China’s Xiaomi Unveils First Electric Car, Position To Become Top Automaker; The Race Between EVs And Hydrogen Run Cars, Which Have A Brighter Future, Especially Considering India?

Chinese technology giant Xiaomi has recently unveiled its debut electric vehicle (EV), the SU7, signaling a foray into the competitive electric automotive market. The expansion into the electric vehicle sector comes as Xiaomi seeks to pivot away from its core smartphone business, which has faced stagnating demand. The company's $10 billion investment commitment over the next ten years indicates its long-term vision to establish a significant presence in the rapidly evolving electric vehicle market. However, a debate is unfolding at the intersection of alternative energy sources- the competition between electric vehicles (EVs) and hydrogen-powered cars. As Europe champions the widespread adoption of electric vehicles, Asia is placing a bold bet on the potential of hydrogen as the driving force for future automobiles. Thus, the question is - which path holds the key to a more sustainable and efficient automotive future, especially in the case of India?

China’s Xiaomi has revealed its inaugural electric vehicle (EV) and declared its aspiration to join the ranks of the world’s leading five automakers.

The sedan, named SU7 (Speed Ultra), boasts “super electric motor” technology, promising acceleration speeds surpassing both Tesla and Porsche EVs, according to CEO Lei Jun.

Despite the unveiling occurring amid a challenging period for China’s auto market, grappling with overcapacity and diminishing demand, Jun remains optimistic about the company’s prospects.

Jun outlined ambitious goals, expressing the company’s determination to become a global automotive powerhouse within the next 15 to 20 years, elevating China’s automobile industry. Xiaomi’s plans extend to creating a “dream car” comparable to top-tier brands like Porsche and Tesla.

The SU7 leverages Xiaomi’s well-established consumer electronics brand, offering seamless integration with the company’s popular phones and electronic devices through a shared operating system. The integration is expected to appeal to consumers familiar with Xiaomi’s ecosystem, positioning the automobile as a smart device.

The SU7 will be available in two versions, offering driving ranges of up to 668 km and 800 km on a single charge, placing Xiaomi in direct competition with Tesla, whose Model S boasts a range of up to 650 km.

While pricing details are yet to be disclosed, Lei Jun acknowledged that the cost would be relatively high but justified.

Positioning the SU7 as a winter-friendly vehicle, Xiaomi highlighted its fast-charging capabilities in low temperatures and advanced technology enabling obstacle recognition under challenging conditions, such as falling snow.

Additionally, the car’s autonomous driving capabilities are touted as industry-leading, adding another dimension to Xiaomi’s foray into the electric vehicle market.

Despite Lei Jun’s ambitious announcements, Xiaomi’s share price failed to see a boost, ultimately closing 0.3% lower on the Hong Kong stock exchange.

The shift is in response to sluggish demand for smartphones, and Xiaomi is not alone in this endeavor, as other Chinese tech companies, such as Huawei and Baidu, have also ventured into the EV space through partnerships with established automakers.

Xiaomi has committed to investing $10 billion in the automotive sector over the next decade, distinguishing itself as one of the few new entrants in China’s EV market to receive approval from authorities, who are cautious about exacerbating the existing oversupply.

The production of Xiaomi’s cars will be handled by a unit of the state-owned automaker BAIC Group in a Beijing factory with an annual capacity of 200,000 vehicles.

Navigating a crowded Chinese EV market, Xiaomi is expected to face stiff competition, particularly from BYD, which holds a significant one-third share, while Tesla commands a 9% share, as per third-quarter figures from Zheshang Securities.

The dynamics of the Chinese EV market remain complex, with established players and new entrants vying for market share amid regulatory considerations and shifting consumer preferences.

Which Are Better – EVs Or Hydrogen Cars

At a crossroads in the automotive industry – are hydrogen-powered vehicles a more promising prospect than electric cars?

While Europe is firmly embracing electric vehicles (EVs), Asia is placing a substantial bet on the potential of hydrogen to propel future automobiles; hence, which approach holds greater promise?

Europe

In Europe, the sales of battery electric cars (BEVs) are experiencing a notable surge, surpassing weekly figures that outstrip the total sales for the entire year of 2012, as reported in the annual Global Electric Vehicle Outlook.

However, despite this surge, concerns about shortages in key components crucial for battery production, including lithium, nickel, and cobalt, raise uncertainties about future supply.

In light of these challenges, is it time to shift the focus towards hydrogen-based energy solutions?

