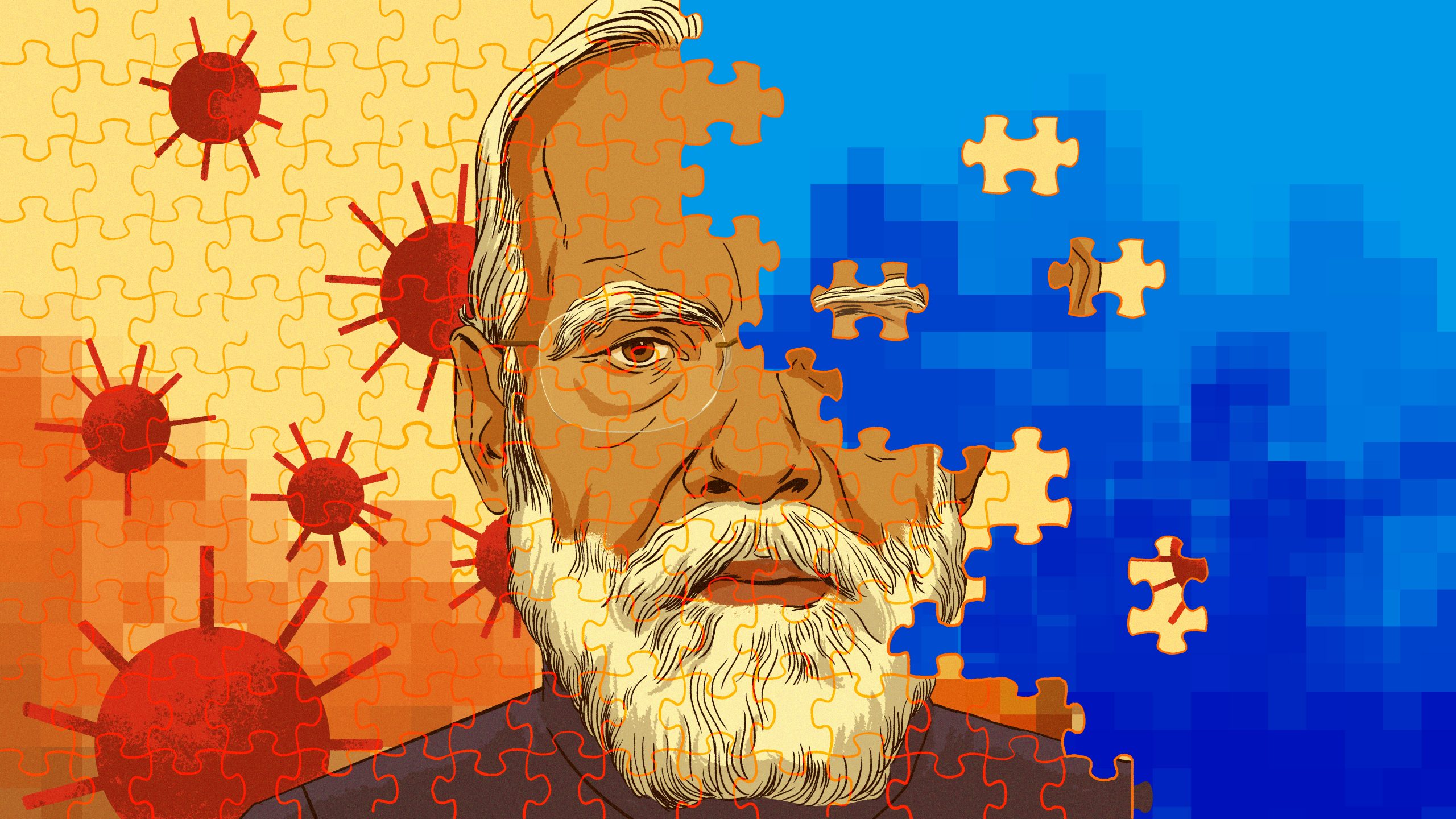

Did Narayan Murthy’s Latest Statement, “China has 6x GDP of India. We are no global leader” Land Infosys In Trouble For Contradicting Modi Govt? “Fear Of No Favour” As Infosys Under The Scanner For Alleged GST Evasion Of Over Rs. 32,000 Crore

Infosys, is currently under the scrutiny of the Directorate General of GST Intelligence (DGGI) for alleged GST evasion amounting to over Rs 32,000 crore. The Directorate General of GST Intelligence states that as the company creates overseas branches to service clients as part of its agreement with the clients, those branches and the company are each treated as 'distinct persons' under the IGST Act. Ironically, this development falls on the heels of a controversial statement made by Narayan Murthy; four years ago, Rahul Bajaj, a renowned industrialist from the Bajaj Group, voiced his concerns about the government's intolerance to criticism. Did Murthy fall out of favour with the Modi Govt?

Infosys Lands Under The Scanner For GST Evasion

Four years ago, the Indian corporate arena witnessed a rare moment of candid criticism when Rahul Bajaj of the Bajaj Group, confronted Amit Shah, the Home Minister of India, during a public event.

