Concerns regarding a conflict of interest are raised by Adani’s relative serving on the SEBI committee.

Concerns regarding a conflict of interest are raised by Adani’s relative serving on the SEBI committee. A relationship between Gautam Adani and Jatin Mehta, who carried off a $1 billion diamond fraud, was noted in the Hindenburg investigation, which set off turbulent times for the Adani Group.

The marriage of Vinod Adani’s daughter to Jatin Mehta’s son is only the first of several dubious connections that have come to light. It was discovered that British Prime Minister Boris Johnson’s brother was an independent director of a company connected to Gautam Adani after he resigned, and it turns out that someone on SEBI’s committee on corporate governance is also related to him.

The father-in-law of Karan Adani, the son of Gautam Adani, is Cyril Shroff, the head of the corporate law firm Cyril Amarchand Mangaldas. Cyril Shroff is a member of the committee that oversees violations, including insider trading on the Indian stock market, in addition to providing legal counsel to the Adani Group. This relationship has drawn attention at a time when SEBI is purportedly investigating the FPO that the group abruptly withdrew and has enhanced scrutiny of Adani’s shares.

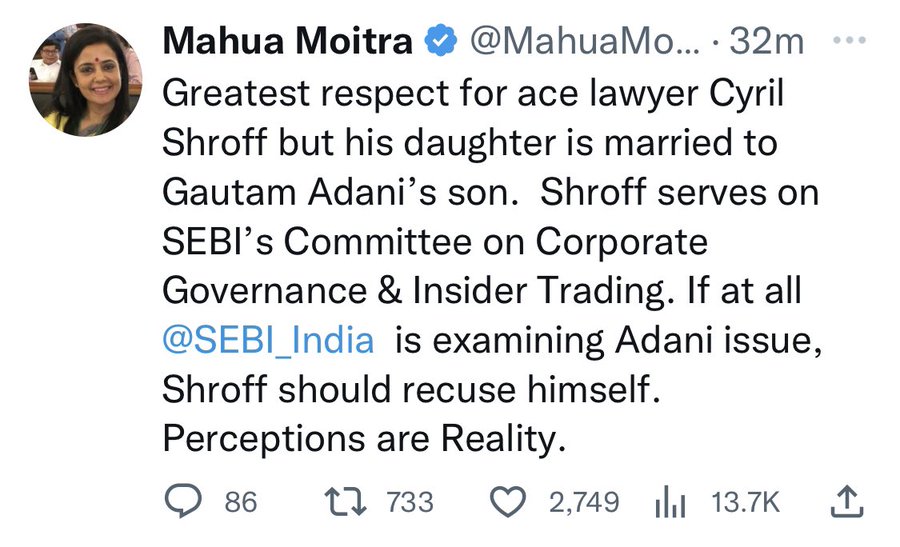

Mahua Moitra questions a SEBI panel member’s ties to the Adani family in the Hindenburg report.

Cyril Shroff’s membership in the SEBI Committee on Corporate Governance was widely brought up on Twitter in response to requests for the Securities and Exchange Board of India (SEBI) to investigate the Hindenburg report against the Adani group. The daughter of Cyril Shroff, managing partner of the criminal enterprise Cyril Amarchand Mangaldas, Paridhi Shroff is married to Karan Adani, the son of Adani Group Chairman Gautam Adani.

Stock prices for the Gautam Adani-led company had plummeted after the short seller Hindenburg Research, located in the United States, made many significant allegations in a report last week. The claims included stock price manipulation and fraudulent transactions. Market losses for the Adani Group have escalated to roughly USD 103 billion (about Rs 8.5 lakh crore). Investments made by public sector banks and the Life Insurance Corporation (LIC) have increased in value. They have also been threatened by the drop in the value of Adani Group’s stock.

Cyril Shroff must resign from the committee, according to MP Mahua Moitra, if SEBI is looking into the claims made against the Adani Group. BRS member Krishank cited rumours claiming that Cyril Shroff’s legal team, led by Cyril Amarchand Mangaldas, has previously provided Adani’s companies with commercial advice.

The Lok Sabha was suspended till 2 p.m. on Friday, February 3, due to opposition legislators’ protests, who demanded a joint parliamentary committee look into the drop in Adani Group stock that was allegedly caused by fraud. Opposition lawmakers rose to their feet shortly after the House adjourned for the day, chanting slogans and calling for an investigation into what caused the shares of the Adani Group to crash, as well as into the corporate giant’s business activities.

The audience was asked by speaker Om Birla to participate in the significant discussions that will occur during the Question Hour. “It is essential that the time provided for inquiries from honourable members be respected.” Critical issues including health, the G20, defence, and other things are being debated right now. You should all make the most of this opportunity to discuss and debate them.

Adani and his businesses have “tight links” to Modi’s administration, which has in the past made it easier for the conglomerate to “grow into the media, energy, and cement industries.” The millionaire and Modi are both largely believed to be of the same stock, having experienced a comparable rise to power and origin story. According to Jairam Ramesh, general secretary of the opposition Congress Party, “The Adani Group is no ordinary conglomerate: It’s intimately connected with Prime Minister Narendra Modi since he was chief minister” of Gujarat state.

The multiple business strategies used by Adani also seem to consistently serve Modi’s goal of growing the Indian economy. Adani can be counted on to provide finance, infrastructure, or expertise for any policy goal, whether it be building highways or updating data centers. The prime minister has not yet spoken on this topic, despite the fact that “it is not certain if or how Indian regulators may intercede.”

Why is the government avoiding debate over the Adani controversy?

The government was criticised on Monday over the Hindenburg-Adani conflict by senior Congressman and Rajya Sabha member Randeep Singh Surjewala, who questioned the administration’s “loud silence” on the issue. Why does the government want to steer clear of discussing the Adani fraud? Why don’t the Finance Minister and Prime Minister Modi visit Parliament? Why did the government, LIC, and SBI invest money in Adani’s failed businesses? Surjewala said.

Additionally, he asked the government to provide an explanation for the “dropping” values of the State Bank of India (SBI) and the Life Insurance Corporation of India (LIC). Why did the Adani investment lose 30,000 crores of rupees in value?According to him, the public is curious about how the Amrit Kaal budget was changed into the Mitra Kaal budget to accommodate PM Modi’s ally. Earlier in the day, Congressman Rahul Gandhi declared that Prime Minister Narendra Modi will “take all steps” to halt any debate over the Adani problem in Parliament.

Gandhi’s comments were made on Monday, when the Lok Sabha and Rajya Sabha were being adjourned for the day in response to opposition party demonstrations calling for a Joint Parliamentary Committee investigation into claims of stock manipulation against the Adani Group. The Parliamentary Budget session was resumed on Monday, two days after both Houses were adjourned due to a ruckus around the Adani-Hindenburg conflict.

edited and proofread by nikita sharma