China’s Export Controls On Chip-Making Materials, Just The Beginning?

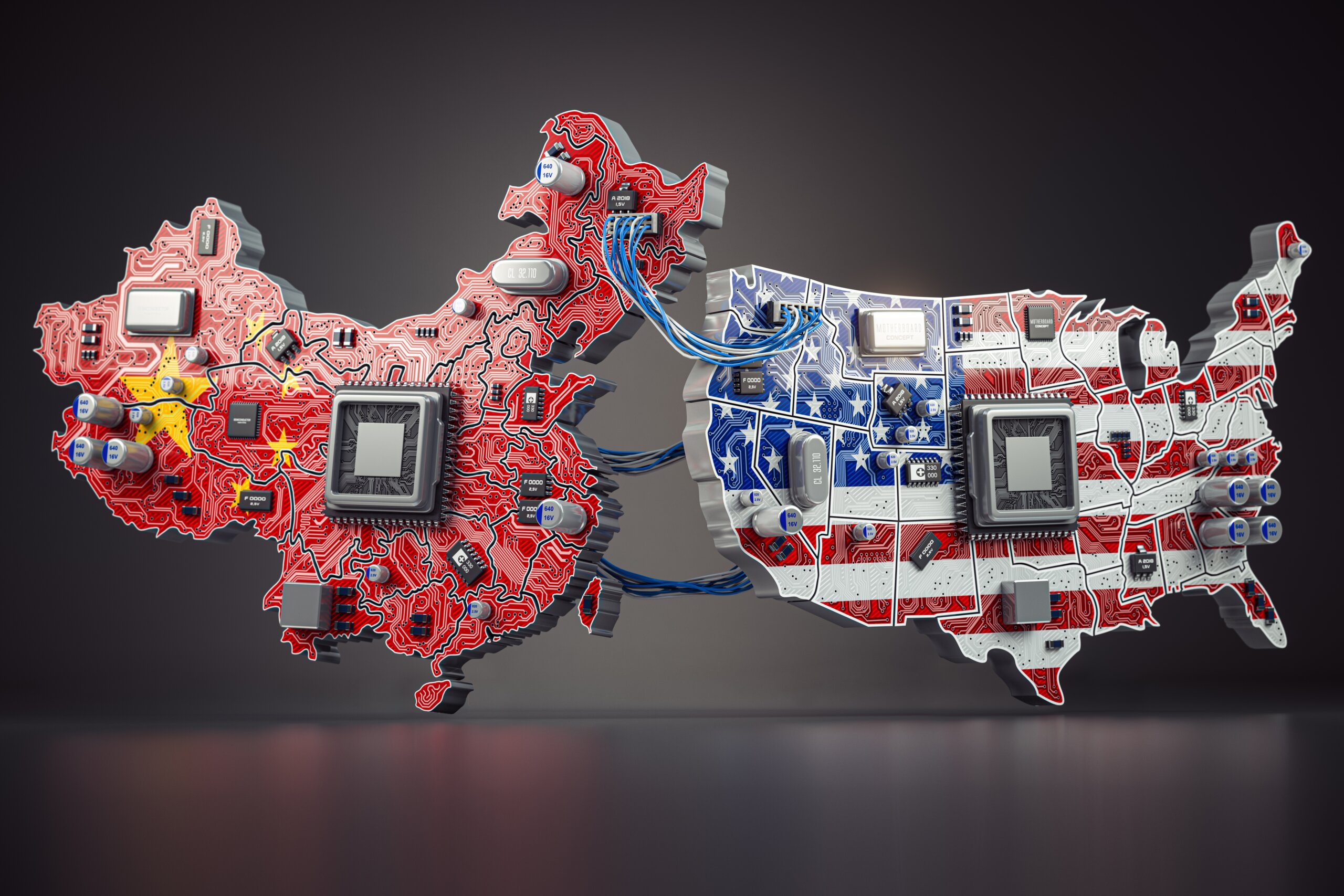

China's recent export controls on chip-making materials have raised concerns about the potential ripple effects on the global tech industry. These measures, characterized as a strategic move by former Vice Commerce Minister Wei Jianguo, are seen as only the starting point of a broader strategy; hence, the implications of these export controls and their impact on international trade relations are becoming more evident as industry players sound the alarm.

If China were to restrict the supply of chip-making materials, the global consequences would be substantial; just a month after China announced export limitations on essential materials like germanium and gallium, which are crucial for semiconductor production, overseas shipments of these materials dropped to zero.

