Comparing The Salaries Of Founders Of Loss Making Unicorns And INR 50,000 Cr Profit Making SBI

Stark difference in salaries of founders of loss-making unicorns and profit-making SBI chairman lays grounds of corruption and dirty startup ecosystem.

Salaries and Losses of Unicorns

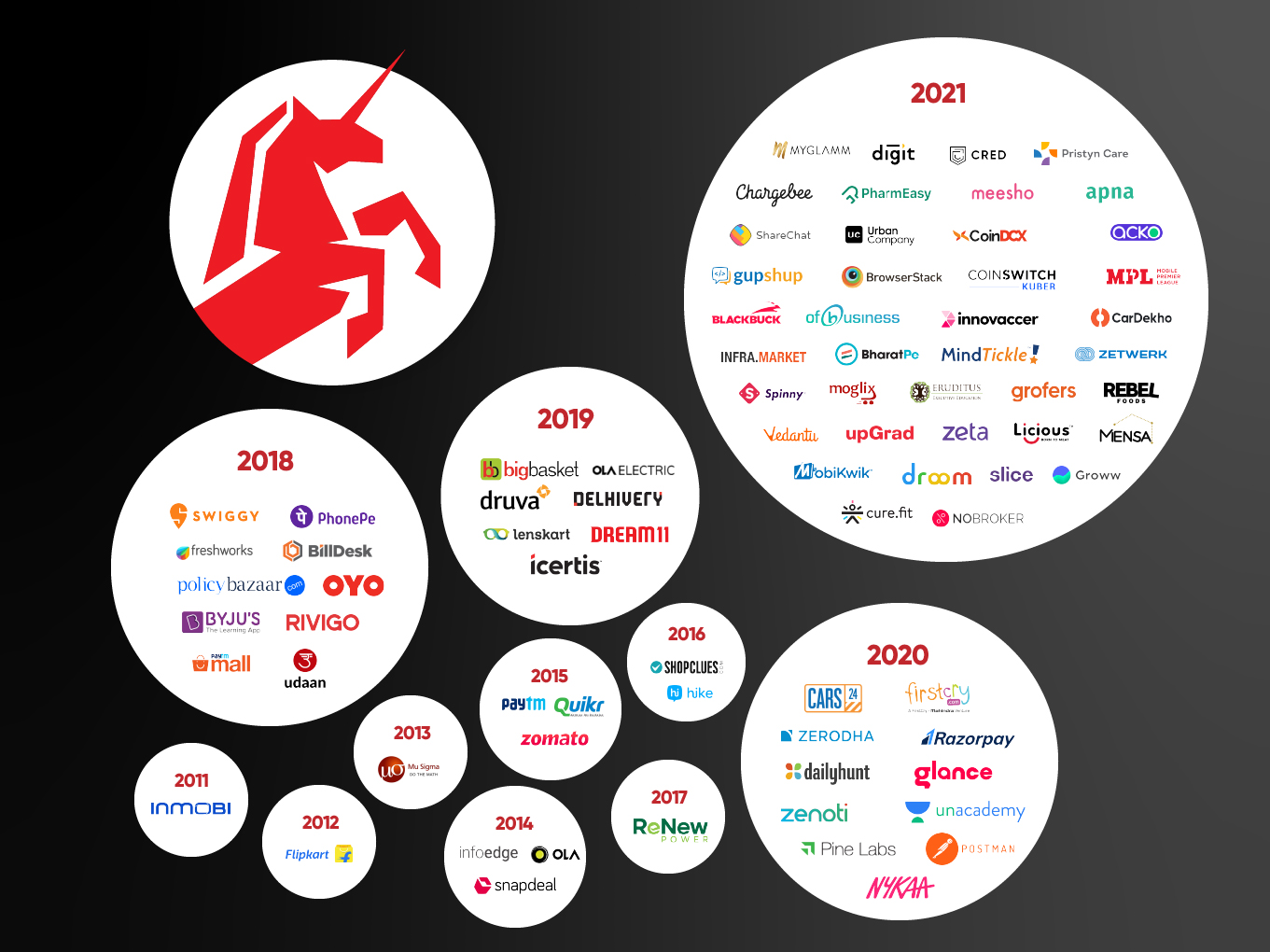

A report’s analysis of 74 Indian unicorns found that 55 (or 74%) had combined operational losses of $5.9 billion in FY22. The 55 loss-making unicorns burnt 1.5 times as much money in FY22, with a median expense-to-revenue ratio of 1.5. Of the 55 unicorns that were losing money in FY22, 14 were solely from the e-commerce industry, followed by fintech with 13 unicorns and consumer services with 6.

