Foreign Investors Knocking The Horn For Haldiram: Why Is Indian Bhujia Baron A Magnet For Global Investing Biggies?

HALDIRAM: Who is there who does not know this name? From tasty Khattha Meetha, mixtures adding sour-sweet to your mood to Lite Chiwda giving diet-conscious satisfaction to your taste buds, it may not be wrong to say Haldiram is the king of Namkeen in India. However, this legacy Namkeen empire may leave its roots as foreign eyes are glueing their eyes on this Indian-owned brand.

Who are the foreign PEs knocking horns for the Indian bhujia baron Haldiram?

Bain Capital is collaborating with Singapore’s Temasek to compete with a Blackstone-led consortium for a majority interest in Haldiram’s Snacks Food Pvt Ltd as global buyout firms battle for what may be India’s largest private equity purchase to date. According to sources familiar with the case, the Bain and Temasek partnership made a non-binding offer late last week that valued India’s largest snack and convenience foods firm at $8-8.5 billion (Rs 66,400-70,500 crore) after initially talking with the 87-year-old brand’s founding family separately.

Blackstone, the Global largest private equity firm, has partnered with the Abu Dhabi Investment Authority (ADIA) and Singapore’s sovereign wealth fund GIC to acquire up to 76% of the company.

Over the previous seven months, Bain has been in intermittent bilateral conversations with the Nagpur and Delhi factions of the Agarwal family, which owns Haldiram, about buying into the firm while the group finalised a pan-India reorganisation plan. The conversations that began towards the end of 2023, including plant visits and management meetings, were mainly focused on a minority stake.

What fuelled the Haldiram family to give their majority stake in the family-owned business?

Although, earlier, there were talks to take a minority stake in Haldiram, however, the founding family is now willing to sell a majority ownership after combining its snacks business and hiving off its restaurant chain into a new firm, which it will keep. The next generation of the Agarwal clan wishes to follow different interests.

Why do foreign funders want to munch on desi namkeen? Is it that tasty?

With a pan-India presence and the equity of an 87-year-old brand, Haldiram’s became a home-grown favourite across generations. When combined with stable sales growth and solid EBITDA despite the cyclicality of raw material costs, Haldiram Snacks creates an irresistibly spicy and mouthwatering offer for PE buyout firms like Blackstone and Bain, among others. It helps that they have significantly more scale than their competitors.

The crunchy competitive edge of Haldiram enjoys in the market.

The majority of Haldiram’s competitors are still regional companies, dominating just three or four states. Three states (Rajasthan, Assam, and Bihar) account for more than 70% of the total income for listed Bikaji Foods. Gopal Snacks, which just went public, draws over 80% of its revenue from just one source: Gujarat. Most unorganised players have a significant distribution reach in only a few regions, which increases volumes through lower pricing and higher retailer profits. They still have plenty of room to expand into southern and eastern states. Haldiram may become a market leader that will be difficult to overtake by combining its north and west activities.

The multiple items are under Haldiram’s portfolio.

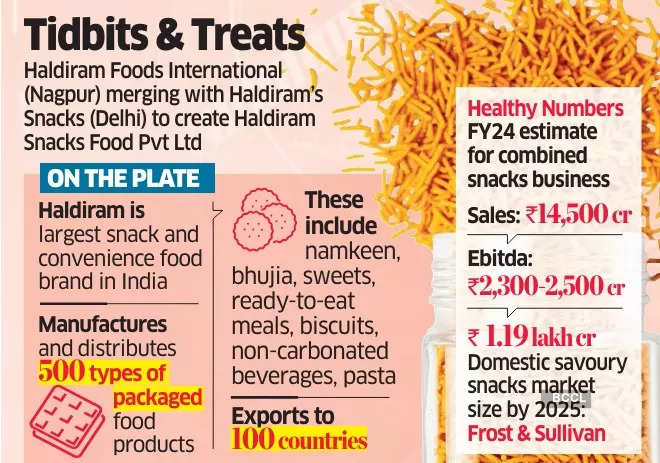

This snack food industry manufactures and distributes about 500 different types of products, including snacks, namkeen, sweets, ready-to-eat and pre-mixed foods, biscuits, non-carbonated ready-to-drink drinks, and pasta. It operates in 100 countries, many through franchisees, including the UK, US, and Japan. The company’s concentration on exports reduces its risk, making it more mouth-watering. Even today, the combined sales of the Delhi and Nagpur factions exceed MNC giants like PepsiCo’s snack sales in the country, placing it first in a very fragmented industry.

It has also expanded into other sub-brands, including Minute Khana, Cup Shup, and Cookie Heaven, and began selling chocolates under the Cocobay brand in January. It is growing into retail supermarkets and quick-commerce platforms to compete with incumbents such as Britannia in biscuits and Mondelez and Amul in chocolates. It has also bought lesser brands such as Babaji Namkeen, Akash Namkeen, and Atop Foods.

The thick, crispy financial portfolio of the Bhujia brand.

Haldiram is a solid firm. It had yearly revenues of $1.5 billion in 2023, up 40% from the previous year, and an annual profit of $200 million. People acquainted with Haldiram operations estimate that the merged food business’s FY24 revenue would be Rs 14,500 crore, with an EBITDA of Rs 2,300-2,500 crore. Over the last five years, the company’s revenue has increased at a compound annual rate of 18%. The average EBITDA margin is 14-15%; however, it increased to 17-18% last year due to reduced commodity rates and price increases in FY23.