Beijing has since claimed to have granted some export licenses; still, these restrictions can be viewed as a warning that China possesses a formidable tool to wield in the escalating trade war concerning the future of technology.

These restrictions emerged in response to restrictions imposed by the United States, Europe, and Japan on chip sales and chip-making equipment to China, intended to deny access to key technology with potential military applications.

“It is still too early to gauge the extent of these restrictions. However, if China significantly curtails its exports, it will disrupt the supply chain for the end consumers,” warns Xiaomeng Lu, director of geotechnology at Eurasia Group.

China’s Monopolistic Advantage

China enjoys a near monopoly on the production of these two critical elements-germanium and gallium; in the previous year, it accounted for 98% of global gallium production and 68% of refined germanium production, according to the US Geological Survey (USGS).

While alternatives do exist for the United States and its allies, however establishing an independent supply chain for gallium and germanium processing would necessitate a substantial investment estimated at over $20 billion and would take years to develop.

Marina Zhang, an associate professor at the University of Technology Sydney, pointed out that “refining technologies and facilities for processing gallium and germanium cannot be built overnight, particularly considering the environmental implications of their extraction and mining.”

Despite their relatively modest “several hundred million dollars” in global trade, according to Zhang, these minerals play a pivotal role in the supply chains of the global semiconductor, defence, electric vehicle, and communication industries, each worth hundreds of billions of dollars.

China has maintained its dominance in the production of these elements for over a decade; Gallium, a soft, silvery metal, is commonly used in producing compounds for radio frequency chips in mobile phones and satellite communication.

While, Germanium, a hard, grayish-white metalloid, is utilized in creating optical fibers for transmitting light and electronic data; these materials are not naturally occurring but are typically byproducts of mining more common metals, such as aluminium, zinc, and copper.

Since processing these elements is complex, energy-intensive, and environmentally taxing, it further enhances China’s competitive edge due to its ability to maintain low production costs.

China’s leading position in the aluminium industry has enabled it to dominate global gallium production; also, strategic policies set by the Chinese government, including requirements for aluminium producers to extract gallium, have further secured China’s role as the primary producer.

Although there are alternative suppliers, such as Russia, Japan, Korea, Canada, and Belgium, bringing these sources online as viable alternatives would take time and be expensive; at the same time, recycling is also a possibility.

For instance, the US Defense Logistics Agency initiated a program to recycle optical-grade germanium used in weapon systems.

![]()

Just The First Step

Former Vice Commerce Minister Wei Jianguo has suggested that China’s recent export controls on chip-making materials are just the beginning of a broader strategy.

In an interview with China Daily, Wei characterized these controls as a well-planned and significant move, warning that if restrictions targeting China’s high-technology sector persist, countermeasures will intensify.

Simultaneously, China has imposed export restrictions on two minerals (as discussed above) vital for semiconductor production, missile systems, and solar cells, in a display of strength ahead of economic talks between the United States and China, who are increasingly shaping trade rules to gain technological dominance.

Industry Players

In the aftermath of the ban, companies affected by China’s recent export restrictions on metals crucial for semiconductors and electric vehicles are urgently seeking alternative sources.

Industry suppliers are growing concerned that these measures could extend to restrictions on rare earth exports, further heightening trade tensions between China and the United States, with the potential to disrupt global supply chains.

The Chinese commerce ministry’s decision, justified on national security grounds, is seen as a response to Washington’s efforts to limit China’s technological progress, with Peter Arkell, chairman of the Global Mining Association of China, noting that “China has hit the American trade restrictions where it hurts.”

As discussed above, according to customs data, China dominates global gallium and germanium production, with Japan, Germany, the Netherlands, France, and the United States being key importers of these materials.

Despite challenges in meeting the demand for gallium without Chinese supply, potential solutions may be achievable through the implementation of industrial public policy incentives.

According to Jefferies analysts, these export controls by China represent the country’s second major countermeasure following the ban on Micron, raising the possibility of further rare earth export controls.

The Last Bit, The export controls imposed by China on chip-making materials are more than just a trade maneuver; they signal the beginning of a new phase in the ongoing tech trade war.

The race to secure alternative sources and diversify supply chains has intensified as nations and companies grapple with these restrictions.

China’s actions have showcased the critical role of these materials in modern technology, and the response from global players will likely shape the future of international trade dynamics; however, the story is far from over, and as tensions persist, we can expect further developments in the struggle for technological dominance.