China’s Position At Risk As iPhone Supplier Foxconn Moving From China To India For Manufacturing iPhones.

Foxconn Technology Group, one of the largest suppliers and a major producer of iPhone components, plans to invest roughly $700 million in a new plant in India. The investment demonstrates how China is at risk of losing its position as the top maker of consumer electronics in the world.

China’s Position At Risk As iPhone Supplier Foxconn Moving From China To India For Manufacturing iPhones.

Apple will manufacture iPhones in a new plant in India, according to officials, as the US tech giant seeks to grow production there and diversify away from China.

Foxconn Technology Group, one of the largest suppliers and a major producer of iPhone components, plans to invest roughly $700 million in a new plant in India as tensions between Washington and Beijing rise, according to people with knowledge of the situation. This move is intended to increase local production.

The 300-acre facility in Bengaluru, a renowned tech hub, is reportedly where the Taiwanese company aims to manufacture iPhone components. It may also produce parts for Apple’s rumored electric vehicle.

Following the COVID lockdowns that impacted Foxconn’s sizable facility in Zhengzhou last year, Apple has been attempting to expand its supply chain outside of China, according to sources. The holiday season was damaged by the production delay, which hurt Apple’s fourth-quarter sales.

According to the trade minister of India, Apple wants India to produce up to 25% of its products rather than the 5% to 7% it does now. Apple started assembling iPhones in India in 2017 through Wistron Corp. and later Foxconn.

This is one of Foxconn’s largest single investments in India to date, the investment demonstrates how China is at risk of losing its position as the top maker of consumer electronics in the world.

Apple and other American businesses depend on their Chinese suppliers to research alternatives like Vietnam and India. A review of the global supply chain has been accelerated by the pandemic and the Ukrainian conflict, which may change how electronics are produced globally.

Foxconn, the biggest producer of contract electronics in the world (officially known as Hon Hai Precision Industries Co Ltd), said Foxconn Chairman Liu had been to India.

Liu said in a statement that his visit strengthened Foxconn’s initiatives to fortify partnerships, reconnect with old friends and forge new ones, and explore partnerships in emerging fields including semiconductor development and electric vehicles.

Aiming to produce both chips and electric vehicles, Foxconn has lofty goals for both.

Liu continued, Foxconn will continue to communicate with local governments to seek the most advantageous development possibilities for the company and all stakeholders on the basis of sharing, collaborating, and thriving together.

He made no reference to any fresh, specific investment intentions for the country, and Foxconn has not made any since his visit.

The company already has factories operating in the states of Tamil Nadu and Andhra Pradesh.

According to the statement, the investment will generate 100,000 new jobs for the state over a ten-year period.

Currently, the business employs about 200,000 people at its massive iPhone assembly facility in Zhengzhou, China, though that figure rises during the busiest production period.

Due to Covid-related disruptions, Zhengzhou plant output fell significantly before the year-end holidays, which prompted Apple to review its China-dependent supply chain. With Foxconn’s decision, suppliers may be moving capacity out of China much more quickly than expected.

Until Foxconn finalizes the investment and project details, the plans could yet alter, according to the sources. Furthermore, it’s not clear if Foxconn is transferring manufacturing to the plant from other locations, like its Chinese plants, or if it is adding capacity.

