Challenges Continue As IT Biggies Witness Headcount Decline, Drastic Pay Cuts, and Hiring Freeze Over Four Quarters

Once known for its strong workforce of millions of engineers, India's IT sector has witnessed notable shifts in recent years. The surge in hiring and headcount levels, which peaked around 2021 and early 2022, has given way to a period of adjustment and recalibration. Factors such as the post-COVID demand for digitization, cloud transition, and geopolitical uncertainties have influenced hiring dynamics, leading to a slowdown in demand. This slowdown has been particularly evident in the cautious approach of clients in key markets like the US and Europe amid concerns over inflation and geopolitical tensions. As a result, leading IT companies in India are feeling the growing pinch and have experienced a decline in headcount, marking a notable shift from the previous growth trajectory.

Once considered a sector for tremendous opportunity, India’s IT sector offered lucrative salaries, rapid promotions, extensive travel opportunities, and many perks unparalleled in other industries.

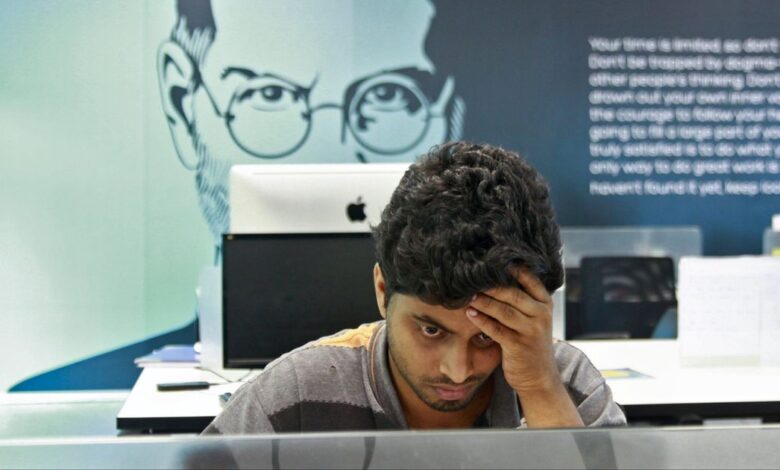

However, the scene has dramatically shifted in recent times. Today, the sector grapples with a sharply different reality marked by hiring freezes, dwindling profits, widespread layoffs spurred by economic slowdowns, artificial intelligence (AI) integration, and geopolitical upheavals.

The once-glamorous allure of the IT sector now confronts a harsh and uncertain future, reshaping the expectations and experiences of those within it.

To put it into perspective, headcount reductions have continued among India’s leading information technology firms for the fourth consecutive quarter, as they trimmed entry-level recruitment and hesitated to hire to counteract attrition amidst uncertain market demands.

According to data compiled by Xpheno, the combined headcount of the top eight IT companies decreased by 17,534 in the quarter ending December 31 compared to the previous three months.

The decline represents a significant drop of 75,000 employees compared to the same period a year earlier, marking the steepest drop in at least six years for firms including Tata Consultancy Services, Infosys, Wipro, HCLTech, LTI Mindtree, L&T Technology Services, Tech Mahindra, and Cognizant’s India division.

Xpheno’s co-founder, Kamal Karanth, noted that the collective headcount of these eight companies has now almost returned to levels seen in early 2022. As of December’s end, these firms employed just under 2 million individuals collectively.

From The Highs To The Current Lows

The hiring surge in India’s IT sector, which employs millions of engineers, peaked around 2021 and early 2022, driven by the post-Covid demand for global digitization and cloud transition.

However, demand has since tapered off due to clients in markets such as the US and Europe exercising caution regarding discretionary spending amidst high-interest rates, inflation, and concerns over conflicts like the Israel-Hamas and Russia-Ukraine tensions.

The slowdown in demand, coupled with the backlog of excessive hiring in 2021, has had a noticeable impact on hiring and headcount in recent quarters.

Today, the net headcount at these companies began to decline in the January-March quarter of 2023, with reductions of 12,455 from the previous three months.

This trend continued with decreases of 28,387 during the April-June quarter and 16,624 in the subsequent three months through September, according to data collected by Xpheno.

The Pay Cuts

Indian IT companies have also recently implemented significant salary reductions, responding to global economic concerns about a potential recession.

As a result, leading Indian IT firms have slashed yearly salary hikes and promotions for their employees.

According to a report on December 15, Bengaluru-based tech giant Infosys has granted its employees less than a 10% salary increase this year and a similar trend is observed among global players headquartered in the US and Europe with substantial operations in Bengaluru.

Personnel expenses represent the largest portion of total expenses for the IT sector, comprising approximately 50-60% of the overall expenditure in the current economic climate. This, coupled with reduced business from existing clients, has prompted the IT sector to prioritize cost optimization measures this year, resulting in reduced hiring activities.

Initially anticipated to be a short-term phase lasting about six months, the situation has persisted, forcing IT companies to implement drastic measures regarding salary adjustments – new employees are not eligible for salary hikes this year.

In the current fiscal year, software firms are offering fewer salary increases, a notable decrease from the previous years when candidates could expect increases of over 40%, and sometimes even up to 100-120%, in their remuneration, citing data from staffing firms.

This situation bears similarities to the challenging period between 2007 and 2009 when the IT sector faced significant setbacks.

With the rise of automation and Artificial Intelligence (AI) impacting job prospects, IT professionals are expressing concerns about the future.

Trend To Change Soon

However, despite all the gloom, industry experts suggest that the tide may be turning soon.

Yugal Joshi, a partner at the tech industry research firm Everest Group, points out that recent financial results from platform vendors and cloud providers have been positive.

“This is likely to stimulate demand and prompt IT providers to ramp up hiring. Additionally, there has been a surge in client requests for 100% offshore-centric support for basic roles, leading to increased demand for entry-level talent,” Joshi explained.

Joshi noted that these companies were actively recruiting before experiencing the slowdown in demand; now, however, some are delaying onboarding of graduates they had previously offered positions to during campus placements.

“They are deferring start dates to safeguard margins, among other reasons. In certain large IT firms, graduates hired in 2022 have yet to be onboarded,” Joshi added.

Nevertheless, seasoned professionals argue that companies that weathered previous recessionary periods will also steer through the current challenges, suggesting that this downturn is a natural phase of the IT industry.

Sources indicate that Infosys, in its communication to employees, expressed gratitude for their unparalleled support and dedication in overcoming the prevailing challenges and ensuring success across all fronts.

The Viewpoint

In today’s tough market scenario, growth and profitability reign supreme; hence, companies across the globe are increasingly turning to artificial intelligence (AI) to drive efficiency and innovation.

With AI becoming a staple in the operations of large corporations in developed countries, Indian IT firms must also adapt swiftly to remain competitive. One key strategy for Indian IT companies is to focus on doubling their profit margins while operating with significantly fewer employees.

Over the past decade, salary hikes in the 0-5 year experience bracket have typically ranged from high single digits to low double digits, while senior profiles have seen increases in the low to mid-single digits.

However, amidst the COVID-19 pandemic, job changers, particularly those securing positions with significant salary increases of 50% to 100%, now face heightened vulnerability to job loss.

Looking ahead to 2024, if the demand for IT services fails to improve, the industry may witness a surge in layoffs, thus making it critical for Indian IT companies to innovate and streamline operations to enhance profitability while steering the challenges posed by AI integration and economic uncertainties.

In the end, the bottom line for IT firms hinges on their ability to adapt swiftly to evolving market dynamics and optimize their margins in an increasingly competitive environment.