Co-CEO Of Netflix Ted Sarandon Named India “Big Prize”, Have To Get Pricing Right

Co-CEO of Netflix conveyed, "India is a big prize" as of its "massive population of entertainment-loving individuals". "We have to bring the pricing and the payment methods directly," Netflix co-CEO executer had conveyed. "Netflix decreased the value of its service in India by 20-60% in December 2021, which expanded its engagement in the country by nearly 30% year-on-year."

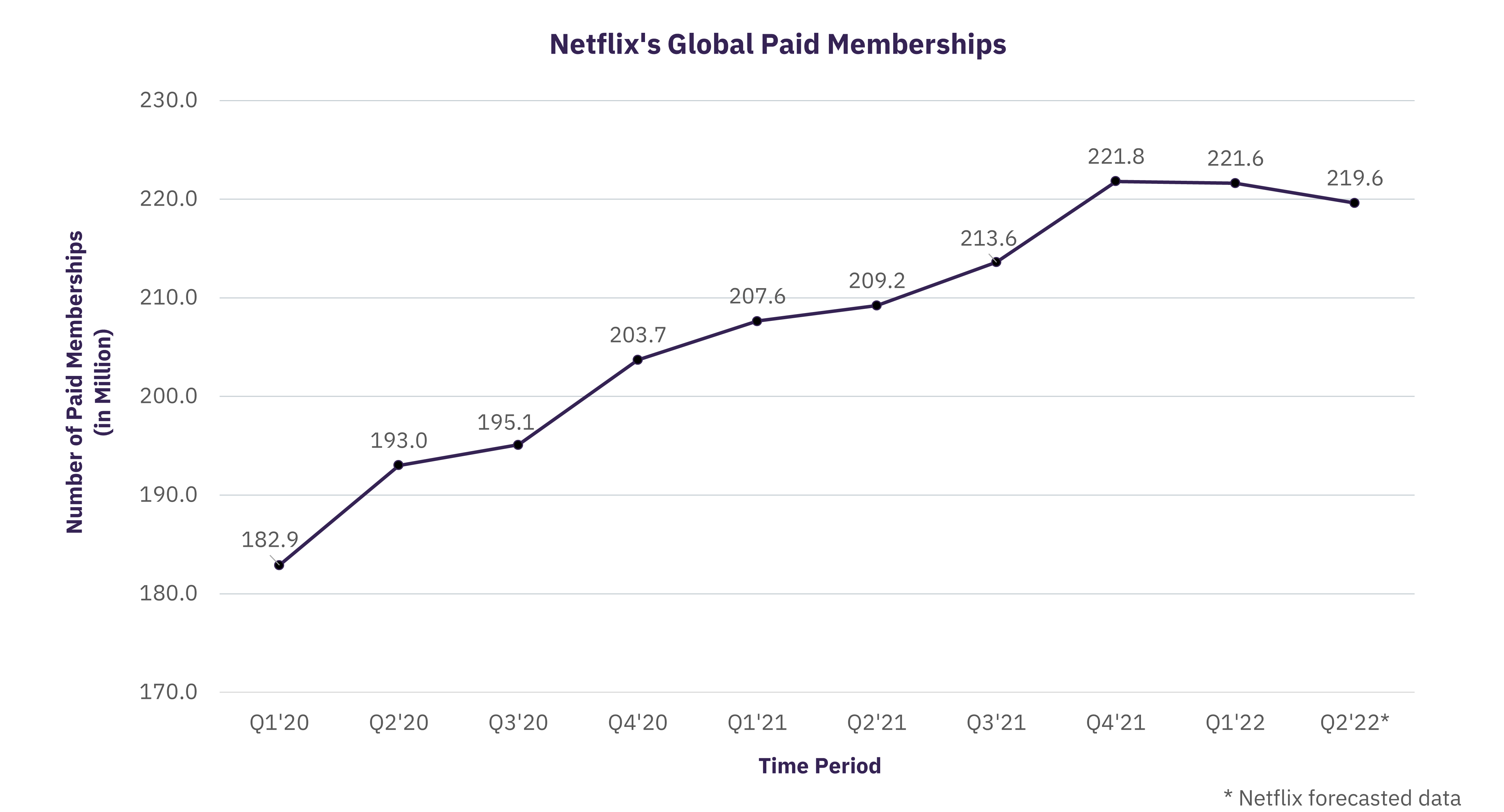

India is called “Big Prize” by Netflix co-chief executive officer Ted Sarandos regarding revenue generation because of its vast, diverse population. The earning of Netflix increased by 24% in 2022 compared to 2021. The 30% growth of engagement by the users has increased, which leads to the profit in revenue. All of it happened after reducing the subscription price in India by 20-60%. It was an attempt to reach more customers. The move has helped the company, earlier seen as a premium service in the country.

Netflix’s co-CEO conveyed, “India is a big prize” as of its “massive population of entertainment-loving individuals”. “We have to bring the pricing and the payment methods directly,” Netflix co-CEO executer had conveyed. “Netflix decreased the value of its service in India by 20-60% in December 2021, which expanded its engagement in the country by nearly 30% year-on-year.”

“When we reach the pricing a little better appropriate to the market, you can notice that we can increase revenue, and therefore, we extend engagement. We have to get the content that people convert out for,” co-CEO said.

“We are accomplishing the creative part, and we are bringing the pricing better, and there’s always lots of commitment to continue to increase in India,” Sarandos says in the company’s earnings call. “We reached to get the pricing and the payment methods right.”

