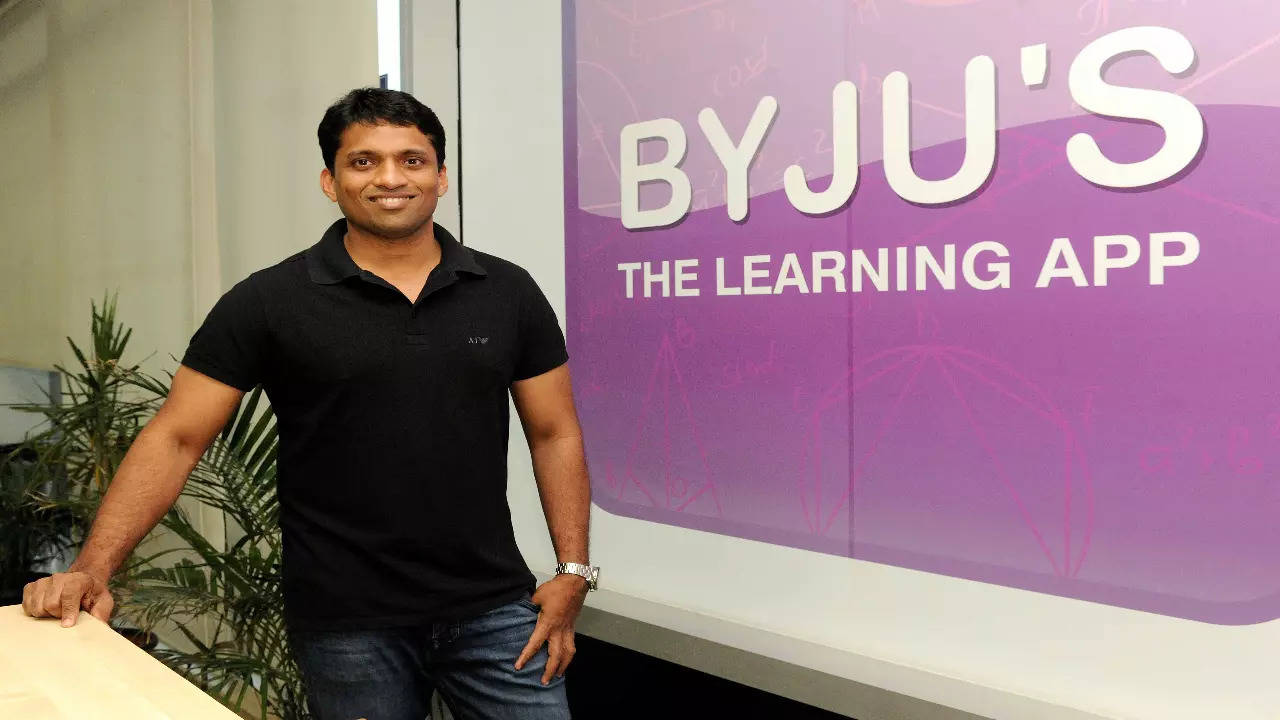

BYJU’S is not my work, it’s my life: Founder Byju Raveendran to investors

BYJU’S is not my work, it’s my life: Founder Byju Raveendran to investors:

BYJU’S, the edtech giant, recently held a shareholders meeting that gained attention due to the resignation of three board members and Deloitte, the company’s auditor. Byju Raveendran, the Founder and CEO of BYJU’S, addressed the investors during the meeting, expressing his deep commitment to the company. “BYJU’S is not my work, it is my life,” he stated passionately.

During the meeting, Raveendran reassured the shareholders that the company’s valuation of $22 billion remains intact, despite the recent changes in the board and the auditor’s resignation. This announcement instils confidence in the investors, emphasizing the company’s stability and growth potential.

Reports from various sources highlighted Raveendran’s investments in BYJU’S, further underlining his belief in the company’s prospects. By demonstrating his personal stake in the business, he sought to convey his unwavering dedication to its success.

