Chinese IT industry is “kneecapped” by US chip sanctions

The powerful new cloud computing system was unveiled by the Chinese e-commerce behemoth Alibaba for use in artificial intelligence projects. It was developed using hundreds of CPUs from US firms like Intel and Nvidia and is used by Alibaba’s cloud users to train algorithms for tasks like chatbot interaction and video analysis.

New export limitations that the US established last week will make such projects unlikely to be undertaken in the future. Under the policies of the Biden administration, companies are not permitted to transfer cutting-edge chips required to operate or train the most potent AI algorithms to China.

As the US and other Western nations make progress, the comprehensive new laws are meant to keep China’s AI industry in the Stone Age. The restrictions prevent the export of software and equipment used in chip manufacture, and the best silicon fabs in the world, such as TSMC in Taiwan and Samsung in South Korea, are prohibited from making cutting-edge chips for Chinese companies.

According to Gregory Allen, director of the Center for Strategic & International Studies’ (CSIS) AI governance project, the United States is allegedly telling China that “AI technology is the future; we and our partners are going there—and you can’t come.”

The US initiative takes advantage of an artificial intelligence boom that has been going on for ten years, where new developments are now closely tied to improvements in computing capacity. Machine learning methods are routinely taught for cutting-edge new projects on supercomputers with hundreds or thousands of graphics processing units (GPUs), processors originally designed for gaming but also suitable for doing the necessary mathematical computations.

China’s AI goals are now mostly dependent on US silicon.

In its data centers, Baidu, the top online search provider in China and a major participant in cloud AI services and autonomous driving, also makes heavy use of Nvidia GPUs. One of the largest language-generation AI models in the world, developed on Nvidia technology, was disclosed by the company last October.

According to its software documentation, Nvidia hardware is used by ByteDance, the Chinese business that operates TikTok, and its Chinese equivalent, Douyin. Several Chinese firms, including Alibaba and Baidu, are creating silicon chips to rival those made by Nvidia and AMD, but all of them need to manufacture them from outside China, which is now prohibited.

Both Alibaba and Baidu chose not to comment on the new guidelines. When WIRED contacted ByteDance and several other Chinese semiconductor companies for comment, no one responded.

Large AI models have become more important to applications including online tracking, product recommendation, language translation and parsing, picture and video recognition, and autonomous driving in both China and the US, according to big tech corporations.

The same AI developments are anticipated to revolutionize military technology in the next few years and influence how the US and China negotiate disputes over things like Russia’s invasion of Ukraine and Taiwan’s independence ambitions. According to Allen of CSIS, “the Biden administration feels that the hoopla around the revolutionary potential of AI in military applications is legitimate.” The American computer chips that are being used in Chinese military AI systems are known to the US very well, and this is considered intolerable.

Despite decades of technical dependency during which Chinese manufacturing has grown to become the cornerstone of the US tech industry, the new export limitations are a contributing factor to the increasing deterioration in US-China relations in recent years. Due to rising rivalry with China, the US government has recently tried to play a more active role in fostering its domestic AI sector and chip manufacturing.

This week, shares of a number of Chinese tech companies, as well as Nvidia and AMD, decreased as investors realized the extent of the limitations. The Department of Commerce had already informed Nvidia and AMD that they would need to stop exporting cutting-edge AI processors to China, but the regulations unveiled last week are much more comprehensive.

After a widespread government crackdown intended to strictly regulate the industry following years of unchecked expansion, the new export regulations have added insult to injury for China’s IT businesses during the last 18 months.

