China’s Economy was once “Robust.” Then Covid Returned 2022.

China’s Economy was once “Robust.” Then Covid Returned 2022.

The pandemic from China affected many countries and brought an amazing level of destruction of lives and families. It started in that country and slowly went to every nation and influenced the population percentage to an extent. The pandemic time has brought the importance of doctors, medicines, hospitals, and all the medical facilities. It has been reported lately that the virus which went back from China has hit the country again.

Apart from the lives, the pandemic even brought tremendous changes in the economy of nations. A country like India has dramatically affected its people compared with other countries. India has much rate when it comes to poor or middle-class families. China is the one country that was once planted a strong defense against the COVID-19 pandemic and is again facing the virus’s return.

The output of the factors and the consumer spending completely degraded last month. In contrast, the growth rate in the investment of the infrastructure of Bejing has been very much-touted to boost the development and growth rate this year, recorded by the National Bureau of Statistics of China.

As per the (POREG), the headline jobless people rate has zoomed to a two-year high of 6.1 percent, proof of the economic downfall wrought by the country’s toughest pandemic protocols. The think tank then pointed out that China’s stimulus has been spurring since the pandemic first came out some years ago, mainly zeroed in on the supply side.

)

As China faces the enormous economic impact of the virus, Chinese Premier Li Keqiang has called for an accelerated pace and ramped-up efforts to implement big policies. Li, a well-known member of the Standing Committee of the Political Bureau of the Communist Party of China Central Committee, made the pointers last week while chairing a symposium on the process of exceeding growth held in Yunnan Province.

Even as per Xinhua news agency and media, he highlighted the efforts to stabilize the growth of all the market entities and raise employment and the basic livelihoods, underpinned by stable growth.

Noting that the coming wave of domestic COVID-19 resurgences and different changes in the international situation has posed extra downward pressure on the economy, Li stressed the importance of confidence, citing China’s more than 150 million market entities and strong resilience, and generally stable prices. “We have always focused on avoiding ‘flood-like’ stimulus. It didn’t issue excess paper currency, even when COVID-19 affected the hardest in 2020,” Li said, adding that there is still some space for policy maneuver in the face of coming challenges.

He emphasized the importance of efforts to cooperate the COVID-19 control with economic and social development more efficiently and the importance of stepping up big regulation. Most of the policies introduced by the Central Economic Work Conference and government work details were completely implemented in the first half of 2022, and Li has called for local governments to put forward more measures in May to quickly bring the back economy track.

The country must ensure full implementation of all of the relief features, including the tax cuts and refunds for the enterprises to enjoy all the policies with support promptly and thoroughly, Li claimed.

To stabilize the growth and economy, the Chinese premier has asserted that the country must make an adequate grain output and energy supply and maintain the stability of prices and all factors underpinning economic development. Li said that impediments in logistics and upstream-downstream connections must be cleared to smoothen industrial and supply chains.