Asia

In stark contrast to Europe’s limited availability of hydrogen cars and approximately 228 refueling stations, Asia is placing a significant emphasis on hydrogen adoption.

The Japanese government, for instance, aims to see 800,000 hydrogen vehicles on the roads by 2030, while China has set an ambitious target of 1 million by 2035. These early adopters are expected to drive down costs, scale up production, and fortify the hydrogen supply chain.

The automotive industry remains divided on this front, with only a few major players, such as Toyota and Hyundai, making substantial investments in hydrogen technology.

However, there are recent indications of a shifting landscape, as BMW renews its interest in hydrogen-powered vehicles.

BMW plans to introduce a limited number of BMW iX5 Hydrogen cars globally by the end of the year for initial testing purposes, recognizing hydrogen’s versatility as a crucial energy source on the path to climate neutrality, according to Oliver Zipse, Chairman of the Board of Management of BMW AG.

While the Stellantis group has ventured into limited production of commercial hydrogen vans, not all automakers share the same perspective.

Mercedes and Audi, for instance, have deferred or abandoned plans to bring hydrogen fuel cell cars to the market, showcasing the industry’s ongoing debate and divergence in strategic directions.

Understanding The Difference Between The Two

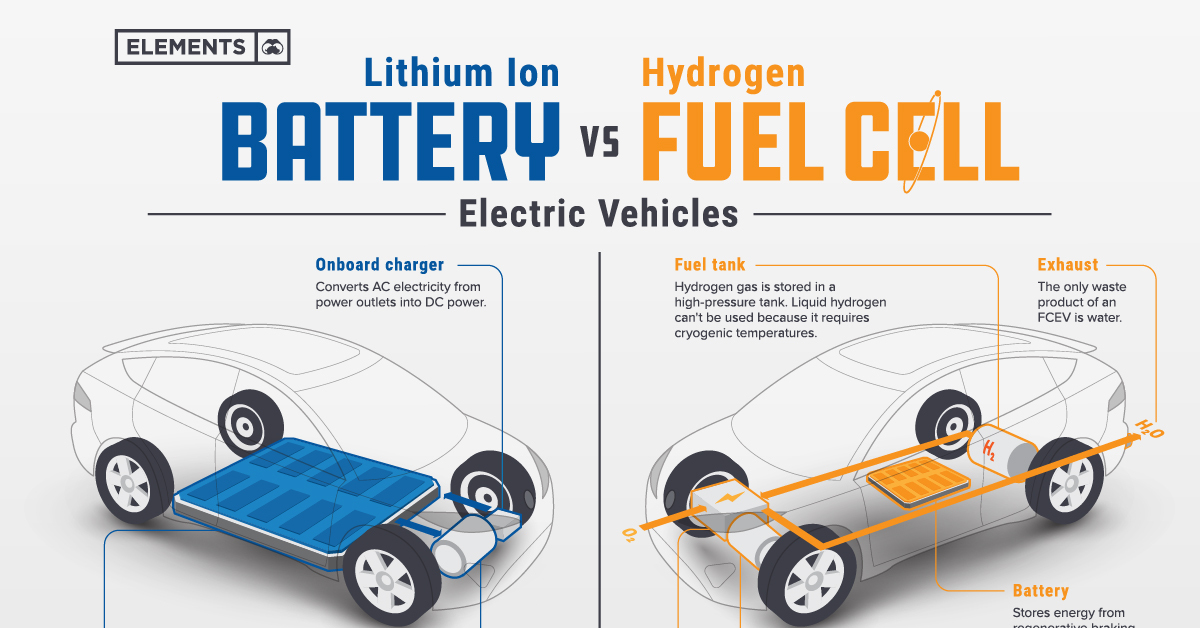

The distinction between electric cars and hydrogen cars lies in their power sources and the mechanisms through which they generate electricity for propulsion.

Electric Cars –

- Power Source: Electric cars, or battery-electric vehicles (BEVs), are powered by electricity stored in a rechargeable battery.

- Charging: These vehicles are recharged by plugging into the electricity grid, typically at charging stations or outlets at home.

- Emissions: Electric cars produce zero tailpipe emissions during operation, contributing to environmental sustainability.

- Refueling Time: Charging times for electric vehicles vary but are typically longer than the time it takes to fill up a traditional gasoline or diesel vehicle.

Hydrogen Cars –

- Power Source: Hydrogen fuel cell electric vehicles generate electricity through a chemical reaction in their fuel cell stack, utilizing hydrogen as fuel.