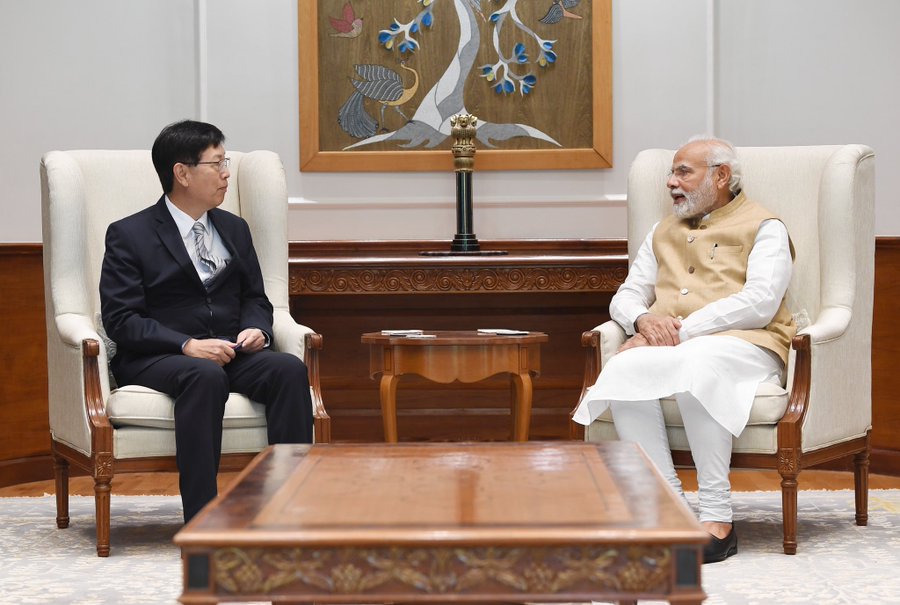

Apple didn’t respond to it. A request for comment sent through email to Hon Hai, whose Chairman Young Liu visited with Indian Prime Minister Narendra Modi this week, was not immediately answered.

Also failing to reply right away was the state government of Karnataka. The adjacent Telangana state has accepted Liu’s commitment to another manufacturing project while she is on tour in India.

The decision by Foxconn would be a victory for Modi’s government, which sees it as a chance to close India’s technological gap with China as Western investors and corporations become weary of Beijing’s crackdowns on the private sector.

Foxconn, which started producing the most recent iPhones at a facility in Tamil Nadu last year, has received financial incentives from India. While vendors like Jabil Inc. have started producing AirPods parts locally, smaller competitors Wistron Corp. and Pegatron Corp. have also increased their presence in India.

For companies like Apple, India has emerged as a desirable possible substitute for China. According to Piyush Goyal, a prominent minister in India, Apple plans to increase manufacturing there to a quarter of its global total from the current range of 5% to 7%.

Apple has relied on a substantial manufacturing network in China for years to make iPhones, iPads, and other well-known items in large quantities. Yet, Beijing’s stringent zero-Covid plan, which was swiftly abandoned in December of last year, put the nation’s reliance on it to the test last year.

Foxconn sees fall in February sales

Foxconn, the Taiwanese company, reported that sales in February decreased 11.65% year over year owing to deterioration in the market for smart consumer devices, but it maintained its first-quarter forecast.

Despite operations returning to normal at the COVID-affected Zhengzhou site in China, a center for iPhone manufacture, sales last month nevertheless managed to hit T$402.0 billion ($13.18 billion), the second highest on record for February, the firm said in a statement.

After restrictions to manage Covid-19, thousands of workers left Foxconn’s production lines in Zhengzhou, disrupting iPhone production ahead of Christmas and the Lunar New Year holidays in January.

Although sales for the first two months of the year increased 17.94% on-year due to January’s unusually good performance, when Zhengzhou operations started to get back on track, revenue decreased by 39.12% from the previous month.

Revenue for smartphones and other smart consumer electronics dropped in February compared to the prior year due to conservative clients’ pull-ins, the company stated without providing further information.

Analysts estimate that Foxconn assembles more than 70% of iPhones. The Zhengzhou facility produces the majority of Apple’s premium models, including the iPhone 14 Pro.

Foxconn indicated that the prediction for the first quarter of 2023 is roughly in line with market expectations based on the revenue performance in the first two months, without providing any other information.

Apple Inc. predicted last month that while its revenue would decline for a second consecutive quarter, iPhone sales were likely to increase as China’s production had resumed after being slowed down due to COVID.

Foxconn shares have increased 2.6% so far this year, trailing the 10.4% increase in the Taiwan market as a whole. The company releases its fourth-quarter profits, along with a more detailed outlook.

edited and proofread by nikita sharma