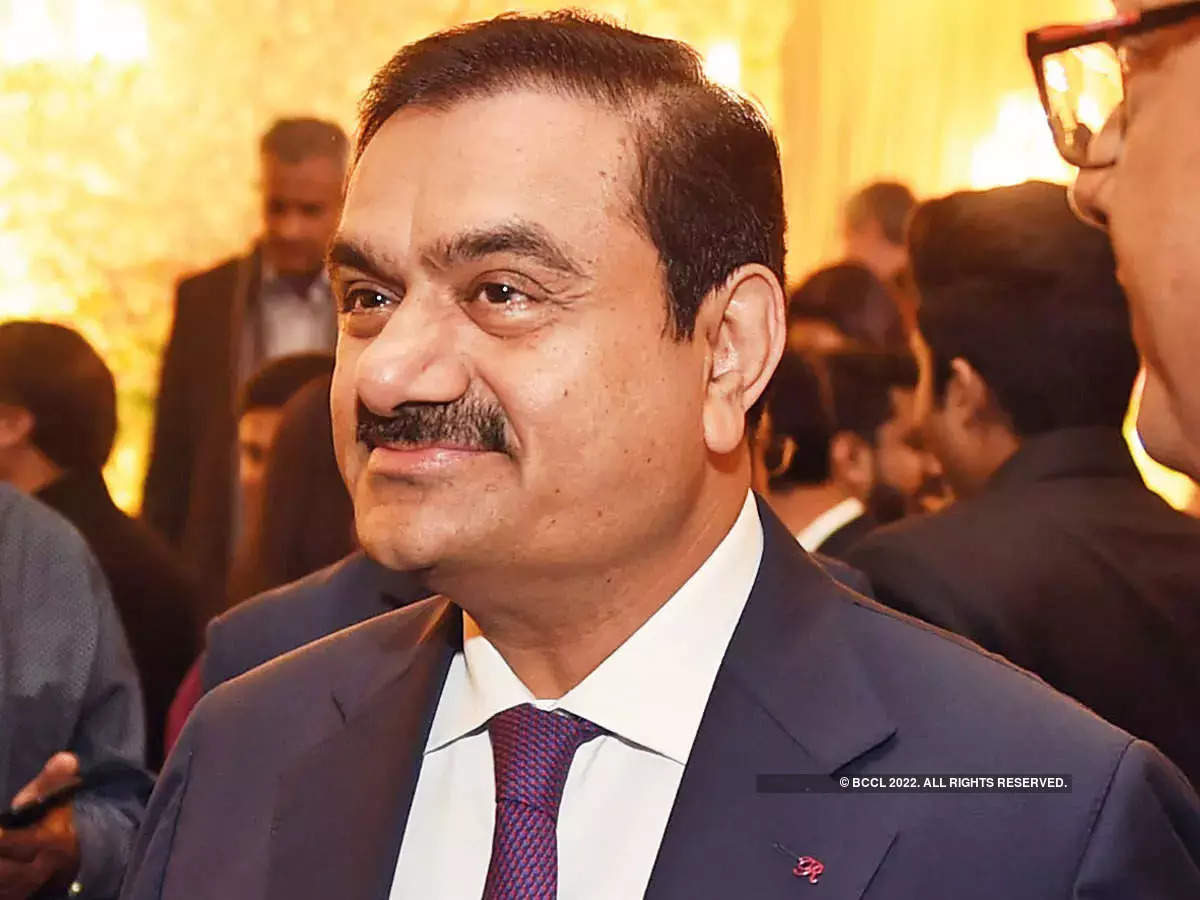

DRI moves SC questioning CESTAT order quashing case against 2 Adani firms.

The CESTAT (Customs, Excise & Service Tax Appellate Tribunal), Mumbai bench, upheld the decision in Adani’s favor. This action by CESTAT granted relief to 3 Adani entities.

Firms that are involved.

- Adani Power Maharashtra Ltd (APML).

- Adani Power Rajasthan Ltd (APRL).

- Maharashtra Eastern Grid Power Transmission Company Limited (MEGPTCL).

The DRI has petitioned the Supreme Court to reverse this ruling. According to court documents, the DRI filed a civil appeal with the Supreme Court in November against the CESTAT verdict on APML and APRL.