- Charging: Instead of plugging in, hydrogen cars are refueled at specialized service stations equipped with hydrogen dispensers.

- Emissions: The only emission from hydrogen fuel cell cars is water vapor, making them environmentally friendly in operation.

- Refueling Time: One of the advantages of hydrogen cars is their quick refueling time, comparable to filling up a traditional gasoline or diesel vehicle.

Yet, there are certain challenges for Hydrogen run cars –

1. Efficiency: The process of producing hydrogen, particularly through electrolysis, is energy-intensive and results in efficiency losses.

Only about 38% of the original electricity is estimated to be used by the time hydrogen is converted back into electricity in the car.

2. Infrastructure: Hydrogen refueling stations are not as widespread as electric charging stations, presenting a significant challenge.

The limited availability of refueling infrastructure creates a “chicken-and-egg” problem – consumers may hesitate to adopt hydrogen cars without a robust refueling network, and investors may be reluctant to build refueling stations without a sufficient number of hydrogen vehicles on the road.

3. Costs: The cost of transporting and storing hydrogen adds to the overall expense of hydrogen fuel, making it less economically competitive compared to other energy sources.

Hence, while hydrogen cars offer the advantage of quick refueling and zero emissions during operation, challenges related to efficiency, infrastructure, and costs have hindered their widespread adoption.

Hydrogen’s Characteristics and Safety Concerns

Hydrogen, despite being a promising alternative fuel, is acknowledged for its highly flammable nature, challenging storage requirements, and safety risks in the event of accidents.

Car manufacturers, such as Toyota, emphasize the safety of fuel-cell electric cars, asserting that extensive testing in extreme conditions ensures their safety and reliability.

Current Hydrogen Cars Available

As of now, only two hydrogen cars are available for purchase in Europe: the Hyundai Nexo SUV and the Toyota Mirai.

However, these vehicles come with a hefty price tag not only in terms of initial purchase cost but also in terms of refuelling expenses.

Challenges and Costs of Hydrogen Cars

Expense: Hydrogen cars are not only expensive to buy initially but also incur high refuelling costs and the cost comparison with recharging electric cars varies significantly across different countries.

Infrastructure: The lack of an extensive hydrogen refueling infrastructure, along with challenges in fuel transportation, poses obstacles to the widespread adoption of hydrogen vehicles.

Comparison with Electric Cars

Issues with Electric Cars: Battery electric vehicles (BEVs) have their own set of challenges, including high initial costs and extended recharging times.

Environmental Considerations: While BEVs produce no tailpipe emissions during operation, concerns are raised about the environmental impact of battery production, recycling, and raw material mining, presenting ethical and environmental challenges.

What Does The Future Look Like

The future balance between hydrogen and electric cars remains uncertain, with both technologies facing challenges.

BEVs encounter issues such as cost and charging times, while hydrogen vehicles struggle with infrastructure limitations and high energy requirements.

Presently, the momentum leans toward battery electric vehicles due to the existing infrastructure, energy efficiency, and lower associated costs.

However, ongoing advancements and collaborative efforts may shape a future where both technologies coexist, addressing specific needs in the evolving landscape of sustainable transportation.

For India, Which Is Better

From an Indian perspective, hydrogen cars emerge as a more promising alternative, given the existing infrastructure tailored for Compressed Natural Gas (CNG) vehicles.

India has invested significantly in CNG infrastructure, creating a network of refueling stations that spans across various regions; hence, leveraging this established infrastructure for hydrogen cars presents a practical and cost-effective solution, potentially minimizing the need for extensive new investments.

In contrast, the prospect of electric vehicles (EVs) faces challenges in India, particularly regarding infrastructure development.

The construction of an extensive EV charging network demands time and substantial financial resources, especially when extending beyond urban cities.

Rural and far-flung areas of the country, which often lack robust infrastructure, pose a particularly challenging scenario for the widespread adoption of electric vehicles.

The synergy between existing CNG infrastructure and the requirements of hydrogen cars in India offers a strategic advantage.

The approach aligns with the country’s ongoing commitment to sustainable transportation while minimizing the hurdles associated with building entirely new charging networks.

The Last Bit, As India navigates the path toward greener mobility, the adaptability of hydrogen vehicles to existing infrastructure provides a pragmatic and potentially expedited solution, enabling a more viable and accessible future for clean energy transportation.