Coca-Cola India’s Bold Leap To Capture India’s Booming Alcoholic Beverage Market, Introducing Lemon-Dou

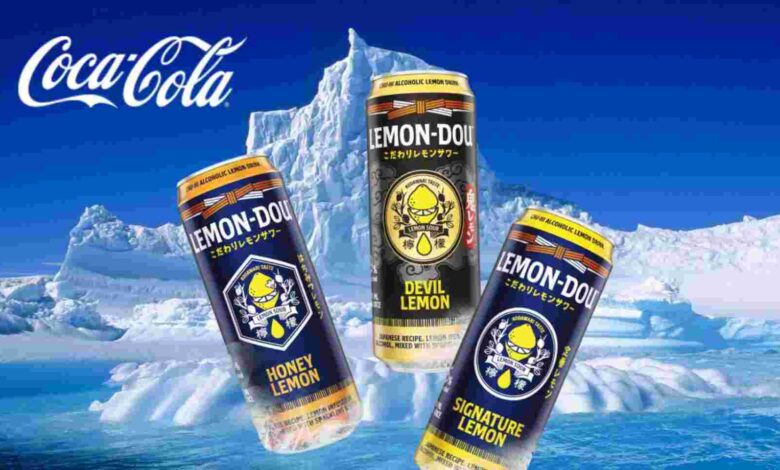

Coca-Cola India has set foot in the alcoholic beverage market with the launch of its inaugural alcoholic beverage, Lemon-Dou. Currently undergoing pilot tests in Goa and select parts of Maharashtra, this global alcoholic ready-to-drink concoction showcases Coca-Cola's strategic foray into the alcohol segment. India's alcoholic beverage market stands as one of the globe's fastest-growing; in 2021, the market's valuation reached an impressive $52.4 billion, constituting approximately 2% of the nation's nominal GDP. Projections indicate a robust growth trajectory, with an anticipated climb to $64 billion in the next five years, showcasing an annual growth rate of 6.54%.

Coca-Cola India has formally entered the alcohol market with the introduction of its first alcoholic beverage, Lemon-Dou and the global alcoholic ready-to-drink beverage is currently undergoing pilot testing in Goa and select areas of Maharashtra.

A spokesperson from Coca-Cola India confirmed that the company is conducting pilot tests for Lemon-Dou, a blend of shochu—a distilled liquor akin to brandy and vodka—and lime.

The distribution and production of these alcoholic beverages are managed in dedicated facilities independent of those handling non-alcoholic, ready-to-drink beverages in India, as specified by the Coca-Cola India spokesperson. The beverage is priced at Rs 230 for a 250 ml can during the testing phase.

Coca-Cola’s decision to venture into the alcohol segment reflects strategic experimentation with a significant market, and Manolo Arroyo, Coca-Cola’s global marketing chief, emphasized the company’s clarity regarding consumer preferences, categorizing these alcoholic beverages as “fuel for the body and the mind.”

Initially launched in Japan in 2018 as chuhai, a Japanese alcoholic cocktail, Lemon-Dou is part of Coca-Cola‘s global portfolio. The ready-to-drink alcohol aligns with the company’s commitment to being a “total beverages company.”

This marks Coca-Cola’s entrance into alcoholic beverages after a three-decade presence in the Indian market, being India’s leading soft drinks company with popular brands such as Coke, Sprite, Thums Up, Fanta, and others,

Manolo Arroyo delved into the fascinating dynamics inherent in beverages beyond soft drinks, characterizing it as an era marked by entering diverse categories while maintaining sustained consumption within those categories.

Arroyo stated the variable nature of these dynamics is contingent upon factors such as the consumer, the decision-maker regarding consumption, and the individual making the purchasing decision.

Nevertheless, navigating the intricate sector of large-scale alcohol distribution and manufacturing in India presents challenges.

Executives familiar with Coca-Cola’s plans revealed a cautious, gradual market seeding strategy in recognition of the complexities involved.

Also, the spirits industry in India adds a layer of complexity, being highly regulated, heavily taxed, and subject to pricing control by individual states.

Beyond its roots in Japan and recent foray into India, Coca-Cola’s Lemon-Dou has found a presence in select countries like China and the Philippines.

Venturing With Determination

In a noteworthy development from October, Coca-Cola joined forces with global spirits maker Pernod Ricard to announce an international collaboration; this collaboration aims to launch “Absolut & Sprite,” a ready-to-drink pre-mixed cocktail set to debut in 2024 in the UK, Netherlands, Spain, and Germany.

This innovative product will feature Pernod’s Absolut premium vodka combined with Coca-Cola’s lemon-lime soft drinks, Sprite and Sprite Zero Sugar.

