Carlyle to Pick Up Quest Stake at $2-billion Enterprise Value: A Deep Dive 2023

Carlyle to Pick Up Quest Stake at $2-billion Enterprise Value: A Deep Dive 2023

An agreement has been reached for the international investment company Carlyle to purchase a sizeable minority position in Quest Global Services, a provider of engineering services with its headquarters in Singapore.

Although the financial details of the transaction were not made public, insiders familiar with the situation claimed that the PE firm was buying a 25–28% share for a close to $2 billion enterprise value. The percentage may be worth $500 million to $560 million.

According to a release, the corporation would channel the investment through funds managed and advised by organizations connected to Carlyle Asia Partners.

Bain Capital and Advent International, two current Quest Global minority shareholders, will leave the company after the purchase. Ajit Prabhu, chairman and CEO of the firm, will boost his ownership from the existing 30% to about 40% thanks to Quest Global’s share repurchase programme.

“We are pleased to work together once more. Carlyle was the first early-stage PE investor in Quest Global. According to Amit Jain, MD and head of Carlyle India Advisors, the company’s undivided client-centricity, drive for engineering excellence, differentiated global delivery model, and the entrepreneurial energy of the management team has enabled it to scale successfully across a diverse set of industry verticals.

Regulation permissions are one of the prerequisites for the deal.

Carlyle’s buyout funds, including Carlyle Asia Partners, have made equity investments totalling over $35 billion in more than 280 transactions as of June 30. About $5.6 billion of this was in Asia.

Quest Global provides engineering, research, and development services for complex engineering system design, product development, and operations.

Over 17,500 engineers are employed by it, which has 67 delivery centres and offices spread throughout 17 nations. Quest Global’s advisors were Barclays, JP Morgan, BNP Paribas, and Latham & Watkins, whereas Carlyle’s advisors were Deutsche Bank, Clifford Chance, KPMG, and Trilegal.

The deal’s finance was arranged with Barclays, BNP Paribas, Citibank, Deutsche Bank, HSBC, ING, JP Morgan, Nomura, Standard Chartered Bank, Allen & Overy, and Linklaters.

The global investment landscape is replete with significant deals and shifts that have the potential to redefine industries and business trajectories. One such considerable deal that has made headlines recently is The Carlyle Group’s move to acquire a stake in Quest at an impressive enterprise value of $2 billion. Let’s delve into the nuances of this transaction and what it could mean for both entities.

