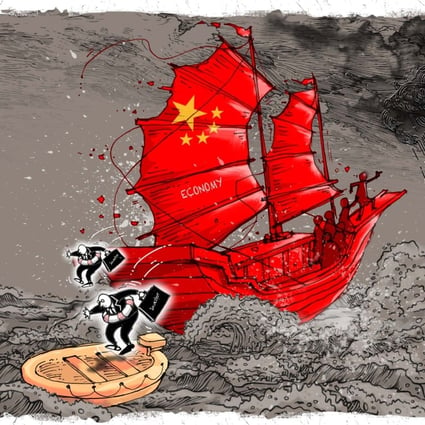

China’s Economic Crossroads, The “Ticking Time Bomb” With Global Implications

As the world watches the shifting tides of global economic dynamics, China emerges as a focal point of concern. Amidst a backdrop of weakening growth, rising unemployment, and deflationary pressures, the once-mighty economic giant finds itself at a crossroads. The recent remarks of U.S. President Joe Biden branding China a "ticking time bomb" could very well be true; here's studying the vastness of economic challenges that have pushed the nation to this precipice.

China’s Economic Problems And Biden’s Warning

President Biden didn’t mince his words at a recent political fundraiser in Utah as he referred to China as a “ticking time bomb,” citing its economic woes and fragile growth as the cause for concern.

The President’s concerns were further fueled by his earlier comments likening President Xi Jinping to a “dictator,” sparking diplomatic tensions between the two nations.

“They have got some problems. That’s not good because when bad folks have problems, they do bad things,” Biden said at a political fundraiser in Utah.

However, even as Antony Blinken, U.S. Secretary of State, embarked on a mission to stabilize U.S.-China relations, the fragility of these ties became apparent, which Beijing described as being at their lowest point since formal ties were established in 1979.

Although Biden did not just stop here, Biden on Wednesday signed an executive order that will prohibit some new U.S. investment in China in sensitive technologies like computer chips.

“China is in trouble,” Biden said on Thursday. He said he did not want to hurt China and wanted a rational relationship with the country.

China, which has the world’s second-largest economy, said it was “gravely concerned” about the order and reserved the right to take measures.

China’s consumer sector fell into deflation, and factory-gate prices extended declines in July; thus, China may be entering an era of much slower economic growth with stagnated consumer prices and wages, contrasting with inflation elsewhere in the world.

The United States, on the other hand, the world’s largest economy, has fought high inflation and seen a robust labour market.

Global Ripple Effects and Uncertain Recovery

The implications of China’s economic challenges resonate far beyond its borders.

A prolonged period of deflation, while potentially curbing inflation pressures elsewhere, could also spell trouble for global manufacturers as cut-price Chinese goods flood international markets.

The recent plunge in exports and imports echoes the concerns over China’s trajectory, with the world’s second-largest economy struggling to maintain pre-pandemic growth rates.

Deflation Dilemma And China’s Economic Woes

The global economic titan, China’s once-thriving consumer sector, has now slipped into deflation, with consumer prices registering their first decline in over two years, causing ripples of concern across international markets. Analysts point to this as a glaring symptom of a deeper ailment in the economy.

The official consumer price index, a barometer of inflation, plummeted by 0.3% last month compared to the previous year. This unsettling trend has ignited pressure on the Chinese government to breathe life into a once-vibrant economy, which is now grappling with the weight of deflationary forces.

The backdrop of China’s predicament is painted by lacklustre import and export statistics, casting doubts on the pace of its post-pandemic revival. As deflation tightens its grip, China’s struggles extend beyond the realm of prices.

The nation confronts many challenges, including ballooning local government debt and turbulence in the housing market. The record-high youth unemployment rate is equally concerning, especially with a staggering 11.58 million university graduates poised to enter the workforce this year.

The downward spiral of prices compounds China’s financial hurdles, impeding the nation’s ability to alleviate its debt burden. The ramifications are far-reaching, contributing to a sluggish growth trajectory, as analysts caution.

Daniel Murray from EFG Asset Management highlights the complexity of the issue, suggesting that a remedy lies in a strategic blend of increased government spending, lower taxes, and more accommodating monetary policies.

A stark contrast emerges when observing China‘s experience compared to that of most developed nations after pandemic restrictions eased. While others revelled in surging consumer spending, China’s economy didn’t follow suit. Instead, consumer prices remained subdued, and deflation has loomed at its edges for months.

Thus marking a stark divergence from the global pattern, where rising demand and energy cost spikes due to geopolitical events have propelled inflation.

Implications Of a Deflationary Economy

The implications of China’s deflationary descent are far-reaching as it mirrors an unsettling demand scenario, contrasting sharply with the awakening economies of the West.

