. Therefore, “I think it’s a little early to be thinking about pausing, also but we’re getting much closer to that day,” but it is.

Summers explained that the Fed’s interest rate increases are like antibiotics for the economy in a September interview with Shawn Tully of Fortune. If we don’t take our medicine for a long enough period of time, inflation may become a long-term issue.

In his words, “most of us have learned that [when] the doctor prescribes you a course of antibiotics and you stop the course when you feel better rather than when the prescribed course is over, your condition is likely to reoccur. And since the bacteria have developed more resistance, it will probably be harder to get rid of it the next time.

The Employment Cost Index (ECI), which will be released on January 31 and measures the average cost per hour worked in the United States, was mentioned by Summers on Friday as the real litmus test for the Fed and the economy. He referred to the index as “gold-standard indicator of wage pressure and labour costs

The economist has been arguing for months that in order to control inflation, central bank officials must slow the labour market and restrain wage growth. According to Bloomberg, the economist even suggested that it might take “five years of current unemployment above 5%.” And he thinks the ECI will be the ideal indicator of whether interest rate increases have started to work.

Others on Wall Street, however, such as David Kelly, the chief global strategist at J.P. Morgan Asset Management, think the Fed has already taken sufficient action to halt inflation. The central bank will probably increase interest rates by an additional 75 basis points between now and May, Kelly predicted on Friday, but he hopes it will decide against doing so.

“They should stop, in my opinion, he told Bloomberg. “They’ve won the war, and now they risk sending the economy into a downturn. I wish they would stop because I believe they are exacerbating the financial issue.

edited and proofread by nikita sharma