Demonetization in 2016: Top 7 dirty practices which made it one of the biggest scams of Indian History

Demonetization in 2016 one of the biggest scams, Withdrawal of INR 2000 notes seems a cover-up for the same

Prime Minister Narendra Modi issued the dramatic declaration to demonetize 84% of the nation’s legal cash on November 8, 2016. As far extravagant declarations go, this one tops the list. It urged 125 crore Indian residents to forgo their own convenience for the benefit of the country as a whole. The populace was assured that, with little compromise, the evils that afflict India today, including black money, corruption, Benami transactions, terrorism, and fake money, would be vanquished.

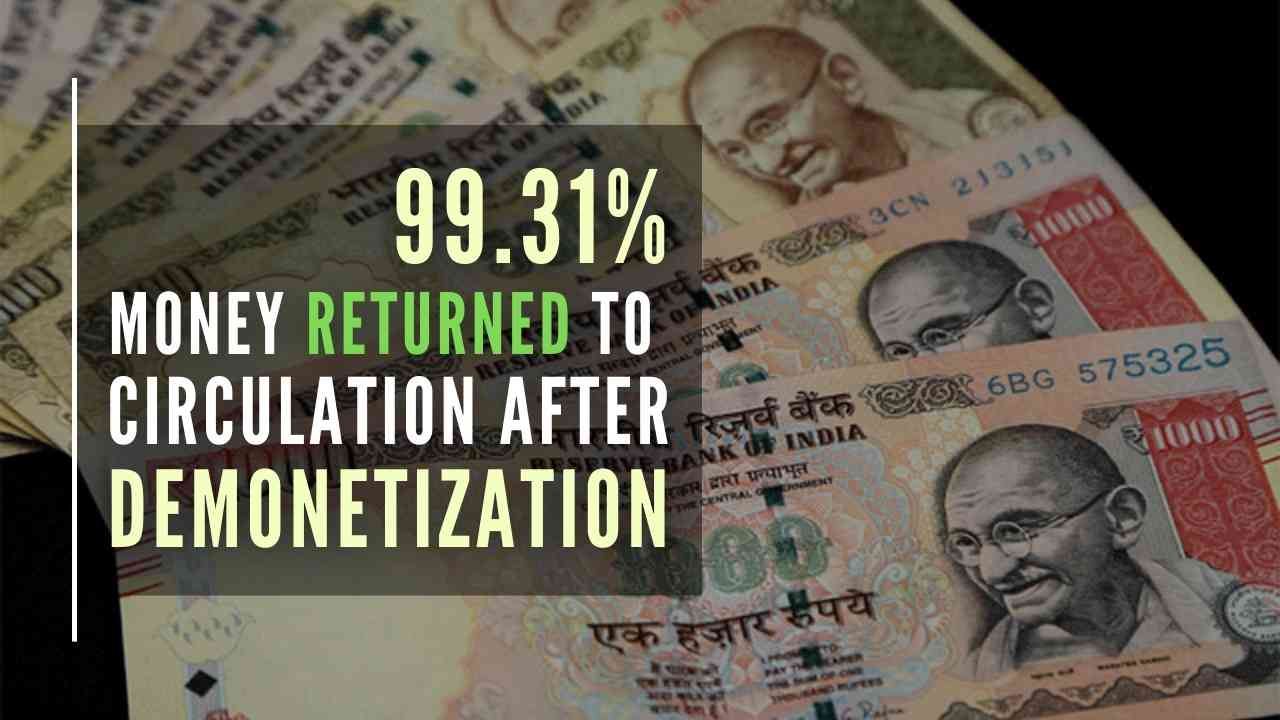

Much had been spoken about the way the black money hidden in cupboards, beneath beds, and other obscure locations would become worthless following demonetization. Predictions of 3 to 4 lakh crores of black money which could not be surrendered to the RBI would rather be placed in the public’s Jan Dhan accounts by the authorities, were used to lure the general population. In the very beginning of demonetization, newspapers frequently depicted images of black money hoarders throwing their soiled banknotes into the water or lighting them ablaze in a fit of rage. But, within a month, it was obvious that all of the money that had been demonetised was returning to the RBI.

Chidambaram was the first one to label demonetization as the “biggest scam of 2016”. He called it a joke and said that the government would never be ready to accept its failure with regards to this move.

In its findings, the RBI stated that nearly 99.3% of the abandoned 500- and 1,000-rupee notes were redeposited to the system of banks, showing that only a negligible amount of money remained outside the system following the government’s historic note ban intended to combat black money and corruption.

As it panned out, there were only 0.0027% counterfeit currency among the INR 15.28 lakh crores of money surrendered to the RBI. Thus, only for a pitiful 0.0027% percentage of fake money, 100 individuals died, and the nation was traumatized?

Even prior to the last day for demonetization had passed, there were fake notes floating around of the very new currency, adding insult to injury. Following the demonetization of currency just two weeks ago, fake 2000-rupee notes were discovered on terrorists murdered in Jammu and Kashmir.

When that happened, Prime Minister Modi, being the shrewd politician that he is, shifted course. The arguments and assertions from the government now focused on demerits of using cash rather than black money. The following 15 days were mostly devoted to the ruling party and their blind supporters making individuals feel bad for having cash, spending cash, and simply thinking about cash. The discussion about “black money” was over. The Prime Minister was being displayed on the journey to cure the new disease, which was cash.

This too proved to be fruitless. Indians resisted to be forced to adopt digital currencies along with the fact that many areas of the nation lacked adequate internet access, there were few cellphones, and retail outlets lacked adequate PoS devices. As a consequence of this, the economy contracted and the growth rate hit a three-year low. Notwithstanding the big crop, the rural economy was notably impacted. As a result of an absence of demand, numerous small businesses that employed millions of Indians failed. For lack of jobs, many migrant workers returned to their locales.