However, Coca-Cola’s expansion into the alcohol market extends beyond this collaboration, with products like seltzers such as Topo Chico Hard Seltzer and pre-mixed cocktails like Schweppes and Jack Daniel’s & Coca-Cola in various global markets.

An Overview of the Booming Alcoholic Beverage Market In India

India’s alcoholic beverage market stands as one of the globe’s fastest-growing, reflecting evolving preferences and expanding consumption patterns.

In 2021, the market’s valuation reached an impressive $52.4 billion, constituting approximately 2% of the nation’s nominal GDP.

Projections indicate a robust growth trajectory, with an anticipated climb to $64 billion in the next five years, showcasing an annual growth rate of 6.54%.

Looking ahead to 2033, the market is poised to reach a staggering $111,238.9 million, underscoring the magnitude of its influence on the country’s economic landscape.

Regional Dynamics

Certain states in India exhibit heightened alcohol consumption, particularly among men, this trend include Arunachal Pradesh, Telangana, Sikkim, Manipur, Goa, and Jharkhand.

Despite regional variations, the nation’s average alcohol consumption stands at 14.6 liters per year, slightly below the global average of 15.1 liters.

Market Outlook and Global Context

In 2023, the revenue in India’s Alcoholic Drinks market is estimated at US$46.6 billion, with a projected annual growth rate of 7.33% (CAGR 2023-2028).

The Spirits segment dominates the market with a volume of US$28.3 billion in 2023.

In a global context, China leads in revenue generation, reaching an impressive US$228 billion in 2023.

Per person revenues in India’s Alcoholic Drinks market are estimated at US$32.60 in 2023 concerning total population figures.

Looking at volume, the market is expected to reach 12.9 billion liters by 2028, demonstrating a 2.4% growth in 2024. The average volume per person is projected to be 7.65 liters in 2023, portraying the multifaceted nature of India’s thriving alcoholic beverage market.

Thus, in recent years, the Alcoholic Drinks market in India has witnessed remarkable growth, propelled by a confluence of factors ranging from evolving customer preferences and emerging trends to distinctive local circumstances.

Customer Preferences

Noteworthy among the driving forces is the discernible shift in customer preferences.

Indian consumers are increasingly gravitating towards premium and craft alcoholic beverages, seeking elevated quality and distinctive experiences.

The surge is underpinned by the rising disposable income and evolving lifestyles of the middle-class demographic, willing to invest in premium products.

Market Trends

A pivotal trend in Indian alcoholic drinks is the escalating popularity of spirits, notably whiskey.

Urbanization and the influence of Western drinking culture have propelled whiskey consumption, fostering the growth of distilleries and an expanding array of whiskey brands.

Additionally, the market is witnessing a surge in demand for flavoured alcoholic beverages, including flavoured vodka and rum, which is geared towards a younger consumer base seeking innovation; this trend is fueled by the introduction of novel flavours and variants by both domestic and international brands.

The Last Bit, Coca-Cola’s strategic entry into the alcohol segment within the dynamic Indian market represents a bold and calculated move in response to evolving consumer preferences and market trends.

The Indian alcoholic beverage market, characterized by significant growth and diverse dynamics, provides a fertile ground for experimentation and expansion.

Coca-Cola’s introduction of Lemon-Dou, a global alcoholic ready-to-drink beverage, aligns with the growing interest in premium and innovative alcoholic drinks observed in the country.

As India’s alcoholic beverage market continues to diversify, driven by changing lifestyles, rising disposable incomes, and a demand for unique experiences, Coca-Cola’s foray into this sector reflects a keen understanding of the nuanced preferences of the Indian consumer.

The company’s cautious approach, gradually seeding the market and introducing a product with global appeal, demonstrates an awareness of the complexities inherent in the highly regulated and regionally diverse alcohol industry in India.

Moreover, Coca-Cola’s strategic move echoes broader market trends such as the growing popularity of spirits, flavored alcoholic beverages, and the emergence of a health-conscious consumer base seeking alternatives like low-alcohol options.

By embracing these trends and leveraging its global portfolio, Coca-Cola positions itself to capture a share of the evolving alcoholic beverage market in India.

However, the success of Coca-Cola’s venture into the alcohol segment will depend on its ability to navigate the unique challenges posed by India’s diverse cultural and religious beliefs, regional variations in alcohol consumption patterns, and the intricacies of a highly regulated market with state-controlled pricing.

Coca-Cola’s entry into the alcohol segment in India reflects a well-calibrated response to the changing dynamics of the country’s beverage market and positions the company to tap into the flourishing opportunities within the spirited domain.