The resignations of three board members and the departure of Deloitte as the auditor have raised questions and concerns among stakeholders. However, Raveendran’s presence and words at the shareholder’s meeting aimed to address these concerns directly. His passionate affirmation of BYJU’S as his life’s work and his personal investments were intended to assuage doubts and demonstrate his unwavering commitment to the company’s mission and vision.

While the specifics surrounding the board members’ resignations and the auditor’s departure were not explicitly discussed in the reports, Raveendran’s statements and reassurances were likely aimed at preventing any negative impact on investor sentiment. Shareholders often seek stability and confidence in the leadership of the company they have invested in, and Raveendran’s commitment and personal investments were intended to provide reassurance and maintain investor trust.

BYJU’S has emerged as a prominent player in the edtech industry, revolutionizing the way students learn and providing innovative solutions for educational needs. The company’s remarkable growth and success have been driven by its adaptive learning platform, engaging content, and effective marketing strategies. BYJU has secured significant funding and achieved substantial valuation, making it one of the most valuable edtech companies globally.

However, the recent resignations and changes within the board and the auditor raise questions about the internal dynamics and governance of the company. Such transitions can often create uncertainty among stakeholders as they seek clarity and transparency regarding the reasons behind these developments and the potential impact on the company’s operations.

As BYJU continues to expand its reach and explore new avenues for growth, maintaining strong corporate governance practices and investor confidence becomes crucial. Transparent communication, timely disclosures, and adherence to regulatory requirements are essential to foster trust and maintain a positive perception among shareholders and other stakeholders.

The edtech industry in India has witnessed significant growth and adoption, especially in recent years. The COVID-19 pandemic further accelerated the demand for online learning solutions, leading to increased opportunities and competition in the sector. In this highly competitive landscape, BYJU’S has emerged as a frontrunner, backed by its innovative approach to education and a strong brand presence.

However, it is essential to note that the long-term success of any company depends on various factors, including its ability to adapt to changing market dynamics, attract and retain talented professionals, and sustain growth amidst evolving customer preferences and technological advancements.

In conclusion, BYJU’S Founder and CEO Byju Raveendran’s remarks during the shareholders meeting aimed to instil confidence in the investors amidst the recent resignations and changes in the board and the auditor. By expressing his personal commitment to the company and highlighting his investments, Raveendran sought to reinforce the company’s stability and growth potential. As BYJU continues its journey in the edtech industry, maintaining strong corporate governance practices and investor trust will be vital for sustaining its success.

According to data obtained from the Employees’ Provident Fund Organization (EPFO) by Moneycontrol, it has been observed that BYJU’S, the edtech company, has been making provident fund (PF) contributions with a delay of approximately 3-4 months. The data revealed that for certain employees, BYJU’S made PF contributions for December 2022 as late as June 2023.

The EPFO data indicates a pattern of delayed payments over several months. Moneycontrol reached out to BYJU’S regarding this matter, to which the company responded by stating, “This is to confirm that there are no pending PF payments towards employees. There are no dues.”

However, the EPFO data contradicts this statement, showing that only around 10,000-13,000 employees have received PF payments for January, February, and March. Most employees are still awaiting their PF payments for April and June.

The delay in PF payments can raise concerns among employees who rely on these contributions for their future financial security. Timely and accurate PF contributions are crucial as they form a significant component of an employee’s retirement savings. Delays in PF payments may affect the employees’ trust in the company and raise questions about the company’s adherence to legal obligations and its commitment to employee welfare.

BYJU’S needs to address this issue and ensure that all pending PF payments are made promptly. Clear communication with employees regarding the reasons for the delay and a concrete plan for resolving the issue is essential to maintain transparency and build trust.

It should be noted that EPFO data provides an objective view of the situation, and the company’s statement contradicts the information presented. However, the EPFO data obtained by Moneycontrol suggests a substantial number of employees have not received their PF payments within the expected time frame.

In conclusion, the EPFO data indicates a delay in provident fund contributions by BYJU’S for several months. Although the company denies any pending payments, the EPFO data shows that a significant number of employees are still awaiting their PF payments. Timely resolution of this issue is crucial to ensure employees’ financial well-being and uphold the company’s commitment to its workforce.