In over 450 raids all around the nation, the income tax authorities discovered that even the new money had been stockpiled by criminals without any notification or documentation. In addition to the crores of fresh cash that were recovered, hundreds of incidents went unreported. Nearly 5.7 crores (2000 notes) were seized from the IT department from Bengaluru, 76 lakhs from Surat, 10 lakhs from Gurugram, 85 lakhs from Mumbai, and 100 crores from Chennai.

Top 7 practices which made demonetization one of the biggest scams of India

During demonetization hoarders explored various clever methods in order to bypass the rules and restrictions levied by the government. Some of the caught transactions and known tactics used to convert black money into white are as follows-

- Several agents engaged in the practice of unlawful conversion black money into white money because they saw this crisis as an ideal opportunity for business. The percentage of commission levied is dependent on a variety of specifications. For starters, the commission was smaller the bigger the sum. The agent received a commission of 30-35 percent if the sum was in crores; the commission fee was 40-50 percent if the amount was in lakhs. Corresponding to that, the fee was also determined by how quickly someone needed money. The charge would be greater if the person needed the money right away; the cost would be lower if the person was ready to wait (which carries risk).

- Salary workers were allegedly contacted by persons with black money requesting them to hold some money in their banking accounts in exchange for a fee. People were prepared to pay a 20% commission for utilising other people’s bank accounts out of the total amount. It was additionally reported that some bank accounts that had remained dormant for quite some time, were receiving sizable contributions and had abruptly started to experience a surge in transactions; obviously, many individuals were profiting handsomely from their extra bank accounts. They received a substantial commission for every deposit of INR 10,000 or more, and they received a flat 10% commission for withdrawals.

- Some media investigations and sting operations revealed that non-government organisations (NGOs) and other types of charitable trusts were helping people launder their black money. Such organisations were found accepting donations, keeping a cut for themselves and then, returning the remaining amount as white transactions. This was done in lieu of displaying payment of some work done for the organisation.

- Many of the employees of banks used this lucrative opportunity to gain money. Some of them got caught and arrested, such as- Bank manager at Kotak Mahindra Bank in a branch of India was found and arrested for converting around 35 crores of the demonetised currency to new currency. He did this through alleged links with hawala trader Paras Mal Lodha and a lawyer Rohit Tandon. Another instance, in relation to the discovery of obsolete money worth INR 10.96 lakh, where the Gurugram Police filed a complaint against an HDFC bank cashier Suakant, Sunny Khanduja, a businessman, and two of his assistants. The Indian Penal Code sections 420, 311 and 120B were applied to file charges against four of the defendants. According to accounts, the bank manager participated in exchanging higher-valued old currency that had been discarded for new currency in exchange for which he was paid a ransom price.

- Tax officers found more than 44 fake bank accounts at the Chandni Chowk branch of Axis bank in Delhi. Amount of over INR 100 crores was seized from these fake accounts. The tax authorities found out that proper KYC forms were not fulfilled for these accounts and an amount of more than INR 450 crores had been deposited in this bank’s branch from the date of announcement of demonetisation.

- Sources claim that even certain vegetable vendors in Delhi were willing to trade INR 1000 of prohibited cash for INR 800 of new legal currency. Further, for such low-income group individuals these opportunities of receiving cash deposits for others and earning 20–30% was not harmful if they just had little sums in their bank accounts.

- Two workers of the Reserve Bank of India’s cash division were detained by the CBI in Bengaluru in relation to the suspected converting of Rs 1.99 crore of demonetised money into designated bank notes of INR 2,000 and 100. In addition to being charged with criminal conspiracy and cheating, Special Assistants Sadananda Naika and A K Kavin were also prosecuted under sections of the Prevention of Corruption Act after being taken into custody for the unlawful conversion of cash.Another RBI official was detained by the CBI in a different instance where he exchanged money valued more than Rs 6 lakh by exerting persuasion over State Bank of Mysore employees. K Michael, a representative of the RBI, was taken into custody in connection with the seizure of Rs 5.70 crore in freshly issued currency.

Therefore, the scam of demonetization became the perfect opportunity for every person, from a vegetable vendor to professional agents to RBI employees, to earn money and for all black money hoarders to turn their black money into legitimate currency at a minimal cost.

In this respect, Anand Sharma, belonging to Congress said-

Demonetization was a big money laundering project,” he added, “NPAs have increased sharply, the banking system was struggling, and now the Modi government was bent on snatching” the contingency reserves of the Reserve Bank of India (RBI).

Further, Randeep Surjewala (Congress) also questioned the demonetization scam-

What did the country get, was black money found, was counterfeit currency recovered, did it stop naxalism and terrorism, instead the Indian economy suffered a loss of Rs 3 lakh crore,” Further adding he said, “Time has come for Prime Minister Narendra Modi to take responsibility for this destruction and apologize. Time has come that the scam of notebandi is probed and those guilty are caught. The country will not forget, it remembers and is ready to hit back with the might of its votes.

Demonetization failed to both find the counterfeit money and promote online transactions. The mechanism even transformed any black money that may have existed into white money. Additionally, the Reserve Bank’s annual report refuted all of the Modi administration’s claims in favor of demonetization. Now, the government in 2023, has come up with the idea of withdrawal of INR 2000 notes. This seems to be a yet another thoughtless action in order to deviate attention from other relevant matters and an unsuccessful attempt to cover up the 2016 demonetization sham.