Car Prices Set To Surge As Trump Slaps 25% Tariff On Imports

US President Donald Trump’s surprise move to impose a 25% tariff on foreign-made cars threatens global trade stability, triggers market panic, and raises concerns over rising vehicle costs.

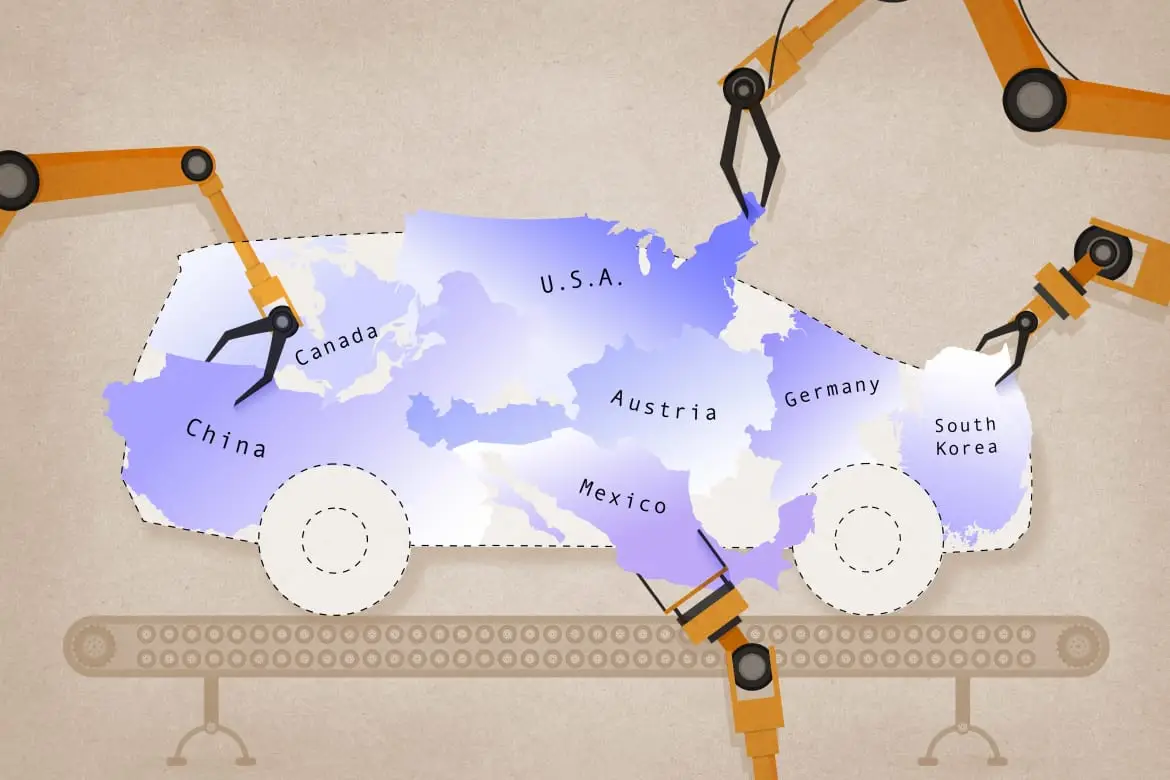

In a surprise move that has the potential to reshape global trade patterns, US President Donald Trump on Wednesday announced that his government would slap a 25% tariff on all foreign-made cars imported into the US. The measure, which takes effect on April 2, will likely heighten tensions between US big trading partners and destabilize global supply chains further.

The Impact of Trump’s Tariff Policies

Since returning to the White House in January, Trump has acted quickly to roll out his economic protectionist agenda. His government has already imposed tariffs, including a 25% steel and aluminium levy, on imports from China, Canada, and Mexico. The car tariffs are the most recent step in his wider economic policy, designed to restore manufacturing to America and cut the country’s reliance on imports. All foreign cars manufactured outside the country will be taxed 25% when imported into the country according to the new policy. All those companies in countries like Japan, South Korea, Germany, and Mexico never anticipated this because they produced most of America’s imported vehicles.

Market Reaction and Economic Implications

The news took financial markets off guard, with steep declines on Wall Street. Tech-sensitive Nasdaq declined 2.0% as investors became increasingly anxious about an economic slowdown. Even the automobile giants were not immune: Ford managed to scrape a slim 0.1% gain, while General Motors fell 3.1%.

Industry experts forecast the tariffs to drive up the cost of cars, pushing new vehicles into the thousands of dollars. Foreign car and metal tariffs, according to the Center for Automotive Research, would affect the labor market and car prices significantly. The employment, sales, and unemployment rates of the motor vehicle sector will all suffer from rising car costs.

Strained Trade Relations and Global Response

The tariffs have already triggered eyebrows from major US trading partners. Mexico, South Korea, Japan, Canada, and Germany are most likely to sue since the ruling violates international trade agreements. The European Union’s trade chief, Maros Sefcovic, emphasized the importance of a “fair, balanced deal instead of unjustified tariffs” in recent discussions with US trade officials.

Japan and Germany, home to some of the world’s biggest automobile companies, are going to receive one of the biggest blows. Mercedes-Benz, BMW, Honda, and Toyota, among others, will have to absorb heavy costs, which they might then transfer to consumers in the form of higher prices. The Mexican economy, one of the world’s leading exporters of cars and automotive parts to the US, will suffer from a fall in exports.

Trump’s Economic Justifications and Political Motivations

Trump has demanded tariffs to save American workers and companies. The administration is calling on automakers to make more domestically by imposing heavy tariffs on foreign autos. That is only half of Trump’s larger “America First” economic plan, which aims to increase domestic production and eliminate trade deficits.

Others say the tariffs would inadvertently lower American automobiles’ competitiveness in global markets. American manufacturers exporting their cars abroad can lose huge sums of money if other countries respond with counter-tariffs. The increased expense of importing auto parts can be transferred to US Automakers’ production costs.

Potential Legal and Trade Disputes

Trade officials note that auto tariffs are Challenging for the World Trade Organization (WTO). The Trump administration will defend the tariffs under national security grounds, which it already used to protect steel and aluminium tariffs. Foreign trade organizations have, however, rejected such explanations.

The White House may depend on the findings of a 2019 government report declaring that excessive US auto imports jeopardized the domestic economy and will further undermine the nation’s national security. It could use such a report as a basis and speed up tariff imposition without an additional investigation.

A Broader Tariff Strategy: What’s Next?

Trump indicated he would also impose tariffs on other sectors, including the automotive industry, drugs, and lumber. Tariffs on autos are threatened only a few days before the deadline of April 2, which the administration has termed “Liberation Day” for the US economy. Trump threatened to retaliate with tariffs against trading partners who were reported to employ unfair trade practices on this day.

Even without additional tariff information, the administration’s reaction signals ongoing demand for aggressive trade action. They allegedly track other segments, such as consumer electronics and semiconductors.

The Road Ahead: Uncertainty and Economic Risks

The international business community is becoming increasingly optimistic about the looming tariff implementation date. While trade partners do arithmetic on the possibility of a retaliatory attack, automakers are scrambling to put numbers on the new tariffs. Trump’s incomprehensibility regarding trade policy has already harmed market confidence and ongoing disruption would trigger economic instability.

While the administration contends that tariffs will raise domestic manufacturing, history has shown us that tariffs add to the price of consumer products and create contentious diplomatic relations. The next few months will be pivotal in deciding the long-term effect of Trump’s recent trade action.

The rest of the world waits nervously for the unveiling of the scope of the administration’s tariff plan on April 2. Only time will be able to tell if this action will really “free” the American economy or produce even greater economic chaos.