Meanwhile, sources told that a similar appeal, against MEGPTCL, will be lodged. The unit asked the department’s parent, CBIC to file an appeal against the Tribunal’s decision with the Supreme Court. A government official with knowledge of the situation says that before petitioning the Supreme Court, a legal opinion will be considered. According to these sources, no new evidence can be presented before the Supreme Court, and the appeal is limited to matters of law and fact.

The appeal names 3 persons, including Vinod Shantilal Shah alias Vinod Shantilal Adani, according to court papers acquired. On November 11, the petition was lodged, and the session was moved to December 16.

The chronology of allegations by DRI.

The DRI granted SCN to ARPL and APML in May 2014 for overvaluation.

In August 2017, the DRI adjudicating authority, i.e. the same body that issued the SCN, canceled all of the charges and dismissed the SCN. The Adjudicating Authority ruled that all of the imports were justified and conducted at arm’s length and that the value declared is justified. It does not need to be re-calculated. On appeal by the Customs Department, upholding the Adjudicating Authority’s Order in July 2022, Mumbai denied the petition.

The DRI matter, which was highlighted in the Hindenburg report is credited with compromising Adani’s shares. The group’s total market capitalization fell to Rs 10 lakh crore in February, from Rs 19.2 lakh crore in January.

Responding to the Adani family’s suspected participation in cases of round-tripping of diamond consignments at inflated values to and from India, the firm said in a press release criticizing the article. As per the Adani team, the CESTAT has closed several complaints involving diamond exports in their favor. This verdict has been reaffirmed twice by the Supreme Court. This attribute has been intentionally ignored and suppressed in the Hindenburg report, which raises contemptuously issues about the appeal tribunal’s competency with spurious assertions that it has ignored the evidence.

In July 2021, after Minister of State for Finance Pankaj Chaudhary stated that the DRI is exploring the Adani Group entities, the conglomerate approached the CESTAT seeking an early hearing on the matter, claiming that it had received investigations about the status of the issue from independent directors, auditors, financial institutions, and lenders.

In its ruling dated July 20, 2022, the tribunal stated that the case of alleged overvaluation is based on some papers received from international branches of Indian banks that were not approved by the standards stipulated in Section 138 C (4) of the Customs Act.

The panel moved on by stating that the DRI’s probe was ‘incomplete’. The tribunal concluded that, while the government provided information collected from Indian banks, it failed to compel international institutions to participate in this investigation. The department was unable to question or compel Standard Chartered Bank to participate in this inquiry, and this cannot be used to rule out the potential of it intervening as an active banker on the behest of EIF (the offshore entity) for the intent of remitting the sum of the original equipment manufacturer, the tribunal order stated.

The burden was on the department to justify why the whole transfer amount was solely through these two banks and no other bank. As a result, it follows that the revenue’s investigations were insufficient, the order stated.

The other charges.

On March 15, 2014, the DRI issued a common show cause notice alleging that EIF, a Dubai-based entity, APML, and APRL were related entities. This is because EIF was owned and controlled by Vinod Adani through EIH (EIF’s holding company). Not only that, it was identified that he is a shareholder in Adani Groups, which owned and controlled APML and APRL.

According to the show cause notice, APML, APRL, Electrogen Infra FZE (EIF), and other respondents colluded to siphon off foreign money for the benefit of their associated alliances. The defendants were summoned to show cause why the reported value of the articles imported by ARPL and APML ought not to be denied under Rule 12 of the Customs Valuation Rules, 2007.

According to the DRI’s allegations, under the guise of importing power industry gear and equipment, APML and APRL appear to have collaborated in the overvaluation of the contested imported goods. The true worth of the imported items is Rs 3187.61 crore. However, they are billed at Rs 7161.73 crore, contributing to an over-valuation of INR 3974.12 crore that appears to have been siphoned off overseas through EIF. The Adani Group has disputed that Vinod Adani is a promoter of the company.

The tribunal did note that where papers are not evaluated as evidence, the government cannot seek a re-determination of value based on these documents.

The final verdict.

India is not a banana republic with liberal aspirations. However, after independence, some businessmen have been treated more fairly than others. One would think that when PM Modi, the broad-chested, vowed “Na khaunga, na khane dunga,” one felt comfortable that the system was fair, just, and principled. After 8 years, it is openly said that India’s top five businessmen have themselves become the king. Dangerously foreboding. If the government, bureaucracy, judiciary, and fourth estate fail to do their duties, the potential of becoming a banana republic increases. That would be tragic, with far-reaching consequences.

edited and proofread by nikita sharma