One of the primary benefits of this industry has been the ‘big topline’ that most players have, which facilitates going public. A smaller operator, such as Gopal Snacks, with a topline of roughly INR1300 crore, may launch an INR650 crore IPO since many retail Indian investors still view the topline as a measure of business scale. Among peers, the two significant companies – Bikaji Foods and Prataap Snacks – trade at multiples that reflect their distinct historical track records, margins, and return profiles. The former is quoted at around 6X revenue and 45X EV/EBITDA, whilst the latter is quoted at 1.3X revenue and 16-17X EV/EBITDA.

Because Haldiram’s is a privately held company, financial information is not freely available. However, based on non-binding bids, at a valuation of USD8 to USD8.5 billion, bidders are looking at a 28-30X forward EBITDA for this rare opportunity, particularly in the highly sought-after consumer market.

Is this the first attempt at selling the Bhujia baron?

Since 2016-17, numerous private equity companies, including General Atlantic, Bain Capital, Capital International, TA Associates, Warburg Pincus, and Everstone, have been in talks with the Agarwal family about acquiring a minority or controlling share.

For more than a year in 2018-19, the family held negotiations with Kellogg’s–then the world’s second largest snack foods maker–to sell a controlling 51% stake at a $3 billion valuation, excluding the restaurant business, but the deal parameters kept changing, causing the US company to walk away frustrated.

Prior to it, PepsiCo’s Indra Nooyi had approached the Agarwals about a takeover. Last September, Reuters reported that Tata Consumer Products Ltd was in talks with the Agarwal family to purchase a 51% share but baulked at the $10 billion price tag. Both firms are officially denied the news.

“With the merger coming to fruition and a professional CEO on board, the chances of a deal are higher than ever,” said a snack food industry veteran. KK Chutani, former CEO of Dabur International, was chosen as CEO of Haldiram last summer, placing a professional in charge for the first time. The next generation is not eager to continue the business with the same zeal and commitment, which is another trigger, but the family is quite picky about a premium valuation. Finally, unlocking the value of the firm through listing is an option, as the public market would value the activities far more than private equity.”

With all such big players of the market in the industry, can we expect that savoury snacks market has a deep potential to grow in the coming times?

With a market share of 38.5 %, Haldiram’s dominates the Indian ethnic and snack business. According to Bikaji Foods’ red herring prospectus, this industry was worth Rs 114 billion in FY22 and is predicted to expand to Rs 204 billion by FY26.

According to a Frost & Sullivan analysis, the India savoury snacks market was worth Rs 72,800 crore in 2021 and will grow at a 13% CAGR to Rs 1,19 2,000 crore by 2025. The Indian savoury snacks industry may be largely divided into two segments: western snacks and traditional snacks, with the latter accounting for around 48% of the entire savoury snacks market — namkeens, bhujia, and ethnic snacks such as dry samosa, kachori, chakli, and others.

According to Mondelez International Inc’s 5th State of Snacking report, “While new middle-class consumers desire to spend more on well-known international brands and products, they often stick to their local traditions and preferences, especially for food ingredients and flavours, with 40% of young consumers in India saying they prefer traditional and familiar food.” The worldwide survey, which examined consumer snacking habits through 2023, also stated that “new arrivals to the global middle class—mostly young urban professionals in Asia—trade up to higher-quality commodities that indicate a specific lifestyle and status, including food and snacks.”

Compared to other categories, this industry has yet to fully benefit from premiumisation. Value-driven impulse and discounted family packs continue to drive the majority of growth. The steady transition from unorganised to organised should benefit all major stakeholders. For numerous snack companies, export contributions range from 5 to 10%, but they are expanding rapidly. As some of these firms expand their foreign physical presence, there is enough opportunity for faster growth and a better profit profile. Dabur and Marico have achieved success in their global enterprises.

Despite the fact that 43.4% of the packaged savoury snacks industry is unorganised, organised businesses such as Haldiram, Pepsico-Lays, Balaji, and Bikaji have a strong presence across the nation and a significant market share in specific regions. By 2021, the organised savoury snacks business was expected to be worth Rs 41,000 crore. Currently, the ethnic Namkeen and snacks business is worth Rs 10,800 crore. This category has increased significantly during the previous few years, particularly after the pandemic.

So can we expect the deal to be fruitful, or the knocking horns global biggies may have to face some thorns in the way to Haldiram?

The scale of the transaction and the Agarwal family’s expectation of a premium are the main issues, according to a PE executive who reviewed the offer but passed on it. This was the same rationale for the cancellation of the rumoured deal with TATA, as the valuation at the time was $10 billion. An analyst at a domestic brokerage, who asked to remain anonymous since Haldiram is not a publicly traded firm, stated, “At that point, a $10 billion valuation for Haldiram is a lot.”

The fact is that Haldiram’s has maintained a steady profit margin and a large international following. Because of this, the owners calculate that the value of their company is between $8/$10 billion. Thus, the price threshold is rather high. Furthermore, the Agarwal brothers may or may not be pleased with a decrease in valuation. Does that imply that there’s a chance the agreement may eventually backfire? Well, only time will tell that.