Bajaj minced no words and was direct “You are doing good work, but despite that, we don’t have the confidence that you will appreciate it when we criticize you openly. Intolerance is in the air.”

Amit Shah’s response attempted to quell the fears, asserting that there was no reason for concern and that criticism would be considered meritorious.

Despite these assurances, the corporate sector’s unease has not entirely dissipated. Rahul Bajaj’s death in 2022 left a void, and no other industrialist of his stature has since voiced similar public criticisms.

Within the business community, the perception persists that while the Modi government has indeed driven significant economic progress, there remains a palpable atmosphere of intolerance towards open criticism.

Infosys Landing In Trouble, The GST Evasion Allegations

Infosys is under investigation by the Directorate General of GST Intelligence (DGGI) for allegedly evading over Rs 32,000 crore in integrated goods and services tax (IGST). According to a document dated July 30, 2024, this evasion is said to have occurred between July 2017 and 2021-2022.

The document indicates that Infosys is scrutinized for non-payment of IGST on the import of services as the recipient. The DGGI claims that as Infosys establishes overseas branches to service clients per their agreements, these branches and the parent company are treated as ‘distinct persons’ under the IGST Act.

“Thus, in lieu of receipt of supplies from overseas branch offices, the company has paid consideration to the branch offices in the form of overseas branch expenses. Hence, M/s Infosys Ltd Bengaluru is liable to pay GST under the reverse charge mechanism on supplies received from branches located outside India,” the document states.

It adds that the investigation is ongoing and will likely progress to a case report, potentially leading to either a visit from a DGGI official or a demand for information and a summons.

A source familiar with the matter reports that Infosys has received the investigation notice from the DGGI but maintains that it is fully compliant with both state and central GST laws.

This is not the first instance of Infosys encountering issues with the GST Department, which it helped to build.

Earlier in April, the Odisha GST Authority imposed a penalty of Rs 1.46 lakh on Infosys for availing ineligible input tax credit, though the scale of the current investigation is significantly larger.

Ironically this comes as in April this year, Infosys declared that it expects a refund of ₹6,329 crore from the Income Tax Department. Additionally, the company informed the stock exchanges about tax demands amounting to ₹2,763 crore, based on various assessment orders.

Infosys stated that during the quarter, it received orders from the Income Tax Department for the assessment years 2007-08 to 2015-16, 2017-18, and 2018-19.

As per these orders, the company expected a refund of ₹6,329 crore (including interest). Infosys then stated that it was evaluating the implications of these orders on its financial statements for the quarter and year ending March 31, 2024.

Furthermore, Infosys disclosed that it received an order for the assessment year 2022-23 with a tax demand of ₹2,763 crore, including interest, and another for the assessment year 2011-12 with a tax demand of ₹4 crore, interest included.

The company also received assessment orders for subsidiaries totaling ₹277 crore, covering assessment years 2021-22 and 2018-19 with a tax demand of ₹145 crore, the assessment year 2022-23 with ₹127 crore, and the assessment year 2022-23 with ₹5 crore, all inclusive of interest.

Infosys stated “it was assessing the impact of these orders on its financial statements and considering filing appeals. Additionally, a subsidiary received refund orders under Section 254 for the assessment years 2007-08 and 2008-09, and under Section 154 for the assessment year 2016-17, resulting in a refund of ₹14 crore”.

Landing In trouble For Narayana Murthy’s Provocative Statement?

Narayana Murthy recently made statements at the ELCIA Tech Summit 2024, which stirred significant debate.

Murthy candidly remarked on India’s lagging position relative to China in terms of becoming a global manufacturing leader, stating that China’s GDP is six times that of India and that it is audacious to claim that India will surpass China in the near future.

“These are big words that we shouldn’t use. China has already become the factory of the world. Around 90% of things in supermarkets and at-home depots in other countries are manufactured in China. They have six times the GDP of India. It is too audacious of us to say India will become the manufacturing hub,” Murthy stated.

Murthy further elaborated on the necessary steps for India to enhance its manufacturing sector, suggesting that entrepreneurs need to learn market assessment and potential size estimation. He also called for improvements in government transparency and accountability.

Before we ponder on the whether this statement may have landed Infosys in trouble, lets look at some reactions!

Online Reactions and Political Implications

Murthy’s comments have elicited mixed reactions from the public.

Some online users support his realistic assessment of India’s position, while others criticize him for undermining national aspirations.

One user noted, “Narayana Murthy Shares Economic Formula For India To Surpass China. generating millions of employment opportunities annually along with disposable income. How much salary is paid to Infosys employees for their disposable income?”

Another commented, “People who compare India and China need to watch this. We’re barely at $3Tn. China is sitting at $19T. And we get pissed when Narayana Murthy tells us to work harder.”

The timing of Murthy’s statement and the now ongoing GST investigation into Infosys is paradoxical; it raises questions about whether the regulatory scrutiny faced by Infosys could be linked to broader efforts to suppress critical voices within the corporate sector.

We link it with the article’s opening paragraph and what Rahul Bajaj said.