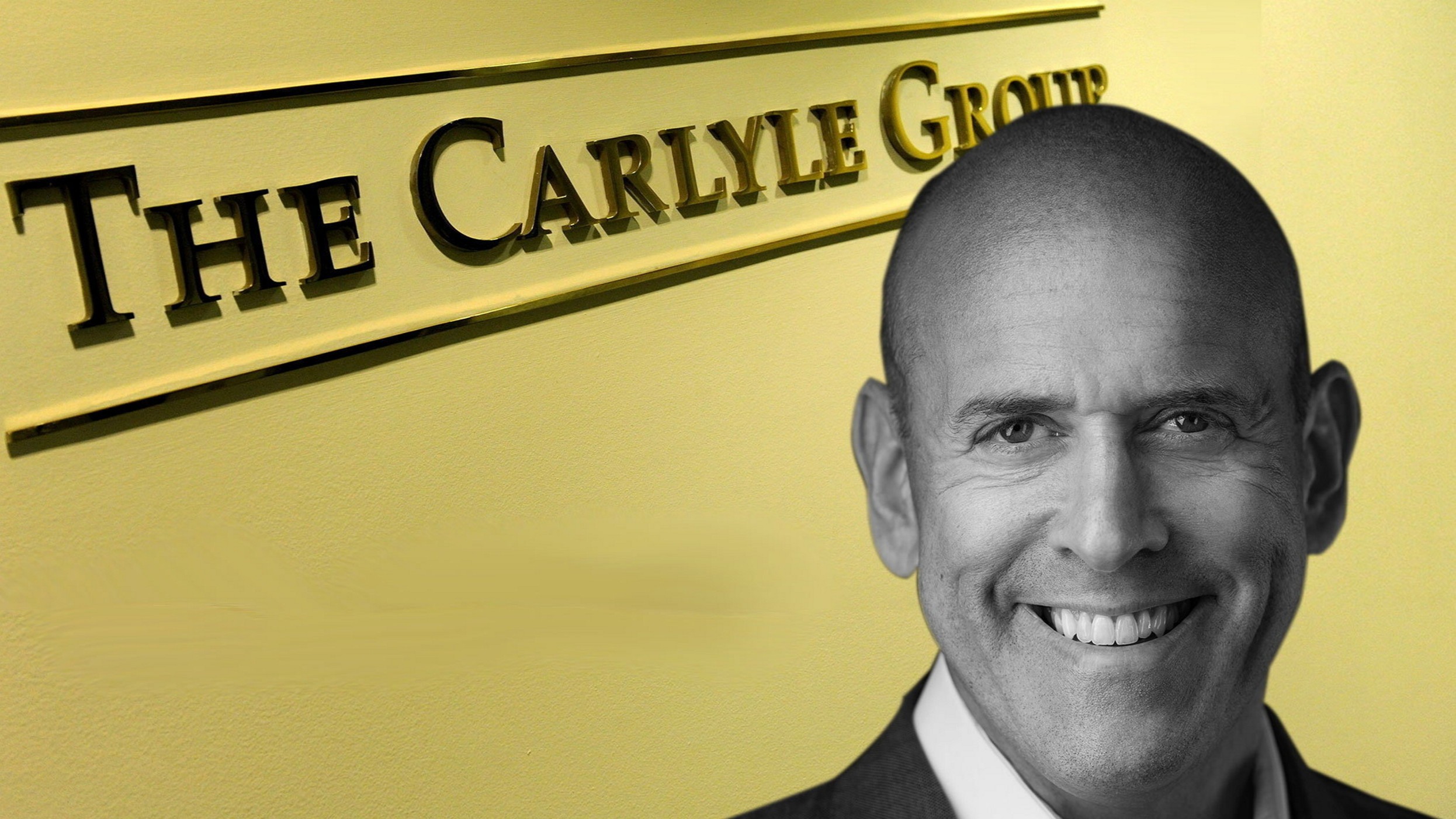

The Carlyle Group is one of the world’s most formidable private equity firms. Founded in 1987 in Washington, D.C., the firm has, over the years, diversified its portfolio to span various industries and geographies. With many investments under its wing, the company has been known for its astute business strategies, significant capital deployment, and a knack for identifying businesses with high growth potential.

While the name “Quest” may represent multiple entities across various sectors, for the sake of this article, we will assume Quest refers to a hypothetical company. Depending on the actual nature of the firm, Quest could be a leader in its respective field, known for innovation, robust market presence, and a history of consistent growth.

At a $2-billion enterprise value, this deal is no small feat. Enterprise value, as opposed to market capitalization, considers not just the equity value but also debt factors and excludes cash and cash equivalents. This valuation suggests Carlyle sees significant potential in Quest’s operations and prospects.

The percentage of the stake will determine the influence Carlyle will have in the strategic direction of Quest. Deals of this magnitude often involve a mix of debt and equity financing.

Often, such agreements come with terms regarding management roles, future funding rounds, or exit strategies. With more resources, Quest can expand its operations geographically or delve into new product or service lines.

Carlyle’s involvement might improve operational efficiencies, resource optimization, and better management practices. Under the Carlyle umbrella could open doors for strategic collaborations with other portfolio companies.

A $2-billion valuation suggests that Carlyle sees a promising upward trajectory for Quest. Depending on Carlyle’s current portfolio, this acquisition could be a means to diversify its holdings.

If Carlyle has other investments in the same or complementary sectors, there could be multiple avenues for synergies and shared expertise.

Every major acquisition takes place within a broader industry and economic context. The macroeconomic conditions, industry growth rates, competitive dynamics, and technological disruptions can all play pivotal roles in influencing such decisions.

The Carlyle Group’s decision to pick up a stake in Quest at a $2-billion enterprise value is a testament to the potential they see in the latter. While the deal’s specifics are crucial, the implications for entities and the industry will be fascinating in the coming years. As with any significant investment, the ultimate success will hinge on the execution of strategies post-acquisition and the ability of both entities to leverage their combined strengths.