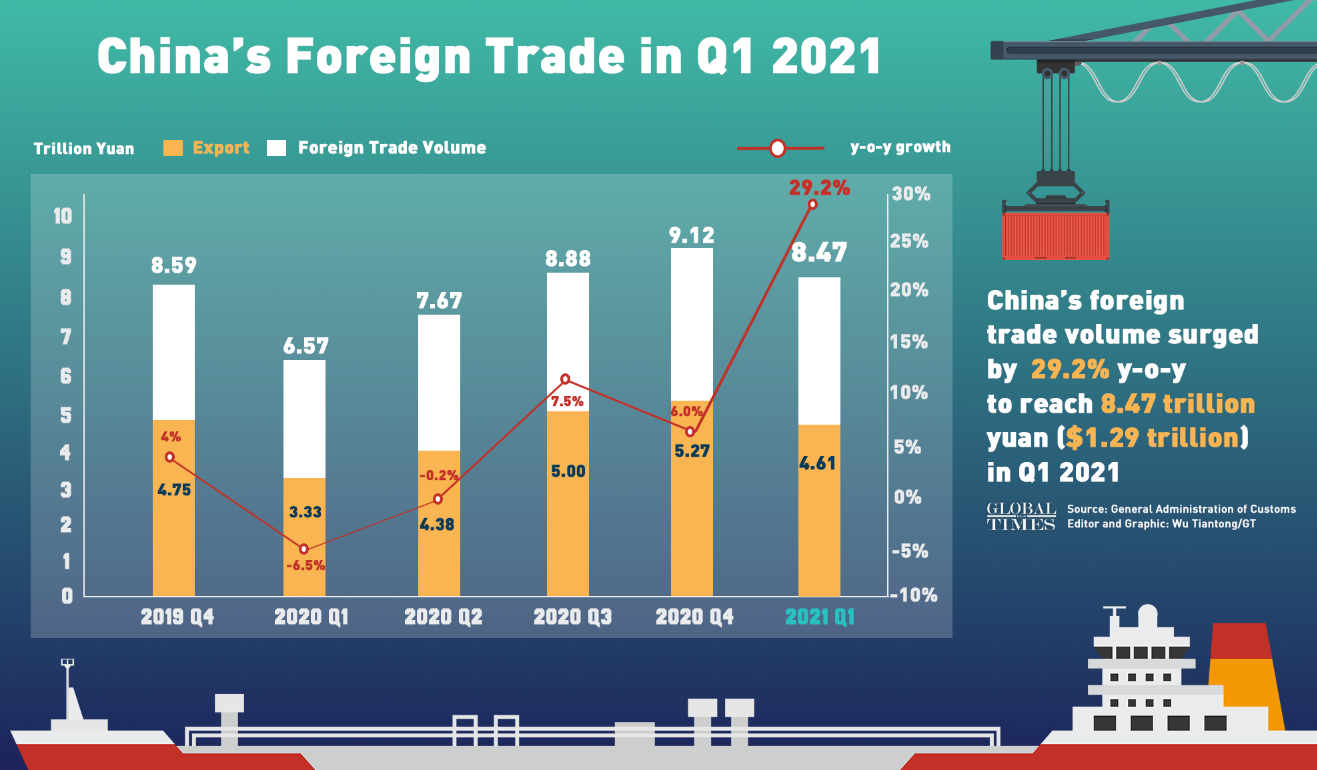

Global growth is expected to race to 5.6% this year, mainly in major economies like the United States and China. And during the growth for almost every region of the world has been revised in the upward direction for 2021, many continue to grapple with COVID-19 and what is likely to be its long effect.

Even after this year’s pickup, the level of global GDP in 2021 is expected to be 3.2% which is below pre-pandemic projections, and per capita GDP in many emerging markets and developing economies is anticipated to remain below the pre-COVID-19 peaks for a long period. Because the pandemic continues, it will shape the path of global economic activity.

China and the United States are expected to contribute about one-quarter of global growth and development in 2021. The U.S. economy has even been bolstered by extensive fiscal support. The vaccination is expected to become widespread by mid-2021. The growth rate is expected to reach 6.8% this year, the fastest pace considered since 1984. China’s economy did not contract last year and is expected to grow a solid 8.5% and moderate because the country’s focus shifted to reducing financial stability risks.

The recovery rate is expected to be the strongest in East Asia and the Pacific, mainly due to China’s recovery rate. In South Asia, recovery has been affected by severe renewed virus outbreaks in India and Nepal. The Middle East and Latin America, North Africa, and the Caribbean are expected to post growth considered too shallow to offset the contraction of 2020. While helped by spillovers from the worldwide recovery, Sub-Saharan Africa’s recovery is expected to remain fragile given the slow pace of the vaccination process and delays to significant investments in infrastructure and the extractives sector.

Economic activity in the advanced economies is anticipated to come down to 7% in 2020 because domestic supply and demand, trade, and finance have been severely disrupted. The emerging market and developing economies (EMDEs) are expected to go by 2.5% in 2022, their first contraction as a complete group in sixty years. The per capita incomes are expected to be down by 3.6%, tipping thousands of people into the most extreme poverty this year.

The blow is hitting very tough in countries where the pandemic has been the most severe and heavy reliance on global trade, commodity exports, tourism, and external financing. While the magnitude of disruption will vary from area to area, all EMDEs have vulnerabilities magnified by external shocks. Moreover, all the interruptions in schooling and main healthcare access are likely to impact human capital development.

edited and proofread by nikita sharma