Netflix has been attempting to break into the price-sensitive India market through mobile-only tariff plans priced more subordinate than the regular subscriptions. However, it faces stiff competition from players like Amazon Prime and Disney Hotstar, priced at a fraction of it’s regular plans.

Sarandos, Co-CEO of Netflix made these comments during the company’s post-earnings interview on April 18, when the company increasingly depends on emerging markets such as India for its future growth.

While Netflix doesn’t deliver a country-wise subscriber breakdown, the Asia Pacific province has stayed as one of its most significant references of new paid member additions in current quarters, as adult markets such as the United States and Europe observer restricting subscriber growth.

In Q1 2023, Netflix conveyed 1.46 million paid subscribe in the Asia Pacific region, getting its total subscriber base to 39.5 million. This symbolised nearly 83.5 per cent of the company’s total 1.75 million subscriber acquisitions in the quarter. Netflix’s global subscriber ground stood at 232.5 million for the quarter.

Marketing Strategy

It has employed a multi-faceted marketing strategy that has contributed to its success as a leading global streaming service. In summary, platform’s marketing strategy is content-centric, personalised, globally branded, and employs a multi-channel approach to engage with its audience, promote its content, and drive customer acquisition and retention. Continuous innovation, data-driven insights, and a focus on customer experience are key pillars of Netflix’s marketing strategy, contributing to its success as a leading streaming service.

Early Days of Netflix In India

Netflix, the popular streaming service for movies and TV shows, has been available in India since January 2016. India is one of the critical markets for Netflix, as the company has been expanding its presence globally. Then, Netflix was less prevalent in India. As time flew and Netflix started overtaking the market in India with the help of entertainment enthusiast citizens of India. But the problem was subscription value.

Pricing of subscription

Netflix has been offering a premium with subscription plans starting from about ₹500. The company has changed pricing and introduced a mobile-only plan in the country since then in 2016. Then Netflix took an evolutionary step and down its subscription price by 60%. Users now pay ₹149 a month from ₹199 earlier for Netflix’s Mobile and ₹199 instead of ₹499 for its basic plan for the same period. The standard plan has charged at ₹499 per month, and for the premium subscription, users have to pay ₹649 per month. These plans were earlier charged at ₹649 and ₹799, respectively.

Expansion In India

Netflix entered the Indian market intending to tap into the country’s rapidly growing digital entertainment landscape. India has a large and diverse population, with a growing middle class, increasing internet penetration, and a growing demand for digital content. Netflix saw an opportunity to provide its streaming service to Indian consumers looking for high-quality entertainment options.

India is a particular market; they like local content, but you are seeing their local content is travelling more than ever, says Sarandos, NetfliX co-CEO. “Rana Naidu now is a fantastic show that we just released — the people are adoring it all over the country, and it generates a great deal of excitement for the service,” a Netflix co-CEO executive says.

Since its launch in India, Netflix has been investing in content creation and localizing its offerings to cater to the Indian audience. This includes producing original Indian content, including movies, TV shows, and documentaries, in various regional languages and acquiring rights to popular Indian movies and TV shows. It has also collaborated with local production houses and talent to create content that resonates with Indian viewers.

Learning from the triumph in India, Netflix decreased costs in 116 countries in Q1 2023. While these designated less than 5% of its FY22 revenue, the company acknowledges that growing adoption in these markets will help to maximize its earnings in the broad term. “We are not saying every market is proceeding to play out like that, but that’s what it would glance like a success,” displays chief financial officer Spence Neumann.

The streaming landscape in India is highly competitive, with many regional and international players vying for subscribers. Amazon Prime Video, Disney+ Hotstar, and local players like ALTBalaji, Voot, and Zee5 are some of the major competitors for Netflix in India. As these platforms continue to invest in local content and expand their user base, Netflix may need help retaining and acquiring new subscribers.

“We discovered opportunities to improve the knowledge of members. We understand more with each rollout, and we’ve contained the latest learnings, which we think will guide us to even better results. To enforce these changes, we shifted the timing of the overall launch from late Q1 to Q2. While this suggests that some of the standard membership growth and revenue benefit will fall in Q3 instead than Q2, we believe this will result in a better outcome for both our members and our business,” the company says.

Conclusion

In addition to content creation, Netflix has been adapting its pricing strategy to suit the Indian market, offering different subscription plans at different price points to cater to different population segments. The company has also introduced features like offline downloads, which allow users to download content and watch it offline to overcome challenges related to internet connectivity in some parts of India.

Netflix’s entry into the Indian market has helped shape the country’s streaming landscape and has faced competition from other streaming platforms that are also vying for the attention of Indian consumers. The Indian streaming market is highly competitive, with several local and international players offering content in various regional languages. Netflix continues to adapt its offerings and strategies to cater to the unique preferences and demands of the Indian audience.

the platform is likely to continue its growth trajectory in India, driven by its substantial content library, investment in local content, and aggressive marketing efforts. The platform has been actively investing in original Indian content across various languages, including Hindi, Tamil, Telugu, and others, to cater to diverse regional tastes.

While it has primarily targeted urban areas in India, it may look to expand its presence into tier 2 and tier 3 municipalities, which are seeing rapid internet penetration and increasing adoption of streaming services.

While it’s future in India looks promising, with potential for continued growth, it may face challenges from increased competition, regulatory changes, and evolving consumer preferences. Adaptability, localization, and strategic partnerships could be critical drivers for Netflix’s success in the Indian streaming market in the future.