Disappointingly, only five major agreements were completed in the initial two months of 2023 (January as well as February), compared to 23 over the same time period in the previous year. According to statistics gathered by the report, Indian entrepreneurs raised around $1.6 billion in the first two months of 2023, as opposed to $8.3 billion in 2021.

Investors’ wallets are now more tightly closed than ever, and their focus is primarily on firms that prioritize profitability, unit pricing, and sales. Not to mention how this affected India’s most valuable startups in FY22, who were considered to be suffering despite significant cash burns due to rising losses.

In accordance with a list titled “India’s Top 200 Startups Financial Index Report 2023” by Inc42, 55 (74%) of the 74 unicorns examined in the research had a collective operational loss of $5.9 Bn in FY22. This was nearly double the $3 billion collective loss suffered by 53 unicorns during FY21.

The 55 loss-making unicorns burnt INR 1.5 to earn INR 1 in revenue in FY22, based on an average expenditure-to-revenue ratio that was 1.5. This is a 15% rise from the median expenditure-to-revenue ratio of 1.3 across 53 loss-making unicorns in FY21, demonstrating that unicorns burnt a greater amount of money in FY22.

Keeping all these statistics aside, the interesting part is that the losses made by these unicorns did not impact the amount of salaries being withdrawn by their founders and CEOs. Let us look at some of the following figures to understand this better-

BHARATPE (FY22)

Total Revenue- INR 680 Cr

Loss- INR 5,610.7 Cr

Salary of Suhail Sameer (CEO of BharatPe)- INR 2.1 Cr

Salary of Ashneer Grover (Founder of BharatPe)- INR 1.69 Cr

Salary of Madhuri Jain Grover (Ashneer Grover’s wife and Former Head of Controls of BharatPe)- INR 63 lakh.

Salary of Shashvat Nakrani (Co-founder of BharatPe)- INR 0.29 Cr

PAYTM (FY22)

Total Revenue- INR 5,264.3 Cr

Loss- INR 2,396.4 Cr

Salary of Vijay Shekhar Sharma (Founder and CEO of PayTM)- INR 3.7 Cr

ACKO (FY22)

Total Revenue- INR 1,087.5 Cr

Loss- INR 382.3 Cr

Salary of Varun Dua (Founder and CEO of Acko)- INR 1.4 Cr

PHONEPE (FY22)

Total Revenue- INR 1,692.7 Cr

Loss- INR 2,013.7 Cr

Salary of Sameer Nigam (Founder and CEO of PhonePe)- INR 2.37 Cr

Salary of Rahul Chari (Co-founder and CTO of PhonePe)- INR 2.37 Cr

UNACADEMY (FY22)

Total Revenue- INR 719 Cr

Loss- INR 2,848 Cr

Salary of Gaurav Munjal (CEO, Founder of Unacademy)- INR 1.58 Cr

Salary of Hemesh Singh (CTO, Co-founder of Unacademy)- INR 1.19 Cr

Salary of Roman Saini (Co-founder of Unacademy)- INR 88 lakhs.

PHARMEASY (FY21)

Total Revenue- INR 2,335 Cr

Loss- INR 641 Cr

Salary of Dharmil Sheth (Founder of PharmEasy)- INR 2.37 Cr

Salary of Dr. Dhaval Shah (Co-founder of PharmEasy)- INR 2.07 Cr

Salary of Siddharth Shah (Co-founder and CEO of PharmEasy) – INR 1.74 Cr

Salary of Hardik Dedhia (Co-founder of PharmEasy) – INR 2.13 Cr

Salary of Harsh Parekh (Co-founder of PharmEasy) – INR 28.3 lakh

On the other hand, STATE BANK OF INDIA (SBI) for the full 2022-23 fiscal earned the net profit of INR 50,232.45 crore. However, SBI chairman Dinesh Khara received a salary of INR 37 lakh during the fiscal year 2022-2023. Moreover, this was an increase of approximately 7.5 percent compared to the previous year, according to the bank’s annual report.

A man responsible for earning profits amounting to almost INR 50,000 crore is paid such a meagre amount of INR 37 lakh, when we see the above-mentioned unicorns laying deep inside losses taking home crores. How can we possibly justify this?