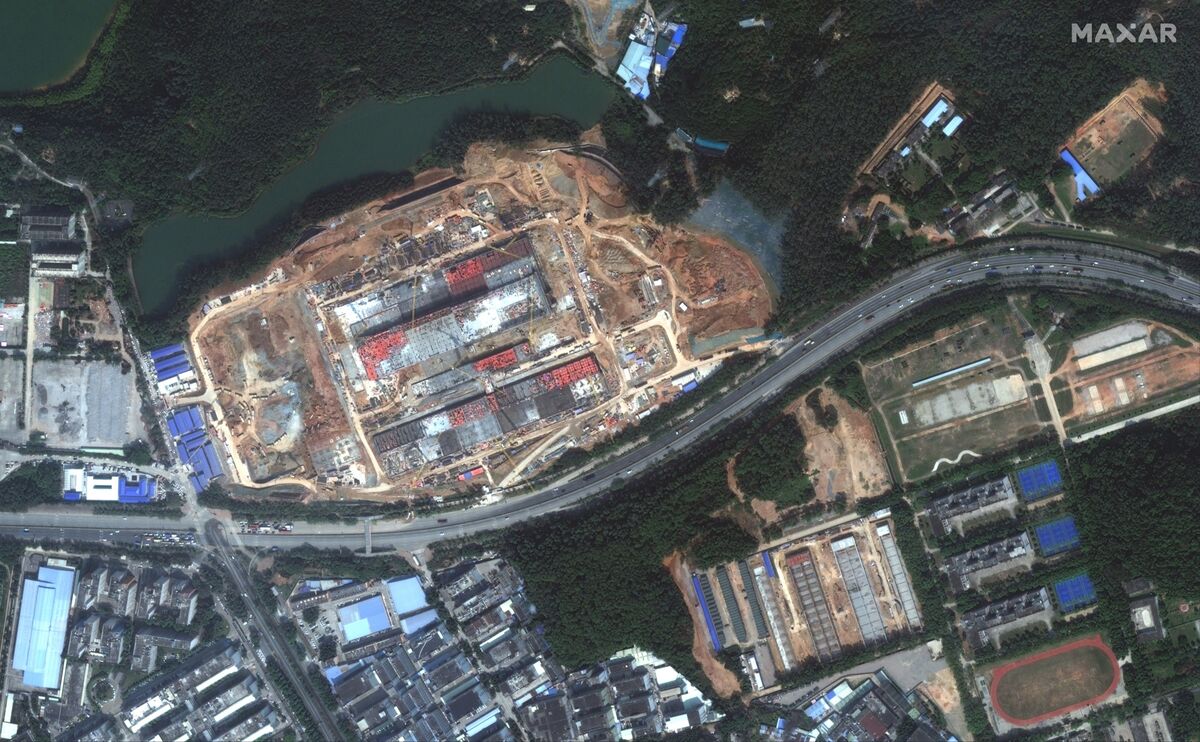

Being shut off from US chips might cause Chinese AI efforts to dramatically slow down. Semiconductor Manufacturing International Corporation (SMIC), the largest domestic chip manufacturer in China, creates semiconductors that are many generations behind those made by TSMC, Samsung, and Intel.

The 14-nanometer generation of chip-building methods, which refers to how tightly components can be packed onto a chip, is what the industry refers to as being used by SMIC to produce chips at the moment. Meanwhile, TSMC and Samsung have switched to more sophisticated 5-nanometer and 3-nanometer technologies. SMIC recently said that it is capable of making 7-nanometer chips, albeit in small quantities.

The inability of any Chinese enterprise to obtain the extreme ultraviolet lithography tools required to produce chips with components smaller than those of the 7-nanometer generation limits its ability to stay up with advancements in chip production. The US government asked the single producer, ASML in the Netherlands, to prevent exports to China.

One from the 5-nanometer generation of semiconductor technology is roughly three times faster or more efficient than a 14-nanometer one, according to David Kanter, executive director of MLCommons, a nonprofit that benchmarks the performance of AI chips, because of a higher transistor density and other design advancements.

But the action won’t immediately stop China’s AI sector. Due to the sensitive nature of the subject, a representative from a Chinese venture capital fund that specializes in artificial intelligence requested anonymity. This person claims that some Chinese businesses have been stockpiling GPU components ever since details of the rule change were revealed in September. It could also be possible for businesses to use equipment deployed elsewhere to train AI models outside of China.

On the other hand, the CEO of a Chinese AI startup predicted that they would be able to catch up to the US in the short term by running older hardware for longer, developing AI models that can perform more tasks with the same amount of processing power, or accumulating more data. The new restrictions, according to the CEO, will slow down AI advancements at Chinese companies in the long run.

The CEO claims that the volume of data may be more useful than computer power if the goal is to attain a specific level of accuracy. “Training AI models do not always require enormous power for the majority of AI jobs.”

According to Douglas Fuller, an associate professor at Copenhagen Business School who specializes in China’s internet sector, the most crucial concern right now is how the regulations are applied. He predicts that the move would, “in the short term, achieve what it plans to do—kneecap China’s high-performance computing initiatives.” However, Fuller claims that China will seek other nations with chip manufacturing experience and may attempt to smuggle components in.