Fear Of No Favour

The timing of Murthy’s statement and the ongoing GST investigation into Infosys is intriguing. It raises questions about whether the regulatory scrutiny faced by Infosys could be linked to broader efforts to suppress critical voices within the corporate sector.

The Modi Government and Corporate India

The relationship between the Modi government and corporate India is highly complex.

On the one hand, many business leaders appreciate the economic growth and increased foreign investment during Modi’s tenure. India’s GDP has grown faster than that of most major economies, and foreign direct investment has more than doubled since Modi took office in 2014.

Significant policy changes, such as the implementation of a national digital-ID scheme and the GST, have streamlined many processes, enhancing the ease of doing business in India.

However, beneath this positive façade lies a layer of apprehension.

Corporate leaders privately express concerns about the potential repercussions of criticizing the government.

The fear of regulatory backlash, in the form of probes by various government agencies, is not considered unlikely.

For instance, let us take the highly publicized mega event—the inauguration of the Ram Mandir.

Some corporate guests attended out of genuine appreciation for his economic leadership, while others appeared out of fear that not doing so might lead to issues with tax inspectors or difficulties in obtaining business permits from a government critics describe as increasingly authoritarian.

Thus, this unusual mix of sentiments reflects the business world’s attitude towards India’s perplexing leader.

Businesses have much to be thankful for. During Mr. Modi’s decade-long tenure, GDP growth has outpaced that of most major countries.

In the third quarter of 2023, it surged by 7.6% year-on-year. Foreign direct investment has more than doubled on average in the past three fiscal years compared to the $24 billion recorded the year before Mr. Modi’s election in 2014.

On January 22nd, India’s stock market surpassed Hong Kong’s to become the fourth-largest by market value globally.

However, at the same time, not all of this progress is directly attributable to Mr. Modi. India has benefited from Western firms’ efforts to diversify supply chains away from China.

However, corporate leaders still also credit his policies.

The implementation of a national digital-ID scheme has fueled a boom in digital payments and e-commerce. The introduction of a national goods-and-services tax (GST) replaced a confusing array of state levies.

Over ten years, the financial sector has been transformed from struggling to robust, and the government has moved from merely talking about privatization to taking some action, notably selling Air India, the long-struggling national carrier.

Unsurprisingly, two weeks before making a pilgrimage to Ayodhya, the heads of India’s three largest conglomerates praised Mr. Modi at a gathering in his home state of Gujarat.

Mukesh Ambani of Reliance Industries called Mr. Modi “the most successful prime minister in India’s history.” Natarajan Chandrasekaran of Tata Sons lauded Mr. Modi’s “visionary leadership.”

Gautam Adani of the Adani Group commended him for setting “a benchmark for a more inclusive world order.” Lesser business figures eagerly echo such sentiments, especially when government officials are within earshot.

However, for others, and in private, though, the praise is more cautious.

Let us consider some facts.

- India’s GDP per capita grew rapidly under Mr. Modi by emerging-market standards but increased half as fast again under his predecessor, Manmohan Singh of the Congress party, who also ruled for ten years.

- Stock market returns have been lower in the past decade than in the one before. Although India is resurgent, the official measure of business investment as a share of GDP has not kept pace.

- Many of Mr. Modi’s most successful policies, such as the digital ID and the GST, were initially proposed by Mr. Singh’s government. Some taxes are lower, but aside from the GST, they remain complex.

- The 73-year-old prime minister has no clear successor, which could lead to political instability when he eventually steps down, a situation businesses prefer to avoid.

These concerns are frequently mentioned in conversations with prominent business figures, though none are willing to be quoted.

- One reason for the public silence is longstanding: a good relationship with the government can help businesses steer the bureaucratic red tape, while a poor one can leave them vulnerable to bureaucratic whims.

-

A newer reason, specific to Mr. Modi’s BJP, is the fear that criticism might invite retribution, such as investigations by the Department of Revenue, the Serious Fraud Investigation Office, or the Central Bureau of Investigation.

These investigations can be based on old matters, making defense more difficult and costly. For many leaders in India Inc., maintaining the government’s favor has shifted from being advisable to essential- hence, in keeping with all the points, the latest GST allegations on Infosys comes as little surprise.

The Last Bit, The Intersection of Business and Politics

The intertwining of Narayana Murthy’s critical remarks and the GST investigation into Infosys is indicative of the ongoing tension between corporate India and the Modi government.

Murthy’s candid assessment of India’s economic standing and the subsequent regulatory scrutiny faced by Infosys spotlights the challenges businesses face in steering the complexities of political and economic dynamics.

As Infosys contends with the allegations of GST evasion, the broader business community will be watching closely to see how the government handles this high-profile case. The outcome could signal broader trends regarding the treatment of corporate criticism and regulatory compliance under the Modi administration.

In the end, Infosys’s predicament shows the intricate balance between fostering economic growth and maintaining an environment where businesses feel free to express their views without fear of retribution.

The coming months will be crucial in determining whether this balance can be achieved or if the fear of no favour will continue to cast a shadow over India’s corporates and their leaders.