Alicia Garcia-Herrero of Hong Kong University of Science and Technology captures the essence of the concern—poor demand, escalating debt, and deflation coalesce into a trifecta of troubling prospects for China’s economic future.

Deflation isn’t just a local woe; it has the power to cascade across global markets. While an extended period of deflation in China might help temper inflation pressures in other regions, the influx of cut-price Chinese goods could adversely impact manufacturers beyond its borders.

This domino effect could spell diminished investments and constrained employment opportunities, amplifying economic reverberations.

The ramifications reverberate through various strata of China’s economy; as a deflationary phase threatens to erode company profits and consumer spending, potentially triggering a vicious cycle of higher unemployment.

The waning demand from the world’s largest marketplace for energy, raw materials, and food could adversely affect global exports, sending shockwaves throughout the international trade landscape.

China’s ongoing struggles come at a critical juncture as the nation seeks to recover from the pandemic’s aftermath.

Stagnant exports and declining imports, evidenced by the grim July trade data, have intensified worries about China’s economic growth trajectory. These concerns are further compounded by an imminent property market crisis in the wake of Evergrande’s near-collapse.

China’s government has projected a facade of control, but the hesitance to adopt sweeping measures to invigorate economic growth hasn’t gone unnoticed. The path to recovery, experts contend, hinges on revitalizing investor and consumer confidence.

Eswar Prasad of Cornell University stresses the need to rebuild trust in the private sector, fostering a climate where households spend and businesses invest with renewed vigour.

Record Youth Unemployment Strikes China’s Fragile Recovery

China’s ambitious economic recovery post-pandemic has also encountered a critical obstacle as youth unemployment soars to an unprecedented high.

Official figures reveal a distressing 21.3% jobless rate among individuals aged 16 to 24 in urban areas, highlighting a concerning trend in the world’s second-largest economy.

The repercussions of this alarming statistic ripple through various sectors; commodity prices, from oil to copper, experienced a downward slide in response to the news.

Luxury goods producers like LVMH, which have long relied on China for growth, were not immune either, as their shares witnessed a dip. Thus, the interconnectivity of global economies comes to the forefront as a weaker China translates into diminished demand on a global scale.

China’s central bank has initiated attempts to revitalize the economy by reducing interest rates, and regulatory leniency has been extended to critical sectors such as technology. However, despite these measures, authorities have thus far refrained from implementing more significant strategies to stimulate economic growth.

As the country struggles with subdued growth rates, it grapples with a unique predicament. Unlike many nations grappling with rising inflation and consequential policy shifts, China faces the challenge of anaemic growth.

The post-pandemic recovery seems to be faltering, casting a shadow on economic prospects and leaving room for authorities to contemplate additional measures to rekindle growth.

The National Bureau of Statistics suggests a “good momentum of recovery,” and official data released recently indicates a 6.3% growth in the second quarter of the year, surpassing first-quarter growth but falling short of analyst projections.

However, the lingering concerns are palpable, as weak retail sales, housing investments, and underlying growth momentum reflect the fragility of China’s recovery.

Amidst these struggles, the demand for Chinese goods on the global stage has significantly receded. An added layer of concern arises from the burgeoning local government debt and the housing market’s instability.

The stark reality of this youth unemployment crisis is that it unfolds against the backdrop of an impending influx of university graduates into China’s job market.

With a record 11.58 million graduates expected to enter the workforce this year, the mismatch between their skills and available job opportunities has contributed to the upward trajectory of unemployment.

Experts acknowledge that the surge in youth unemployment might continue for several more months, potentially peaking around August. Despite this, the proportion of unemployed young people within China’s urban areas remains relatively low at 1.4% of the potential workforce, according to Dan Wang, Chief Economist at Hang Seng Bank China.

However, the resonating concern lies beyond the statistical figures. The vociferousness of the youth population, especially in the online sphere, could precipitate a broader loss of confidence in the economy. China’s move to release youth unemployment data since 2018 accentuates the significance of this demographic’s economic participation.

Given these challenges, the government’s commitment to achieving a 5% economic growth target remains resolute. The central bank’s recent interest rate cut aims to spur spending, yet experts believe that China still has a repertoire of economic tools at its disposal to invigorate growth if the current situation persists.

The Last Bit, China’s economy finds itself teetering on the brink of uncertainty, caught in a whirlwind of deflation, faltering growth, and rising unemployment.

President Biden’s cautionary words about a “ticking time bomb” aptly capture the gravity of the situation.

The global community watches with bated breath as China grapples with its economic challenges, knowing that the fate of the world’s second-largest economy is intrinsically tied to the global economic landscape.

As China searches for solutions to reignite its economic engine, the ripple effects of its decisions will undoubtedly reverberate across nations and industries, shaping the trajectory of the world’s economic future.