Furthermore, Khara’s compensation is insignificant even in comparison to the wages of private bank CEOs. As a straight contrast, HDFC Bank CEO Sashidhar Jagdishan received an annual compensation of Rs.6.51 crore in fiscal 2021-22. However, Jagdishan maintains a balance sheet that is less than half the size of SBI. Furthermore, according to the bank’s FY22 annual report, Axis Bank’s Managing Director and CEO Amitabh Chaudhry served as the highest-paid private bank head in the country in the previous fiscal year, earning a total of 7.62 crore in yearly remuneration.

This disparity lays down the grounds for corruption

SBI has generated large profits while playing an important role in the growth of essential industries and the country’s economy. Despite its remarkable success, the chairman’s remuneration is frighteningly low in comparison to the excessive sums made by CEOs and founders of loss-making startups, unicorns, and private firms.

This significant disparity in pay reveals a major problem in our system, one that contradicts the concepts of justice and integrity. It not only fails to reward those who are driving the nation’s success, but it also fosters corruption. When the head of a government business is paid inadequately while private sector leaders accumulate huge fortune, it becomes increasingly difficult to resist the temptation to engage in unethical acts.

The discrepancy unintentionally encourages corruption since those in positions of authority may be more open to bribes, kickbacks, and other unethical behavior. Trust and motivation are damaged when skilled and seasoned professionals witness how highly compensated their rivals in the private sector are for accomplishments that are significantly less noteworthy. The temptation of individual financial gain can then weaken the fundamental principles of public service, resulting in a decline in confidence in the federal government and its institutions.

Furthermore, there is a major danger of talent loss due to the dramatic disparity in salary between public and private sector organizations. Top individuals, who might contribute significantly to public sector businesses, can prefer to migrate toward private companies since the financial incentives there are more profitable.

The government is deprived of talented individuals who could foster innovation, efficacy, and success in public sector businesses as a result of this talent exodus.

The government must review its compensation regulations and make sure they are in line with industry norms in order to remedy this problem. While a desire to serving the country should be the driving force behind every public sector appointment, it is equally crucial to acknowledge the achievements made by those in vital positions and pay them fairly.

Implementing fair and open pay systems inside government-run businesses helps reduce corruption and attract and keep top people. By doing this, the government can provide a fair playing field where bright people may share their knowledge without feeling exploited or devalued.

Furthermore, the government must establish an accountability culture in which the performance of public sector firms is properly reviewed and those who drive good change are appropriately rewarded. Merit-based promotions and incentives may be effective instruments for inspiring leaders to achieve and improving the overall performance of government organizations.

We can reduce corruption concerns, enhance talent retention, and create a more inclusive and equitable economy for India’s prosperity by offering fair remuneration to persons running government firms.

Rising problems with Unicorns

Unicorns, which are privately owned enterprises worth more than a billion dollars, have long been viewed as icons of success and innovation. However, an increasing number of these unicorns have found themselves in grave financial trouble, prompting investors to question the basis for excessive CEO remuneration. While the founders and CEOs of these firms believe that such remuneration is vital to recruit and retain outstanding people, opponents say it shows a brazen disrespect for investors’ financial well-being.

Investors, including venture capitalists and other funding sources, put large resources into these firms with the hope of big returns. However, when the very individuals charged with directing these firms to profitability are paid well regardless of their financial success, it fosters investor exploitation and erodes faith in the startup ecosystem.

This mismanagement of investor funds raises severe concerns about the firms’ governance and monitoring processes. It emphasizes the critical need for improved openness and accountability. Investors have a right to know that their money is being used properly, with a clear path to long-term success. The current situation, with huge wages being paid out despite significant losses, demonstrates a fundamental problem in the system.

Furthermore, this reward pattern might favor short-term thinking and risky decision-making. When founders and executives are promised large compensation regardless of company performance, they might feel less inclined to prioritize the firm’s long-term financial well-being and success. This emphasis on personal financial gain at the cost of investor interests not only undermines the goal of these firms, but also promotes a risk-taking culture that lacks accountability.

To address these issues, regulators, investors, and industry stakeholders must work together to develop tight criteria for CEO remuneration within startups, particularly those running at a loss. To guarantee that compensation are linked to firm performance, growth prospects, and appropriate financial management, comprehensive reporting and accountability methods must be implemented.

In addition to this, founders and CEOs need to be held responsible for their choices. To safeguard the interests of investors, regulatory organizations should keep a close eye on the financial health of unicorns and take measures as warranted. Penalties for exorbitant executive remuneration that is not supported by the company’s financial performance or future prospects are part of this.

Furthermore, investors are essential in pushing for greater openness and responsibility from the firms they support. Investors may support the development of a culture of responsible entrepreneurship and sustainable growth by undertaking extensive due diligence while holding founders and CEOs personally accountable for their conduct.